Analysis

July 10, 2022

Construction Adds 13,000 Jobs, Unfilled Positions Set Record: AGC

Written by David Schollaert

Construction employment increased by 13,000 jobs in June while the number of jobseekers with construction experience plunged to a record low for the month, the Associated General Contractors of America (AGC) reported.

The construction industry would likely have added even more jobs in June had it not been for the shortage of available workers, AGC said

“Although nonresidential contractors were able to add employees in June, the industry needs more as demand for projects is outpacing the supply of workers,” AGC chief economist Ken Simonson said. “With industry unemployment at a record low for June and openings at an all-time high for May, it is clear contractors can’t fill all the positions they would like to.”

The unemployment rate among jobseekers with construction experience tumbled from 7.5% in June 2021 to 3.7% last month, the lowest rate for June in the 23-year history of the data series, Simonson noted.

The number of unemployed construction workers fell by 345,000, or 47%, to 385,000, suggesting there are few experienced jobseekers left to hire.

There were 466,000 construction-industry job openings at the end of May, a jump of 130,000, or 39%, from a year earlier and the largest May total since that series began in 2000, Simonson added.

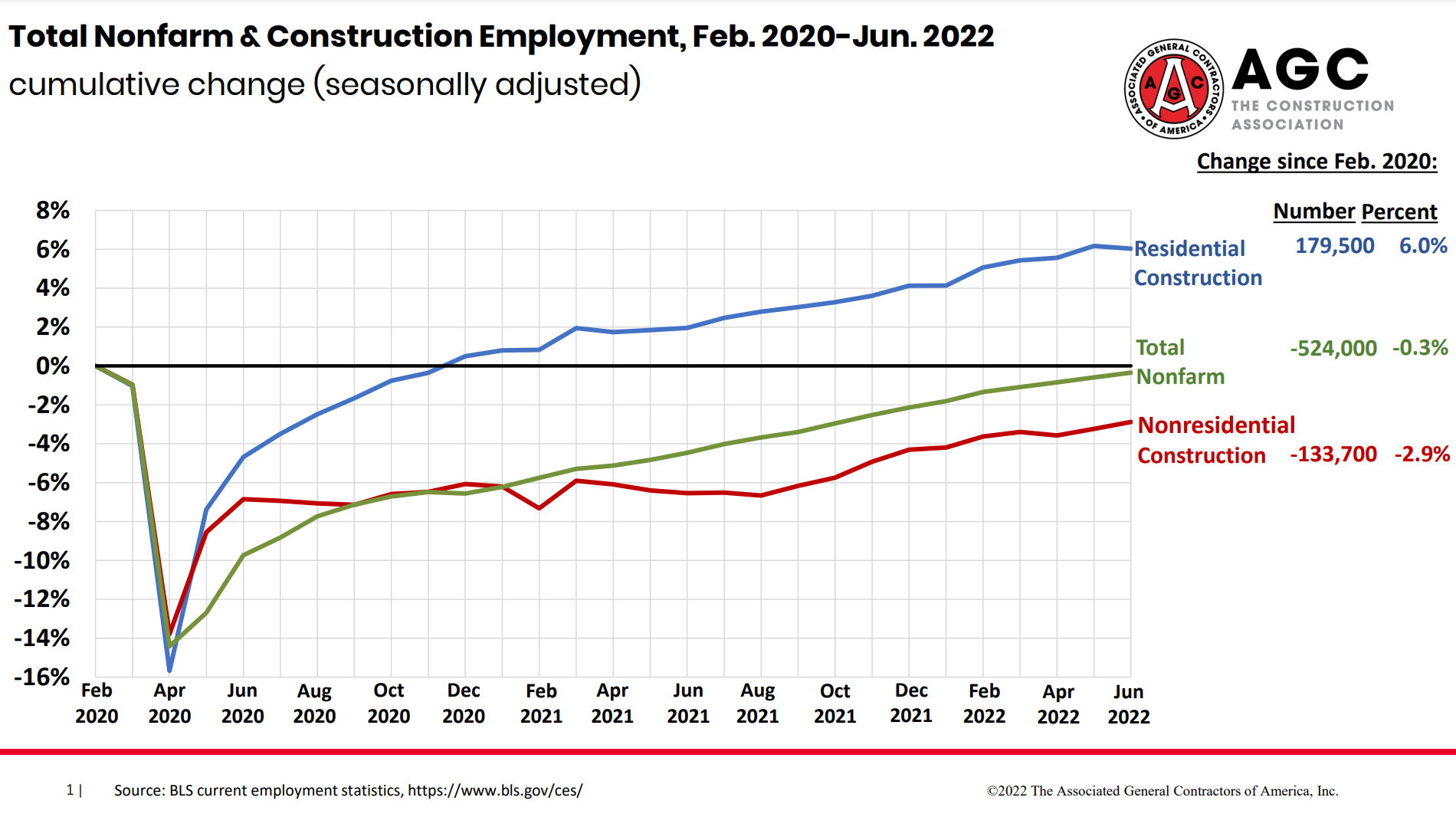

Total construction employment moved up by 13,000 to 7,670,000 in June, as nonresidential gains offset the first decline in residential employment in 14 months.

Nonresidential firms added 16,500 employees, including 600 for general building contractors and 11,400 for nonresidential specialty trade contractors. Another 4,500 were added for heavy and civil engineering construction firms. Employment in residential construction – homebuilders, multifamily general contractors, and residential specialty trade contractors – dipped by 4,100.

The AGC said it was working to attract more people into the construction industry, with a nationwide targeted digital advertising campaign – Construction is Essential – to identify and recruit new workers, including from segments of the population not typically involved in the industry. And they have launched a workforce retention campaign as well, called “Culture of Care.” The group also urged public officials to also take steps to make workers aware of construction career opportunities.

“The industry is working hard to recruit new people into the many high-paying career opportunities that are available,” AGC CEO Stephen Sandherr said. “But too few current and future workers are ever even exposed to construction as a career choice, undermining interest in an industry that everyone sees but too few appreciate.”

By David Schollaert, David@SteelMarketUpdate.com