Analysis

June 17, 2022

North American Auto Assemblies Improve in May

Written by David Schollaert

North American auto assemblies improved by 5.9% in May, after shrinking by 15.8% the month prior – the first decline all year. And though ongoing supply hurdles continue, North American production has improved since bottoming out last December. May’s results are 14.4% higher year-on-year (YoY), but still 17.5% below the pre-pandemic period of May 2019.

North American automotive manufacturers have endured major supply chain disruptions for two years now. The lack of semiconductor chips and other components has hammered the sector, leading to production halts, delays, and inventory shortages.

And relief from the microchip shortage is not expected in the near term. Microchip lead times are extending to nearly 24 months in some cases, a stark contrast from the 2-3 months lead times seen prior to the pandemic in early 2020. Intel’s revised forecast on the chip shortage now extends into 2024, a 12-month jump from the initial forecast of 2023.

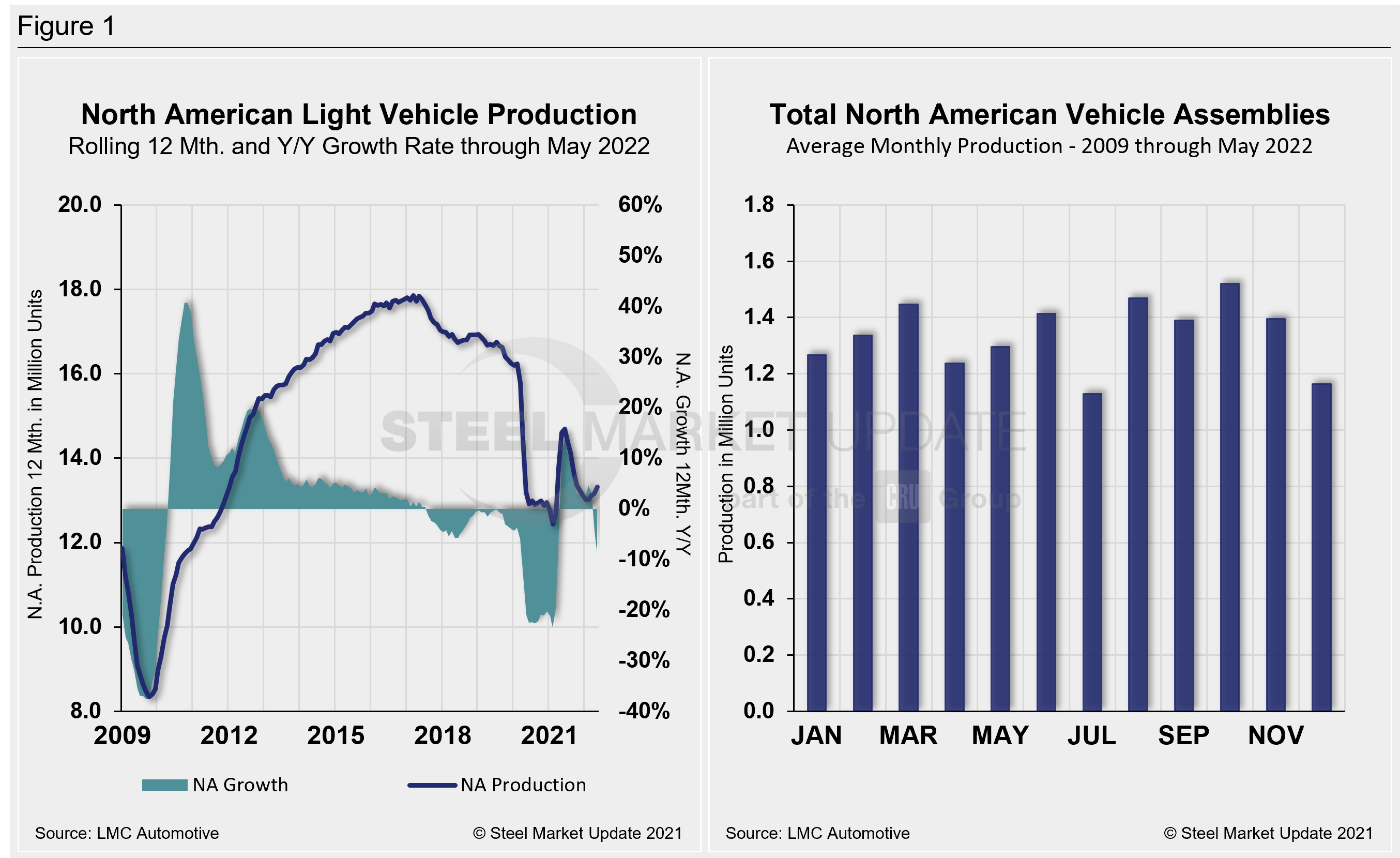

North American vehicle production, including personal and commercial vehicles, totaled 1.22 million units in May, up from 1.14 million units in April. Though somewhat improved over the past 12 months, North American automotive assembly totals are still well behind pre-pandemic totals. Last month’s total was down 258,124 units from May 2019’s production total.

Below in Figure 1 is North American light vehicle production since 2009 on a rolling 12-month and year-over-year growth rate. Also included is average monthly production, including seasonality, over the same period.

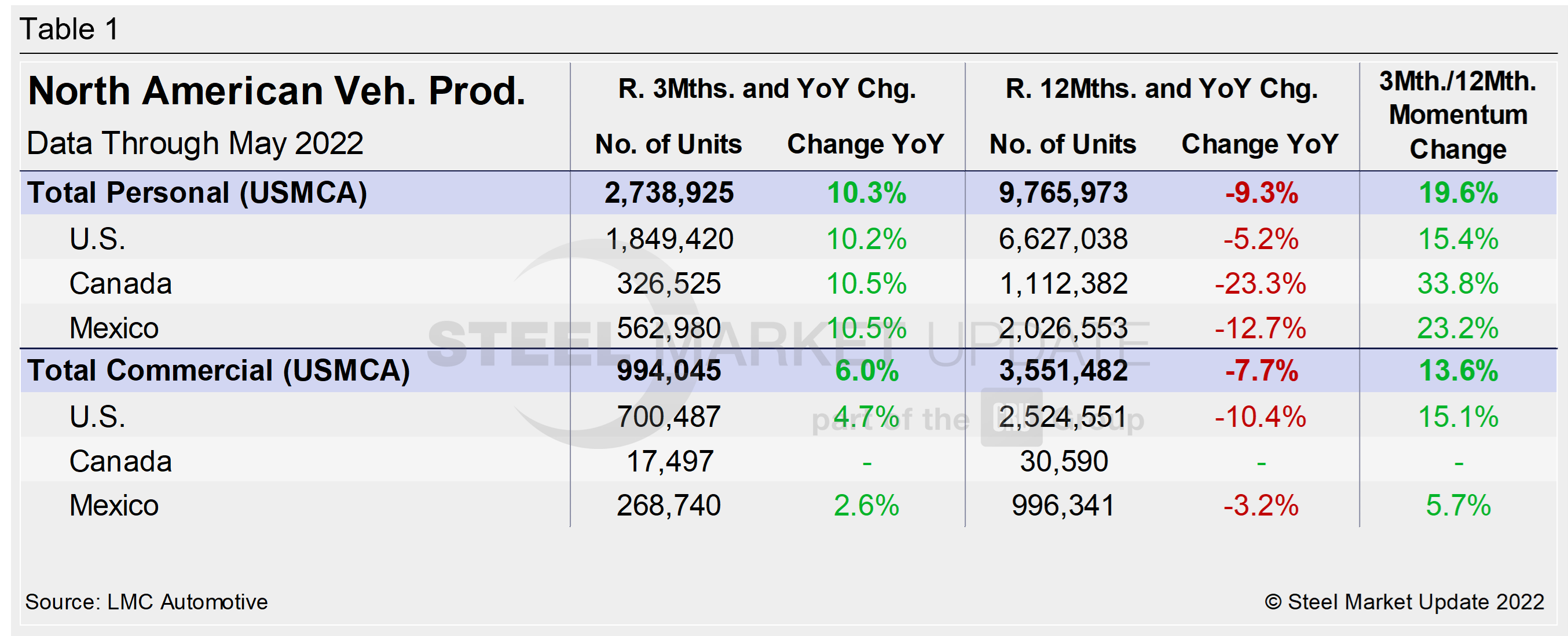

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into US, Canadian and Mexican components, along with the three- and 12-month growth rate for each. On the far right, it shows the momentum for the total and for each of the three nations.

Although the initial rebound from the Covid doldrums was impressive, the effect of the chip and parts shortage has been broader due to its prolonged nature. Through last June, growth rates for personal and commercial light vehicles soared by 156.8% and 127.4%, respectively. But they have since tumbled owning to the ongoing chip shortage and supply-chain disruptions have persisted.

For three months through May, the growth rate for total personal and commercial vehicle assemblies in the USMCA region is up, and a turnaround from -4.5% for both. The improvement was surprising given the demand for fleet vehicles, as automakers focus their limited microchips on the best-selling vehicles. On a 12-month period through May, the story is much different, with decreases of 9.3% for personal assemblies and 7.7% for commercial. The trend points to the extended impact of the continued chip shortage.

Personal Vehicle Production

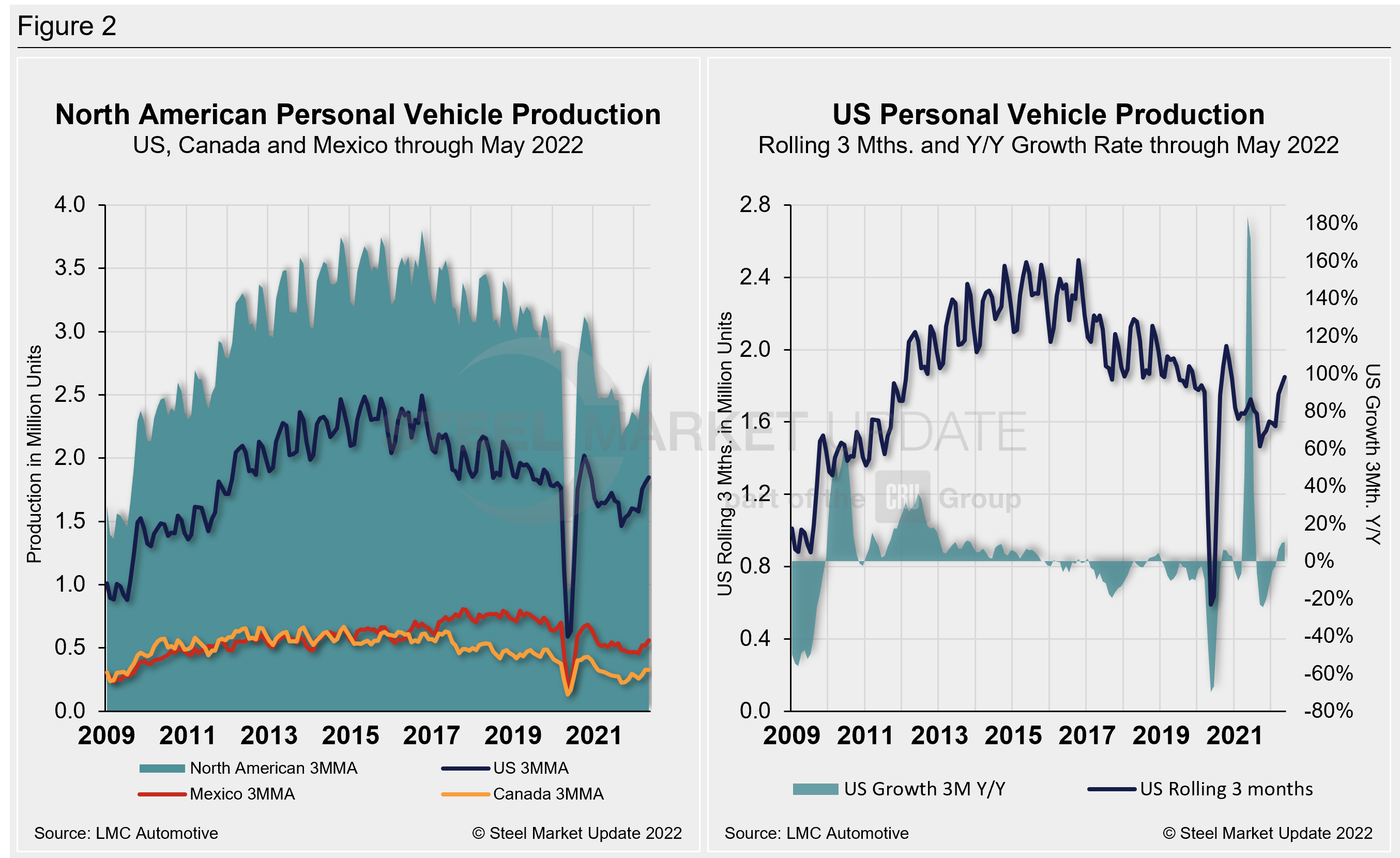

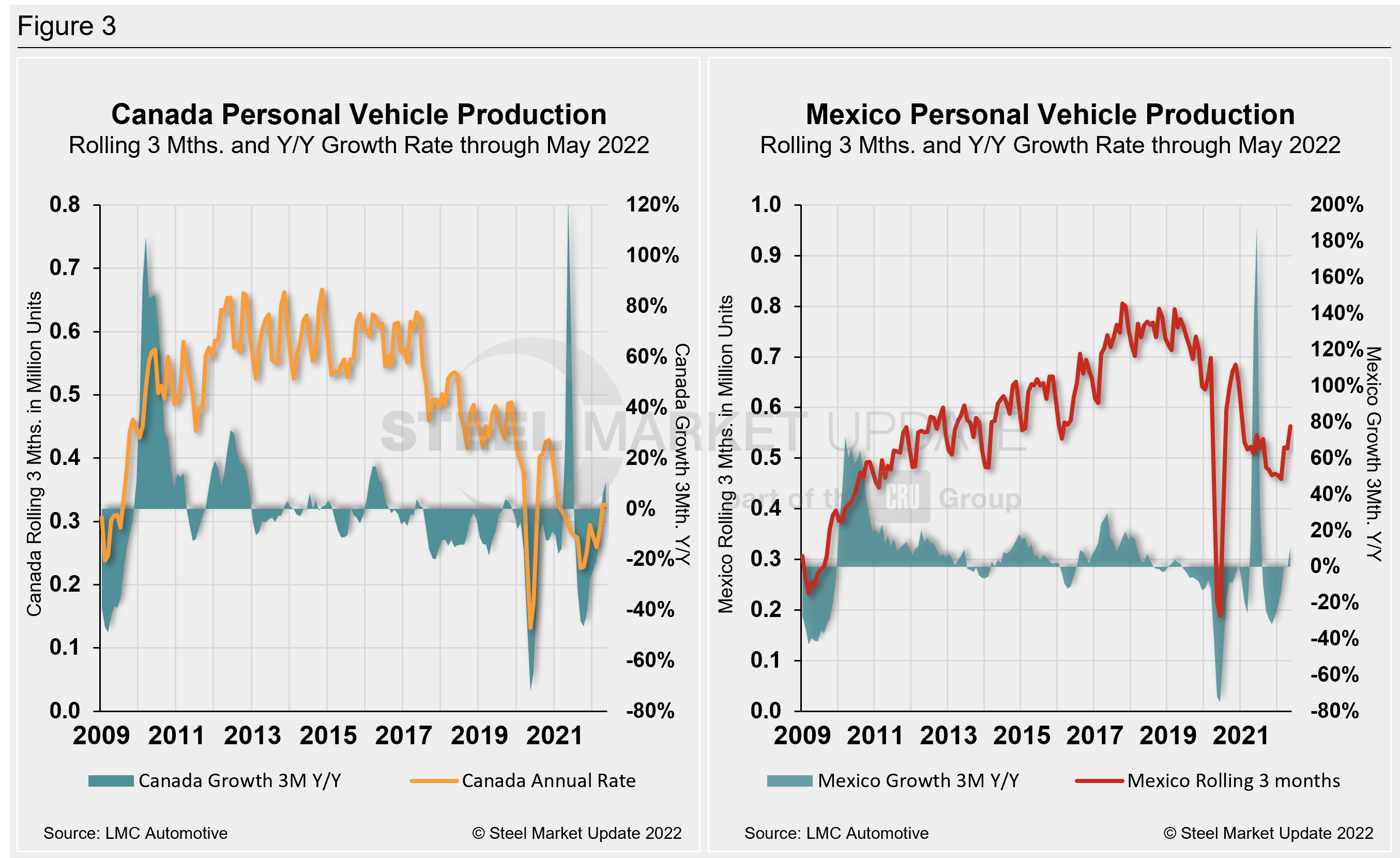

The longer-term picture of personal vehicle production across North America is shown below. The first chart in Figure 2 shows total personal vehicle production for North America as well as the total for the US, Canada, and Mexico individually. The production of personal vehicles in the US and the year-over-year growth rate are displayed in the second chart. Figure 3 shows side-by-side the production of personal vehicles in Canada and Mexico and the year-over-year growth rate.

In terms of personal vehicle production, the US and Mexico saw MoM gains while Canada was down by double digits in May.

Canada fell by 11.5% (-12,252 units) versus the month prior. Mexico saw the largest increase in total units and overall growth MoM, up 29,506 units (+18.1%). US auto assemblies were also 3.3% higher (+19,105 units) over the same period.

The annual growth rate across the region in May improved. Canada and Mexico saw the best gain at 10.5% each, followed by the US at 10.2%. Overall, the region saw an increase of 36,359 units in May, a 4.3% gain from April’s total.

Canada’s personal vehicle production share of the North American market slipped slightly to 11.9% month over month in May, while Mexico’s share was up at 20.6%. The US saw its share of the North American market slip 0.6 percentage points to 67.5% in May.

Commercial Vehicle Production

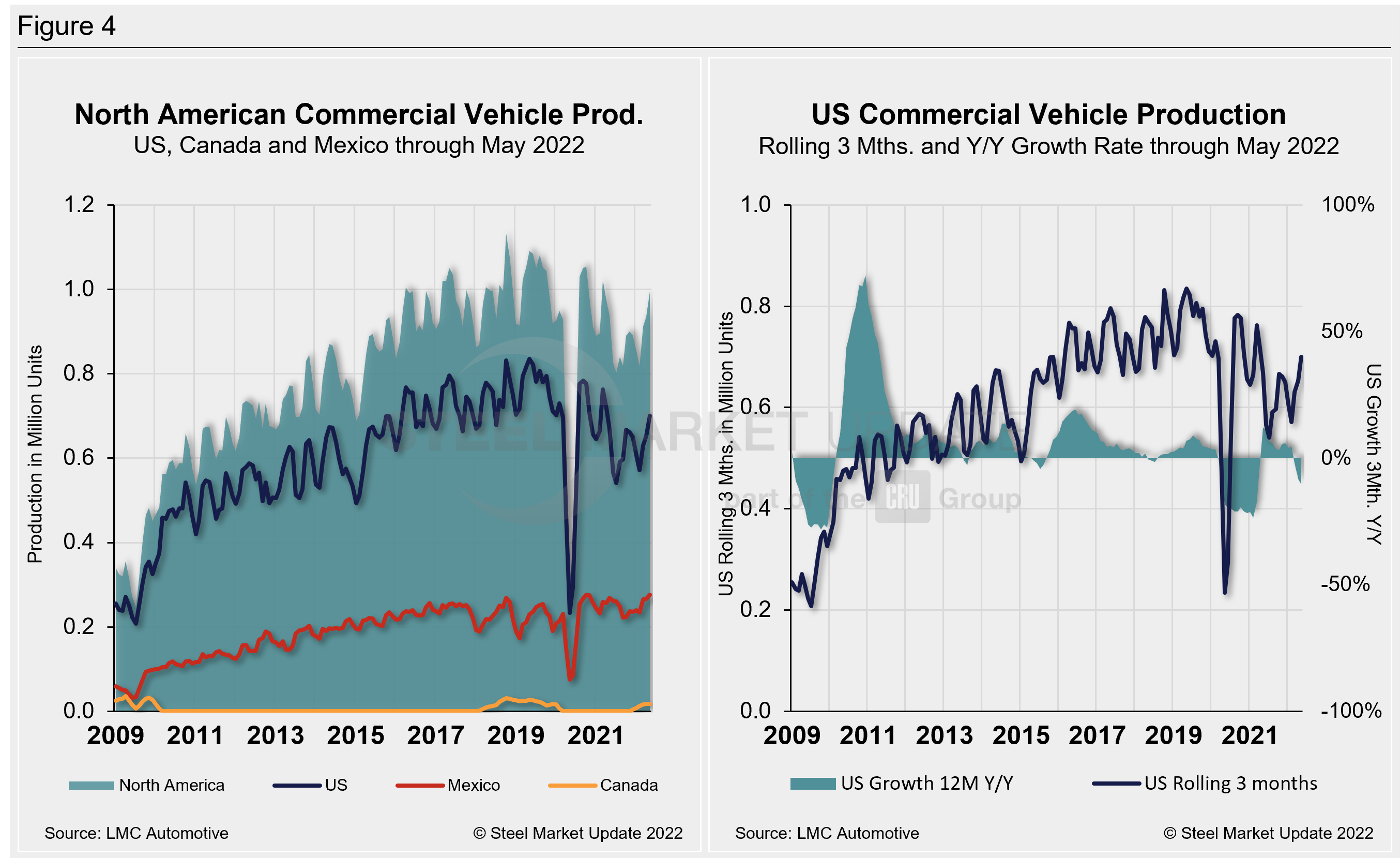

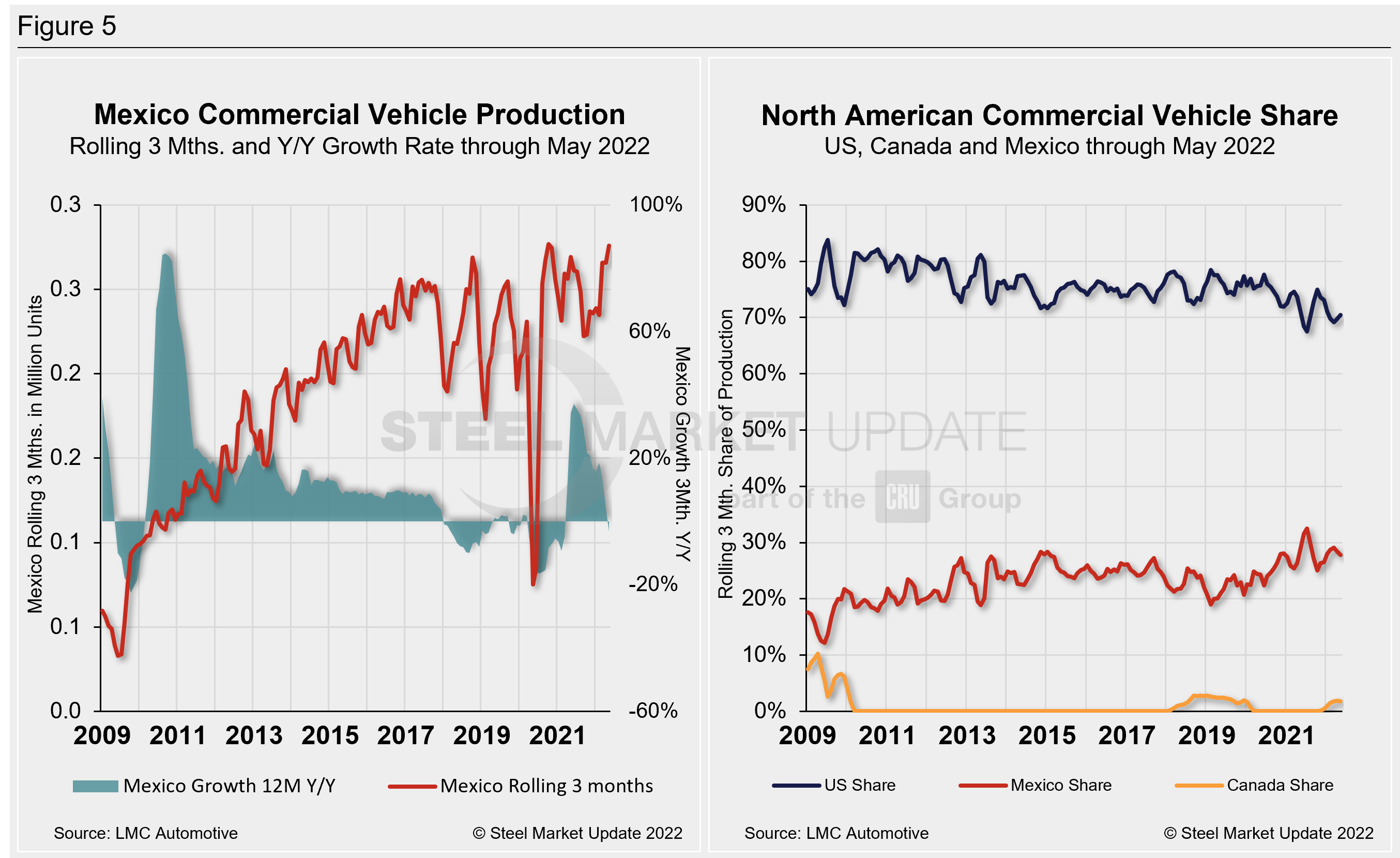

Total commercial vehicle production for North America and the total for each nation within the region are shown in the first chart in Figure 4 on a rolling three-month basis. The production of commercial vehicles in the US and the YoY growth rate are displayed in the second chart. The first chart in Figure 5 shows the production of commercial vehicles and the year-over-year growth rate in Mexico. The second chart shows the production share for each nation in North America.

Of note for the Canadian automotive sector: May marked Canada’s seventh straight month of commercial vehicle production after a 20-month production halt. Canada produced 5,623 light commercial vehicles in May, a 4.7% increase MoM.

North American commercial vehicle production rose 10.3% in May to 339,478 units from 307,884 units in April. The 31,594-unit gain MoM was driven by solid increases across the region. The US saw the greatest unit gain, up 22,494 (+10.4%), followed by Mexico, up 8,847 (+10.2%), and Canada.

The annual commercial production growth rate is now 6% for the region, an improvement from -3.9% in April. The US share was little changed at 70.5%, up 0.1 percentage points in May MoM. Mexico saw its share decline slightly to 27.8% in May from 28.4% in April, while Canada saw its share stay unchanged at 1.8% in May. Presently, Mexico exports just under 80% of its light vehicle production. The US and Canada are the highest volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the US, Canada, and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included).

By David Schollaert, David@SteelMarketUpdate.com