Market Data

July 10, 2022

CRU: Worsening Outlook Drags on Commodity Prices

Written by James Mills

By CRU Research Analyst James Mills, from CRU’s Multi-Commodity Monthly Report

The upside risk to commodity prices created by the war in Ukraine diminished in June as markets assessed the impact of a slower global demand growth outlook, higher inflation expectations, and a continuation of Covid-19 lockdowns in China.

Bearish Economic Forecasts Are Downside Risk for Prices

June saw many metal prices continue to fall as economic and demand growth forecasts continued to deteriorate.

In the West, higher than expected headline CPI inflation in the US and Europe has triggered a tightening of monetary policy. Tackling inflation with interest rate rises has become an increasing priority in central banks and presents a downside risk to commodity prices. Further downside risk to prices was added by the continuation of the zero-Covid policy in China and associated regional lockdowns, which raised fears of slower Chinese growth, particularly in construction and real estate.

Prices for many commodities have fallen toward, or below, price peaks shortly after Russia’s invasion of Ukraine in late February. However, support for commodity prices remains. Market confidence was low in June. But forecast demand increases from the auto sector, and improved Chinese economic activity, could signal more support for prices in the short term.

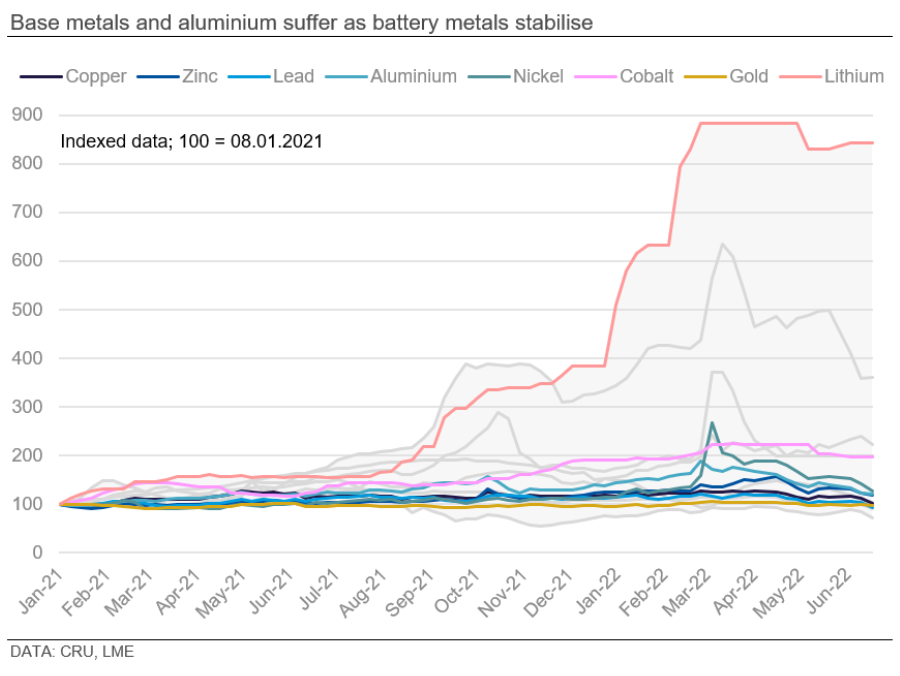

Base Metals’ Price Drops Reflect Poor Economic Outlook

June has seen price declines across base metal markets as fears of economic slowdown and lockdowns in China overcome tight markets, low inventories, and supply disruptions. The LME 3-M copper price hit a 16-month low, finding support just above $8,000 per ton, with nickel falling the most – below $25,000 per ton for the first time since February as the fallout from the LME short squeeze in March continues.

Rising energy prices, especially in Europe, provide a relatively high-cost floor for aluminium – reflected in 2022 Q1 earnings reports, beyond which production is not financially viable. The LME aluminium price dropped 16% in June, renewing risks of further curtailments and closures in Europe and America. CRU believes this price drop brings aluminium prices towards the bottom of the trough.

Battery metals appear to have stabilized at high levels, buoyed by limited supply, and continued positive market sentiment regarding EV demand.

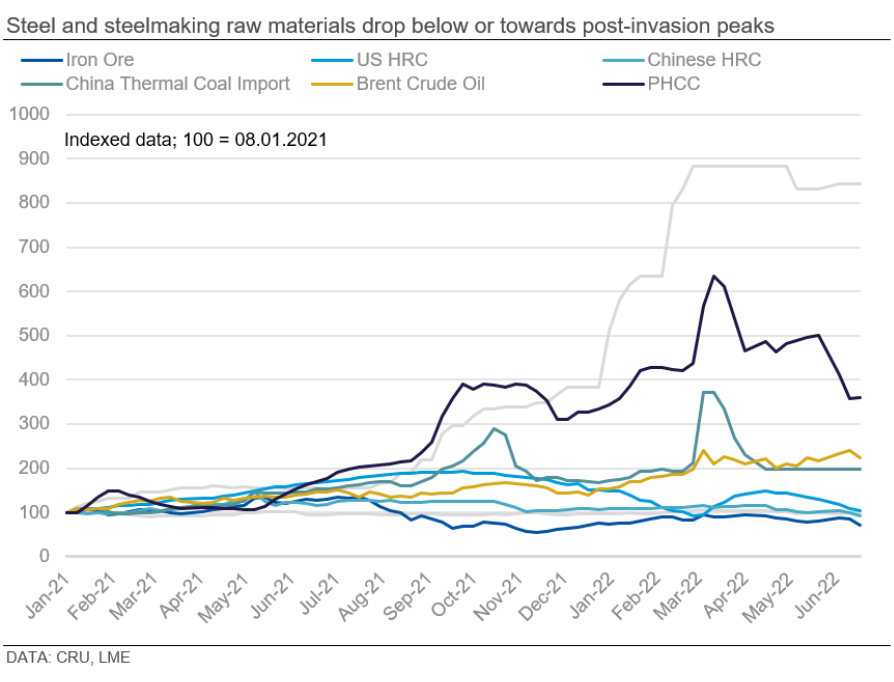

Steel and Raw Material Prices Drop as Tight Supply Eases

Global steel sheet prices continued to fall this month from price peaks following Russia’s invasion of Ukraine as tightness within the steel value chain eased. Steel buying activity slowed due to full inventories and concerns over economic growth. Declining steel prices and weak demand proved a downside risk for raw material prices, countering price gains in early June.

The End of Price Highs for Metallurgical Coal?

Interest in spot cargoes of metallurgical coal, at current high prices, reduced drastically in June as steel production decreased globally and Australian coal supply improved. Weekly coal shipments from Queensland improved by 20% in June compared to an average of the last five months. The result has been a significant decrease in metallurgical coal prices as end users draw on inventories while waiting for prices to drop. High current thermal coal prices do, however, present a level of support to metallurgical coal prices.

Bearish Steel Market Pressures Margins for Producers

The Russian invasion of Ukraine reversed a steady price decline from 2021 as market participants feared a loss of CIS raw material and semi-finished steel supply. June saw the influence of this upside price risk slip, with many regional steel prices falling below pre-war prices. Falling steel prices have reduced margins for steel producers which have been, and remain for certain producers, at historic highs.

Chinese steel demand remained muted in June, as lockdowns continued to hamper economic activity, while strong inventories in Europe resulted in consumers avoiding costly steel purchases at current prices. The resulting drop in prices has lowered margins for steel producers. In Europe, this has resulted in some marginal producers with exposure to spot power prices ceasing or ramping down production, while in China producers have scheduled outages.

The pace at which steel prices have been falling slowed at the end of June as Chinese steel demand appeared supported and regional sheet prices approached or dropped below, pre-war price levels. Regardless, CRU believes factors such as rising energy costs, uncertain gas supply and uncertain demand growth will continue to shrink producer margins back towards more normal levels, particularly in Europe.

Fertilizers Stabilize at High Price Level

Unlike prices in metal markets, fertilizers and fertilizer raw materials remained supported at high levels during June due to severe disruption caused by the Russian invasion of Ukraine (Russia, Ukraine, and Belarus being major exporters) and by high gas prices (a principal input for the production of nitrogen fertilizers).

Prices for nitrogen-based fertilizers were supported in June by continued unprecedented gas prices. Europe’s TTF natural gas price has been steadily falling towards pre-invasion levels. However, increased indication of gas rationing this winter resulted in prices rising again in June. These higher gas prices have resulted in further closures of European nitrogen plants.

The phosphate fertilizer market appears less supported as buyers demand lower prices which are being resisted by sellers. The market continues to face significant uncertainty over potential export quotas from China and the specifics of India’s delayed 2022 Q2 phosphoric acid price contracts with OCP.

This article was originally published on July 7 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com