Market Data

April 1, 2022

Manufacturing PMI Expands Again in March But at a Slower Pace

Written by David Schollaert

The outlook among purchasing managers surveyed by the Institute for Supply Management remains optimistic, showing continued expansion in March despite a slight month-on-month decline in growth rates.

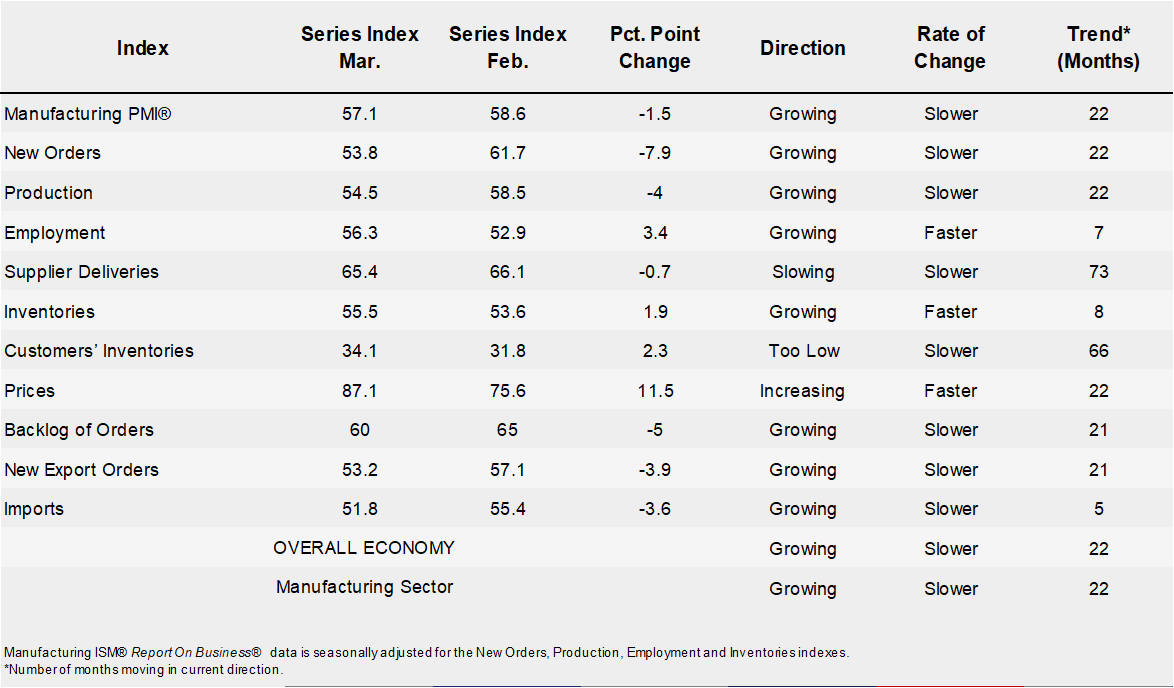

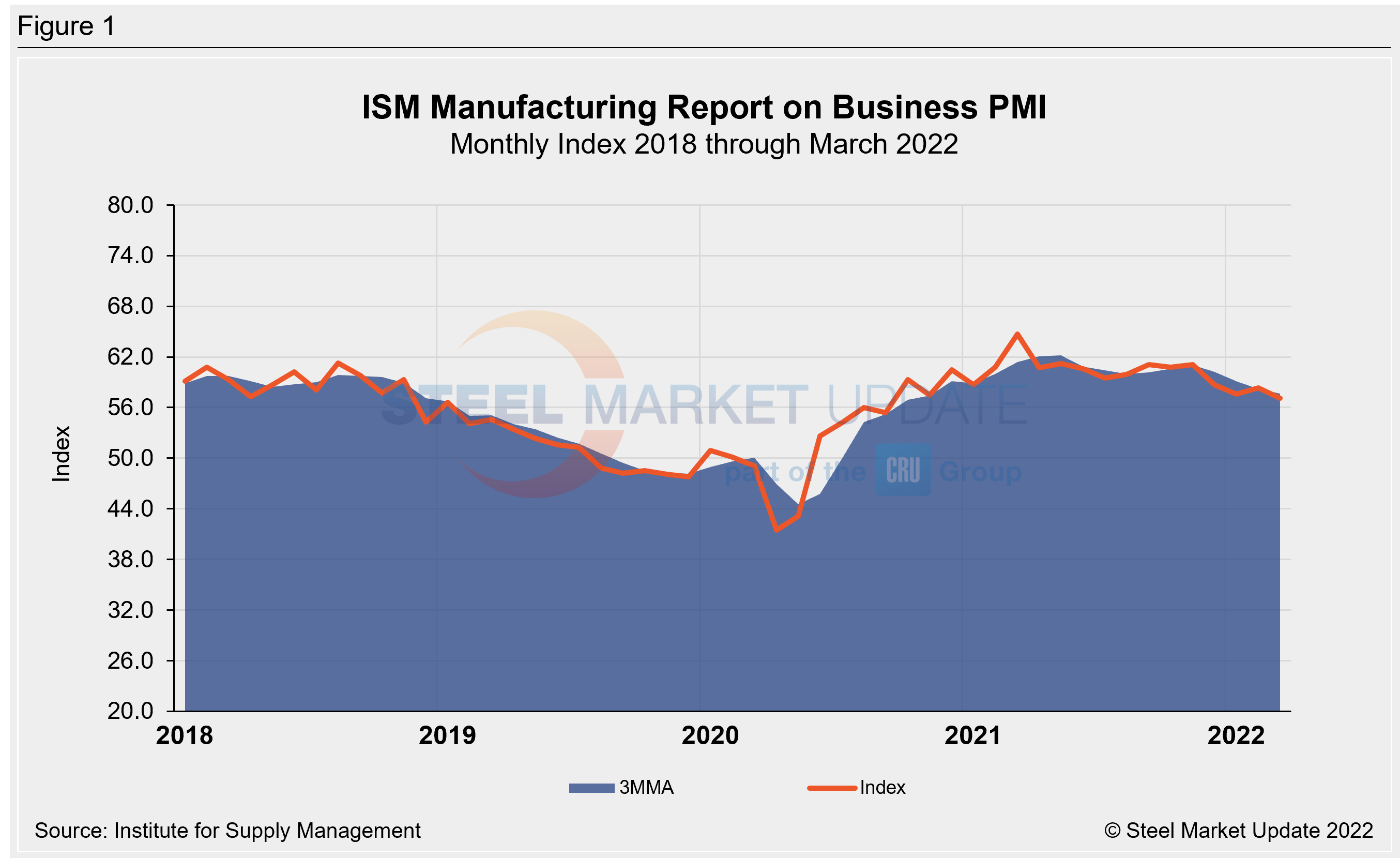

Last month’s Manufacturing PMI edged down to a reading of 57.1% versus 58.6% in February. The index reading above 50% indicates growth in the manufacturing sector, and March’s measure marks the 22nd consecutive month of expansion since contractions in April and May 2020 following the COVID-19 outbreak.

“The US manufacturing sector remains in a demand-driven, supply chain-constrained environment,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “In March, progress was made to solve the labor shortage problems at all tiers of the supply chain, which will result in improved factory throughput and supplier deliveries.”

Extended lead times were likely to blame for slightly slower month-over-month growth in manufacturing, the report said.

Other findings from ISM’s monthly survey of purchasing professionals:

- The New Orders Index remains in growth territory.

- The Customers’ Inventories Index remained at a very low level.

- The Backlog of Orders Index held in strong growth territory.

- Consumption (measured by the production and employment indexes) grew during the period, though at a slower rate, with a combined negative 0.6 percentage point change compared to the Manufacturing PMI calculation.

- The Employment Index expanded for a seventh straight month, with signs that firms’ ability to hire continues to improve. This was offset by continued challenges with turnover (quits and retirements) and resulting backfilling. In short, firms continue to struggle to adequately staff their organizations, but to a lesser extent compared to February.

Fiore also urged cautioned despite nearly two years of growth. “Omicron impacts are being felt by overseas partners, and the impact to the manufacturing community is a potential headwind.”

An interactive history ISM Manufacturing Report on Business PMI index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com