Analysis

June 12, 2022

Final Thoughts

Written by John Packard

Steel Market Update just conducted one of our flat rolled and plate steel market surveys. The data collected consisted of responses from service centers (46% of respondents), manufacturing companies (32%), steel mills (10%), trading companies (8%), suppliers to the steel industry (4%), and toll processors (2%).

We intentionally weight the number toward distributors and manufacturing companies because we feel this provides us a better view of what is happening within the greater steel market.

The first thing I want to flag is that the SMU Steel Buyers Sentiment Index is showing signs of fatigue.

The SMU Steel Buyers Sentiment Indices, both present and future, are flashing a warning that the economy may be turning. Based on the responses collected this past week, Current Sentiment is +70, which is the same as what we measured two weeks ago. But it’s down 12 points from the beginning of the second quarter. A year ago, our Sentiment Index was +78.

Future Sentiment, which measures how buyers and sellers of steel feel about their company’s ability to be successful three to six months into the future, has dropped even more dramatically than our Current Sentiment Index. Future Sentiment is at +64, down 16 points from the +80 recorded just four weeks ago.

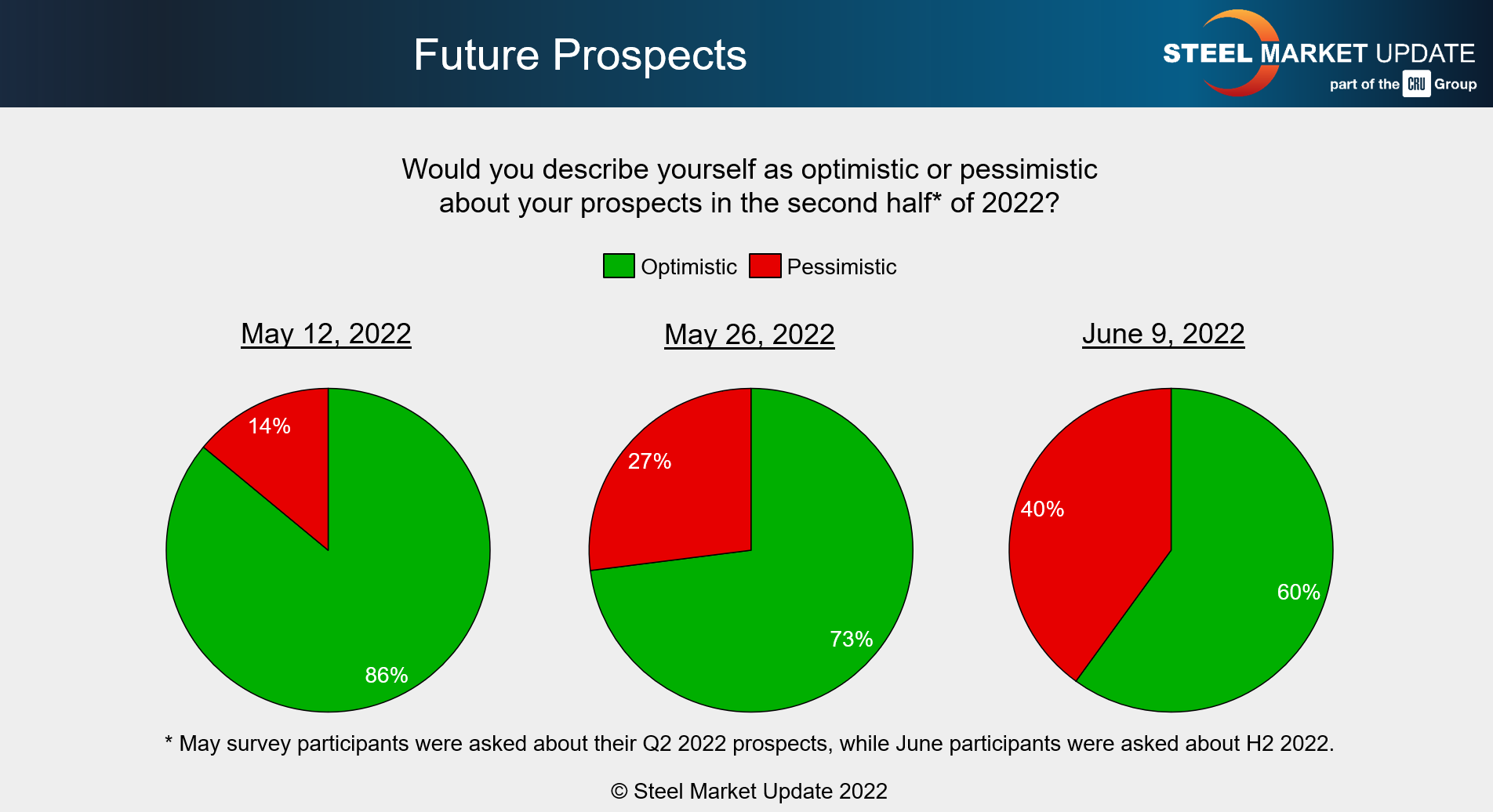

Pessimism Growing Within Steel Community

We asked those responding to our survey last week whether they were optimistic or pessimistic about their prospects in the second half of 2022. What we are finding is that a fairly significant amount of pessimism is taking hold. In mid-May, only 14% of respondents reported being more pessimistic. By late May, that number had almost doubled to 27%. This past week, the percentage of respondents reporting being more pessimistic expanded to 40%.

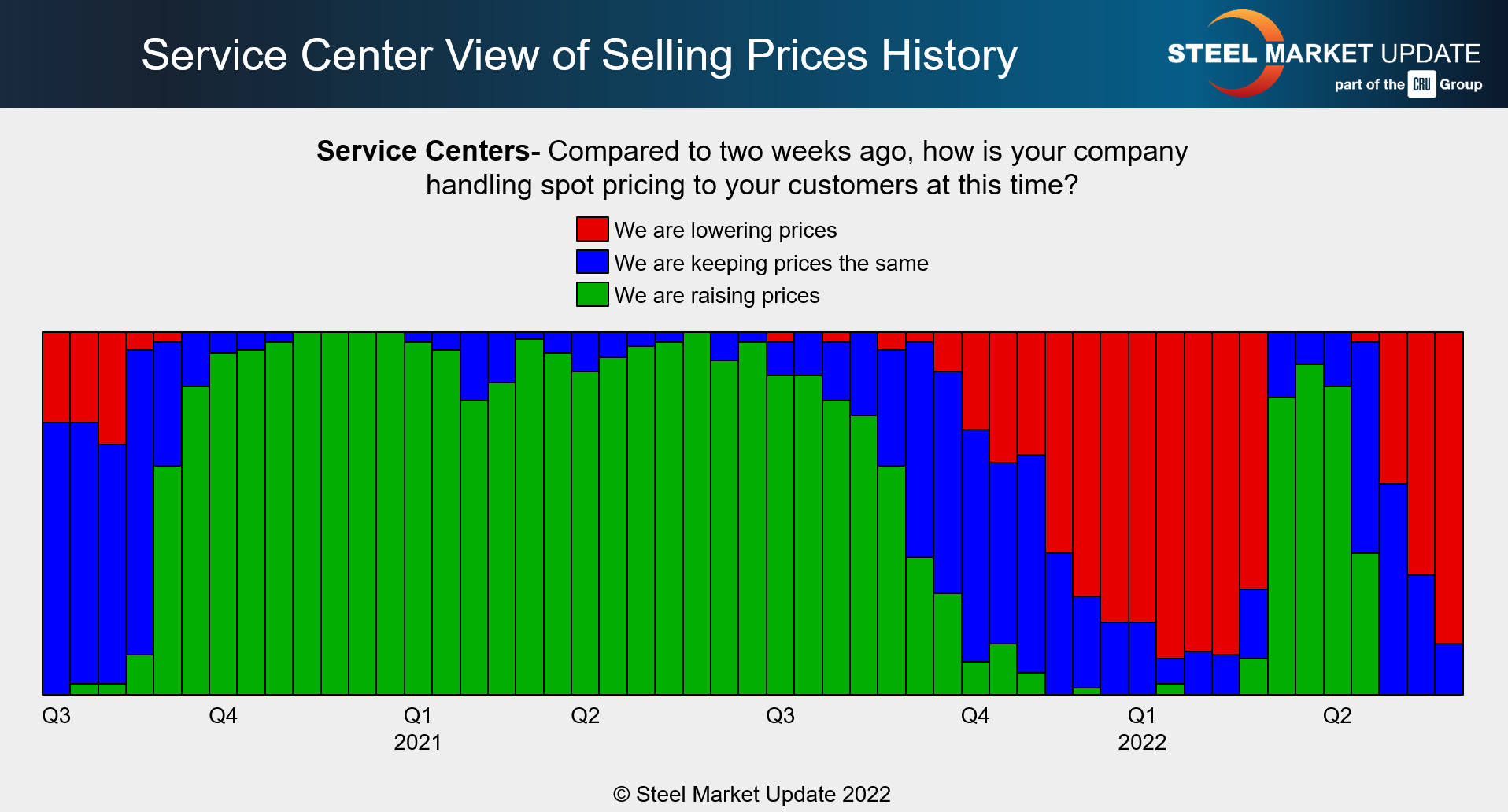

Service Center Selling Prices at Point of Capitulation?

Approximately 86% of the manufacturing companies responding to last week’s survey reported that their service center suppliers were dropping spot prices compared to two weeks ago. That’s up from 44% a month ago and 78% two weeks ago.

Service centers are in agreement with the manufacturing community: 86% of service centers reported that their companies were lowering spot prices. That compares to 42% a month ago and 67% two weeks back.

Those of you who have been reading Steel Market Update for many years are aware of our theory regarding service centers reaching a point of “capitulation.” This is the point where the pain associated with growing levels of lower spot pricing leads to an acceptance of price increases by the domestic steel mills. This used to be a consistent leading indicator. But with steel prices at +$1,000 per ton levels, it appears the level of pain may need to be prolonged compared to what we saw when prices moved within the more “normal” range of $400 per ton to $800 per ton.

As you can see in the graphic above, in this last price move service centers had spent 10 weeks above 75% (red bars). In the past, it would have only taken a few weeks before prices would have begun to move higher out of the domestic mills. When we look at this same graphic, we need to understand that the war in Ukraine, and the psychological fear of supply disruptions, moved prices higher (not service centers capitulating).

We will have to watch the markets carefully to see how long it takes to squeeze any excesses out of the market. And at the same time, we need to carefully watch demand to see if high interest rates and supply chain issues are slowing it. Slowing demand will put pressure on service centers and manufacturing companies to lower inventories, thus putting pressure on steel prices.

Solar, Wind, and Other Energy Developments Impacting Steel

In this evening’s issue of Steel Market Update, Lewis Leibowitz discusses the Biden Administration’s change of course on imported solar panels. Due to the war in Ukraine, and the high cost of oil resulting from Russian oil being banned by many countries (including the US), the need to transition to other forms of power generation has become a priority. Thus the need for solar, wind and other forms of clean energy has become a priority.

At this year’s SMU Steel Summit Conference, part of our program will be dedicated to renewable energy generation and what that means for the steel industry. We have added Frank Frederickson, vice president of customer experience at Minnesota Power, to our agenda. During his career, Frederickson has been responsible for several wind and solar projects.

We will also have a timely, informative and fun conference this year. We continue to be on pace to get to our goal of 1,200 attendees. You can learn more about the conference, our agenda, speakers, costs to attend, and how to register by clicking here or going to https://events.crugroup.com/smusteelsummit/home.

Also, don’t forget to nominate a rising star at your organization for the NexGen Leadership Award. The three finalists will receive a free pass to the conference. You can nominate someone for the award by clicking here.

A reminder that our hotel block is quickly filling up, and I expect all four hotels will have our block of rooms sold out by the end of this week. You can access our room block after registering for the conference. Once you register, you will receive a link to the Marriott hotel reservation system for the 2022 Steel Summit Conference. The hotels may have full-priced rooms available, but I expect they will be totally sold out by the end of June – if not before then.

Note, we never use a third party to book rooms for our conference. If you receive a solicitation, we recommend you ignore it and either book through us or directly with the hotel.

We will have more information coming out about our new app, which you can use before and during the conference for networking, viewing the agenda and speakers, and for live streaming the event. Stay tuned.

Advanced Steel Hedging Workshop

Finally, a quick note to advise you that our Advanced Steel Hedging: Strategies & Execution Workshop will be held virtually on July 12-13 (a half day each day). You can find out more about the agenda, our instructors, costs to attend, and how to register by clicking here.

As always, your business is truly appreciated by all of us associated with Steel Market Update.

John Packard, Founder, John@SteelMarketUpdate.com