Analysis

July 10, 2022

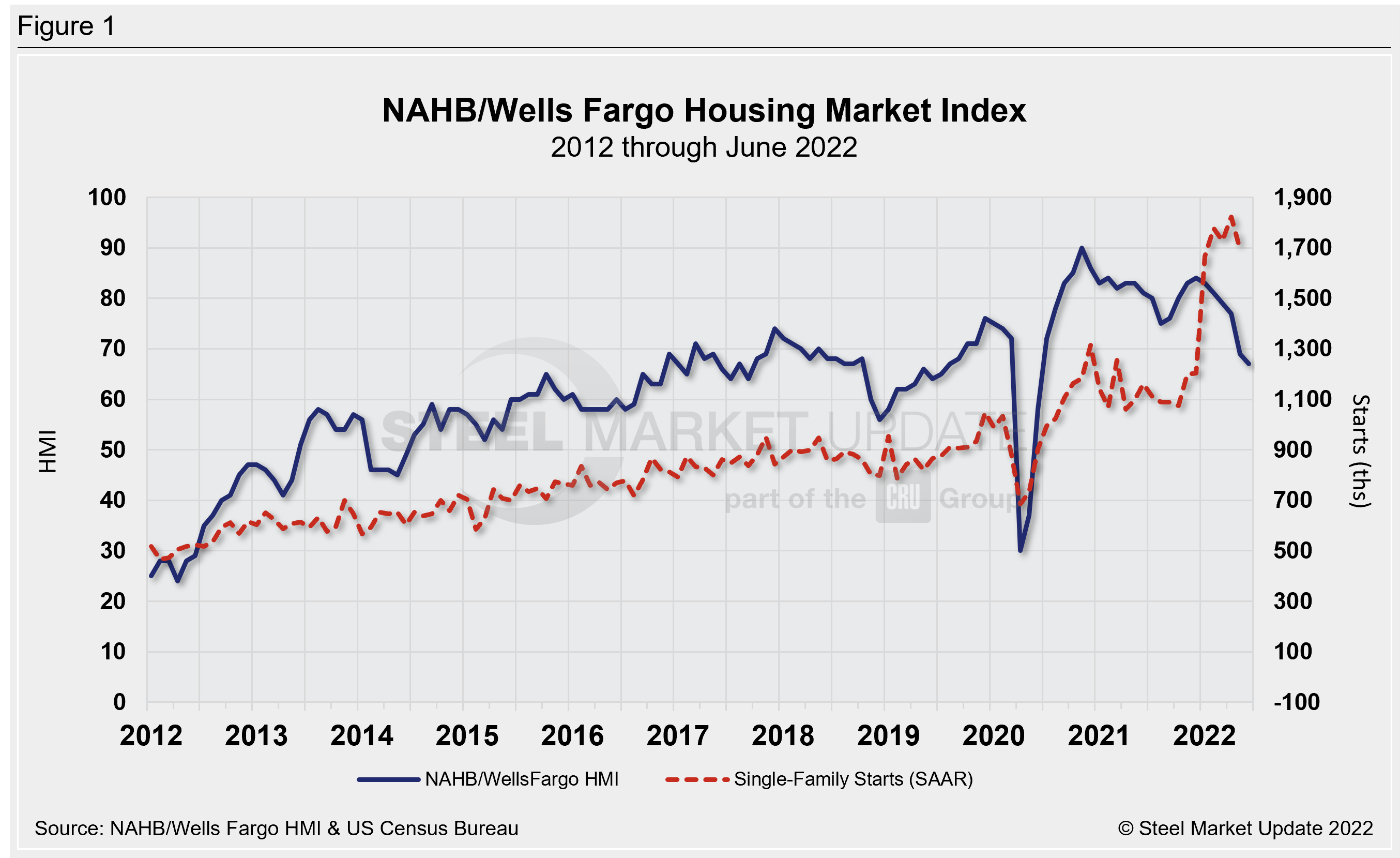

NAHB: Tightening Financial Conditions Slow Housing

Written by David Schollaert

Rising inflation and higher mortgage rates are slowing traffic of prospective home buyers and putting a damper on builder sentiment. According to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), the headline number fell two more points to a level of 67 in June – the lowest HMI reading since June 2020.

Six consecutive monthly declines for the HMI is a clear sign of a slowing housing market in an environment of high inflation and slow economic growth, the report said.

With inflation running at a 40-year high, economic policy needs to focus on improving the supply side of the economy by bringing down material, energy, and transportation costs. Largely because of these supply-chain challenges, single-family starts decreased 9.2% in May to an annual rate of 1.55 million.

Single-family permits decreased as well, dropping 5.5% and bringing the annual rate down to 1.05 million – the slowest pace since July 2020. Further declines are expected in the months ahead.

Total existing-home sales in May — including single-family homes, townhomes, condominiums, and co-ops — fell 3.4% to a seasonally adjusted annual rate of 5.41 million. On a year-over-year basis, sales were 8.6% lower than. However, after posting four consecutive monthly declines on rising mortgage rates and worsening affordability conditions, new home sales posted a solid gain in May as some buyers rushed into the market in advance of the Federal Reserve’s June interest rate hike.

New home sales surged 10.7% to a 696,000 seasonally adjusted annual rate, although year-to-date sales are 10.6% lower compared to a year ago.

New single-family home inventory remained elevated at a 7.7-month supply, up 42.6% over last year, with 444,000 available for sale. However, only 8.3% of new home inventory is completed and ready to occupy. The median sales price dipped to $449,000 in May, but is up 15% compared to a year ago, primarily because of higher construction and development costs, including materials.

The NAHB expects a modest economic recession in mid-2023 given tightening financial conditions and increased economic uncertainty. Higher interest rates are expected to slow housing and business investment, acting as a drag on economic growth.

The unemployment rate is therefore expected to rise from near-cycle lows to above 5% in 2023, while broader-based inflation will ease further as the economy slows, the report concluded.

By David Schollaert, David@SteelMarketUpdate.com