Prices

March 18, 2022

CRU: War in Ukraine and Higher Global Prices Will Put Pressure on Brazil

Written by Diego Giangreco

By CRU Analyst Diego Giangreco, from CRU’s Steel Monitor, March 16

Brazilian distributor sheet prices fell month on month in March due to weak demand, while mills increased their prices in February or stopped giving discounts to match the trends in the international markets. Before the invasion of Ukraine, we were expecting a downward trend in prices, but now the trend may reverse – at least in the short term. The invasion will put upward pressure on the costs of semifinished steel and steelmaking raw materials. In 2021, the top three exporters of slabs were Russia, Brazil and Ukraine, which accounted for 37%, 26% and 12% of all global exports, respectively. Due to the war in Ukraine and the new sanctions on Russia, a dramatically lowered slab supply will support prices.

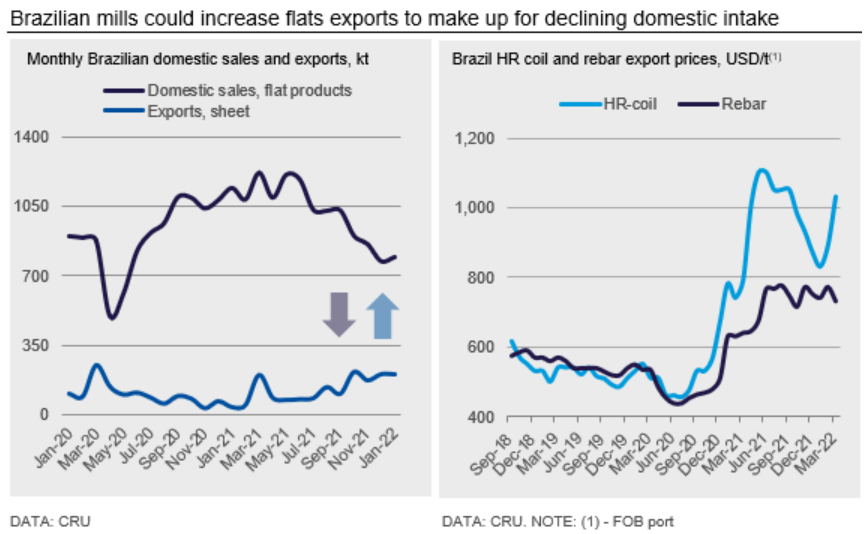

On the demand side, March distributor sales have started to slow. There is an ongoing caution in the economy due to high inflation, higher interest rates, and the political uncertainty of an electoral year. Part of the slow sales could also be related to a pause in economic activity due to the carnival holidays. With the invasion of Ukraine and consequent disruption of supply from Ukraine and sanctions against Russia, more markets could open for Brazilian exports. If local demand remains slow, Brazilian mills could try to increase exports to compensate for lower domestic sales (see chart).

Brazilian long prices increased by 2% in the last two weeks of March as mills have been trying to raise domestic prices. Chinese rebar prices increased by 8% and Turkish rebar prices 18% since March 3. Brazilian domestic prices are now at a discount of ~18% and ~26% compared to Chinese and Turkish import material, respectively. The spread between domestic and import parity prices has increased since the beginning of 2022.

Outlook: Upward Pressure Ahead for Long and Flat Prices

We expect considerable upward pressure on flat prices as the invasion of Ukraine limits the supply of raw materials and semifinished steel as well as disrupts trade flows. The magnitude of any increase will depend on how the war evolves. International buyers will want to mitigate their risk and source from countries outside of the CIS such as Brazil.

Demand has been seasonally weak for long products, and the oversupplied Brazilian market drove Brazilian longs prices down again last month. With the domestic price now at a larger discount to the Chinese and Turkish import parity price as prices in these regions are increasing, there will be room for domestic prices to increase.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com