Analysis

April 10, 2022

CPIP Data: Construction Spending Grows Marginally in February

Written by David Schollaert

Steel Market Update is pleased to share this Premium content with Executive members. For information on upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

US construction spending in February totaled $1.704 trillion at a seasonally adjusted annual rate, rising less than expected as an increase in outlays on private projects was partially offset by a decline in government spending, the Commerce Department reported.

February’s investment in construction rose 0.5%, behind earlier forecasts of 1.0% growth. Year-over-year, construction spending increased by 11.2% in February. Also, data for January was revised higher: construction outlays were 1.6% instead of the previously reported 1.3%.

The Census Bureau’s report on construction shows outlays on private construction projects gained 0.8% in February, and investment in residential construction increased 1.1%. Investment in private non-residential structures, such as those used in oil and gas drilling, rose 0.2% in February.

Single-family homebuilding spending shot up 2.5%. But outlays on multi-family housing projects were largely unchanged, edging up just 0.1%. Demand for housing is far outstripping supply as homebuilders grapple with higher prices for materials, including framing lumber, as well as for appliances.

According to the Federal Home Loan Mortgage Corporation, commonly known as Freddie Mac, mortgage rates have surged. The 30-year fixed rate averaged 4.67% last week, its highest reading since December 2018.

In contrast, spending on public construction projects fell 0.4% in February. Outlays on state and local government construction projects dropped 0.3%, while federal government spending tumbled 1.3%.

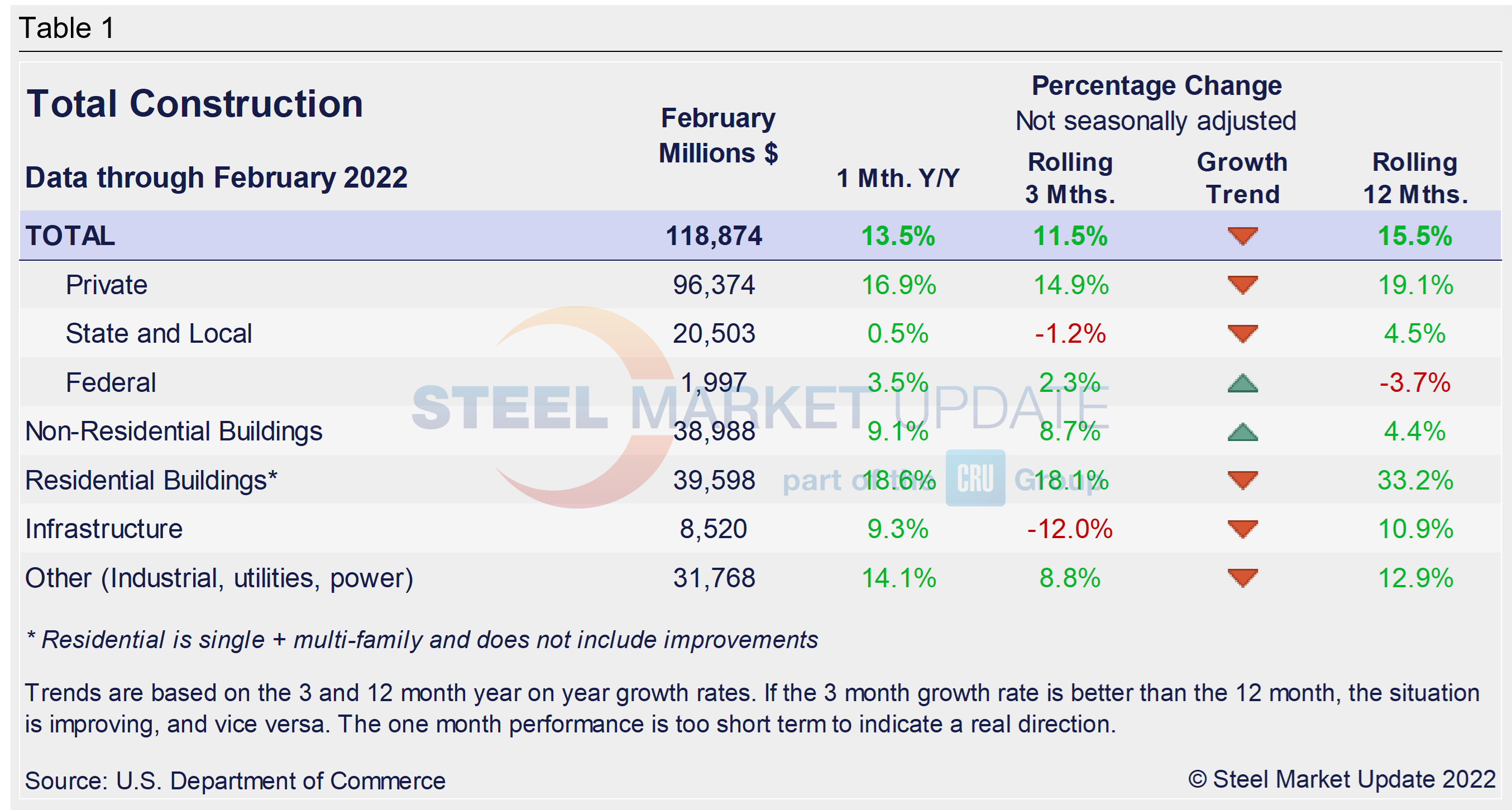

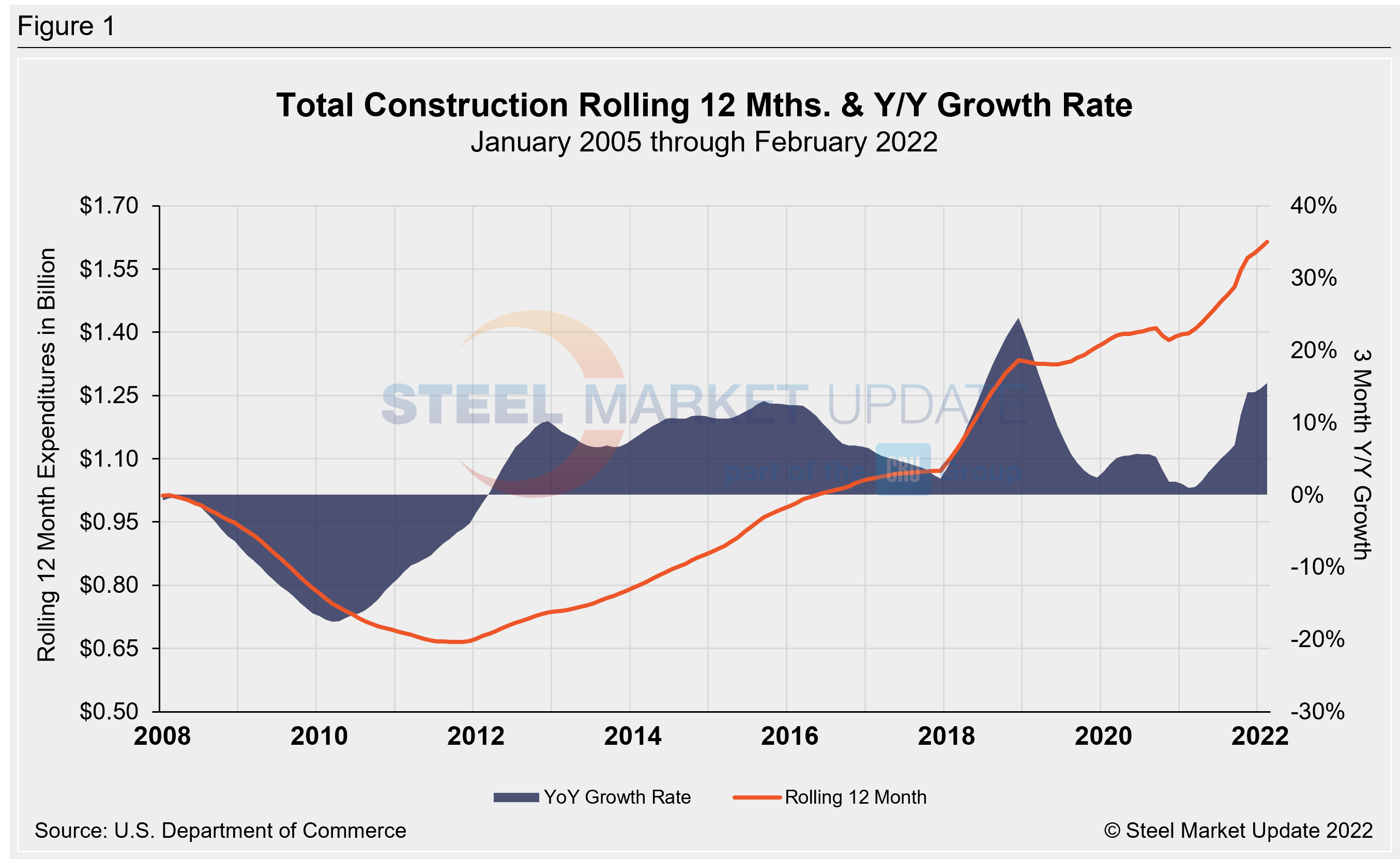

Total construction expenditures and their major categories are shown in Table 1 below. Figure 1 shows total construction and infrastructure expenditures. It details the year-on-year growth rate versus a rolling 12-month average.

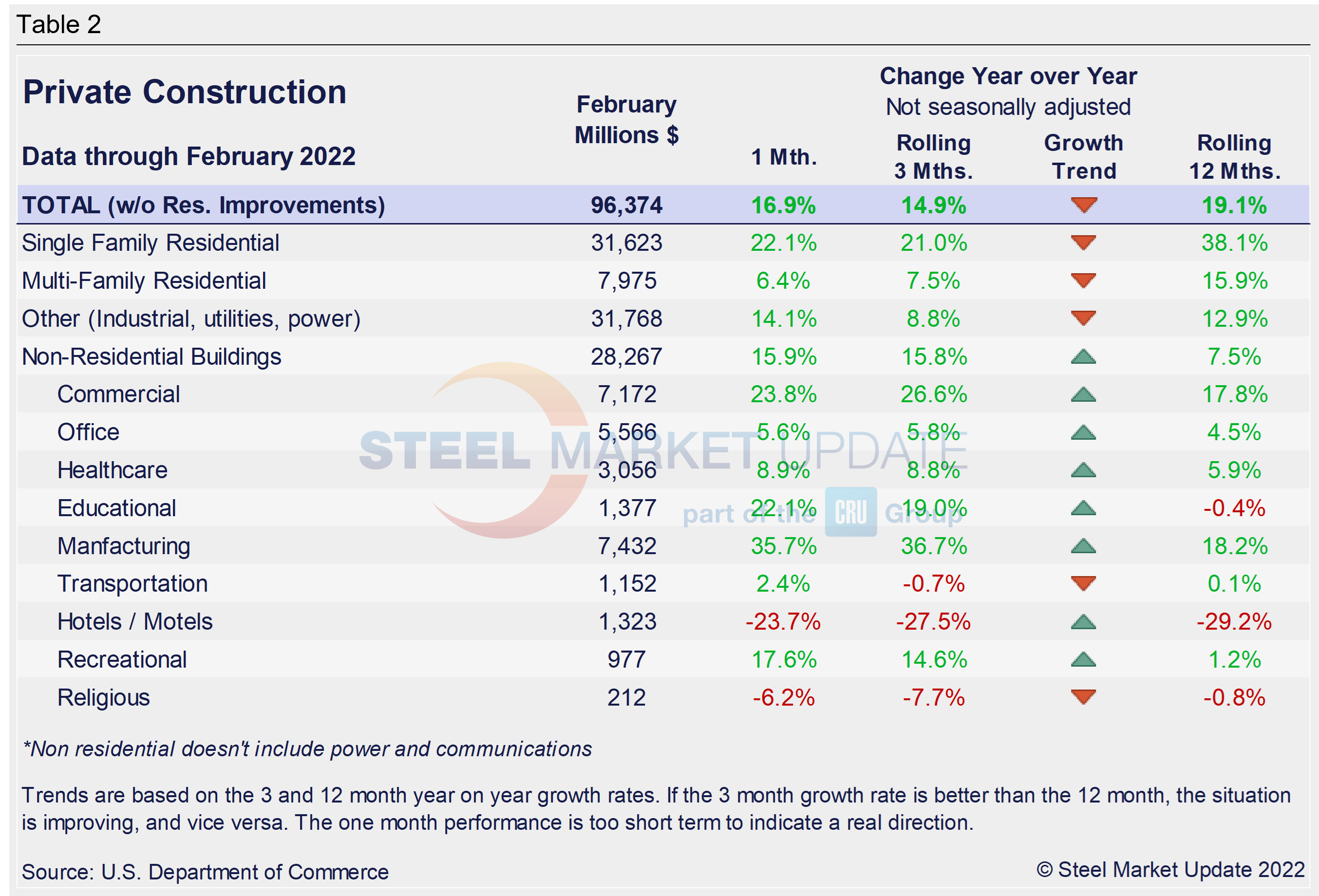

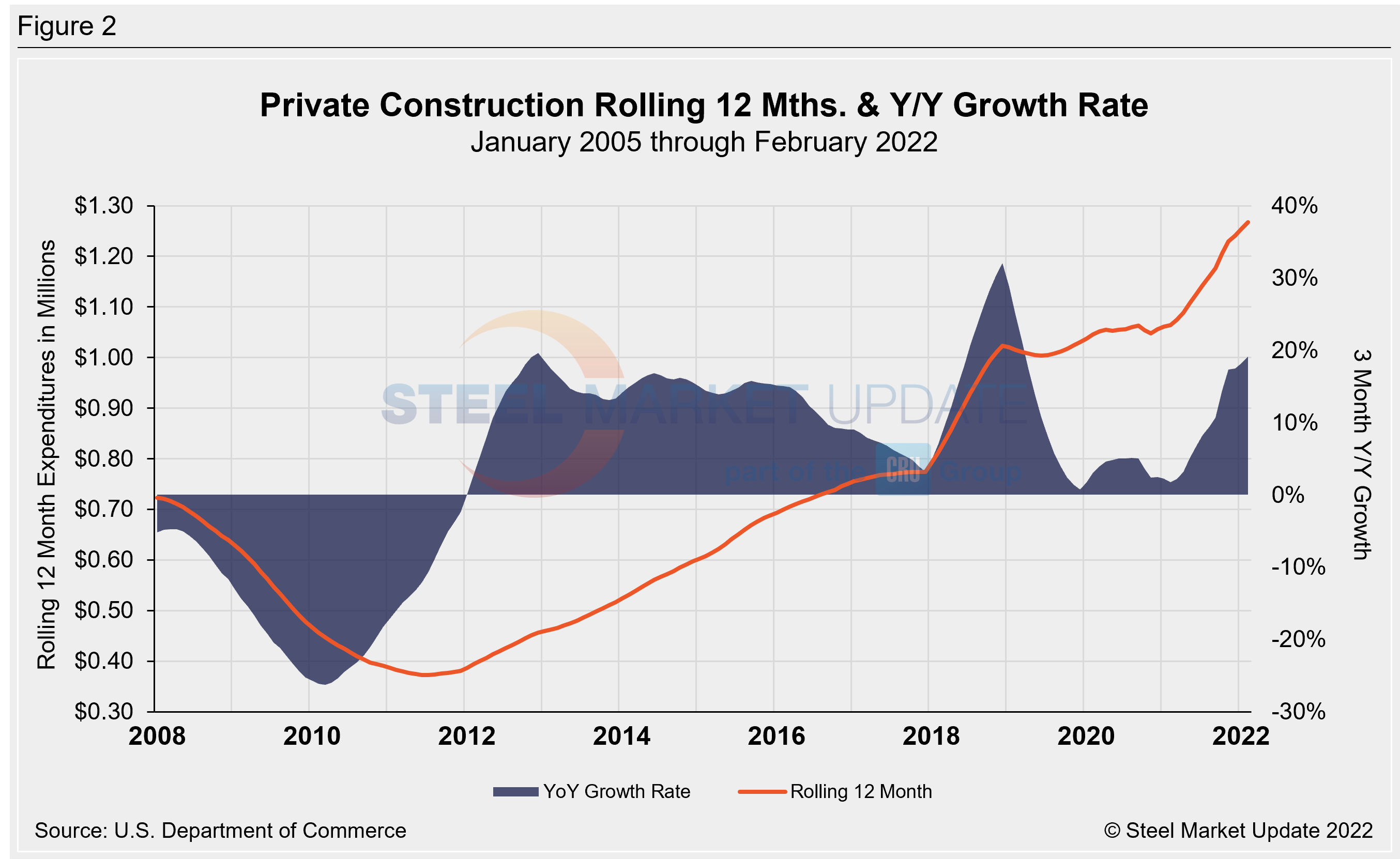

Private Construction

The breakdown of private expenditures into residential and nonresidential, and their subsectors, are highlighted in the Table 2 and Figure 2 below. Construction put in place in the private sector totaled a seasonally adjusted $1.354 trillion in February, up from the revised $1.343 trillion the prior month, a 0.8% increase.

Within that category, residential construction was at a seasonally adjusted annual rate of $850.6 billion in February, up 1.1% from the revised January estimate of $841.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $503.0 billion in February, up from the revised January estimate of $502.2 billion.

Spending on most private construction subcategories was up (Table 2) on an annual basis in February. But on a monthly basis, outlays in 10 of the 16 nonresidential subcategories were down. Private nonresidential spending was up 0.2%, while public nonresidential construction spending was down 0.5% in February.

More telling is that nonresidential spending decreased in February despite inflationary pressures that should have driven it higher. True, nonresidential spending is up year over year. But given significant inflation in construction materials, spending has almost certainly declined in real terms, according to an analysis by Associated Builders and Contractors.

Despite February’s continued growth among residential segments, homebuilding remains constrained by higher prices for building materials, especially framing lumber. That’s in large part because the US doubled antidumping and countervailing duties on softwood lumber imported from Canada last November.

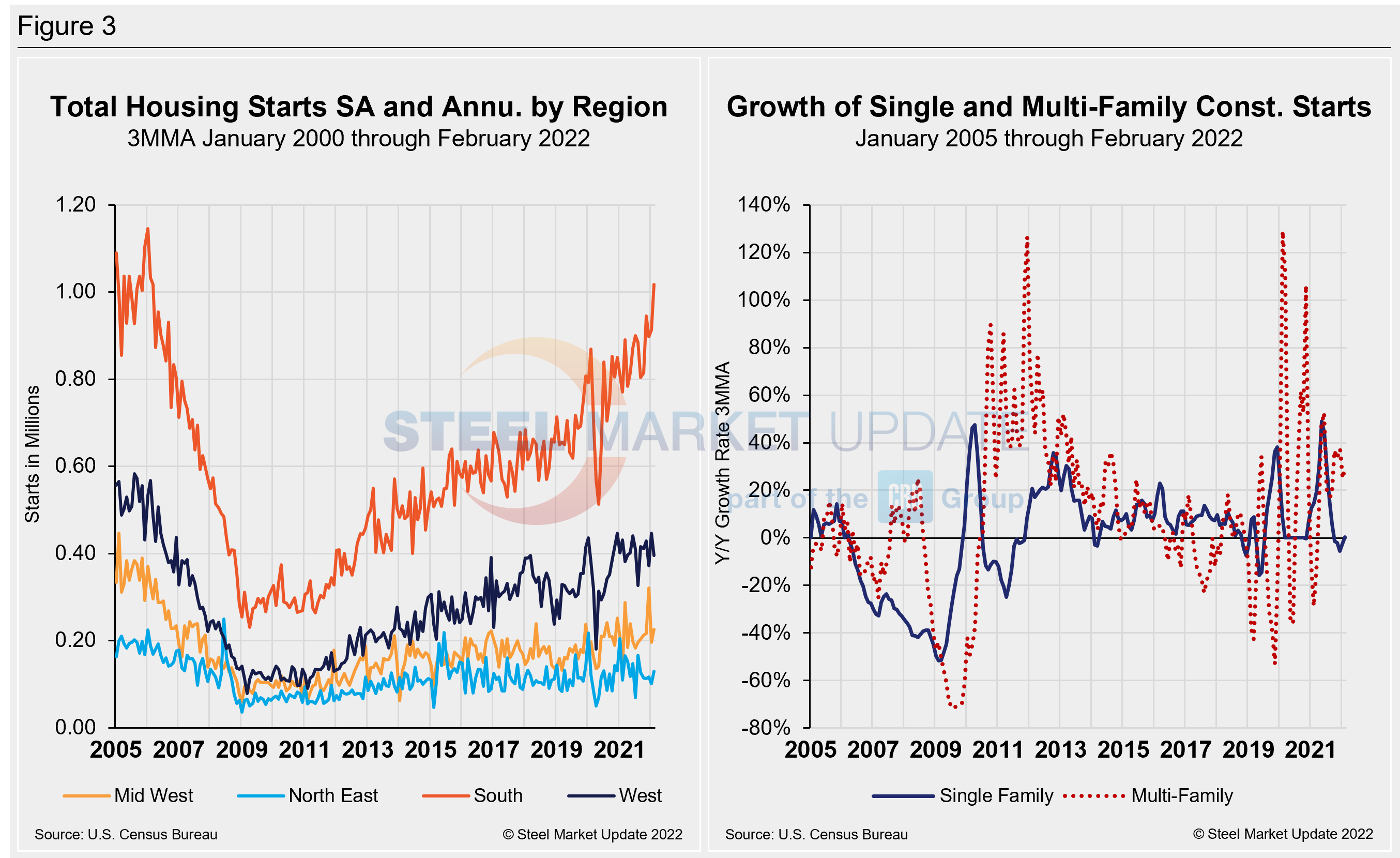

Total housing starts in four regions – the Midwest, Northeast, South and West – are displayed below (Figure 3). Figure three also displays the growth of single- and multi-family construction starts. Privately owned housing starts in February were at a seasonally adjusted annual rate of 1.769 million, up 6.8% from the revised January estimate of 1.657 million.

Regional results were mixed. The West saw a 11.4% decline in February as starts totaled 396,000, down from 447,000 the month prior. The Midwest plummeted 15.3%, with 226,000 starts. The South was up 11.4%, with 1.017 million starts in February. And the Northeast saw the largest percentage gain, up 28.7% with 130,000 starts.

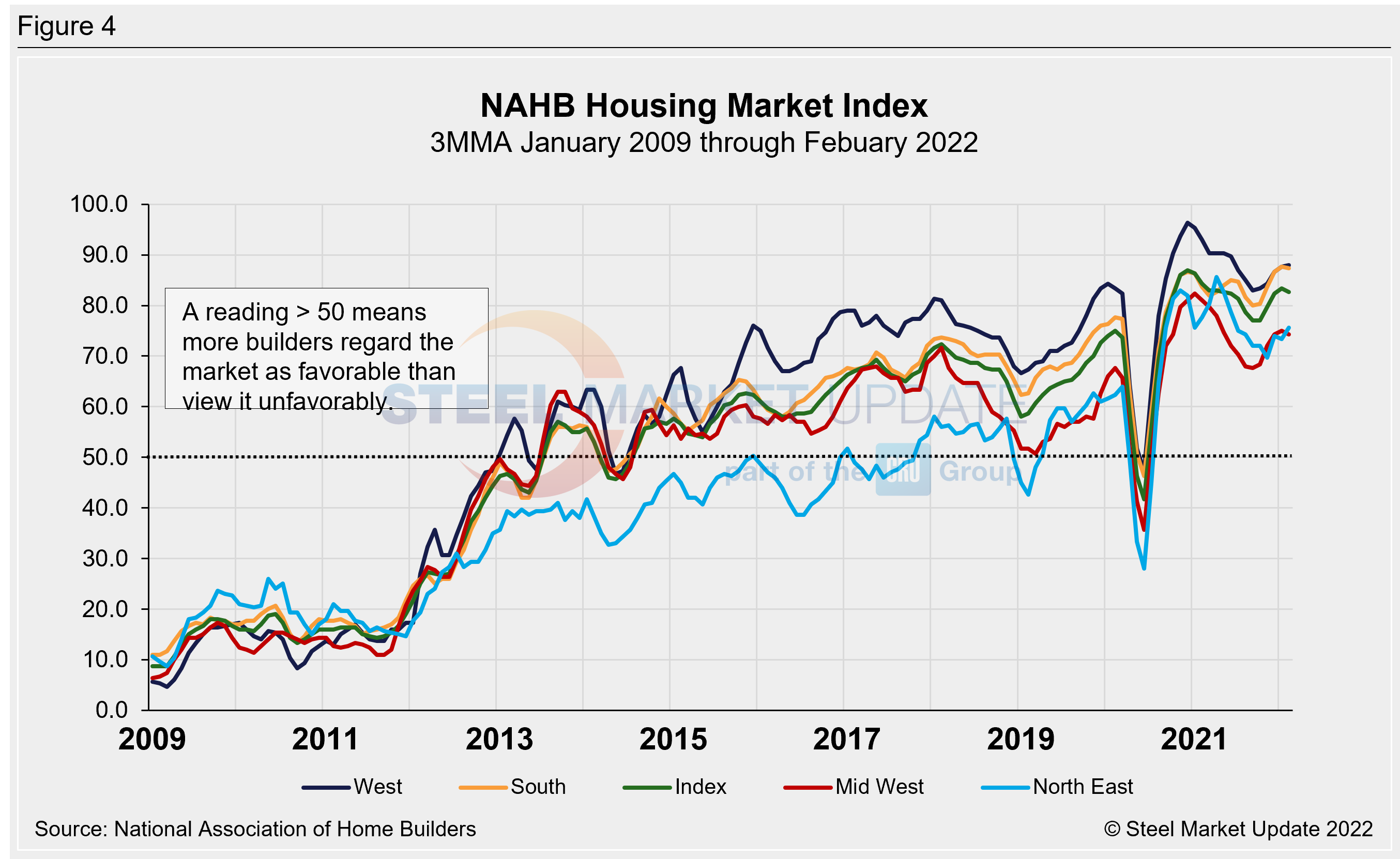

The National Association of Homebuilders (NAHB) said last month that building material production bottlenecks were raising construction costs and delaying projects. NAHB’s Optimism Index registered 81 in February, down slightly from 83 the month prior, and slipping for the second straight month. Advance reports indicate that the index may remain down in March (Figure 4).

State and Local Construction

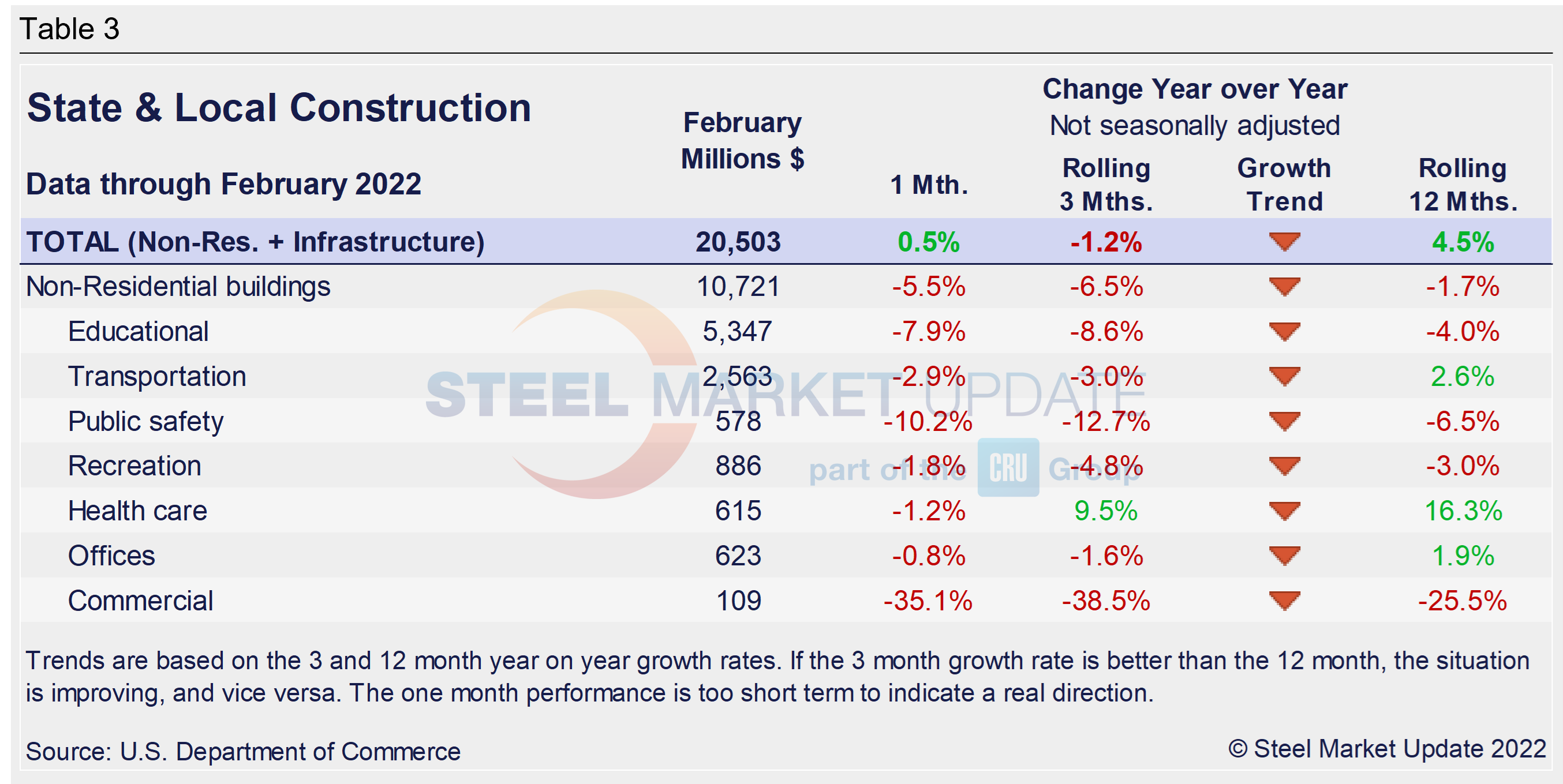

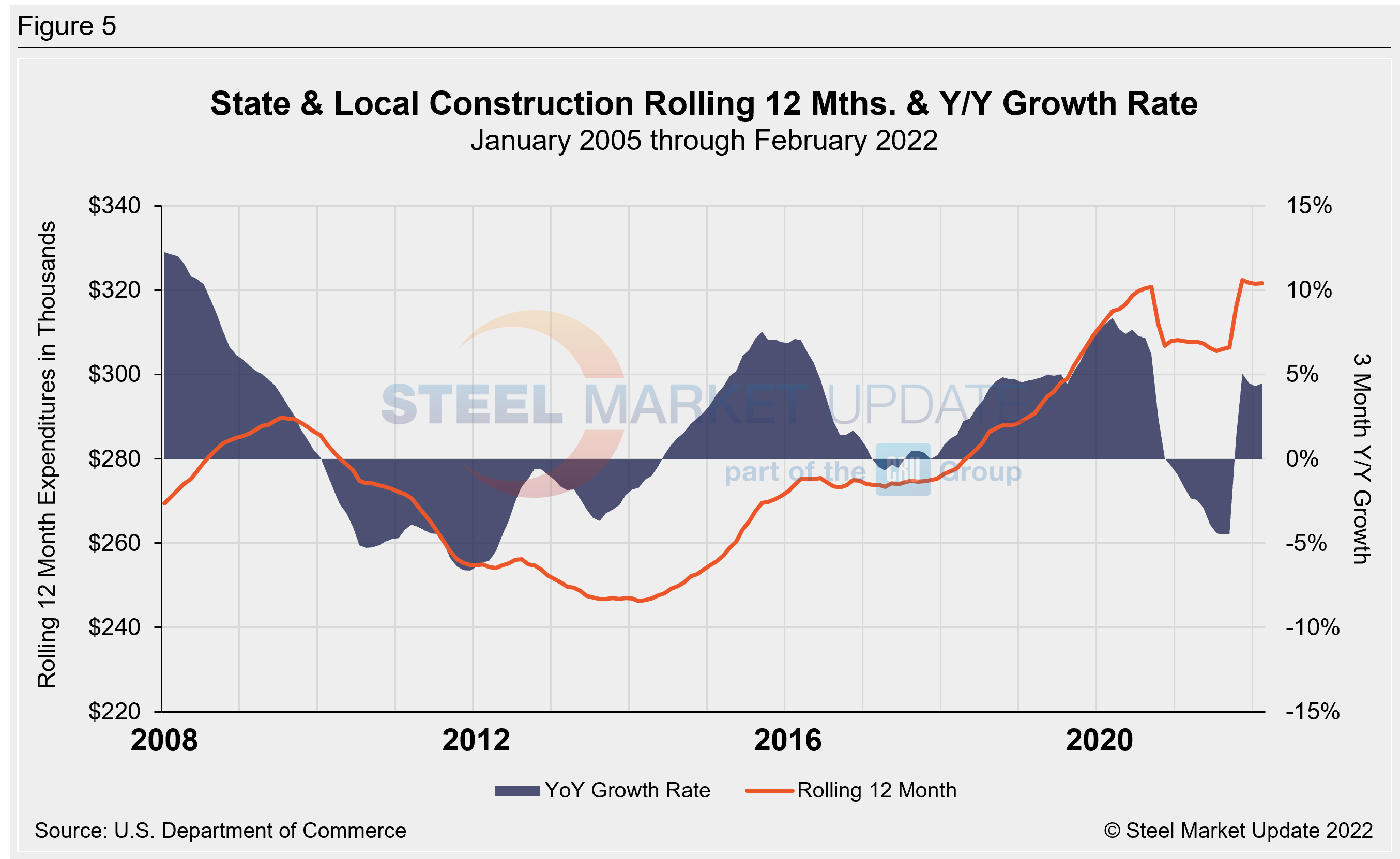

Publicly funded construction spending in February was $350.7 billion, at a seasonally adjusted rate, falling for the first time in five months. February’s outlays slipped 0.4% below the revised January estimate of $352.2 billion. Spending on state and local government construction projects rose 1.5%, while federal government spending edged up just 0.1% month on month in February (see Table 3 and Figure 5 below).

Educational construction was at a seasonally adjusted annual rate of $80.6 billion, 1.3% below the revised January estimate of $81.7 billion. Highway construction was at a seasonally adjusted annual rate of $104.4 billion, 1.3% below the revised January estimate of $105.8 billion.

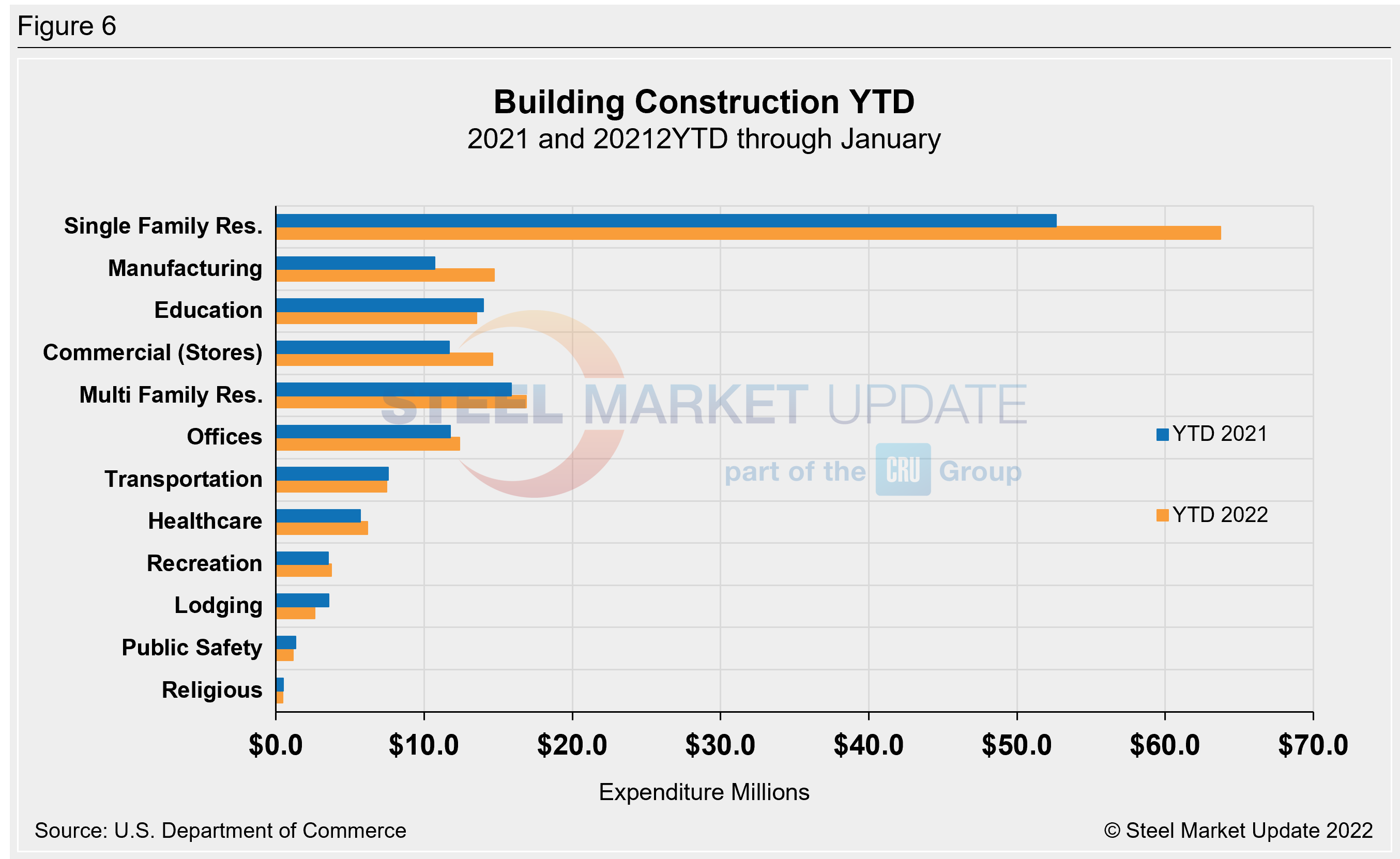

Year-to-date expenditures for construction of the various building sectors for 2021 and 2022 are compared in Figure 6. Single-family residential construction was dominant in 2021 with expenditures totaling $409.9 billion. The trend has continued into 2022: single-family residential totaled $63.7 billion in February, 21.1% above $52.6 billion a year ago. Manufacturing (+37.7%) saw the strongest subsector growth versus last year followed by commercial (+25.2%). Multifamily residential grew by 6.5% and totaled $16.9 billion when compared to the same year-ago period. Lodging is behind by double digits at 26.2% year on year, followed by recreation and public safety, down by 12.5% and 9.9% respectively.

Explanation: Each month, the Commerce Department issues its Construction Put in Place (CPIP) data, usually on the first working day covering activity one month and one day earlier. There are three major categories based on funding source: private, state and local, and federal. Within these three groups are about 120 subcategories of construction projects. SMU analyzes the expenditures from the three funding categories to provide a concise summary of the steel-consuming sectors.

By David Schollaert, David@SteelMarketUpdate.com