Market Data

May 17, 2022

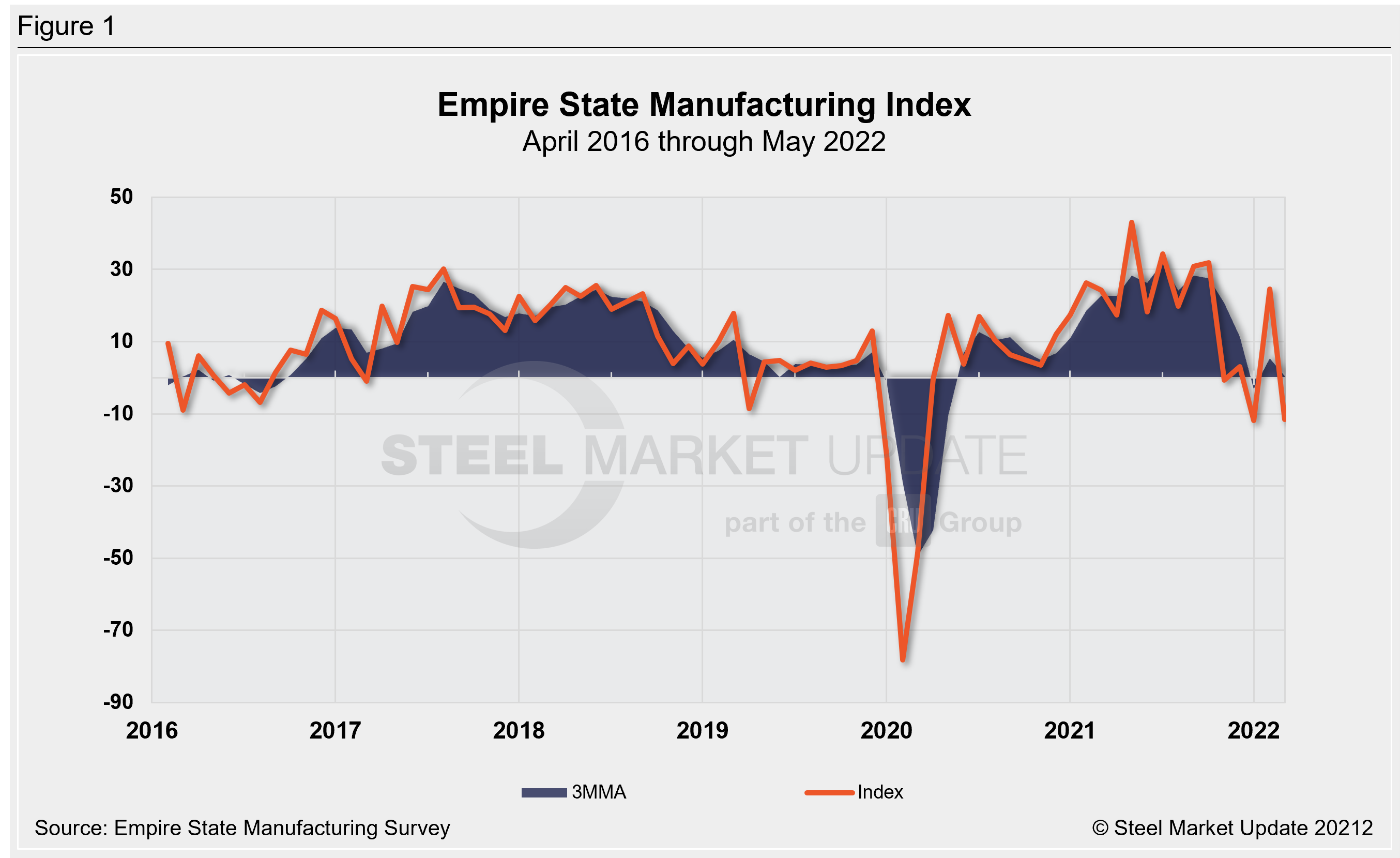

A Shocker: Empire State Manufacturing Index Falls in May

Written by David Schollaert

Business activity in the state of New York sank in May, a startling result following a strong turnaround in the headline index the month prior, according to the Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index – a gauge of manufacturing activity in the state – is now at -11.6, diving well past the forecasted measure of 16.5. The reading was a complete reversal from the 36.4-point surge the month prior.

This is just the second decline since the onset of the global pandemic more than two years ago, but the second negative reading in three months. The decline is not a good signal for the economic outlook. Could supply-chain woes and higher prices finally be cooling off demand?

Any reading below zero indicates deteriorating conditions.

In May, new orders, and shipments both declined sharply, mirroring the weakness in the headline index. Unfilled orders slipped and delivery times lengthened, though at a slower pace than in recent months. Inventories also ticked down.

The new orders index fell 33.9 points to a -8.8 reading in May, and the shipments index plummeted by 49.9 points to -15.4.

Unfilled orders fell 14.7 points to 2.6, while delivery times slipped 1.6 points to 20.2. There were declines in both input and selling prices but not enough to signal any cooling of inflationary pressures.

In May, the prices received indexes inched down 3.5 points to 45.6, while the prices paid index fell 12.7 points to a still-elevated 73.7.

Both employee indexes improved slightly in May. The average workweek index was 11.9 – up 1.9 points versus April’s reading.

Despite lower readings in May, firms were slightly more optimistic about the next six months, but still a downgrade from their view earlier in the year. The future business conditions index rose 2.8 points to a reading of 18, the Federal Reserve Bank of New York said.

Shorter delivery times, lower prices, and declining employment are all expected in the months ahead. Capital spending plans also fell for the first time in 2022.

The indexes for future prices paid and received both slipped in May. Future prices paid fell 9.5 points to a reading of 63.2, while future prices received was down 9.9 in May to a reading of 45.6. The capital expenditures index slipped by 6.4 points to 25.4, yet still suggests firms plan for significant increases in capital spending. The technology spending index edged down 4.5 points to a measure of 22.8 in May.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com