Analysis

March 8, 2022

AGC: Construction Industry Boosts Jobs, Wages in February

Written by David Schollaert

The U.S. construction sector added 60,000 new workers to payrolls in February, while hourly wages climbed at the steepest pace in nearly 40 years, reports the Associated General Contractors of America (AGC) in its latest analysis of government data.

“All segments of construction added workers in February,” said Ken Simonson, AGC’s chief economist. “However, filling positions remains a struggle, as pay is rising even faster in other sectors.”

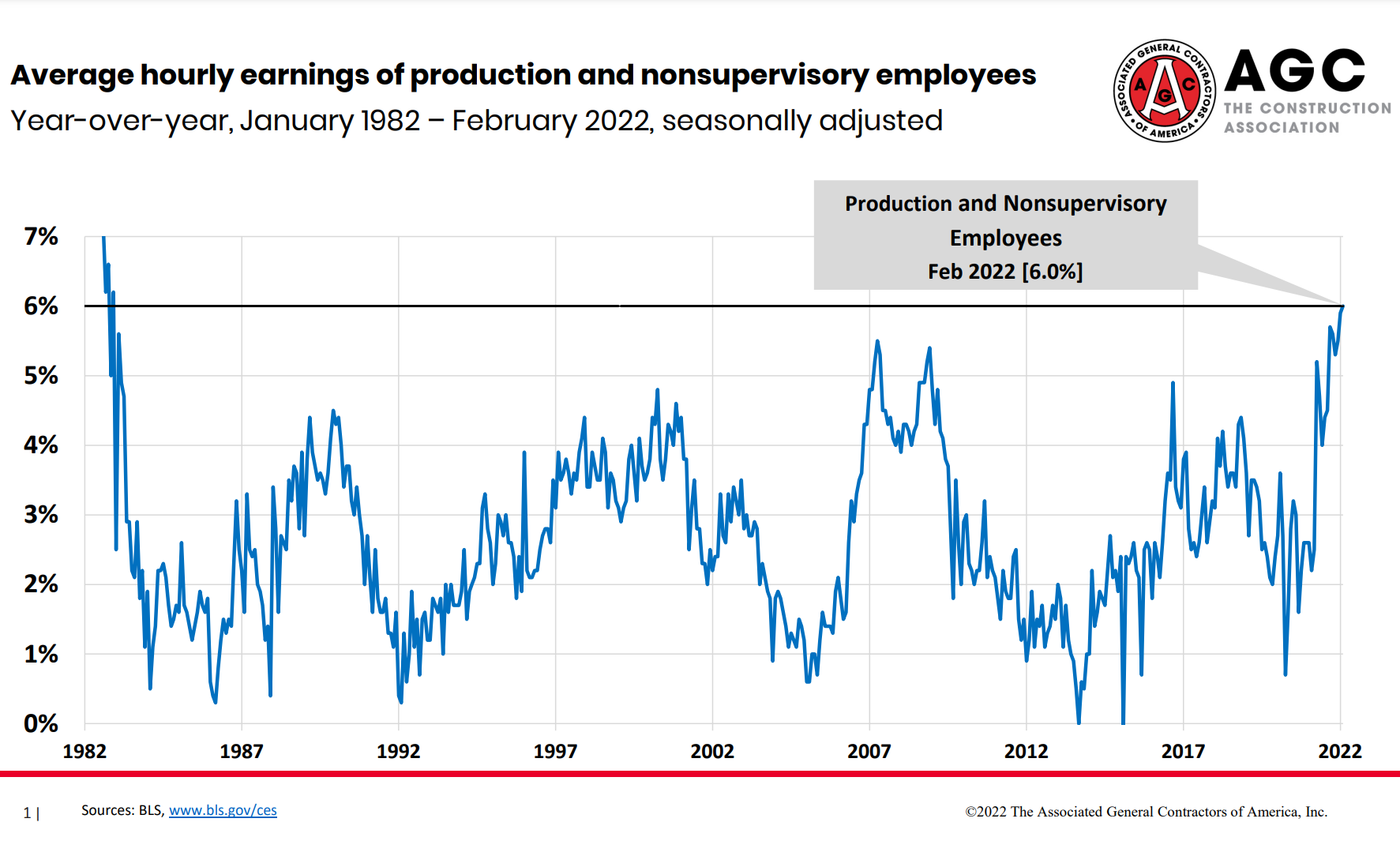

Average hourly earnings for “production and nonsupervisory employees” – largely hourly craft workers, in the case of construction – increased 6% year on year, the steepest 12-month increase since December 1982, Simonson said.

The industry average of $31.62 per hour for such workers exceeded the private sector average by 17%, the economist pointed out. Nevertheless, the average for the entire private sector climbed even more in February – by 6.7% year-over-year – and the competition for workers has intensified as other industries offer working conditions that are not possible in construction, such as flexible hours or work from home.

Employment rose at all types of construction firms in February. Nonresidential construction firms added 29,400 employees: including 19,900 specialty trade contractors, 7,300 at heavy and civil engineering construction firms, and 2,200 working for general building contractors. Employment in residential construction rose by 31,000 workers, including 24,300 at specialty trade contractors and 6,700 employed by homebuilders and multifamily general contractors.

The number of unemployed jobseekers with construction experience shrank by 26% over the past year to 677,000 last month. Simonson said the decline is further evidence that the industry will have a hard time filling positions with experienced workers.

The industry will need to hire hundreds of thousands of additional workers in each of the next several years to complete projects that will be funded by the infrastructure bill, said AGC, as well as to satisfy the continuing demand for homebuilding and private nonresidential structures.

AGC urged officials in Washington to boost support for career training and education to enable more workers to pursue high-paying construction careers and to support a wider range of apprenticeship and training opportunities.

“Construction firms are doing all they can to add employees and pay them well,” said Stephen Sandherr, AGC’s CEO. “But there are not likely to be enough workers to meet demand unless officials in Washington act now to prepare more jobseekers for these opportunities.”

By David Schollaert, David@SteelMarketUpdate.com