Analysis

April 21, 2022

NAHB: March Housing Starts Weaken

Written by David Schollaert

Housing starts declined in March, driven by rising mortgage interest rates and ongoing supply chain bottlenecks that continue to delay construction projects and raise home building costs.

Though the single-family housing market showed signs of softening last month, strong multifamily production pushed overall housing starts up 0.3% to a seasonally adjusted annual rate of 1.79 million units, according to the latest data from the US Census Bureau and the Department of Housing and Urban Development.

The March reading of 1.79 million stats – indicating the number of housing units builders would begin if development kept this pace for the next 12 months – was driven by a 4.6% gain in the multifamily sector to an annualized 593,000 pace. The single-family starts decreased 1.7% to a 1.20 million seasonally adjusted annual rate.

“Higher mortgage interest rates and rising construction costs are pricing buyers out of the market, and these higher costs are particularly hurting entry-level and first-time buyers,” said Jerry Konter, NAHB’s chairman and a home builder and developer from Savannah, Ga. “Policymakers must address building supply chain disruptions to help builders bring down construction costs and increase production to meet market demand.”

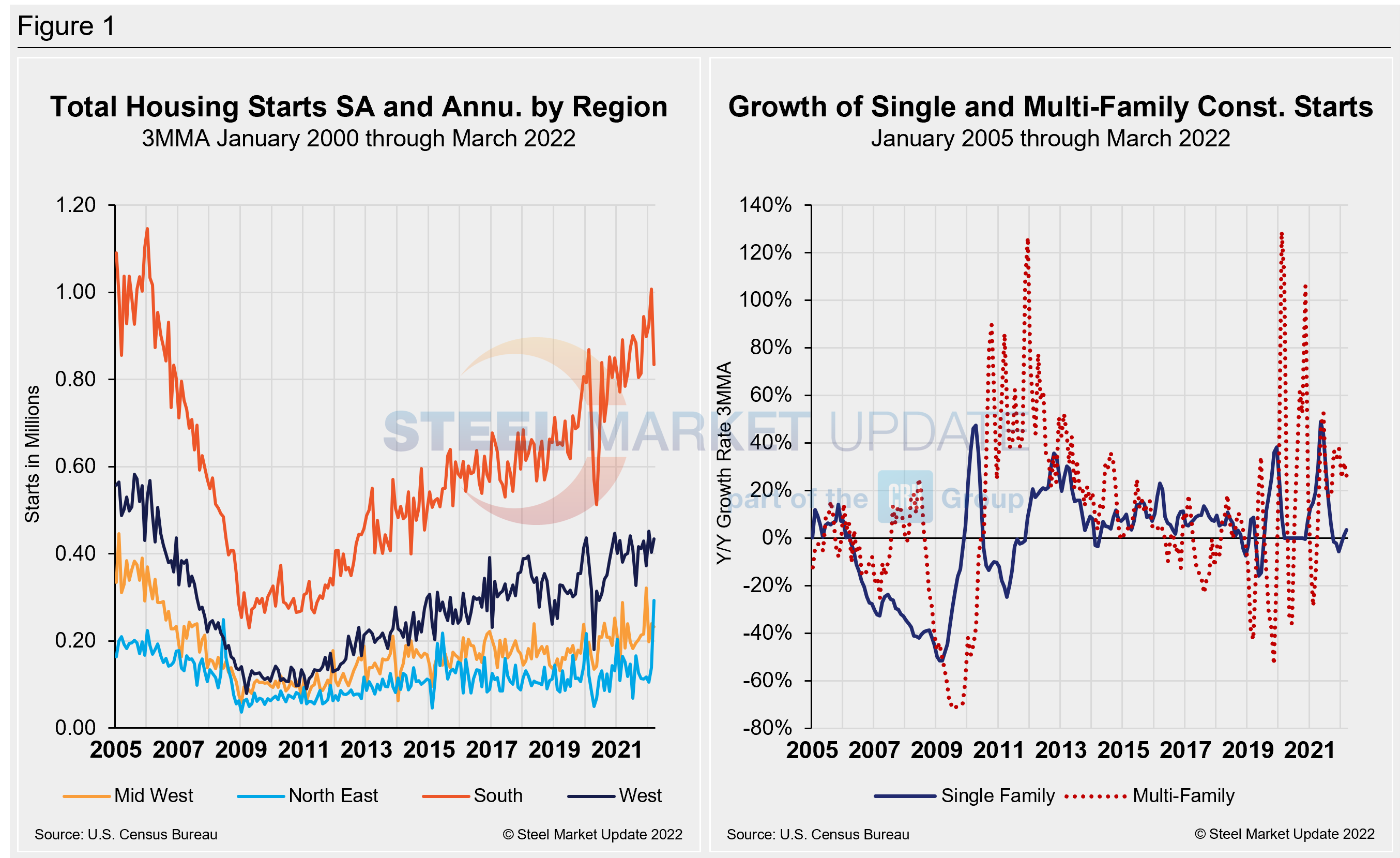

On a regional basis compared to the previous month, combined single-family and multifamily starts are 17.3% higher in the Northeast, 6.6% higher in the Midwest, 11.2% higher in the South, and 7.5% lower in the West.

Below in Figure 1 is the long-term picture growth of housing starts from January 2005 through March 2022. Total housing starts are also shown, seasonally adjusted and annualized, broken down by region over the same period.

“The shift in affordability can be seen in the March data with strength for multifamily construction and some weakness for single-family permits,” said Robert Dietz, NAHB’s chief economist. “Our builder surveys show that confidence levels in the single-family market have declined for four straight months as affordability conditions continue to worsen, and this is a sign that single-family production will face challenges moving forward.”

Overall permits decreased 0.4% to a 1.87-million-unit annualized rate in March. Single-family permits decreased by 4.8% to a 1.15-million-unit rate. Multifamily permits increased 10% to an annualized 726,000 pace.

Compared to the previous month, regional permit data shows that permits are 5.5% higher in the Northeast, 4.0% higher in the Midwest, 7.5 % higher in the South, and 4.9% higher in the West.

There are now 149,000 single-family permits authorized but not yet started, a 14.6% year-over-year gain as higher construction costs and material delays slow previously permitted projects.

By David Schollaert, David@SteelMarketUpdate.com