Market Data

February 25, 2022

Consumer Confidence Down Again in February

Written by David Schollaert

U.S. consumer confidence slipped again in February following a downward revision in January, reported The Conference Board. The slight erosion in the headline index was the second straight decline following a small recovery in late 2021 that saw gains from September through December. Though results are mixed, the shift in momentum is worth noting.

Sentiment towards current business and labor market conditions was slightly improved in February even though Americans’ views on the outlook for the economy continued to cool. The share of respondents who said conditions were “good” fell 1.3 points in February after climbing to a six-month high the prior month.

Concerns about the effects of inflation expanded in February following declines in December and January, the report said. More consumers expected the economy to improve, however income and job availability in the next six months face headwinds. Americans were slightly more unsure about present business conditions, as the marketplace looks to be more watchful.

“Consumer confidence was down slightly for a second consecutive month in February,” said Lynn Franco, senior director of economic indicators at The Conference Board. “The Present Situation Index improved a touch, suggesting the economy continued to expand in Q1 but did not gain momentum. Expectations about short-term growth prospects weakened further, pointing to a likely moderation in growth over the first half of 2022. Meanwhile, the proportion of consumers planning to purchase homes, automobiles, major appliances and vacations over the next six months all fell.”

“Concerns about inflation rose again in February, after posting back-to-back declines. Despite this reversal, consumers remain relatively confident about short-term growth prospects. While they do not expect the economy to pick up steam in the near future, they also do not foresee conditions worsening. Nevertheless, confidence and consumer spending will continue to face headwinds from rising prices in the coming months,” she added.

The headline index slipped by 0.6 points in February to 110.5, following a downward revision in January from 113.8 to 111.1. The result is now 18.4 points behind its peak of 128.9 seen last June, and a disappointing start to 2022. Despite the contraction, February’s total was still 15.3 points above the same year-ago total when the index measured just 95.2.

February’s present situation index, which is based on consumers’ assessment of current business and labor market conditions, improved by 0.6 points after a 0.3-point downward revision in January. The reading for the index stands at 145.1 in February. The expectations index, which is based on consumers’ short-term outlook for income, business and the labor market, fell by 1.3 points to 87.5, its lowest total in 15 months.

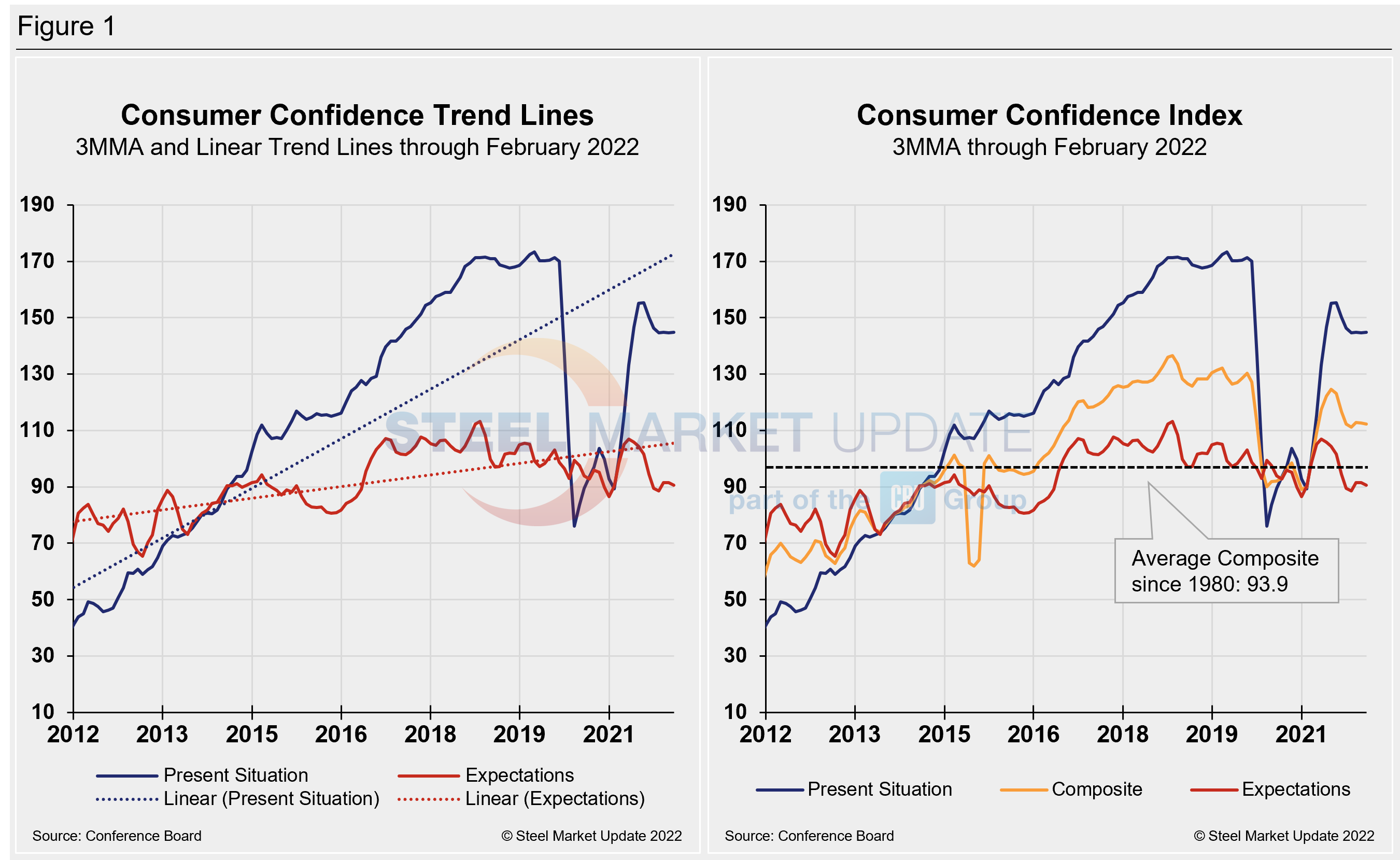

Calculated as a three-month moving average (3MMA) to smooth out the volatility, The Conference Board’s composite index rose in January to 112.3 versus 112.7 in January – falling for the second consecutive month and still well below the pre-pandemic high of 130.4 seen in February 2020. The recent growth pushed the index 22.5 points higher than the 89.8 seen a year ago. The composite index is made up of two sub-indexes: consumers’ view of the present situation and their expectations for the future. Figure 1 below notes the 3MMA linear trend lines from January 2012 through February 2022 versus the trend lines of all three subcomponents of the index: present situation, composite and future expectations. All three were above the average composite line in October 2020 before falling consecutively through last February. The surge from March through June pulled all three indexes above the composite line once again, but a summer lull pulled them back down, causing expectations to slip below the average composite line as it tries to recover.

On a 3MMA basis comparing February 2022 with February 2021 in the table below, the present situation has an index reading of 144.8, a 0.2-point increase from the month prior and 49.8 points above the year-ago reading. Expectations are at 90.6, down 0.9 points from January, and 4.8 points below year-ago levels. Despite continued erosion in February, two out of three indexes show positive gains against year-ago measures when the economy was still recovering from the first COVID-19 wave, yet two out of three momentum indicators are moving down.

When comparing current 3MMA totals to the 2020 pre-pandemic year, the composite is still down 18.1 points, while the present situation is down 26.4 points. The expectations reading is down 12.6 points in February when compared to the same 2020 period. The consumer confidence report also includes both employment data and some purchase plans and these are likewise summarized in the table below. The color codes show improvement or deterioration of the individual components.

The composite, present situation and expectations indices rallied midway through 2021, recovering much of what was lost in the fallout from the global pandemic. Driven by the surge in new variant cases, momentum shifted downward during Q3, followed by a bit of a rally in the fourth quarter. Concerns over inflation and a tight job market continue to keep measures below the pre-summer highs seen last year.

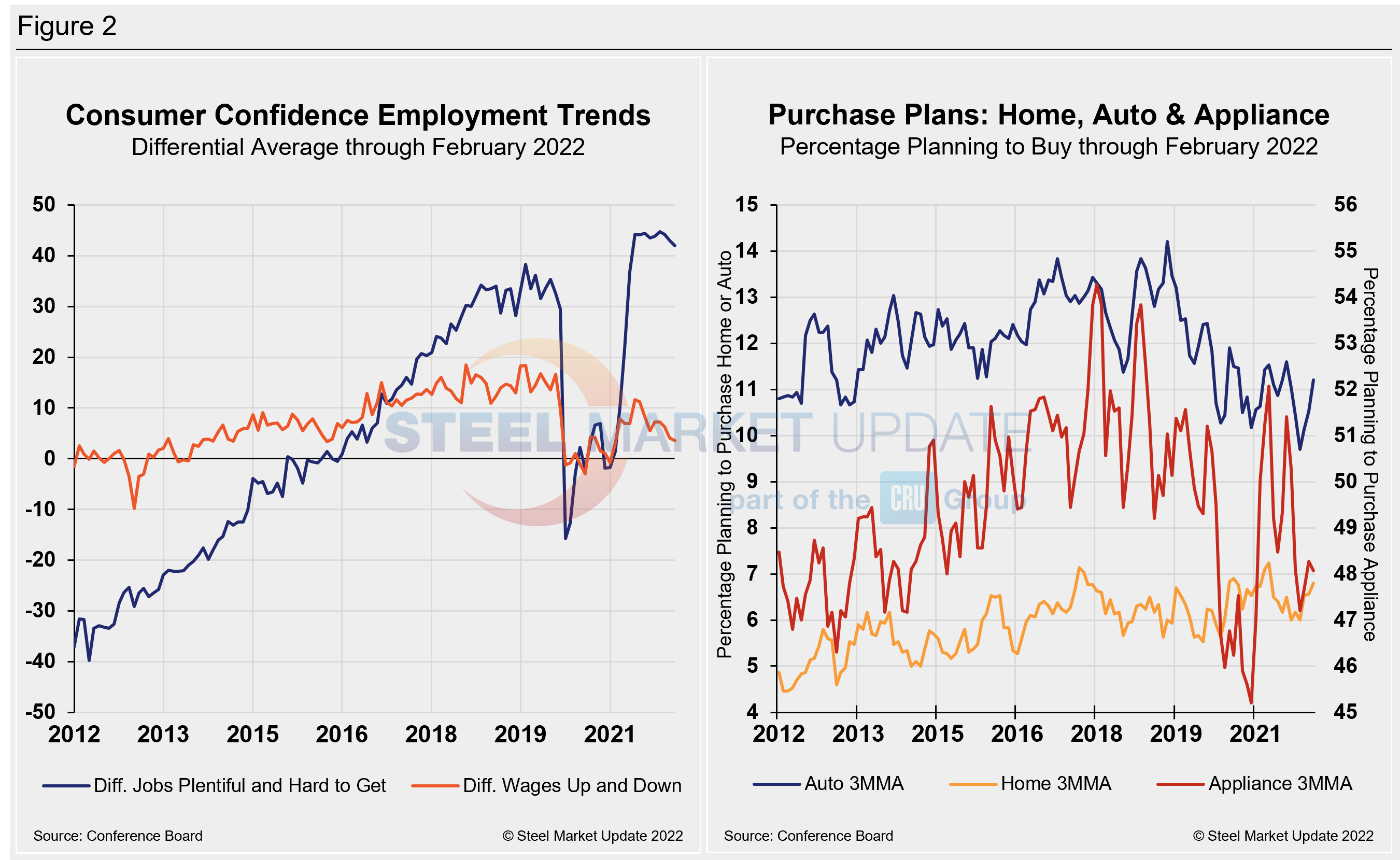

People found jobs slightly less plentiful in February and were a bit less optimistic about wage increases compared to the month prior, slipping for the second straight month. The differential between those finding jobs plentiful and those having difficulty was 42 in February, down from 43 in January. The measure, despite recent decreases, remains well above the most recent pre-pandemic high and is a strong rally from the 1.4 seen a year ago. The differential between those expecting wages to rise versus those expecting wages to fall is presently 3.6, down 0.5 points month on month and down from the recent high of 11.6 last June.

Spending plans for consumer goods as measured by automobiles, homes and appliances had been trending up through June, but started slowing through the summer and into the fourth quarter. Despite some recent variation, all three moved down in February. Appliance buying plans saw the strongest decline, down 2.0 points or 4.1% month on month in February to a reading of 47.2. Automotive and home buying both slipped 0.5 points monthly in February, to readings of 11.0 and 6.5, respectively. These recent dynamics and historical movements are illustrated below in Figure 2.

Note: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.

By David Schollaert, David@SteelMarketUpdate.com