Analysis

February 20, 2022

NAHB: Builder Confidence Slips Further in February

Written by David Schollaert

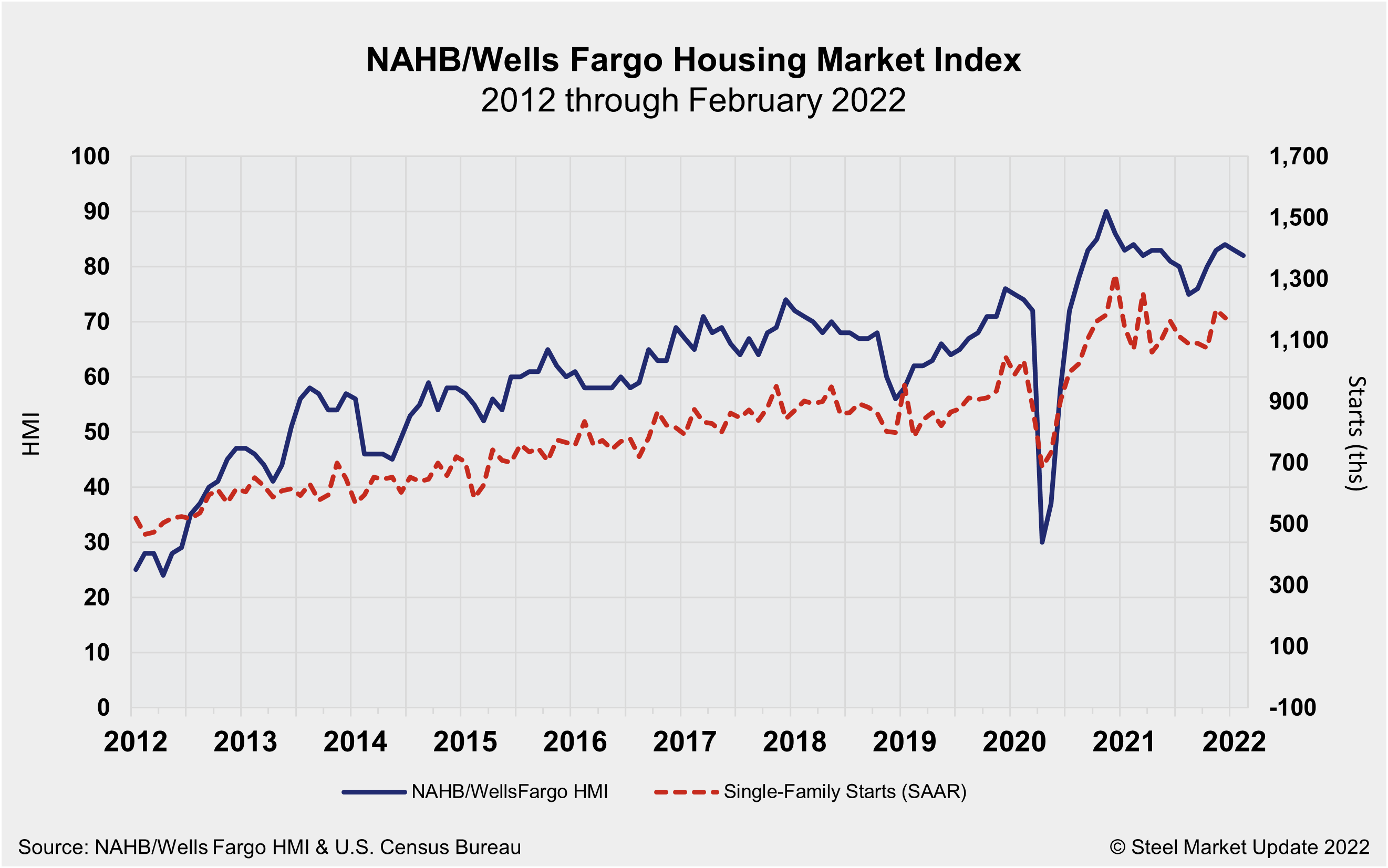

Builder confidence fell again in February despite strong demand from buyers, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

Home builder sentiment fell for the second straight month on ongoing building material production bottlenecks, which have pushed up construction costs and delayed projects.

February’s HMI reading moved one point lower to a reading of 82. Despite two months of declines, the HMI has posted solid readings at or above the 80-point mark for the past five months.

“Production disruptions are so severe that many builders are waiting months to receive cabinets, garage doors, countertops and appliances,” NAHB Chairman Jerry Konter said. “These delivery delays are raising construction costs and pricing prospective buyers out of the market. Policymakers must make it a priority to address supply chain issues that are harming housing affordability.”

The NAHB/Wells Fargo HMI survey gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Two out of the three major HMI indices posted decreases in February. The gauge charting traffic of prospective buyers posted a four-point decline to 65 while the component measuring sales expectations in the next six months fell two points to 80. The index gauging current sales conditions rose one point at a reading of 90.

“Residential construction costs are up 21% on a year-over-year basis, and these higher development costs have hit first-time buyers particularly hard,” said Robert Dietz, NAHB’s chief economist. “Higher interest rates in 2022 will further reduce housing affordability even as demand remains solid due to a lack of resale inventory.”

Looking at the three-month moving averages for regional HMI scores, the Northeast increased three points to 76, the West increased one point to 89, and the South and Midwest each posted a one-point decrease to 86 and 73, respectively.

By David Schollaert, David@SteelMarketUpdate.com