Market Data

June 16, 2022

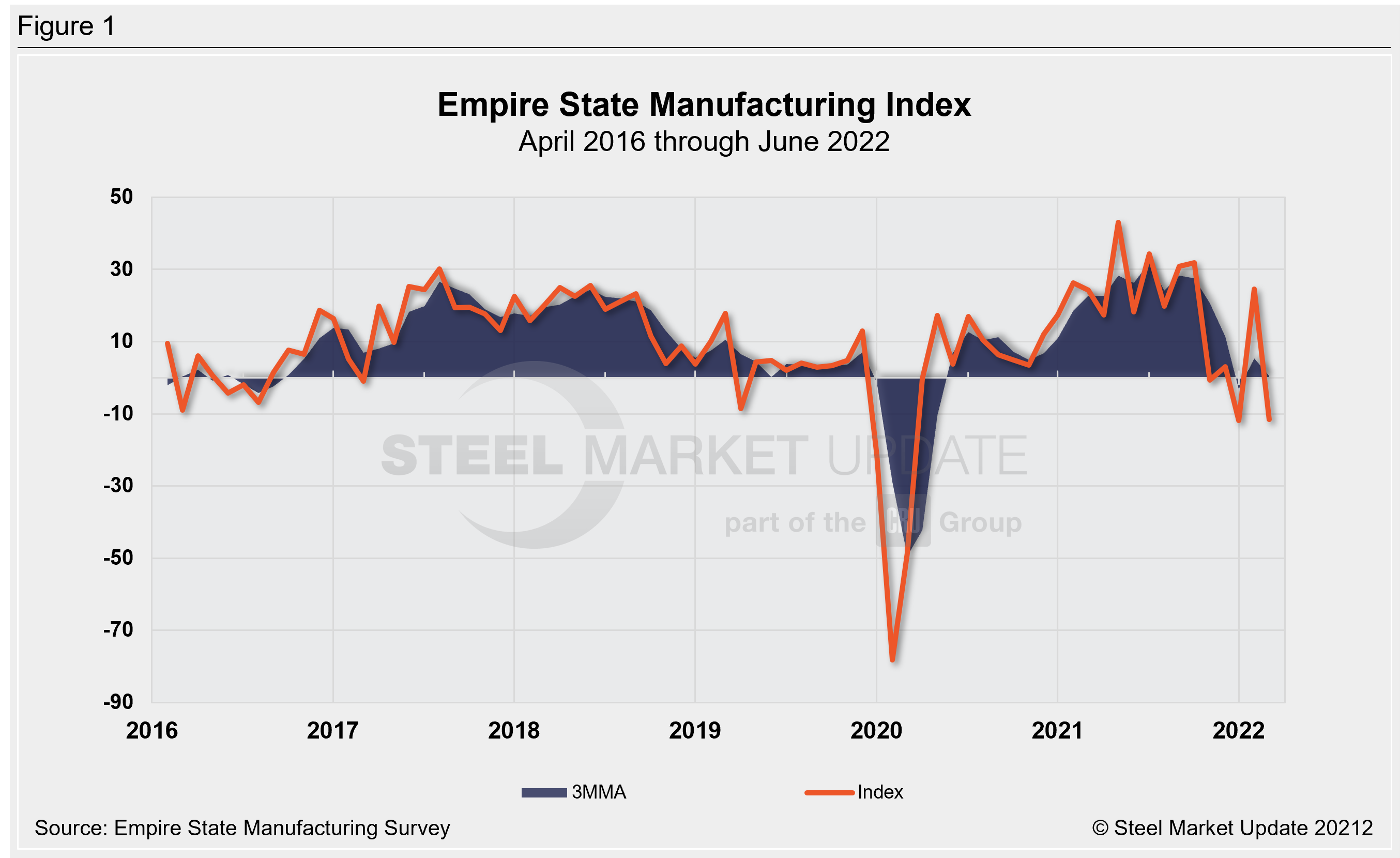

Empire State Manufacturing Contracts Again in June

Written by David Schollaert

Business activity in the state of New York was little changed in June, following a surprising fall in May, according to the Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index – a gauge of manufacturing activity in the state – rose 10.4 points in June but remained at a -1.2 reading after falling 26 points to -11.6 the month prior.

This is just the fourth negative reading since the onset of the global pandemic more than two years ago, but the third negative reading in four months. Any reading below zero indicates deteriorating conditions.

The specifics of the report were somewhat stronger than the headline index. In June, new orders, and shipments both rebounded from share declines month-on-month (MoM). The prices-paid and prices-received indexes remained elevated. Unfilled orders fell in June, while delivery times lengthened at a slower pace. Inventories also rose.

The new orders index rose 14.1 points to a reading of 5.3 in June, and the shipments index jumped 19.4 points to 4.

Unfilled orders tumbled 6.9 points to a reading of -4.3 in June while delivery times lengthened at a slower pace, falling 5.7 points to 14.5. Inventories rose 9.2 points to 17.1 in June.

In June, the prices received index inched down 2 points to 43.6, while the prices paid index rose 4.9 points to a still-elevated 78.6.

Employee indexes diverged in June. The average workweek index was 6.4 – down 5.5 points versus April’s reading, while employment increased 5 points to a reading of 19.

Firms were slightly less optimistic about the next six months, as the view on future market conditions was subdued for a third consecutive month. The future business conditions index fell 4 points to a reading of 14, the Federal Reserve Bank of New York said.

Shorter delivery times, lower prices, and declining employment are all expected in the months ahead. Capital spending plans were little changed (+0.2 points) after falling for the first time in 2022 last month.

The indexes for future prices paid and received both diverged in June. Future prices paid rose 6 points to a reading of 69.2, while future prices received was down 2 in June to a reading of 43.6.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com