Market Data

March 30, 2022

Global Steel Production Slipped in February: WSA

Written by David Schollaert

World crude steel production fell in February, declining for the second straight month. Global output was estimated at 142.7 million metric tons last month, as steelmakers around the world cut production by 12.3 million metric tons, or 7.9%, from January, according to World Steel Association (worldsteel) data.

After hitting an all-time high of 174.4 million metric tons last May, global steel output has waned in seven of the last nine months. The decreases have been driven largely by continued Chinese cutbacks, although February’s total saw a more widespread decline. Chinese steel production was down 6.7 million metric tons, or 8.2%, last month versus January. Output in the rest of the world also fell month on month in February by 7.6%, or 67.7 million metric tons.

February’s global total was down 5.0%, or 7.6 million metric tons, from February 2021 and was off by 31.7 million metric tons from the high-water mark set in May 2021. The big drop last month pushted total ouput down 1.2%, or 1.7 million metric tons, versus the pre-pandemic period of February 2020.

The US remained the fourth-largest crude steel producer in the world in February, accounting for 6.4 million metric tons, or 4.5%, of the global total. US production last month sank by 12.3%, or 900,000 metric tons, versus January’s total. It was the lowest output in 12 months.

Last month’s production was up 1.6% year-over-year compared to February 2021. Recall that the US economy was then still clawing its way back from pandemic shutdowns in early 2021. But February 2022 was down 10.7% compared to February 2020, a good time for steel before the pandemic walloped the market in the spring of that year.

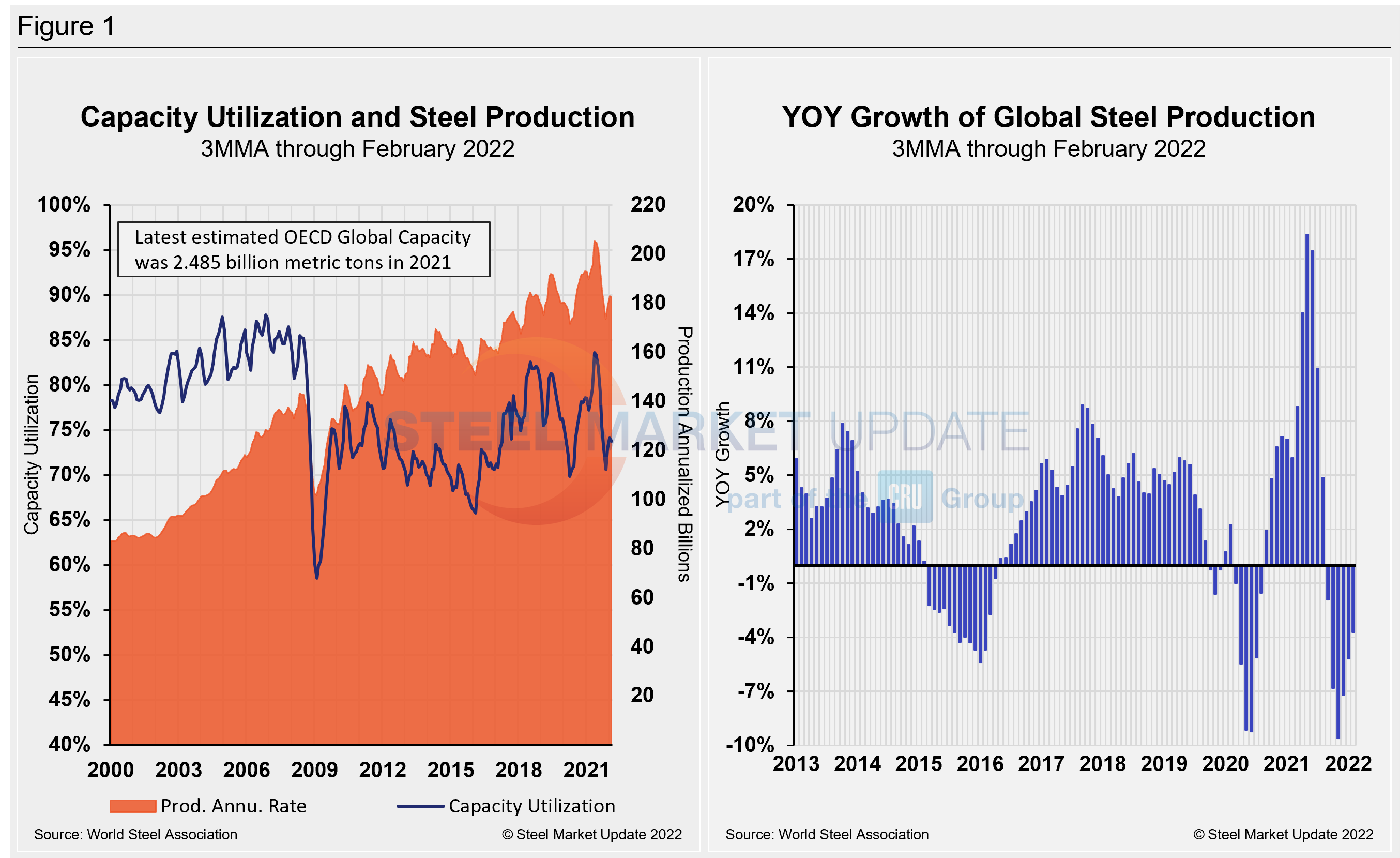

Shown below in Figure 1 is the annualized monthly global steel production on a three-month moving average (3MMA) basis and capacity utilization since January 2000. Also shown is the year-over-year growth rate of global production on the same 3MMA basis since January 2013. Both are based on data from worldsteel.

Mill capacity utilization in February on a 3MMA basis was 73.7%, down 0.4 percentage points from the month prior. On a tons-per-day basis, production in February was 5.096 million metric tons, a 1.9% month-on-month increase. That figure is 717,000 tons off May 2021’s record rate of 5.813 million metric tons. Growth on a three-month moving average basis through February year-over-year was down 3.7%, an improvement from a decline of 5.2% the month prior. But it was a far cry from the 18.4% expansion seen in May of last year.

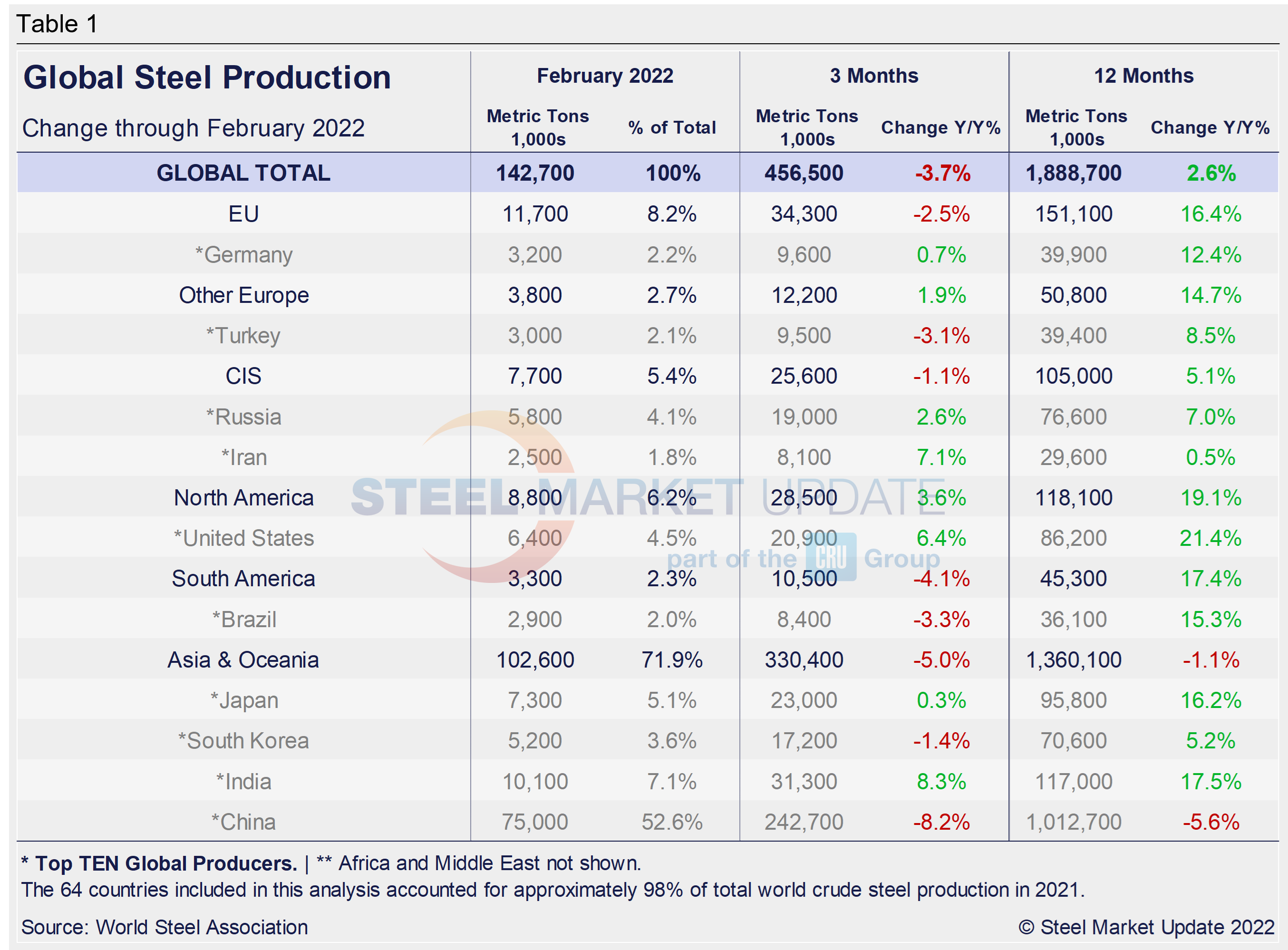

Displayed in the table below is global production broken down into regions. It shows the production of the top 10 nations in February and their share of the global total. It also shows the latest three months and 12 months of production through last month with year-over-year growth rates for each period. Regions are shown in black font and individual nations in gray.

World steel production overall fell 3.7% in three months, a significant deceleration from the 17.9% growth just eight months prior. Over 12 months through February, though, growth was 2.6%, down 0.8 percentage points from the same period in January. The market has not maintained positive momentum: the three-month growth rate has been lower than the 12-month growth rate for six straight months now.

The table shows that North American production was up 6.2% in the three months through February and up 19.1% year on year. The positive momentum in the North American market indicates that the economy has proven resilient in the face of the pandemic and despite inflation. Yet, when compared to the same pre-pandemic period in 2020, the present output is down 3.8%.

China’s Crude Steel Production

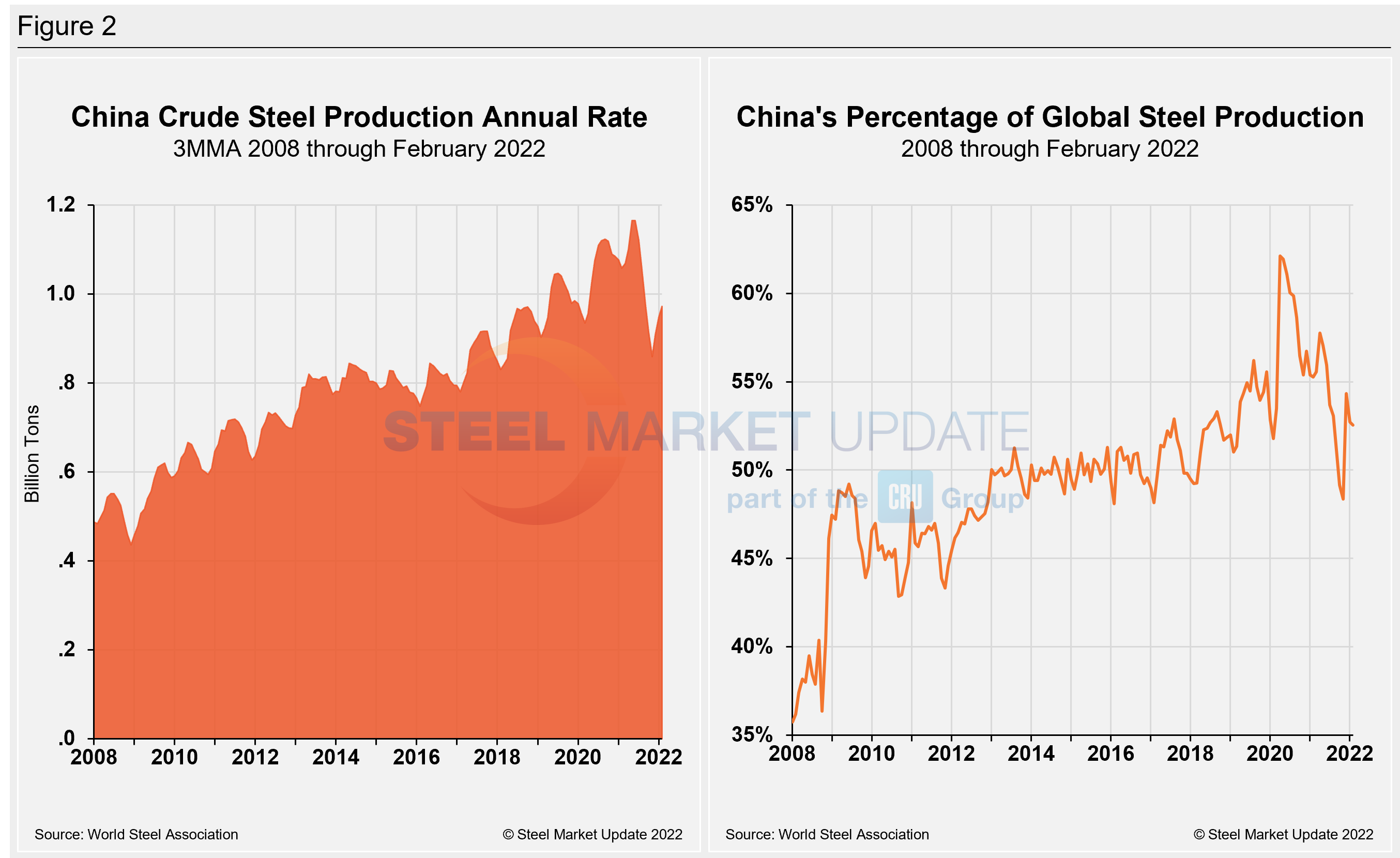

China’s monthly steel production was estimated at 75 million metric tons in February, down from 81.7 million metric tons the month prior. The 6.7-million-ton monthly decrease was a sharp reversal compared to the 16.9-million-ton increase seen just two months ago. China has seen only a single month of steel production growth since crude steel output reached its all-time high of 99.5 million metric tons last May.

On a 3MMA basis, the annual rate of China’s crude steel production maxed out at 1.123 billion metric tons in September 2020. It has fallen repeatedly since February of last year. China’s annual capacity stands at 1.128 billion metric tons. Its annual capacity utilization slipped to 89.9% last month, its lowest mark in 18 months and down from an all-time high of 98.4% last June.

China produced more than half of the world’s steel in February, 52.6%, or estimated 75 million metric tons. The total last month was an 8.2% decrease from January and a 9.6% decline compared with the same year-ago period. Chinese production last month was just 0.3% above pre-pandemic levels from 2020.

China’s crude steel production rate and its percentage of global output are displayed side-by-side in Figure 2.

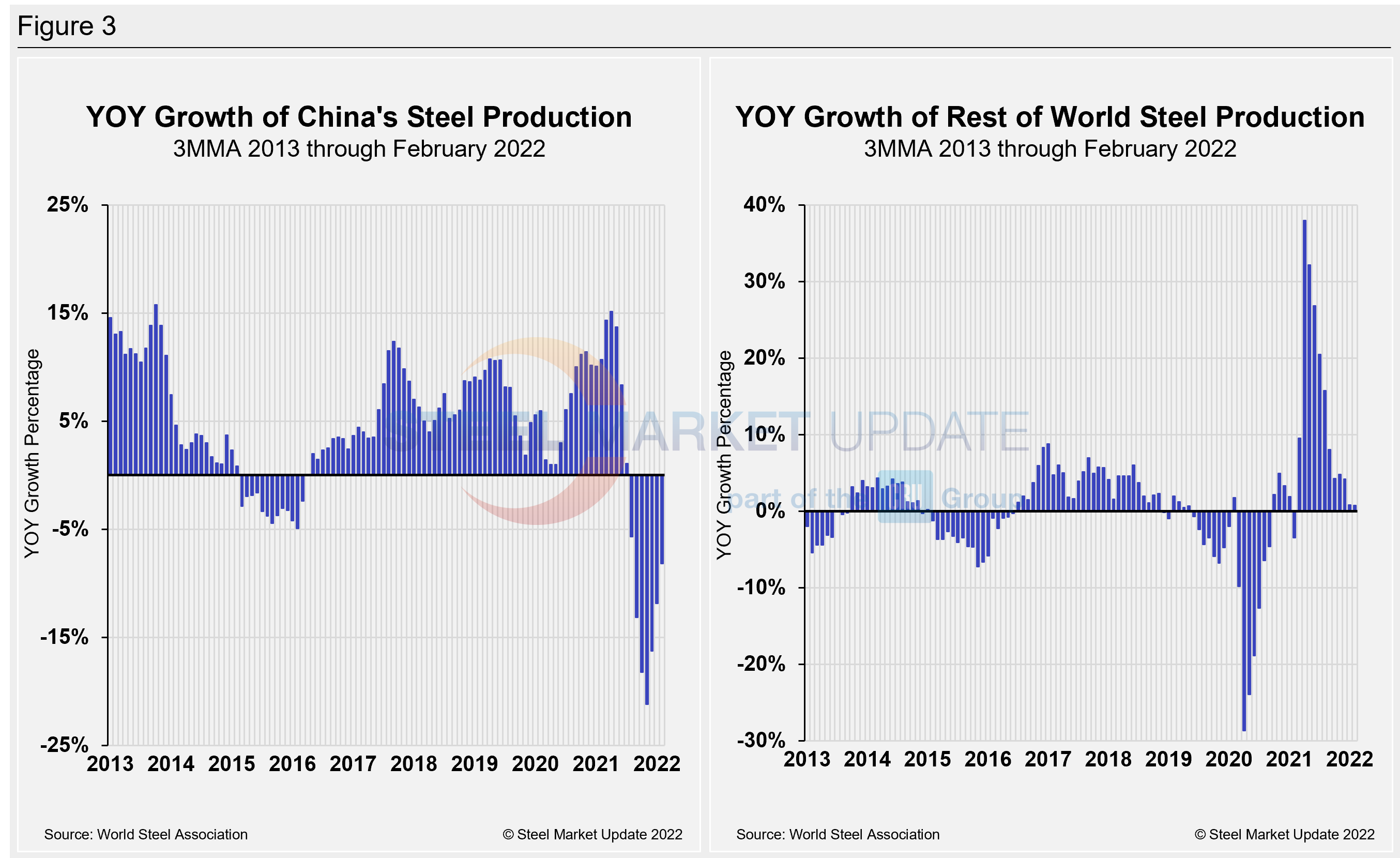

The fluctuations in China’s steel production since January 2013 versus the growth of global steel excluding China, both on a 3MMA basis, are shown side-by-side in Figure 3. From October 2020 through December 2021, the rest of the world’s production rose sharply, reaching a peak of 38.0% in April. Since then, the rate for the rest of the world’s annual production has decreased sequentially to just 0.7% in February, a 0.1 percentage point drop versus the month prior. China’s annual growth rate was -8.1% in February, an improvement from -11.9% in January. Though annual growth has recovered by 3.8 percentage points over the past month, it remains well behind the +15.1% seen last April. The month-on-month decline in Chinese steel production remains in line with expectations, as the Asian giant seeks to curb harmful air emissions and limit energy consumption. February’s lower production levels were also a result of the Lunar New Year celebration and Winter Olympics.

By David Schollaert, David@SteelMarketUpdate.com