Market Data

February 15, 2022

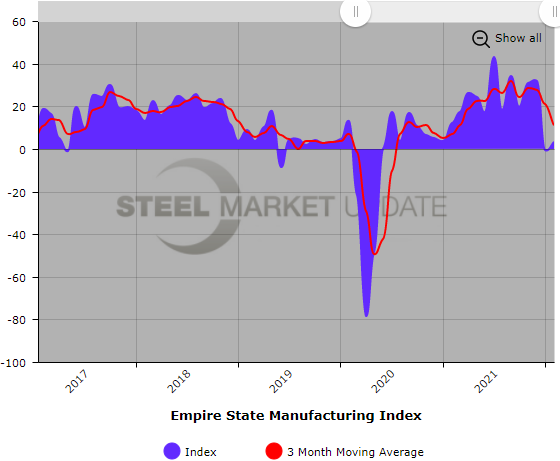

Empire State Manufacturing Index Holds Steady in February

Written by David Schollaert

Business activity in the state of New York was little changed in February following an abrupt decline the month prior, according to the Empire State Manufacturing Survey.

![]() The headline general business conditions index is now at 3.1 (above the neutral mark of 0), moving up four points versus the -0.7-mark seen the month prior when the index fell by more than 33 points. New orders and shipments held steady, and unfilled orders increased, while delivery times continued to lengthen.

The headline general business conditions index is now at 3.1 (above the neutral mark of 0), moving up four points versus the -0.7-mark seen the month prior when the index fell by more than 33 points. New orders and shipments held steady, and unfilled orders increased, while delivery times continued to lengthen.

The new orders index was up 6.4 points to a 1.4 reading after plummeting 32 points in January. Shipments were up 1.9 points to a reading of 2.9 for the month. Labor market indicators pointed to a solid increase in employment and a longer average workweek

Unfilled orders rose 2.3 points to 14.4, while delivery times were unchanged, holding at 21.6 in February. The inventories index moved higher, albeit slightly, expanding by 1.4 points to a reading of 11.7.

Prices paid waned for just the third time in six months, a fractional decrease of 0.1 point in February to 76.6. Prices received expanded in February, jumping 17.0 points to a reading of 54.1 from 37.1 the month prior. The number of employees also gained ground this month by 7.0 points to 23.1, rebounding after falling by nearly 10.0 points in the two prior months. The average workweek index was 10.9, up by just 0.6 points versus January’s reading of 10.3.

The six-month outlook remained generally optimistic, although optimism did wane this month versus January. The index for future business conditions fell seven points to a reading of 28.2 in February versus 35.1 the month prior, its lowest level since the early stages of the pandemic, the Federal Reserve Bank of New York said.

Longer delivery times, higher prices, and increases in employment are all expected in the months ahead. New orders slipped by 0.4 points to 32.5 in February, while shipments rose 3.3 points to a measure of 32.6.

The indexes for future prices paid and received both fell after reaching record highs in January. Future prices paid slipped 6.3 points to 70.3, while future prices received was down 10.7 in February to a reading of 51.4. The capital expenditures index slipped by 1.5 points to 37.8, holding near a multi-year high, suggesting that firms plan significant increases in capital spending. The technology spending index fell 2.2 points to a measure of 29.7 in February.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use its interactive features. You can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com