Prices

February 1, 2022

Weekly Raw Steel Production Slips Again

Written by David Schollaert

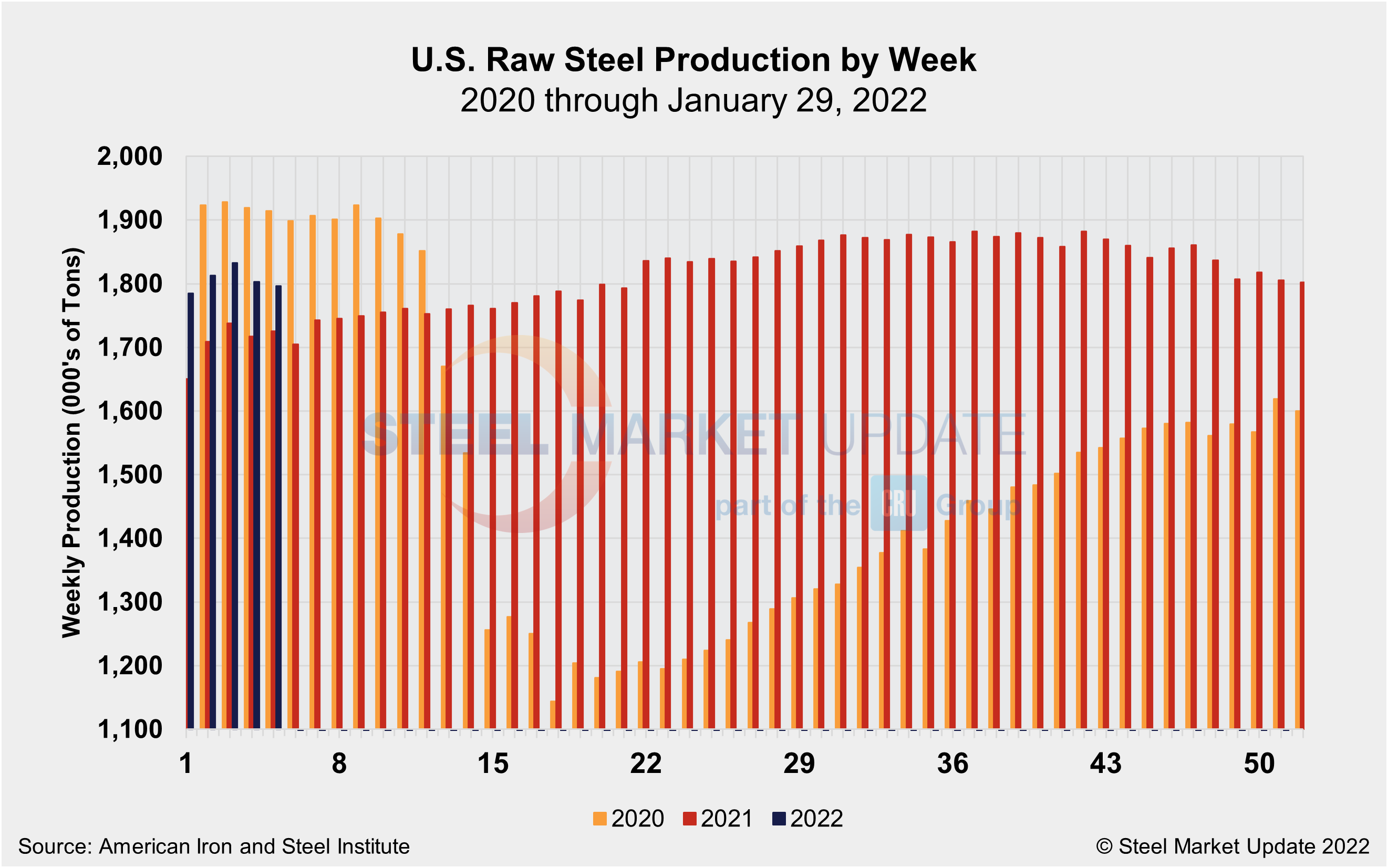

Raw steel production by U.S. mills totaled 1,796,000 net tons in the week ending Jan. 29, slipping for the second straight week, reported the American Iron and Steel Institute.

Domestic output was down 1.6% versus the prior week, but was still 3.5% higher than the same year-ago period when production was 1,736,000 net tons. Mill capacity utilization last week averaged 81.6%, a slim 0.3 percentage point decline from the prior week yet still 5.0 percentage points higher than in the same period one year ago.

Adjusted year-to-date production through Jan. 29 totaled 7,500,000 net tons at an average utilization rate of 82.2%. That’s up 4.3% from the same period last year when the utilization rate was 76.6% and production was 7,192,000 net tons, AISI said.

Production fell in three out of five regions last week, with only the North East and Midwest districts posting week-on-week increases. The largest decrease versus the prior week in total tons was seen in the Great Lakes, down 10,000 net tons. The West district saw the largest percentage decline, down 6.3% or 5,000 net tons compared to the prior week.

Below is production by region for the week ending Jan. 29: Northeast, 170,000 tons; Great Lakes, 624,000 tons; Midwest, 211,000 tons; South, 716,000 tons; and West, 75,000 tons – for a total of 1,796,000 net tons, down 7,000 net tons from the prior week.

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage provided by approximately 50% of the domestic production capacity combined with the most recent monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI production report “AIS 7”, published monthly and available by subscription, provides a more detailed summary of steel production based on data supplied by companies representing 75% of U.S. production capacity. Given the large number of changes to steelmaking capability in the current rapidly evolving market environment, AISI is undertaking a comprehensive review of its raw steel production and capability utilization statistics to ensure that they accurately reflect market conditions. Any updates to capability will be phased in over several weeks. Capability for the first quarter 2022 is approximately 28.3 million tons.

By David Schollaert, David@SteelMarketUpdate.com