Analysis

April 7, 2022

AGC: Construction Jobs Expand in March Despite Growing Challenges

Written by David Schollaert

The US construction sector added 19,000 new workers to payrolls in March, while spending on construction projects rose for the 12th straight month through February, reports the Associated General Contractors of America (AGC) in its latest analysis of government data.

Despite repeated gains, the AGC urged US trade officials to end tariffs on key materials and broaden training and education opportunities for construction careers. The group warned that growth might stall unless the supply of workers and materials improves.

“Construction is contributing significantly to the expansion of employment and the overall economy,” AGC chief economist Ken Simonson said. “But the sector is facing growing challenges in terms of filling job openings, obtaining materials, and keeping up with soaring wages and prices.”

Total construction industry employment was 7,628,000 in March, topping the pre-pandemic peak set in February 2020.

Residential building and specialty trade contractors added 7,600 workers in March, and the sector’s employment exceeded the February 2020 level by 161,000 workers, or 5.4%.

Employment increased by 11,300 last month among nonresidential firms: building, specialty trade, and heavy and civil engineering construction contractors. But it remained 157,000 workers, or 3.4%, shy of the February 2020 high water mark.

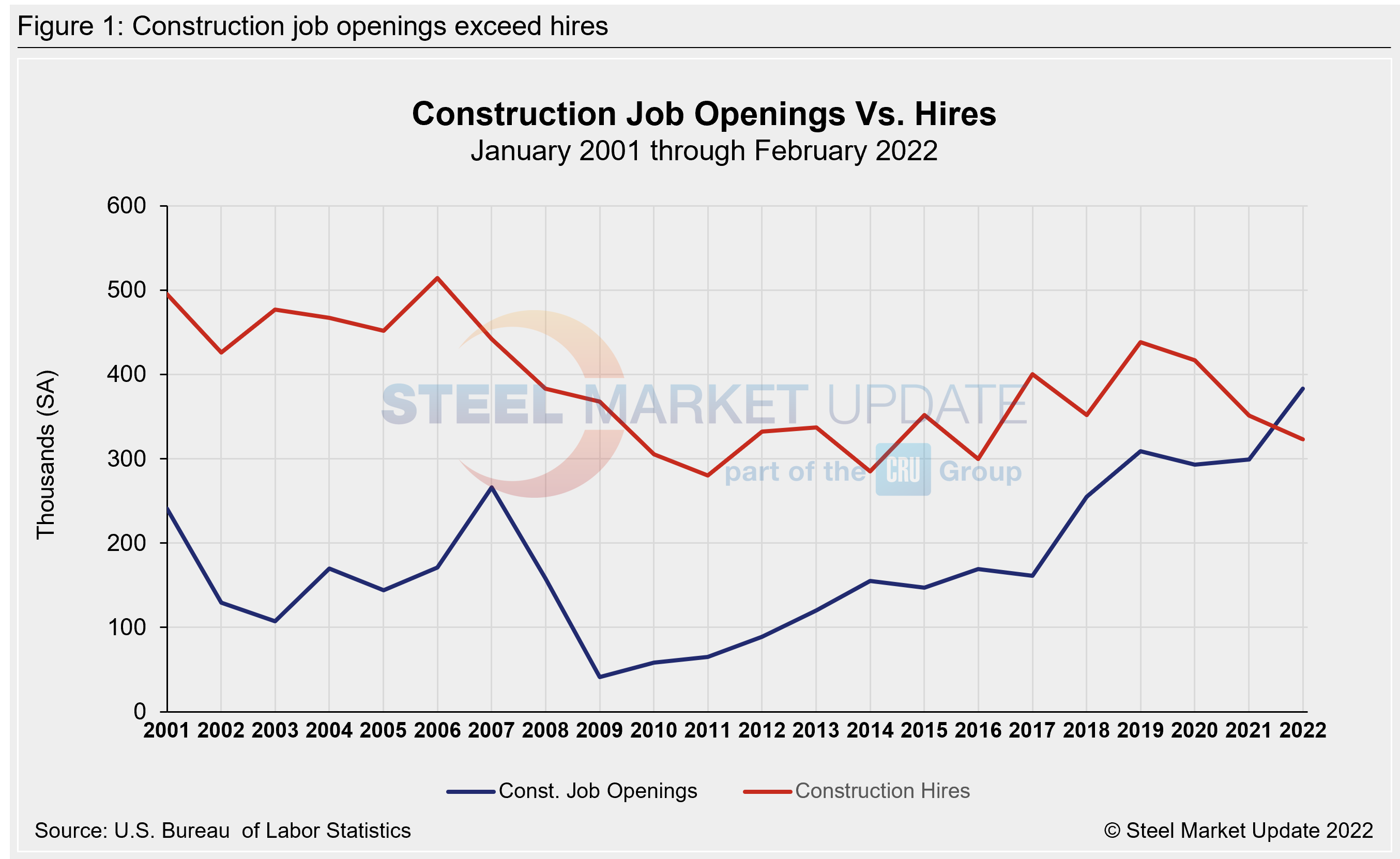

Construction job openings at the end of February totaled 364,000, the largest February total, by far, in the 22-year history of that data series, Simonson noted.

Openings exceeded the 342,000 workers hired in February, implying that contractors wanted to hire more than twice as many workers as they were able to, he added.

Construction spending increased for the 12th consecutive month in February to $1.70 trillion, a rise of 0.5% for the month and an 11.2% year-over-year gain. All three major subsectors posted year-over-year increases.

Private residential construction rose 1.1% in February and 16.6% over 12 months. Private nonresidential spending edged up 0.2% for the month and 9.7% since February 2021. Public construction rose 1.5% from a year earlier despite slipping 0.4% in February.

The industry will need to obtain materials more quickly and hire hundreds of thousands of additional workers to execute projects soon to be funded by the infrastructure bill – and that work will come on top of ongoing demand for homebuilding and for private nonresidential structures, the report said.

AGC urged Congress and the Biden administration to end lumber, steel, and other tariffs. It also asked for increased funding for career and technical education as well as for a wider range of apprenticeship and training opportunities.

“Contractors are doing their part to add employees and complete projects,” AGC CEO Stephen Sandherr said. “But there won’t be enough materials or workers to go around if officials in Washington fail to allow more goods into the US and prepare more jobseekers for these opportunities.”

By David Schollaert, David@SteelMarketUpdate.com