Prices

February 24, 2022

Hot Rolled Steel Futures – Opposing Forces

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

It seems the worst-case scenarios discussed for weeks have now unfolded in dramatic fashion in the Ukraine with the overnight invasion by Russia. Markets have been roiled by volatility leading up to this point and today was no exception with massive intra-day swings in equity indices, but ultimately ending up positive on the day. The tone of news broadcasts today felt different and much more ominous than I can recently recall as the world digests the implications of Russian aggression and the impacts of global escalation.

Considering the situation in the Ukraine, it seems a bit trivial to pontificate on steel market direction, but as I reflect on conversations had last week during the SMU Tampa conference it seemed to underscore that considerable uncertainty continues to exist in the steel markets here in the U.S. and it’s worthwhile to share some observations from physical and financial market participants’ perspectives.

Most in the physical markets suggest that demand remains strong, though operational and supply-chain limitations persist, hampering their organization’s ability to satisfy demand. The service center segment continues to struggle navigating a declining price environment with high-cost inventory, and most mills admit they could use a few more orders.

New flat rolled capacity continues to dominate the bear case for why steel prices should fall, while those with an international perspective have grown slightly more bullish as the import arbitrage has nearly evaporated on some products during this five-month domestic price collapse.

The chart below shows where global futures prices were a few weeks ago between the U.S. and Europe/China as converted to dollars per short ton, highlighting the fact that we are essentially at parity on an Ex-Works basis with Europe and a slight premium to China, excluding any tariffs and logistic costs or margin that would incent those regions to export to the U.S.

Unsurprisingly, the ferrous futures trading activity has also been a bit erratic. The HRC futures popped on Tuesday with futures prices moving higher between $25-43/t across the Q2 through Q4 following Cleveland-Cliffs’ price increase and the announcement of their decision to shutter the 2-million-ton-per-year #4 blast furnace at Indiana Harbor. Wednesday and Thursday trading saw more muted and mixed movement across the Q2 through Q4 months with less discernible daily trends indicating where buyers and sellers think steel prices may be headed in those months.

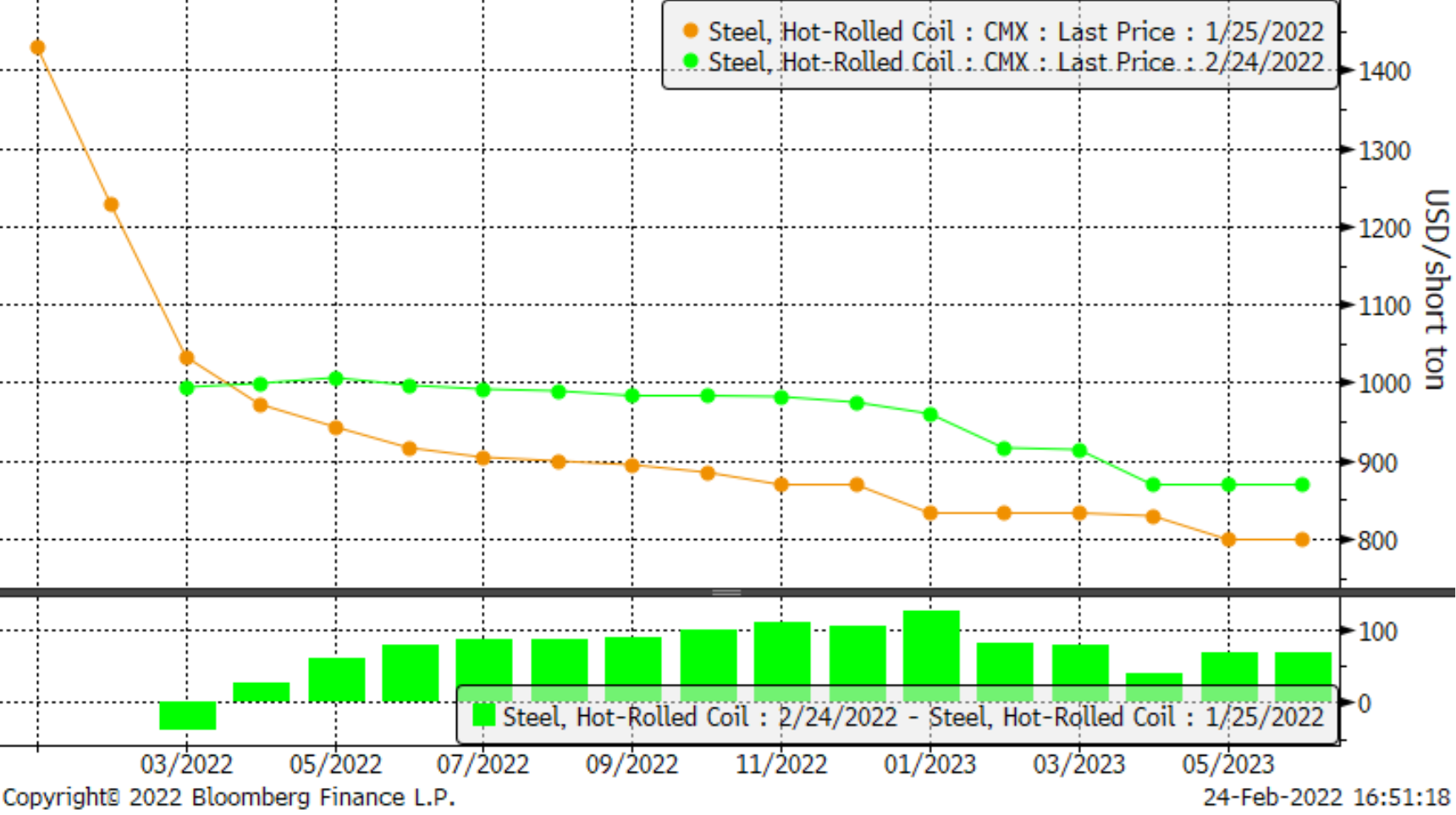

The chart below is a month over month comparison of HRC settlements, which illustrates the subtle moves higher that have occurred in the HRC futures market despite an overarching bearish tone in physical markets.

HRC Curve MoM

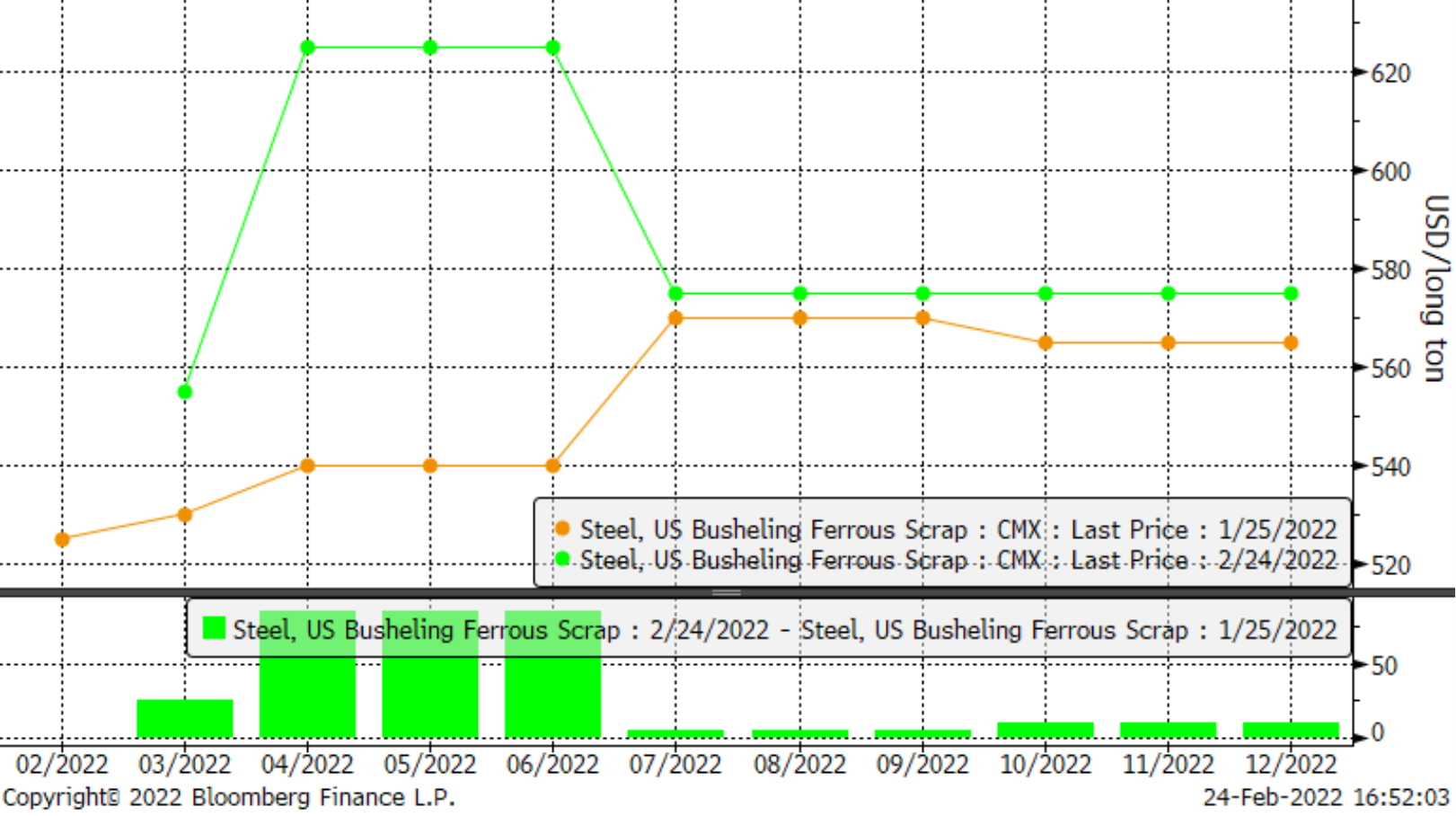

Scrap futures trading suggests a more bullish near-term picture than the above HRC chart as you’ll see below with the Q2-22 busheling scrap contract trading about 16% higher than a month ago, following a small $625/GT trade in the Q2 today. It stands to reason that with the conflict in Ukraine, exports of pig iron could be immediately disrupted and that countries dependent on trade flows of slabs and other steel products/raw materials emanating from Russia/Ukraine will have to search for alternative sources of supply from other parts of the world.

BUS Curve MoM

We shall see how the opposing forces of more bullish sentiment from financial players plays out against the slightly more bearish tones coming from the physical market. But from our perspective, it remains worthwhile to consider adopting a risk management strategy that helps protect market participants in these incredibly volatile times.

In closing, we hope you all stay safe and remain hopeful that those fighting for their freedom prevail.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.