Analysis

February 15, 2022

Final Thoughts

Written by Tim Triplett

Service centers are the Dangerfields of steel—they just don’t get no respect. Sure, nobody likes to pay the middleman, especially when prices are plunging and margins are getting squeezed. But let’s face it, the supply chain wouldn’t work without them, especially today.

![]()

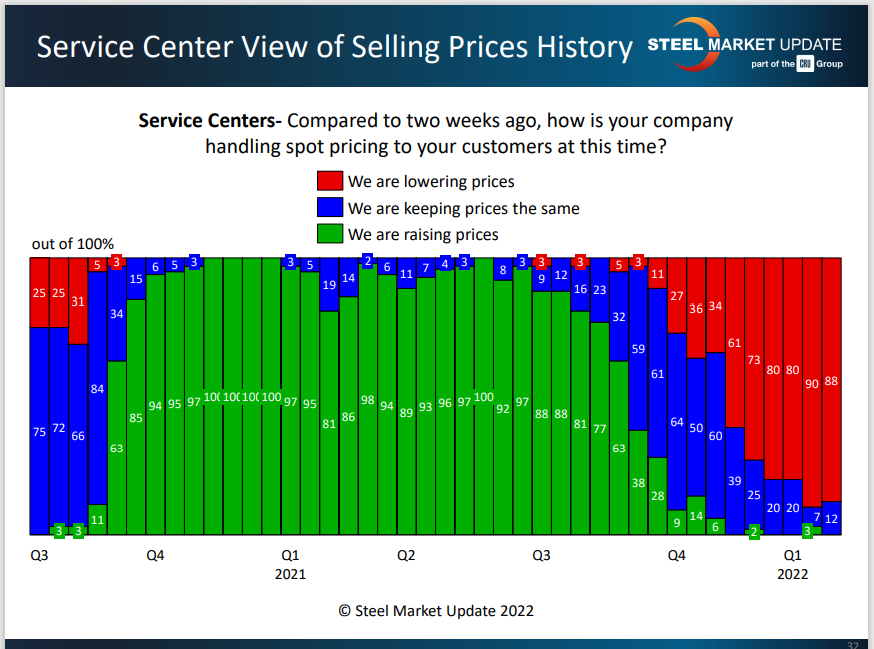

Nine out of 10 service centers report they are lowering prices to their customers, and they have been since the fourth quarter last year (see chart below from SMU’s latest survey). But apparently not fast enough. Buyers are complaining.

Speaking during SMU’s Community Chat last Wednesday, Majestic Steel USA CEO Todd Leebow described a market in which end users are reluctant to place orders with the mills, postponing purchases today in hopes of a better price tomorrow. That makes them more reliant than usual on their service center suppliers. But these buyers read about mill prices declining by $50 to $100 per ton each week and don’t understand why they don’t see the same from their local distributor.

“We can’t correct prices on the way down as quickly as the mills because there is value in maintaining inventory and providing all our other services,” Leebow said. In other words, service is not a commodity. Service centers deserve to get paid for having the right products at the right time, for processing them, and for delivering them just in time in small quantities. Service centers need an incentive to take on the risk of carrying inventory even in a pricing environment where that steel is continually devalued, Leebow said. “We need inventory in the supply chain, but when the pricing environment disincentivizes you to carry that inventory, that makes it challenging.”

So take it from Todd (and Rodney), your service center partners deserve some respect as they take on the inventory risk for themselves, and for you, in both good times and bad.

Vertical Integration

Steelmakers have dabbled in distribution over the decades, without much success. There seems to be renewed interest in vertical integration of late, with producers investing in holdings from mines to mills to consumers. Even service centers. For example, SDI’s recently completed acquisition of a 45% stake in New Process Steel and Nucor’s stake in Steel Technologies.

Leebow does not see mill ownership of service centers as a likely trend, though. “I don’t think the mills can do what service centers do; they just aren’t as nimble,” he said. “We like building partnerships with all our suppliers. They each bring something different, whether its product or geography or tonnage. Our job is to diversify for our customers; it’s not single sourcing.”

Another quotable bit of wisdom from the young Majestic exec during SMU’s webinar: Avoid the whiplash effect. “There is so much panic over what is happening in the market, my job is to be the steadying influence for Majestic and make sure we don’t overreact.” Good advice.

Upcoming SMU Events

SMU is now accepting registrations for a virtual Introduction to Steel Hedging Workshop scheduled for April 26-27 and SMU’s 2022 Steel Summit in Atlanta on Aug. 22-24. Hope to see you there, virtually and in person.

As always, we appreciate your business.

Tim Triplett, SMU Executive Editor, Tim@SteelMarketUpdate.com