Analysis

February 15, 2022

AGC: Construction Material Costs Jump Again in January

Written by David Schollaert

Prices contractors pay for construction materials jumped more than 20% in January versus the same period a year ago, reports the Associated General Contractors of America (AGC) in its latest analysis of government data. The results have led AGC to urge federal officials to take additional steps to ease the industry’s challenges associated with volatile materials costs, supply-chain disruptions and labor shortages.

“Unfortunately, there has been no let-up early this year in the extreme cost runup that contractors endured in 2021,” said Ken Simonson, the association’s chief economist. “They are apparently passing on more of those costs, but will have a continuing challenge in getting timely deliveries and finding enough workers.”

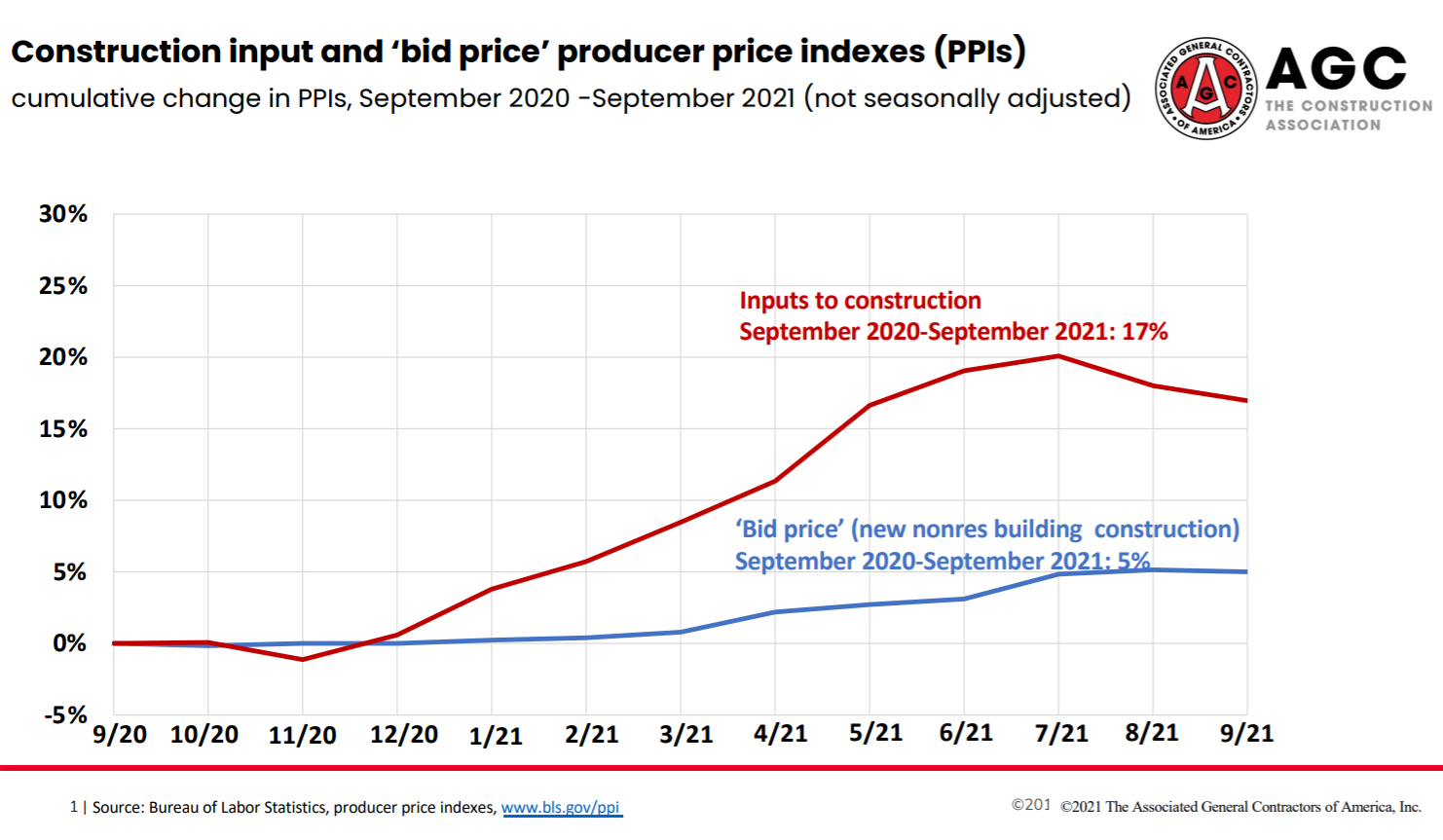

The producer price index for inputs to new nonresidential construction – the prices charged by goods producers and service providers such as distributors and transportation firms – increased by 2.6% month on month and 20.3% over the past 12 months. In comparison, the index for new nonresidential construction – a measure of what contractors say they would charge to erect five types of nonresidential buildings – climbed by 3.8% for the month and 16.5% from a year earlier, Simonson said.

A wide range of inputs contributed to the more than 20% jump in the selling prices of most materials used in every type of construction, including lumber and plywood, which leaped 15.4% for the month and 21.1% year-over-year.

The price index for steel mill products soared 112.7% over 12 months despite declining 1.6% in January. The index for plastic construction products climbed 1.8% for the month and 35.0% over 12 months. Architectural coatings such as paint had an unusually large price gain of 9.0% in January and 24.3% year on year. The index for several other construction-related products also saw double-digit percentage increases, including plastics, gypsum, insulation, prepared asphalt and tar roofing, and siding products.

In addition to increases in materials costs, transportation and fuel costs also spiked, AGC said. The index for truck transportation of freight jumped 18.3%, while fuel costs have soared by 56.5%.

Many contractors are being squeezed by increased costs for materials and labor shortages. As a result, AGC is appealing to federal officials to take additional steps to address supply-chain disruptions and rising materials prices, including the removal of costly tariffs on key construction components.

“Spiking materials prices are making it challenging for most firms to profit from any increases in demand for new construction projects,” said Stephen Sandherr, AGC’s CEO. “Left unabated, these price increases will undermine the economic case for many development projects and limit the positive impacts of the new infrastructure bill.”