Market Data

February 3, 2022

Steel Mill Lead Times: About as Low as They Can Go

Written by Tim Triplett

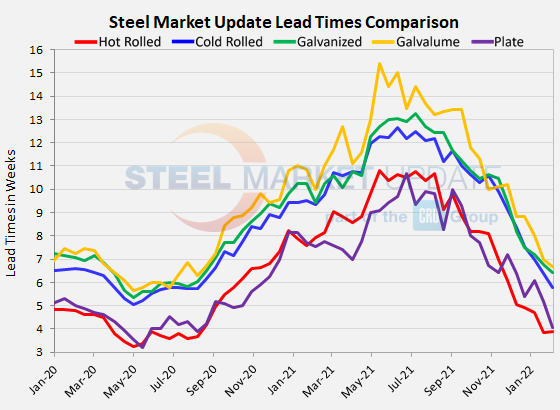

Steel mill lead times have shortened to what is considered nearly normal by historical standards, with hot rolled lead times below four weeks and cold rolled and coated around six weeks, plus or minus. In other words, the time it takes the mills to make steel and process orders can’t get much shorter. But the downward-trending steel prices – which are still double the historical norm – may have a ways to go before they level out. But we don’t expect a lot more downward movement in lead times. The thing to watch now is whether and when they start moving upward again. Recall that lead times began falling over the summer – well before prices did in the fall.

Buyers polled by SMU over the past three days reported mill lead times ranging from 2-6 weeks for hot rolled, 4-8 weeks for cold rolled, 4-9 weeks for galvanized, 6-8 weeks for Galvalume, and 3-5 weeks for plate.

The latest survey shows that the average lead time for hot rolled was roughly flat at 3.89 weeks. Cold rolled lead times now average 5.79 weeks, a small decline from 6.38 weeks in late January. Galvanized lead times dipped to 6.43 weeks from 6.78 in the past two weeks. The average Galvalume lead time is now down to about 6.67 weeks. Mill lead times for plate are now at 4.08 weeks, down from 5.17 weeks in SMU’s last check of the market.

Measured as a three-month moving average to smooth out the variability, the 3MMA is 4.74 weeks for hot rolled, 7.36 weeks for cold rolled, 7.59 weeks for galvanized, 8.26 weeks for Galvalume and 5.72 weeks for plate.

To put the current hot rolled lead time in perspective, the last time it was this short was in August 2020 when the average HR price hit a COVID-induced low of $440 per ton. At its peak, the average HR lead time extended to a high of 10.81 weeks in May 2021. At that point, the average HR price was $1,540 per ton. In the nine months since then, the lead time has shortened by about seven weeks and the price has dropped by more than $300 per ton.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com