Market Data

June 9, 2022

Employment by Industry: Manufacturing, Construction Add Jobs in May

Written by David Schollaert

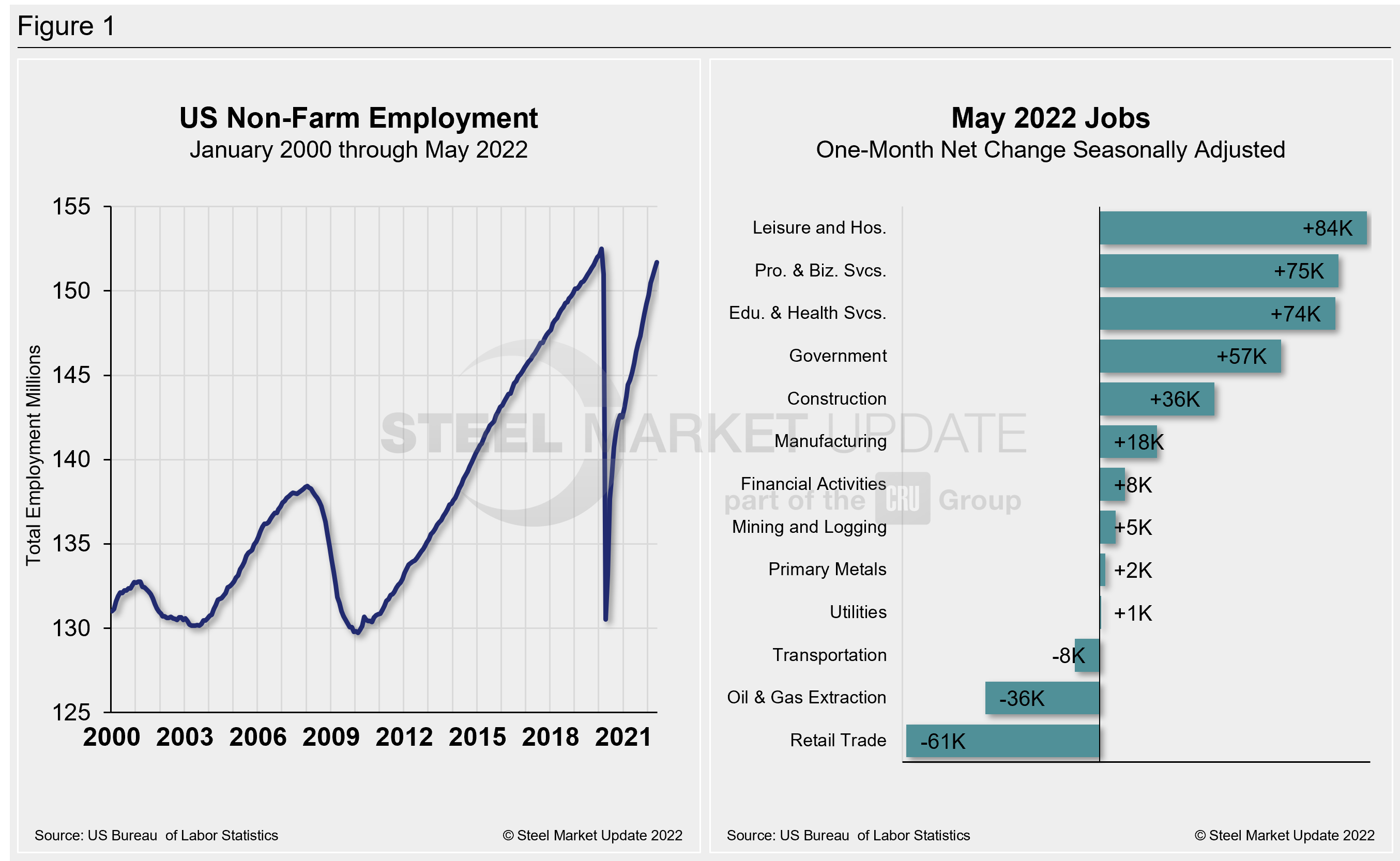

The US labor market added 390,000 jobs in May, a robust figure but a slower pace of hiring versus the upwardly revised 436,000 additional payrolls in April. The result kept the unemployment rate unchanged month on month (MoM) at the pandemic-era low of 3.6%, the Bureau of Labor Statistics reported.

Payroll gains were better than economists had forecast and came despite the economy being battered by surging inflation and a competitive labor market.

April was the 17th straight month of robust job gains, according to the BLS figures released last Friday. In fact, the 390,000 jobs added are far more than the typical gains in normal times.

In the decade leading up to the end of 2019, the average monthly job gain was 183,000. Yet ever since the economy shed nearly 22 million jobs in the early months of the pandemic, employers have been scrambling to hire back workers.

The report showed that job gains were widespread. The major exception was in retail – the nation’s largest sector in terms of jobs – which saw a net loss of 60,700 jobs. Automakers and their parts suppliers also lost 3,500 jobs in May. Plants had to temporarily shut down or eliminate shifts due to the semiconductor and parts shortage.

The biggest job gains came in the leisure and hospitality sector, which added 84,000 jobs in anticipation of a strong summer travel season.

Employers were able to add jobs despite a shortage of workers looking for positions. There are nearly two job openings for every job seeker, according to a separate Labor Department survey.

Shown below in Figure 1 is the total number of people employed in the nonfarm economy as well as the month-on-month net change in total jobs in May.

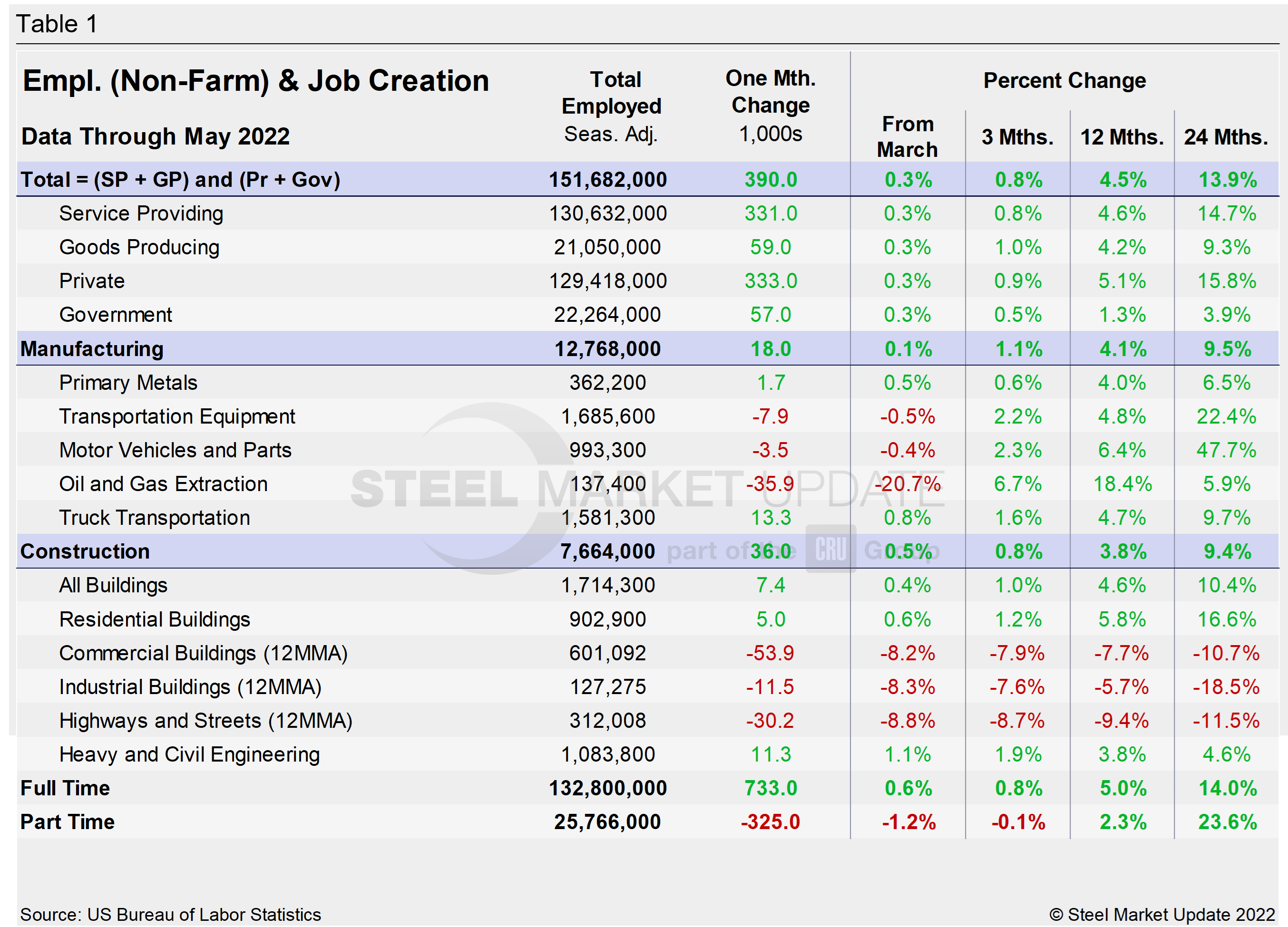

Designed on rolling time periods of 1 month, 3 months, 1 year, and 2 years, the table below breaks total employment into service industries and goods-producing industries, and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction. Comparing service and goods-producing industries in May shows both increased by just 0.3%. The steady month-on-month gains have pushed both above pre-pandemic levels. Note, that the subcomponents of both manufacturing and construction shown in this table do not add up to the total because we have only included those with the most relevance to the steel industry.

Comparing May to April, manufacturing employment was just 0.1% higher, less than the 0.6% growth the month prior. Construction saw a 0.5% boost MoM after being unchanged in April. The construction sector, which is being driven by the residential market, has been held back by a slowdown in commercial and industrial buildings, as well as by less activity when it comes to highways and streets. Despite the overall improvement, the inconsistencies in some of the subcomponents reflect the obstacles still facing the US economy and domestic job creation.

The three-month and 12-month comparisons show a decent recovery. But some still lag the 24-month pre-pandemic comparisons. In the year-over-year contrast, manufacturing is up 9.5% and construction is up 9.4%. Further growth is expected as the marketplace recovers from Q2 2020, when the economy nearly collapsed following the outbreak of the Covid-19 pandemic.

Manufacturing employment added 18,000 jobs in May, a slower pace than the 55,000 added in April, while construction employment saw a 36,000 payroll boost following a largely flat month, adding just 2,000 new jobs in April.

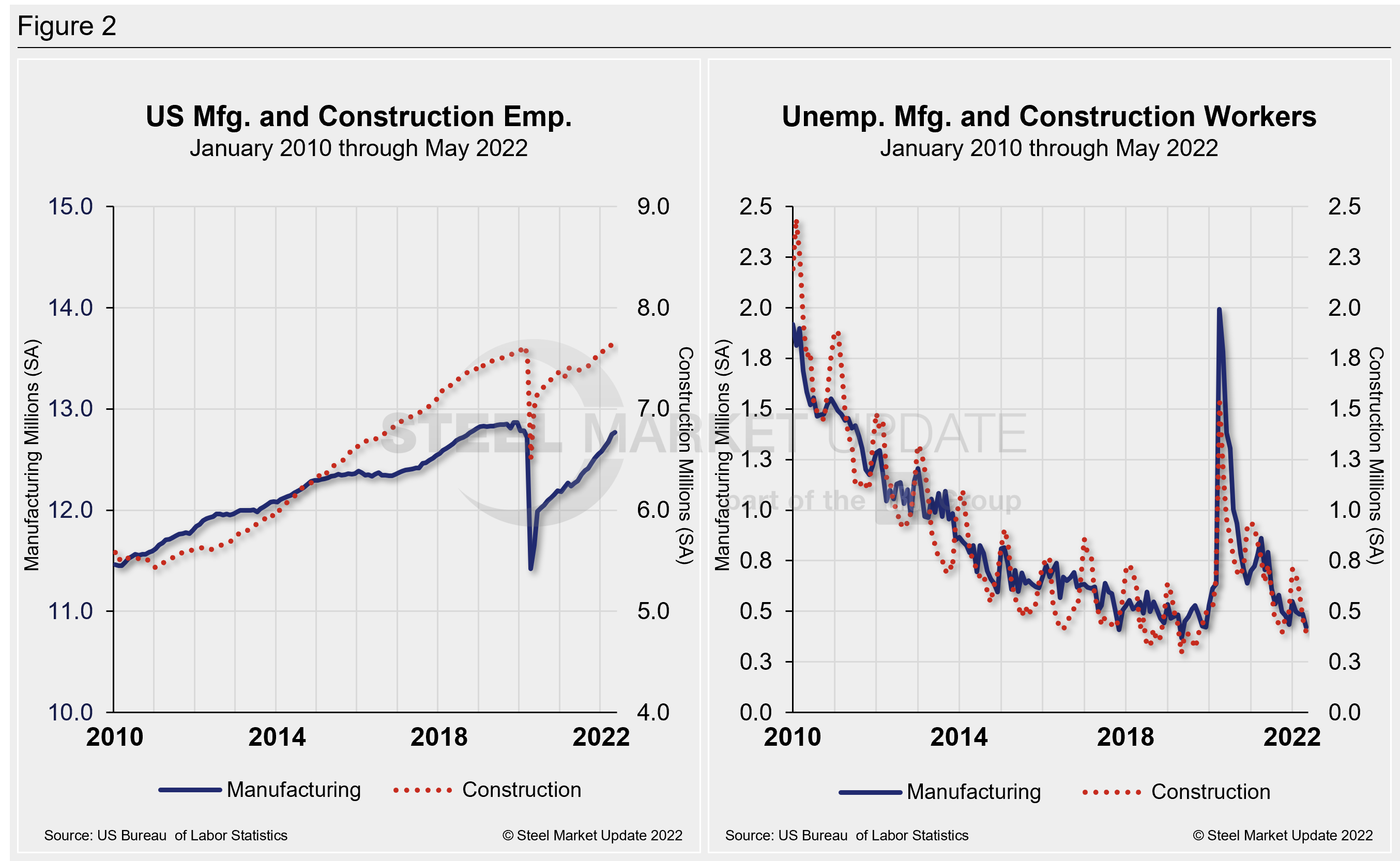

Construction and manufacturing unemployment fell in May. Construction unemployment fell 15.5% MoM from 464,000 in April to 392,000 in May. Manufacturing unemployment fell 13.7% MoM following a 0.8% increase the month prior. Manufacturing unemployment fell from 489,000 in April to 422,000 in May. Both sectors have been heavily impacted by supply-chain disruptions and labor force constraints.

The history of employment and unemployment in manufacturing and construction since January 2010 is shown below side-by-side in Figure 2, seasonally adjusted.

According to human resources consulting firm Challenger, Gray and Christmas Inc., the construction industry has been heavily impacted by job cuts. Rising inflation and interest rates are beginning to impact the housing market, and construction firms announced 817 job cuts in May. All told, a total of 1,150 cuts have been announced year to date, a 55% increase from the 741 cuts announced through May 2021. It is the highest monthly total for the sector since October 2020 when construction firms announced 967 cuts.

This follows a slight slowdown in housing starts and permits in April, according to the Census Bureau. Housing permits fell 3% from March but remain 14% higher than a year ago, while starts fell 0.2% from March.

“After the housing frenzy over the last 18 months, demand has cooled somewhat, which will lead to job cuts in related sectors,” Challenger said.

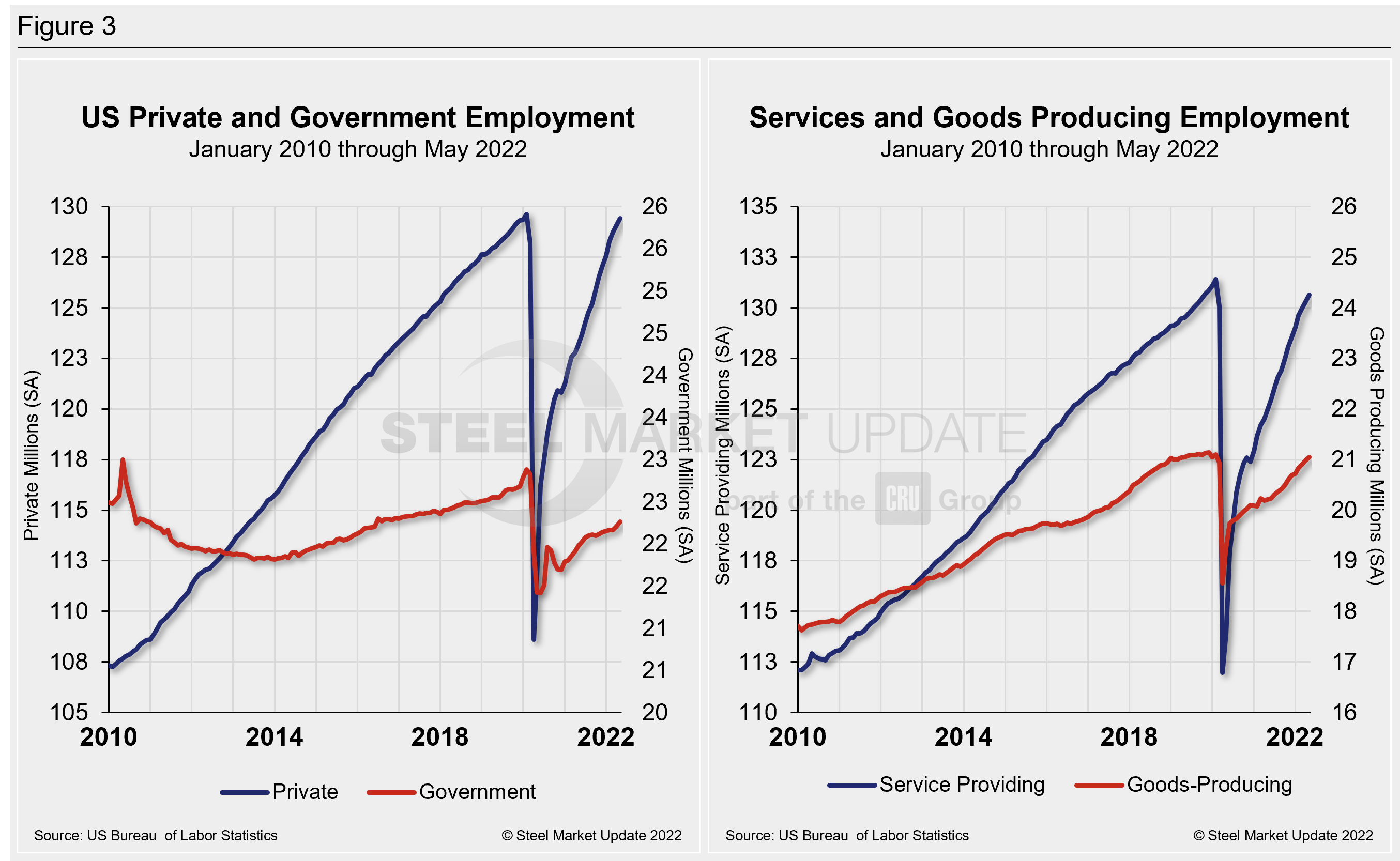

Figure 3 details employment comparisons between private and government jobs, as well as services and goods-producing jobs.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is not necessarily the nominal numbers, but the direction in which they are headed.

By David Schollaert, David@SteelMarketUpdate.com