Prices

June 7, 2022

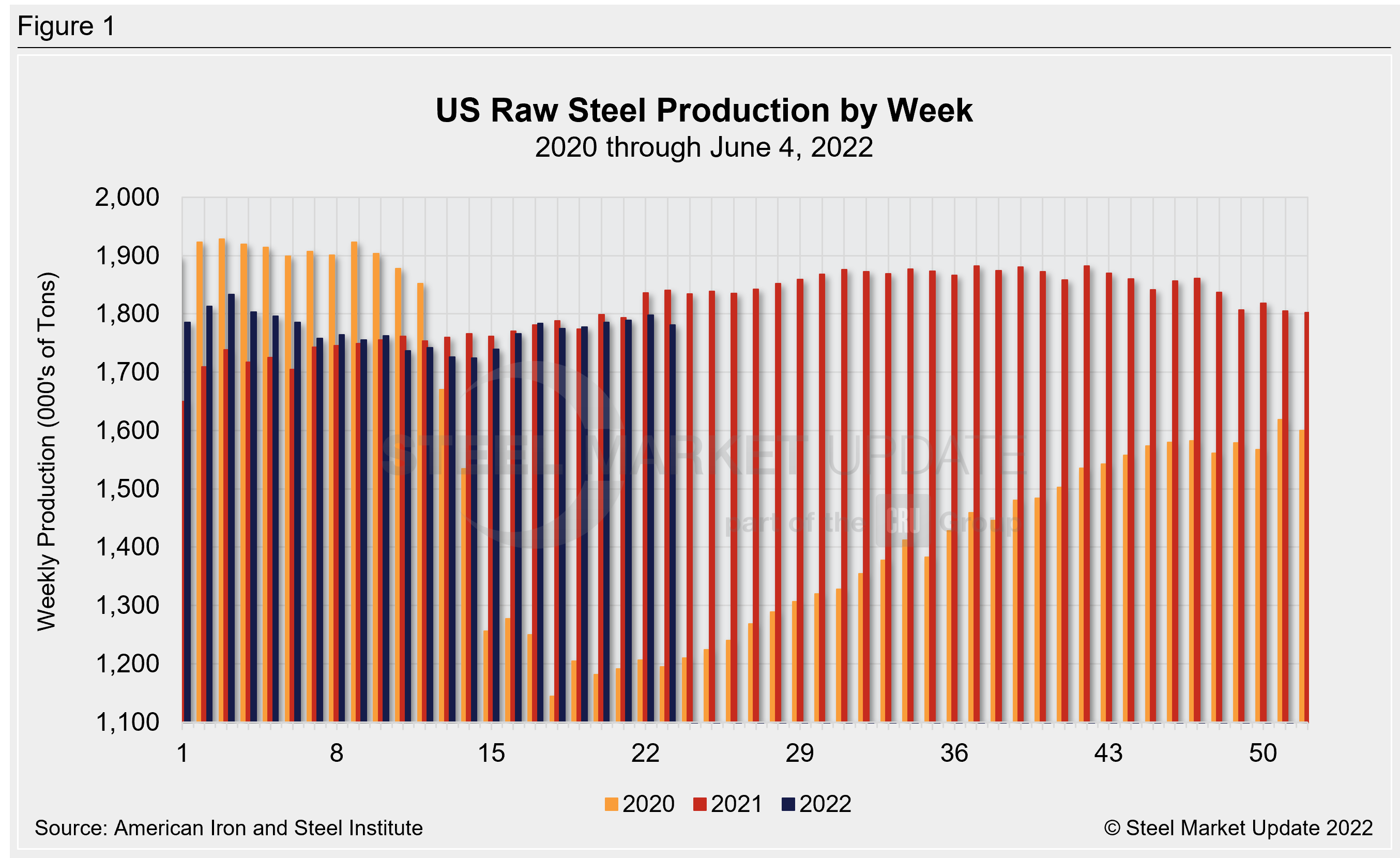

Raw Steel Production Slips From High Level

Written by David Schollaert

Raw steel production by US mills was down slightly last week, edging down for the first time in five weeks. Despite the lower output, domestic capacity utilization was a healthy 81.6% while mill production totaled 1,781,000 net tons in the week ending June 4, reported the American Iron and Steel Institute.

US output was down 0.9% versus the week prior and 3.2% below the same year-ago period when production was 1,840,000 net tons. Mill capacity utilization last week was 0.8 percentage points below the prior week and 0.5 percentage points below the same period one year ago when utilization was 82.1%.

Adjusted year-to-date production through June 4 totaled 38,874,000 net tons, at an average utilization rate of 80.6%. That’s 1.6% below the same period last year when production was 39,517,000 net tons, though the utilization rate was lower at 78.8%, AISI said.

Production rose in only two of five regions last week (Northeast and Midwest). The gains were offset by declines in the Great Lakes (-10,000 tons or -1.7%), South (-9,000 tons or -1.2%), and West (-2,000 tons or -2.8%) over the same period.

Below is the production by region for the week ending June 4: Northeast, 170,000 tons; Great Lakes, 577,000 tons; Midwest, 207,000 tons; South, 758,000 tons; and West, 69,000 tons – for a total of 1,781,000 net tons, down 17,000 net tons from the prior week.

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7”, published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of U.S. production capacity.

Given the large number of changes to steelmaking capability in the current rapidly evolving market environment, AISI is undertaking a comprehensive review of its raw steel production and capability utilization statistics to ensure that they accurately reflect market conditions. Any updates to capability will be phased in over several weeks.

By David Schollaert, David@SteelMarketUpdate.com