Market Data

January 18, 2022

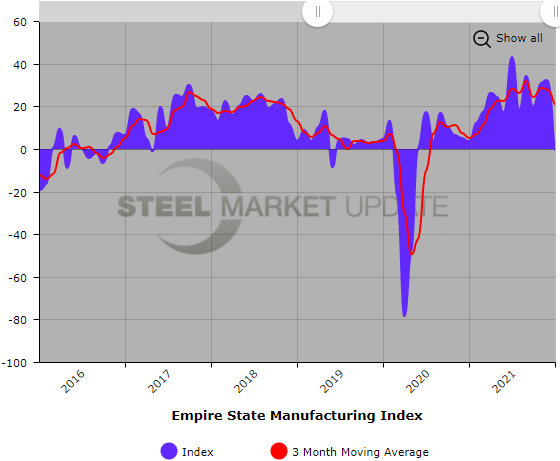

Empire State Manufacturing Index Levels Off in January

Written by David Schollaert

Business activity in the state of New York abruptly declined in January, as the headline index fell by nearly 33 points, according to the Empire State Manufacturing Survey. The headline general business conditions index is now at -0.7 compared to 31.9 the month prior.

![]() The downward move suggests that growth in manufacturing stalled in New York state after a period of significant expansion. After 18 months of positive readings, the general outlook fell as 23% of respondents reported worsening business conditions.

The downward move suggests that growth in manufacturing stalled in New York state after a period of significant expansion. After 18 months of positive readings, the general outlook fell as 23% of respondents reported worsening business conditions.

New orders and shipments both posted decreases during the month. The new orders index posted a steep decline, falling 32 points to a -5.0 reading, while shipments were little changed at a reading of 1.0. Labor market indicators pointed to a moderate increase in employment and a longer average workweek. Both price indexes moved lower but remained elevated.

Unfilled orders fell 6.9 points to 12.1, while delivery times edged down slightly to 21.6 in January versus 23.1 the month prior. The inventories index moved higher, albeit slightly, expanding by 1.2 points to a reading of 10.3.

Prices paid waned for just the second time in five months, down 3.5 points in January to 76.7. Prices received also slipped in January, down by 7.5 points to a reading of 37.1. The number of employees contracted by 5.3 points to 16.1 in January, falling by nearly 10.0 points in two months. The average workweek index was 10.3, slipping by 1.8 points versus December’s reading of 12.1

The six-month outlook remained generally optimistic, as the index for future business conditions held steady at a reading of 35.1, the Federal Reserve Bank of New York said. New orders rose 2.9 points to 32.9 in January, while shipments slipped 2.2 points to a measure of 29.3.

The indexes for future prices paid and received both rose to record highs, 76.7 and 62.1, respectively. The capital expenditures index climbed two points to 39.7, a multi-year high, and the technology spending index held steady at 31.9, suggesting that firms plan significant increases in both capital spending and technology spending in the months ahead.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use its interactive features. You can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com