Market Data

March 1, 2022

Manufacturing PMI Expands in February

Written by David Schollaert

Sentiment among purchasing managers surveyed by the Institute for Supply Management remains strongly optimistic, showing growth last month following a small dip in January.

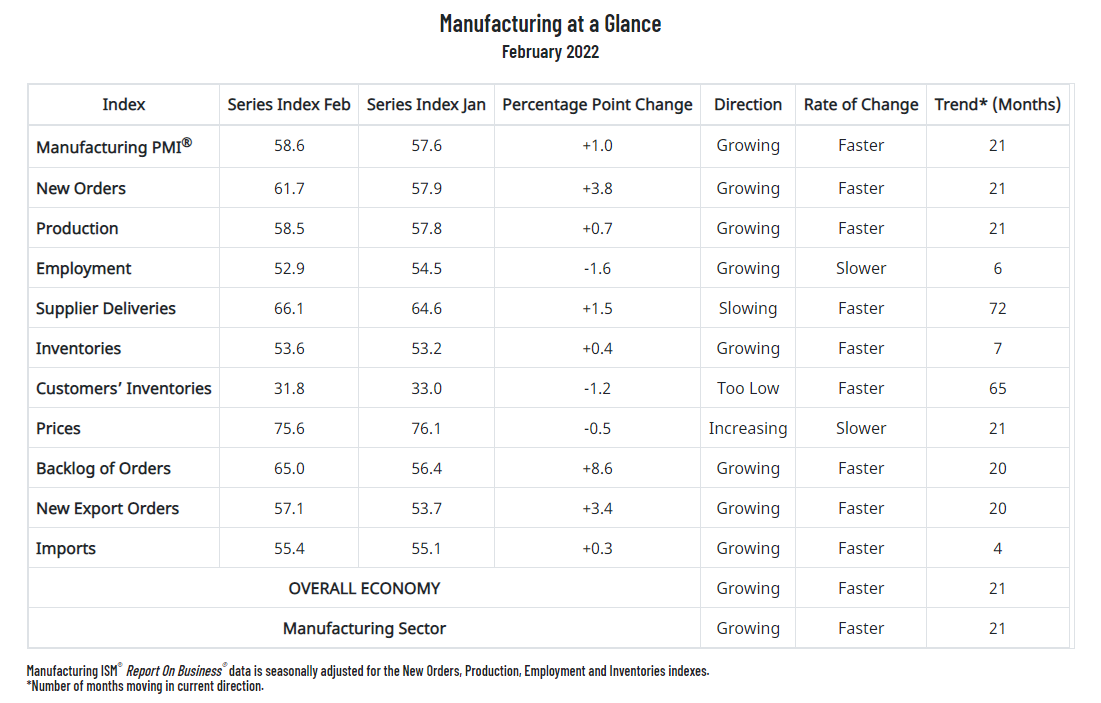

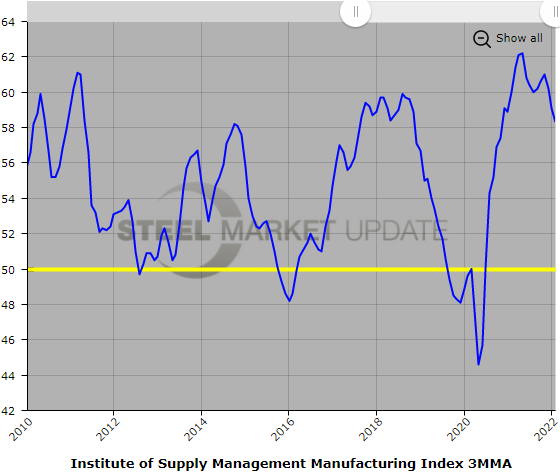

February’s Manufacturing PMI edged up to a reading of 58.6% versus 57.6% the month prior. The index reading above 50% indicates growth in the manufacturing sector, thus February’s measure marks the 21st consecutive month of expansion since the COVID-related contraction in April and May 2020.

“The U.S. manufacturing sector remains in a demand-driven, supply-chain-constrained environment,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “Manufacturing performed well for the 21st straight month, with demand registering month-over-month growth and consumption softening slightly, though less than forecast. The impact of omicron declined in February as swiftly as it appeared in December, leaving March and April’s manufacturing environment favorable, especially with new orders and backlogs registering strong growth.”

Other findings from ISM’s monthly survey of purchasing professionals:

- The New Orders Index increasing and remaining in strong growth territory, supported by stronger expansion of new export orders.

- The Customers’ Inventories Index remaining at a very low level.

- The Backlog of Orders Index increasing to historically high levels.

- Consumption (measured by the Production and Employment indexes) grew during the period, though at a slower rate.

- The Employment Index expanded for a sixth straight month, with signs that firms’ ability to hire continues to improve. This was offset by continued challenges with turnover (quits and retirements) and resulting backfilling, as firms struggle to adequately staff their organizations.

February’s PMI recovery and growth was largely the result of a fast-receding omicron, making way for new orders and rising backlogs, ISM said.

By David Schollaert, David@SteelMarketUpdate.com