Market Segment

June 22, 2022

US Steel’s Gary Works To Host Innovative Carbon Capture Study

Written by Laura Miller

An innovative and collaborative study to capture carbon emissions and inject them into concrete products for permanent storage will soon begin at US Steel’s Gary Works in northwest Indiana.

The University of Illinois Urbana-Champaign’s Prairie Research Institute will lead the study after receiving a research reward of almost $3.5 million from the US Department of Energy’s National Energy Technology Laboratory.

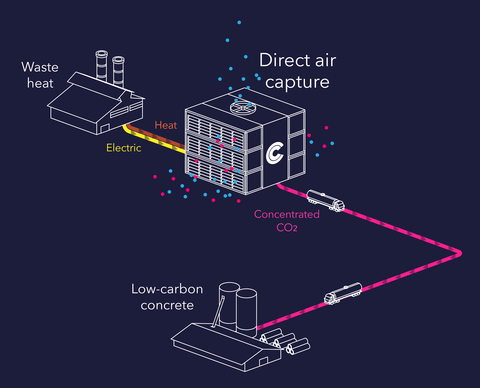

The study’s focus will be on advancing a direct air capture and utilization system developed by CarbonCapture Inc. to remove 5,000 metric tons per year of CO2 from ambient air and then inject it into concrete products to be permanently mineralized. CO2 removal and utilization technologies from CarbonCure will be used to transport the liquified gas CO2 emissions to Ozinga ready-mix concrete plants.

“US Steel is committed to progressing our efforts described in our Climate Strategy Report to decarbonize and accelerate towards a lower carbon future, but we know that one company’s actions are not enough,” said Rich Fruehauf, the steelmaker’s senior vice president – chief strategy and sustainability officer. “Achieving our goal of net-zero emissions by 2050 is going to take unprecedented innovation and collaboration.”

“We’re very excited about participating in this groundbreaking study. Direct air capture is particularly effective when energy costs can be reduced via the use of waste heat and the captured CO2 can be permanently stored in concrete. At scale, we think this solution will lead to the removal of massive amounts of CO2 from the atmosphere,” CarbonCapture CEO Adrian Corless said.

By Laura Miller, Laura@SteelMarketUpdate.com