Analysis

February 25, 2022

Multifamily Construction Ends Q4 on a High

Written by David Schollaert

The outlook for multifamily construction closed the year on a positive note, as confidence in the market for new multifamily housing improved in the fourth quarter of 2021, according to the National Association of Home Builders’ (NAHB) Multifamily Market Survey (MMS).

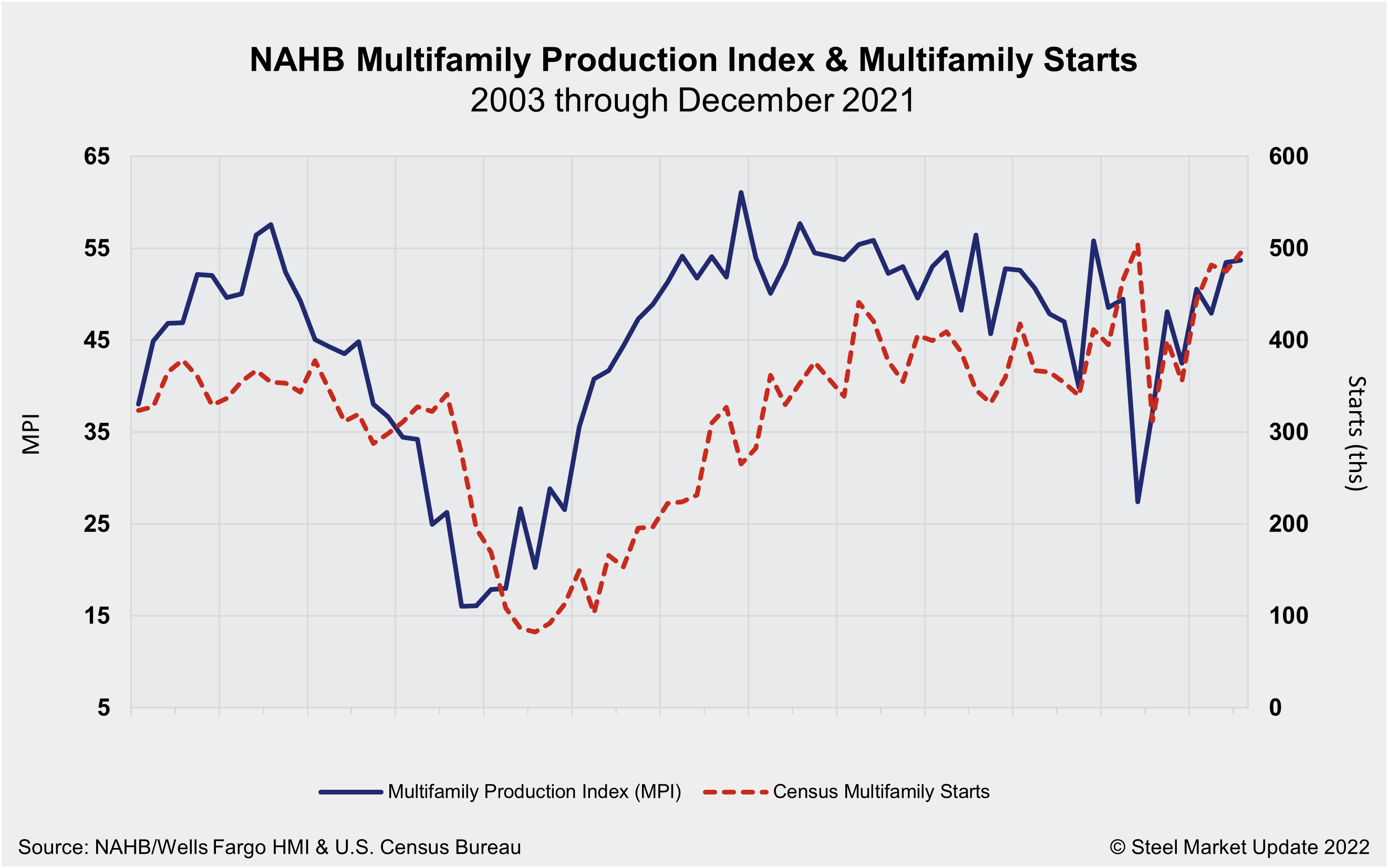

The MMS’s two separate indices saw mixed results. The Multifamily Production Index (MPI) gained one point to 54 versus the previous quarter, while the Multifamily Occupancy Index (MOI) fell six points to 69.

The MPI measures builder and developer sentiment about current conditions in the apartment and condo market, while the MOI measures the multifamily housing industry’s perception of occupancies in existing apartments. Both are measured on a scale of 0 to 100, and a result above 50 indicates growth.

The MPI is a weighted average of three key elements of the multifamily housing market: low-rent units-apartments, market-rate rental units-apartments, and condominiums. Two of the three components increased from Q3 to Q4 2021. The component measuring market rate rental units inched up one point to 61, while the component measuring for-sale units posted a six-point gain to 53. The component measuring low-rent units fell seven points to 48 during the same period.

“Multifamily developers remain largely optimistic about this segment of the market,” said Sean Kelly, NAHB’s Multifamily Council. “Demand in many parts of the country has been strong enough to compensate for the rising costs of land, labor and materials.”

The MOI measures current occupancy indexes for class A, B and C multifamily units. Even though the index fell six points to 69, it remains as high as it’s been at any time prior to the second quarter of 2021.

“The strength of the MPI is consistent with Census production statistics, which show 750,000 apartments under construction and new apartments being started at a rate in excess of 500,000 per year,” said Robert Dietz, NAHB’s chief economist. “The modest decline in the very strong MOI number is not likely to result in any significant change in Census rental occupancy rates, which are still rising and will likely remain high given the strong 69 index number from our survey.”

About the report: The Multifamily Market Survey (MMS) is based on a quarterly survey of NAHB multifamily builders and property managers. The survey is designed to monitor conditions for multifamily production (starts) and multifamily rental occupancy in the current versus preceding quarter as well as in the next six months.

By David Schollaert, David@SteelMarketUpdate.com