Market Data

June 1, 2022

More Steel Buyers Turn Pessimistic, See Demand Weakening

Written by Laura Miller

With one month left in the second quarter of 2022, more steel buyers are reporting decreasing optimism and weakening demand.

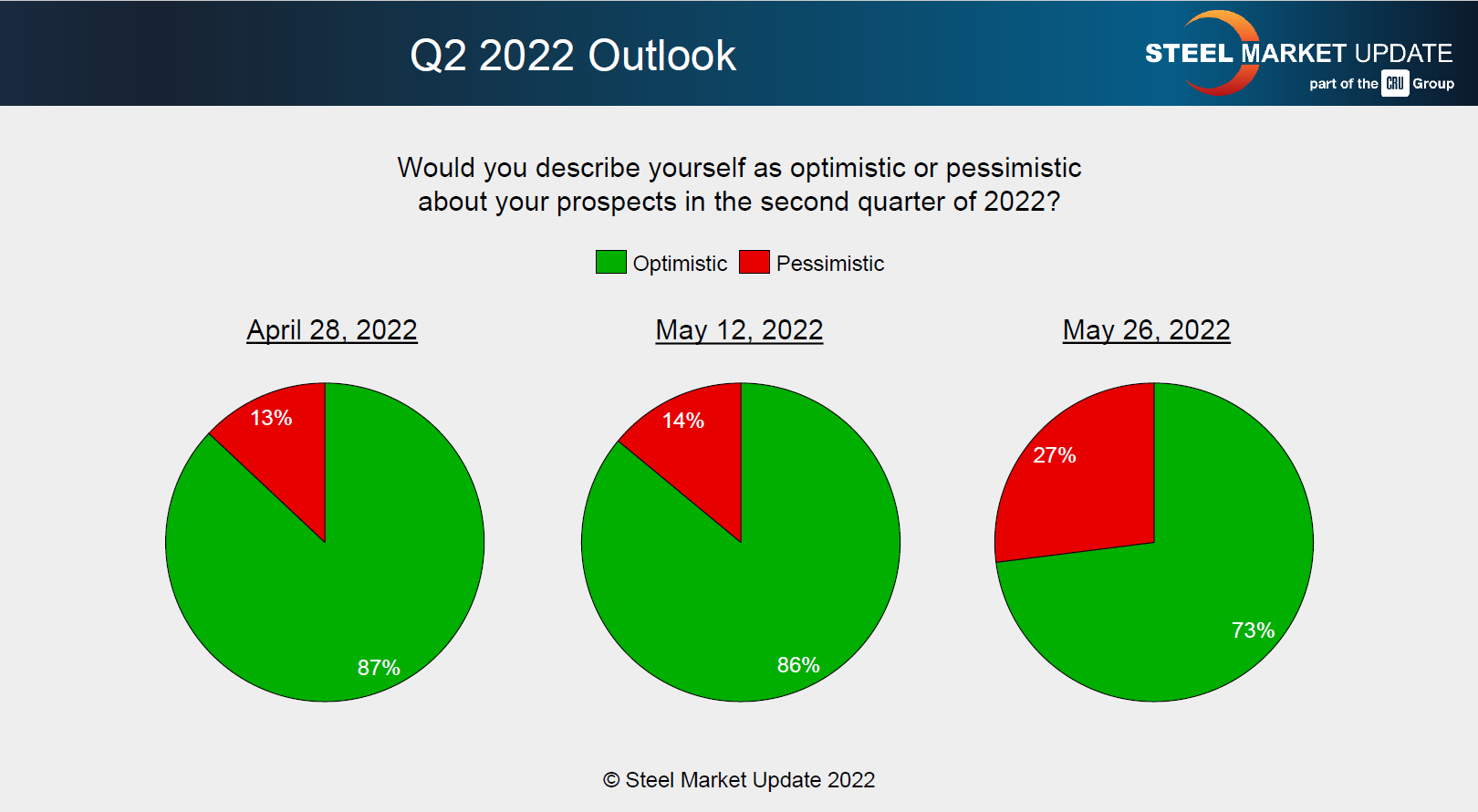

When asked about their optimism or pessimism for the remainder of Q2, the number of buyers reporting pessimism rose from 14% in the prior survey to 27% in last week’s Steel Market Update market survey. Still, the majority remains optimistic.

Here are some comments from the buyers:

“The first part of Q2 has been good. There is no reason to think much will change for the remainder.”

“We have a very busy Q2 and into Q3. Late Q3 and Q4 are unknown.”

“Demand seems to be softening … mills are eager to cut deals.”

“Demand remains strong, but we will certainly experience some headwinds.”

“I think pricing will continue to erode, customers may see that trend and hold off on purchases.”

“Market is turning, clouds forming.”

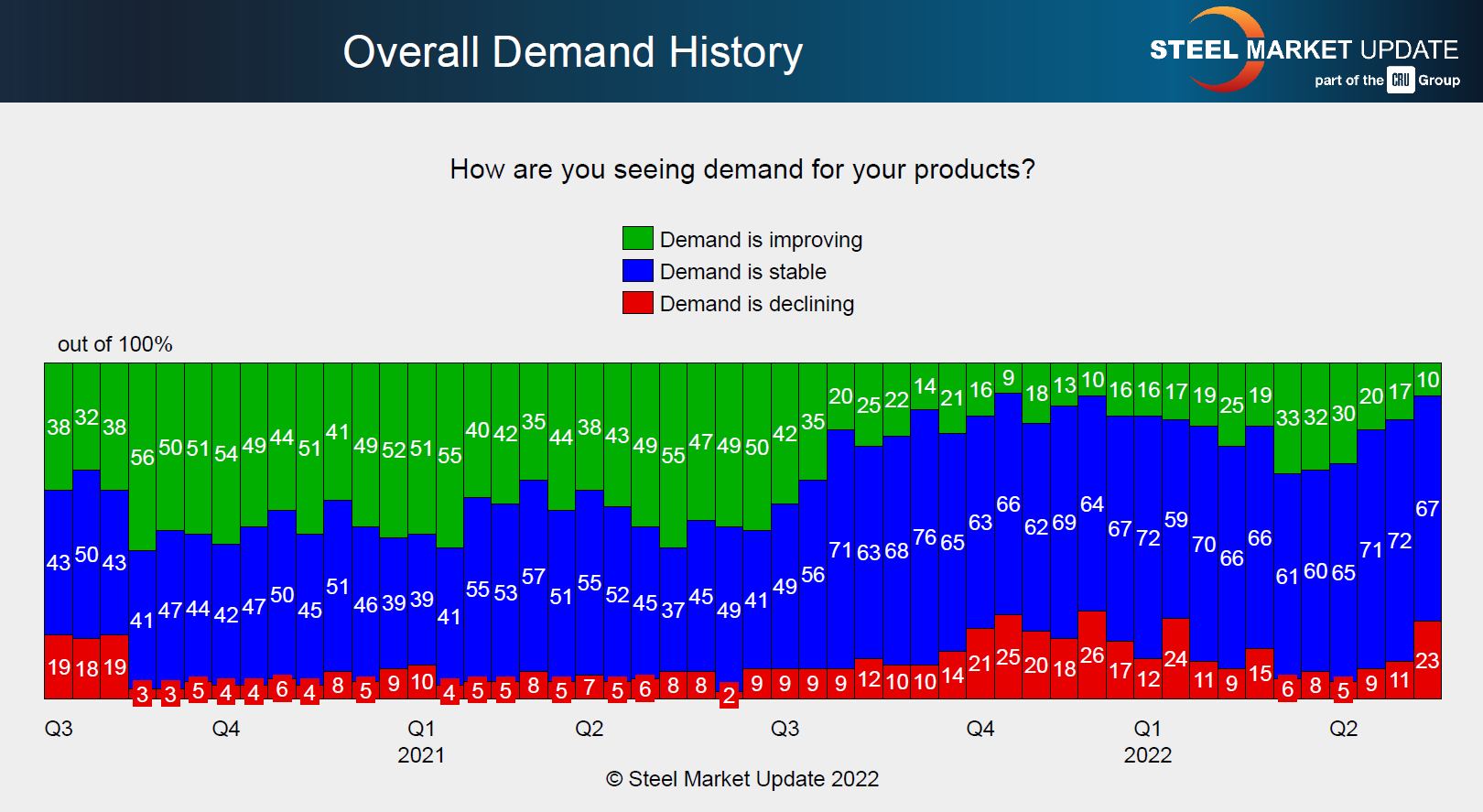

Comments from buyers suggest they are seeing stable demand, but the latest survey shows an increasing number of buyers seeing a decline in demand. Last week’s survey showed 23% of buyers noting a decline in demand — an increase from the 11% reporting this in the previous survey and the highest figure since early Q1. The number of buyers reporting improving demand dropped from 17% to 10% — the lowest amount reporting demand improvement since Q4 2021.

Here’s what a few of the buyers had to say:

“It’s slight to moderate currently, though I feel it’s due to robust order books.”

“Service centers are full from West Coast to East Coast to Düsseldorf.”

“Spot demand is down.”

“Expect overall Q3 demand to be better than Q2 demand.”

“Demand is less for ‘stock buyers,’ less from service centers, and somewhat less from end users.”

“Stable at best…”

“The demand is stable but at a tipping point. Some of the sluggishness we are seeing is due to the late spring, but if it doesn’t pick up soon, we could see a decline in demand.”

The comments are in line with SMU’s latest Steel Buyers Sentiment Index, which fell last week to the third-lowest level seen in the past 13 months.

By Laura Miller, Laura@SteelMarketUpdate.com