Market Data

July 5, 2022

ISM: US Manufacturing Grew at a Slower Pace in June

Written by David Schollaert

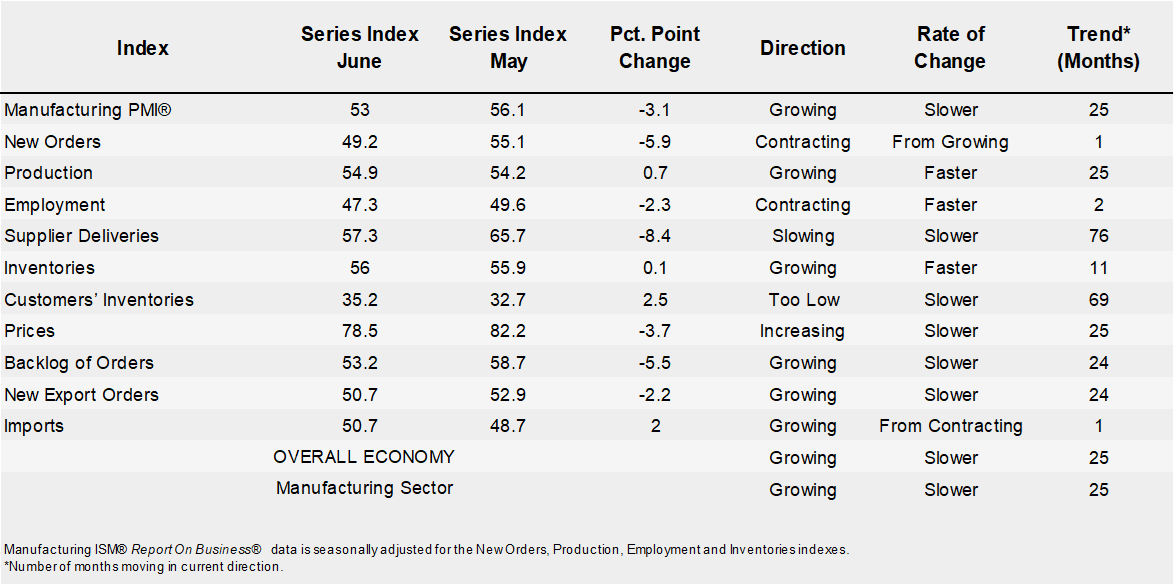

US manufacturing activity expanded at a much slower pace in June than in May. The employment, new orders, and prices paid indexes all fell month-on-month (MoM), according to the Institute for Supply Management (ISM).

June’s Manufacturing PMI fell to 53%, a 3.1-percentage-point decline compared to a reading of 56.1% in May. The measure came in weaker than the market expectation of 54.9%. The index reading above 50% indicates growth in the manufacturing sector. Despite June’s decline, the measure marks the 25th consecutive month of expansion since the Covid-19 outbreak in the spring of 2020.

“The U.S. manufacturing sector continues to be powered — though less so in June — by demand while held back by supply chain constraints,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “Despite the Employment Index contracting in May and June, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain.”

- The Employment Index registered 47.3% in June. The reading was 2.3 percentage points lower than May’s 49.6%.

- The New Orders Index registered 49.2% in June, down 5.9 percentage points from May’s reading of 55.1%.

- The New Export Orders Index was 50.7% last month, down 2.2. percentage points compared to the May reading of 52.9%.

- The Inventories Index registered 56% in June; 0.1 percentage points higher than 55.9% in May.

“There are signs of new order rates softening,” Fiore said. “But the root cause is difficult to determine.” Possibilites include a combination of lower demand and long lead times causing orders to be cancelled. Still, “employment activity remains strongly positive in spite of the uncertainty with new order rates,” he said.

An interactive history ISM Manufacturing Report on Business PMI index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com