Analysis

March 20, 2022

NAHB: February Housing Starts Accelerate

Written by David Schollaert

Housing starts grew in February, boosted by a strong multifamily reading and despite production bottlenecks as well as rising construction costs. Strong demand and low levels of existing inventory aided last month’s results, according to the latest data from the U.S. Census Bureau and the Department of Housing and Urban Development.

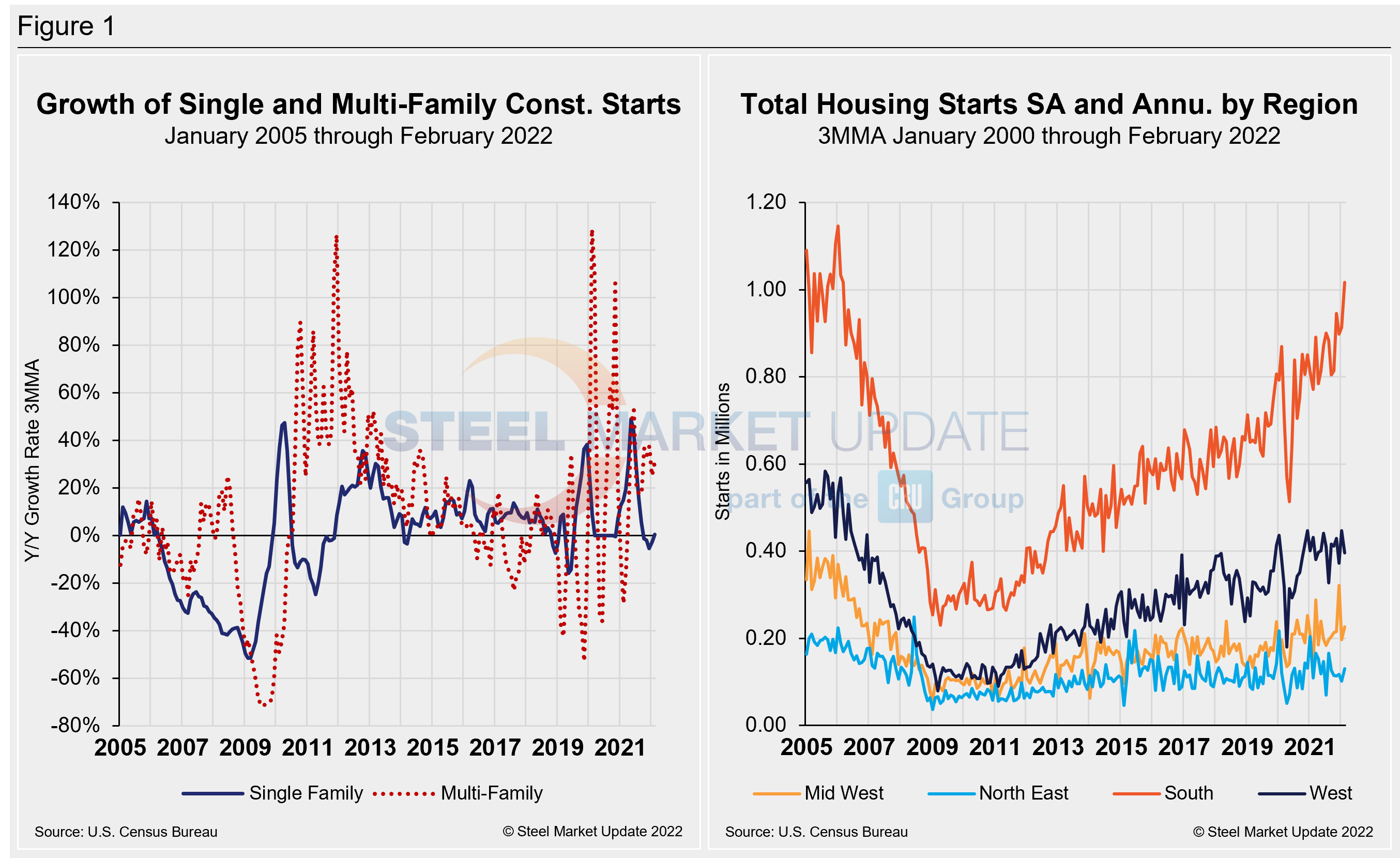

Overall housing starts increased 6.8% to a seasonally adjusted annual rate of 1.77 million units. The February reading – indicating the number of housing units builders would begin if development kept this pace for the next 12 months – was driven by a 9.3% gain in the multifamily sector to an annualized 554,000 pace. The single-family starts increased 5.7% to a 1.22 million seasonally adjusted annual rate.

“Builders continue to start homes as the demand for new construction remains solid in a market lacking inventory of previously owned homes,” NAHB chairman Jerry Konter said. “However, construction costs are rising too quickly, which threatens housing affordability conditions in 2022 as interest rates rise.”

On a regional basis compared to the previous month, combined single-family and multifamily starts are 28.7% higher in the Northeast, 15.3 % higher in the Midwest, 11.4% higher in the South, and 11.4% lower in the West.

Below in Figure 1 is the long-term picture growth of housing starts from January 2005 through February 2022, as well as total housing starts, seasonally adjusted and annualized, broken down by region over the same period.

“The February pace for apartment construction was the best since January 2020, and we expect the multifamily sector to continue to show strength as the economy reopens,” NAHB chief economist Robert Dietz said. “On the single-family front, the count of homes permitted but not started construction reached a four-month high in February, rising to 152,000. This is an indication of the ongoing supply-chain delays and cost issues that are limiting the pace of home building in many markets.”

Overall permits decreased 1.9% to a 1.86-million-unit annualized rate in February. Single-family permits remained essentially flat, falling 0.5% to a 1.21-million-unit rate. Multifamily permits decreased 4.4% to an annualized 652,000 pace.

Compared to the previous month, regional permit data shows that permits are 22.7% higher in the Northeast, 8.4% lower in the Midwest, 5.5 % lower in the South, and 2.1% higher in the West.

There are now 799,000 single-family homes under construction, a 28.3% year-over-year gain.

By David Schollaert, David@SteelMarketUpdate.com