Market Data

March 30, 2022

Consumer Confidence Rebounds in March

Written by David Schollaert

US consumer confidence bounced back slightly from a one-year low in March on labor market optimism. But confidence could slip as the Federal Reserve raises interest rates to tamp down inflation, The Conference Board reported.

Sentiment about current business and labor market conditions recovered in March after falling in the prior two months. Americans’ outlook for the economy, though, continued to cool. And concerns about inflation grew, the report said.

“Consumer confidence was up slightly in March after declines in February and January,” said Lynn Franco, senior director of economic indicators at The Conference Board. “The Present Situation Index rose substantially, suggesting economic growth continued into late Q1. Expectations, on the other hand, weakened further with consumers citing rising prices, especially at the gas pump, and the war in Ukraine as factors. Meanwhile, purchasing intentions for big-ticket items like automobiles have softened somewhat over the past few months as expectations for interest rates have risen.”

“Nevertheless, consumer confidence continues to be supported by strong employment growth and thus has been holding up remarkably well despite geopolitical uncertainties and expectations for inflation over the next 12 months reaching 7.9 percent—an all-time high. However, these headwinds are expected to persist in the short term and may potentially dampen confidence as well as cool spending further in the months ahead,” she added.

The headline index rose by 1.5 points in March to 107.2, following a downward revision in February from 110.5 to 105.7. Despite the recovery, March’s total was still 7.7 points below the same year-ago total when the index measured 114.9.

March’s present situation index, which is based on consumers’ assessment of current business and labor market conditions, improved by 11 points after a 0.5-point downward revision in February. The reading for that index stands at 154 in March. The expectations index, which is based on consumers’ short-term outlook for income, business and the labor market, fell by 4.2 points to 76.7, its lowest total since 2014.

Calculated as a three-month moving average (3MMA) to smooth out the volatility, The Conference Board’s composite index slipped in March to 108 versus 110.7 in February – falling for the third consecutive month and still well below the pre-pandemic high of 130.4 seen in February 2020.

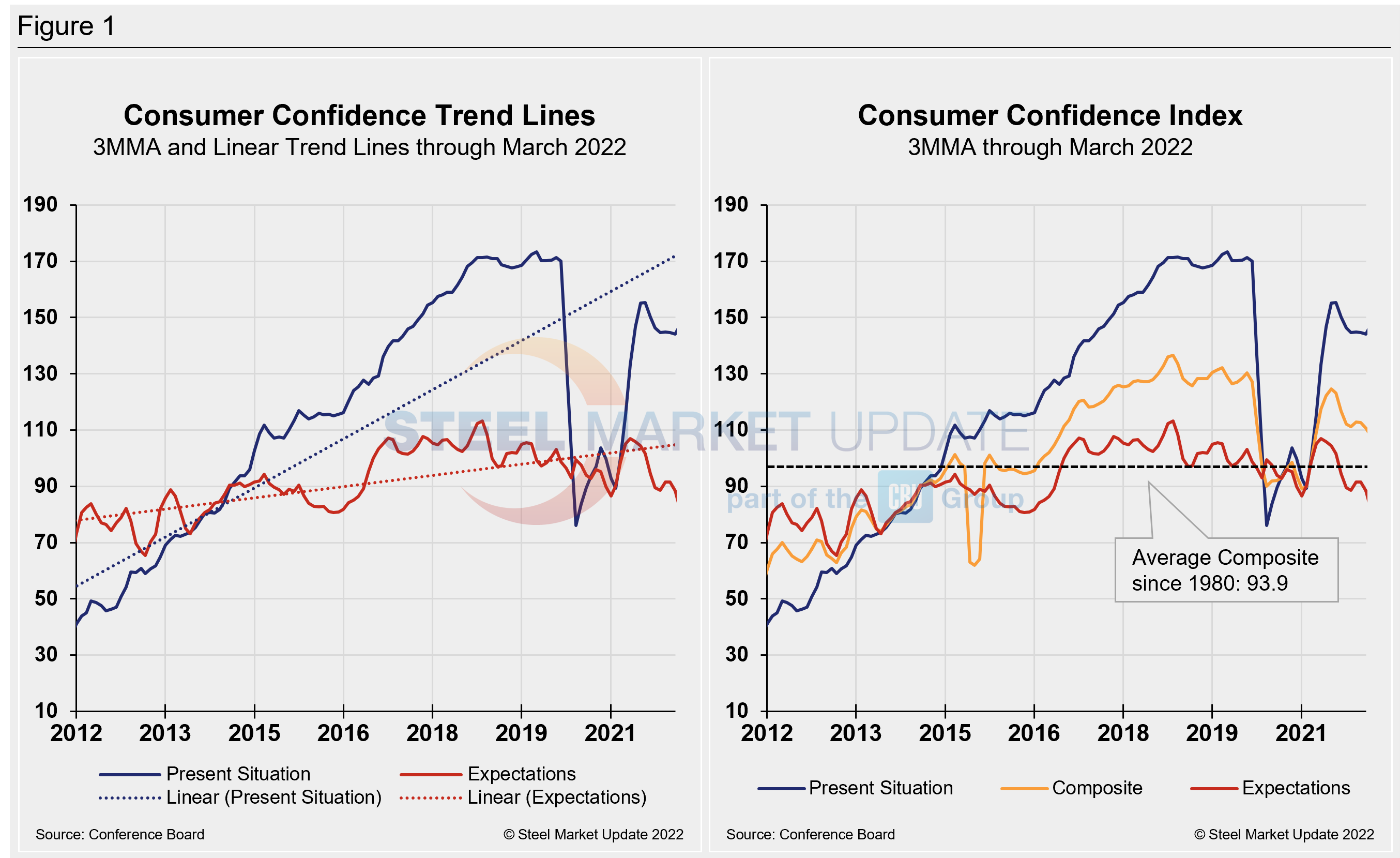

The composite index is made up of two sub-indexes: consumers’ view of the present situation and their expectations for the future. Figure 1 below notes the 3MMA linear trend lines from January 2012 through March 2022 versus the trend lines of all three subcomponents of the index: present situation, composite and future expectations. All three were above the average composite line prior to the pandemic before falling consecutively through last February. The surge from March through June pulled all three indexes above the composite line once again. But economic uncertainty has eroded confidence.

The table below compares March 2022 with March 2021 on a 3MMA basis. The present situation has an index reading of 147.2, a 3.1-point increase from the month prior and 47.2 points above the year-ago reading. Expectations are at 82.1, down 6.3 points from February, and 16.4 points below year-ago levels. The mixed result in March has two out of three indexes showing losses against year-ago measures.

The composite is down 19.3 points when comparing current 3MMA totals to 2020. The present situation is down 22.8 points. The expectations reading is down 16.7 points in March when compared to the same period in 2020. The consumer confidence report includes employment data and purchase plans. These are summarized in the table below.

The composite, present situation and expectations indices rallied midway through 2021, recovering much of what was lost in the fallout from the global pandemic. Momentum fluctuated during the second half of 2021. Concerns over inflation, despite an improving job market, have kept these measures below where they were last year.

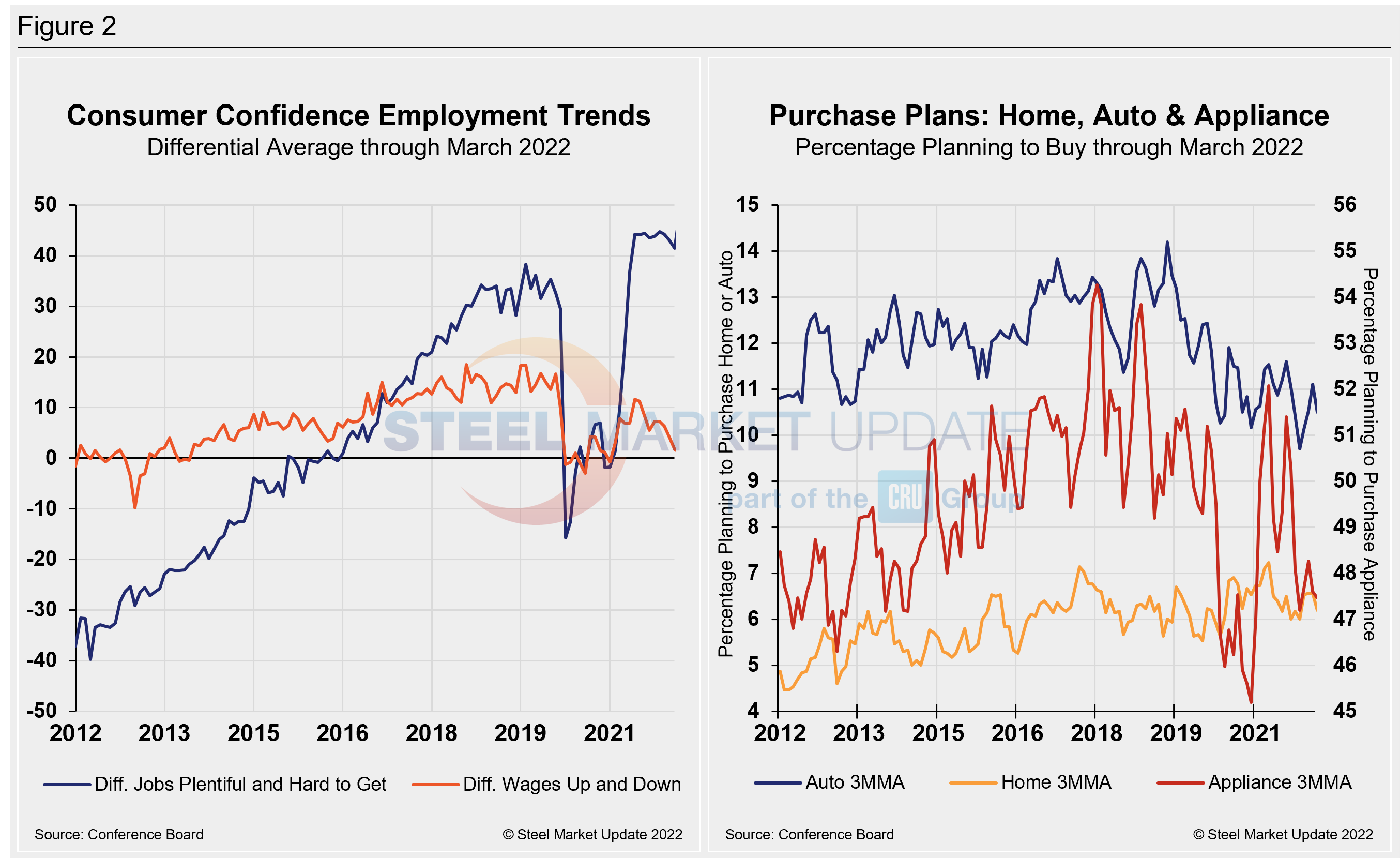

People found jobs slightly more plentiful in March but were a bit less optimistic about wage increases compared to the month prior. The differential between those finding jobs plentiful and those having difficulty was 47.5 in March, up from 41.5 in February. The measure, despite recent fluctuation, remains well above the most recent pre-pandemic high and is a strong rally from 10.2 a year ago. The difference between those expecting wages to rise versus those expecting wages to fall is 1.2, down 0.5 points month on month and down from the recent high of 11.6 last June.

Spending plans for consumer goods as measured by automobiles, homes and appliances had been trending up through last June but started slowing through the summer and into the fourth quarter. All three moved down consecutively in January and February, with only appliance buying plans gaining ground in March, up 3.5% to 47.4. Automotive buying plans fell 13.1% to a reading of 9.3, the lowest measure in over a decade. Home buying was unchanged month on month with a reading of 5.8 in March. These recent dynamics and historical movements are illustrated below in Figure 2.

Note: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.

By David Schollaert, David@SteelMarketUpdate.com