Market Data

March 4, 2022

Employment by Industry: February Gains Ground

Written by David Schollaert

The U.S. labor market exceeded expectations in February, adding 678,000 new jobs last month. It was the best month for job growth since last July, the Bureau of Labor Statistics reported Friday.

The U.S. still has 2.1 million jobs to go before hitting the February 2020 level and recouping all positions lost in the pandemic.

February’s result exceeded the 467,000 new jobs added the month prior and was well ahead of the expected 400,000 forecasted. The payroll boost was met by a lower unemployment rate, down to 3.8% and representing a new pandemic-era low.

The latest data from the BLS showed that the leisure and hospitality sector, which was hit hardest by COVID-related layoffs, once again added the most jobs at 179,000. The industry needs another 1.5 million jobs to reach its pre-pandemic level. Most of the positions added in February were created at restaurants and bars as Americans ventured out more to socialize once the Omicron surge subsided.

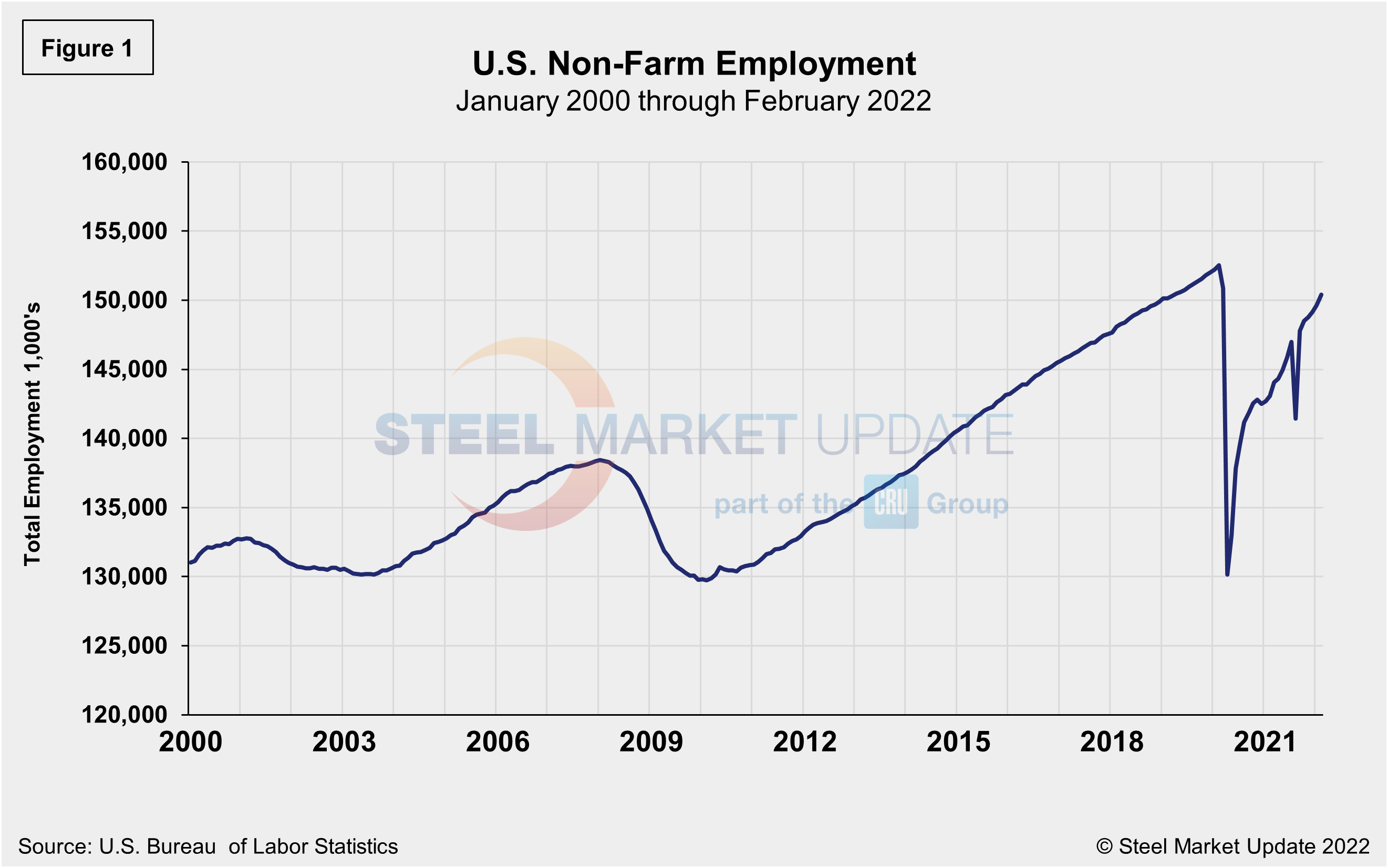

Professional services, health care and construction also recorded strong job gains. In total, the number of unemployed persons edged down by 243,000 to 6.3 million last month. Figure 1 shows the total number of people employed in the nonfarm economy.

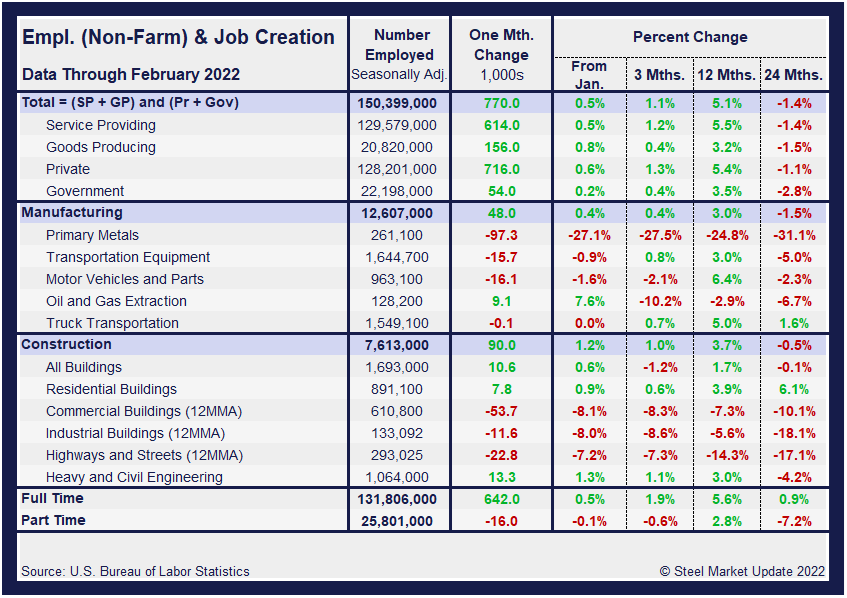

Designed on rolling time periods of 1 month, 3 months, 1 year, and 2 years, the table below breaks total employment into service industries and goods-producing industries, and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction. Comparing service and goods-producing industries in February shows service jobs have increased by just 0.5%, while goods-producing jobs were up 0.8%. Despite steady month-on-month gains, both industries remain behind pre-pandemic levels. Note, the subcomponents of both manufacturing and construction shown in this table don’t add up to the total because we have only included those with the most relevance to the steel industry.

Comparing February to January, manufacturing employment was up 0.4%, a better pace than 0.1% growth the month prior. Construction saw a 1.2% recovery last month after slipping 0.5% in January. The construction sector, which has been driven by the residential market, also rebounded in February, posting a 0.9% gain following a 0.3% loss the month prior. Gains have been held back even further by struggling commercial and industrial building sectors. Despite the overall improvement, the inconsistencies in some of the subcomponents reflect the obstacles still facing the U.S. economy and domestic job creation. The three-month and 12-month comparisons show a good recovery but still lag the 24-month pre-pandemic comparisons. In the year-over-year contrast, manufacturing is up 3.0% and construction is up 3.7%. Further growth is still expected as the marketplace advances from the freefall-driven pandemic in Q2 2020.

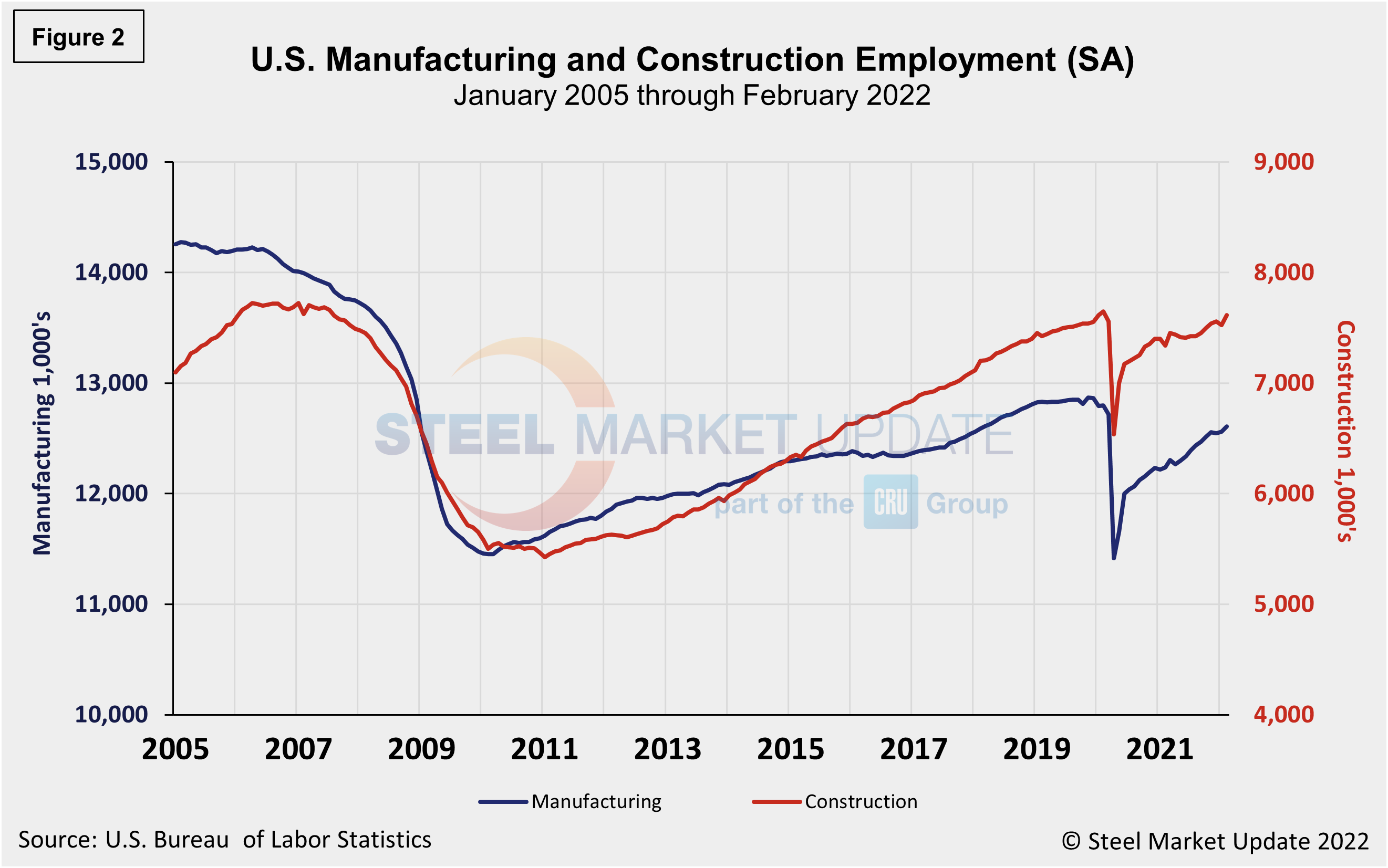

Manufacturing employment added 36,000 jobs in February, nearly tripling the results seen in January. Construction employment was boosted by 60,000 new workers last month after posting a loss of 37,000 the month prior. The boost is likely due to the withdrawal of the emergency vaccine mandate in late January. The history of employment in manufacturing and construction since January 2005 is shown below in Figure 2, seasonally adjusted.

According to human resources consulting firm Challenger, Gray and Christmas, Inc., companies in health care announced the most job cuts in February with 3,875, followed by the government sector with 3,010, and entertainment/leisure with 1,032 announced job cuts last month.

Over a third of cuts in February were due to market conditions. A total of 5,558 jobs were cut for this reason. Another 4,671 cuts were due to store, unit or plant closings, while 1,430 cuts were due to workers refusing to get vaccinated against employer policy. Since June 2021, employers announced 14,821 cuts due to vaccine refusal, Challenger said.

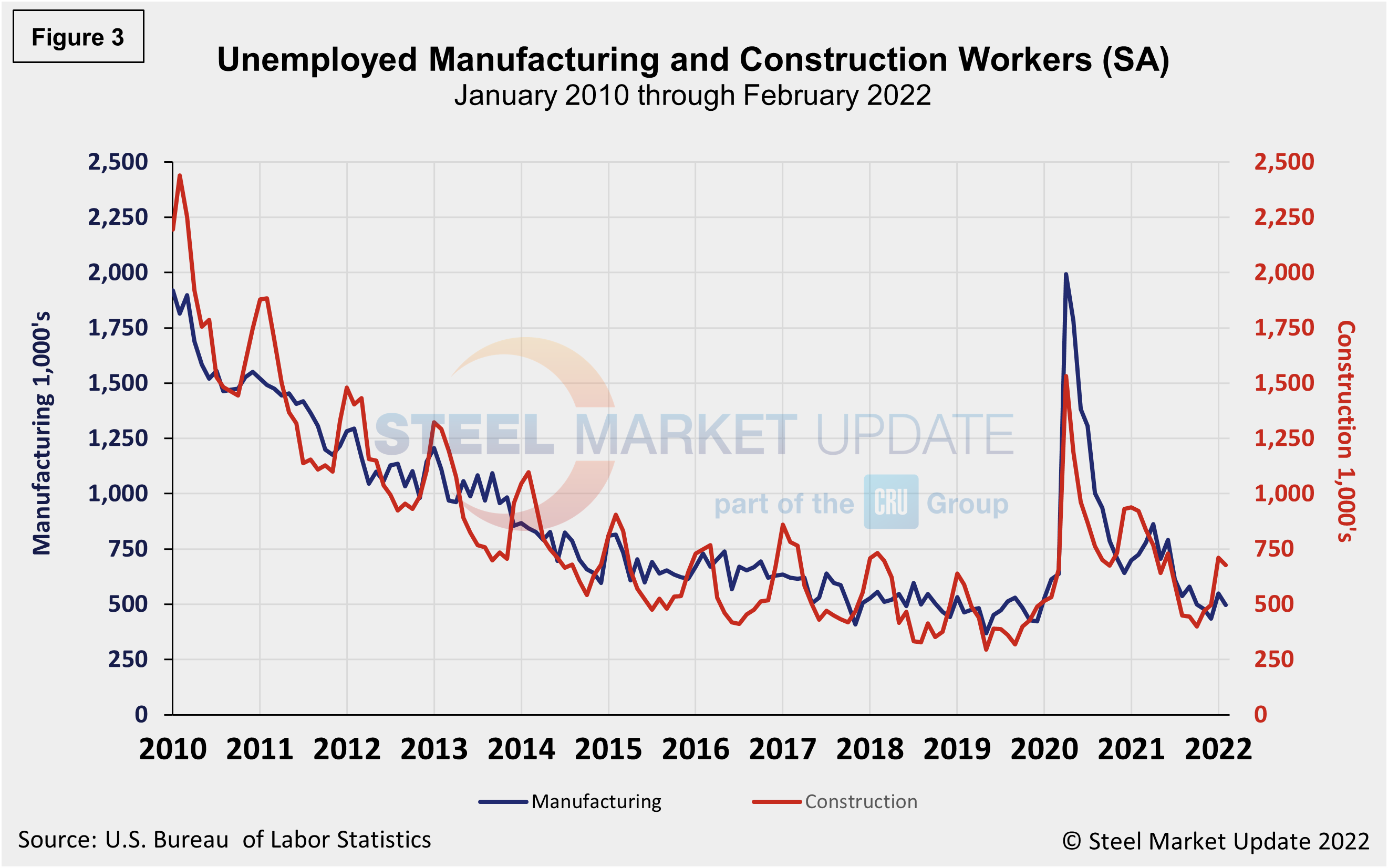

The reported number of unemployed manufacturing and construction workers is shown in Figure 3. Construction and manufacturing unemployment fell in February after diverging over prior months. Construction unemployment fell 4.5% month on month, from 709,000 in January to 677,000 in February. Manufacturing’s unemployed fell from 549,000 in January to 497,000 last month, a 9.5% decline month on month. Both sectors have been heavily impacted by supply-chain disruptions and labor force constraints, on top of seasonality. Withdrawal of the vaccine mandate by the White House in late January boosted employment in these sectors and is expected to further aid growth in the coming months.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is not necessarily the nominal numbers, but the direction in which they are headed.

By David Schollaert, David@SteelMarketUpdate.com