Analysis

January 17, 2022

North American Auto Assemblies Decline in December

Written by David Schollaert

North American auto assemblies contracted in December to the second lowest monthly total in 2021 after expanding the two prior months. December’s production total was down 14.7% sequentially, and down 15.0% from the same month last year.

The ongoing microchip shortage and supply-chain disruptions are still limiting the automotive sector. And although most carmakers have seen noticeable production improvements, assembly totals are still a far cry from the pre-pandemic totals.

North American vehicle production, including personal and commercial vehicles, totaled just 977,654 units in December, down from 1.146 million units in November, and down from 1.150 million units in December 2020.

Despite some improvements, and speculation that the worst may have passed, continued delays and production shortages are expected at vehicle assembly plants across North America in the first half of 2022, keeping vehicle inventories at historically low levels and further impacting sales.

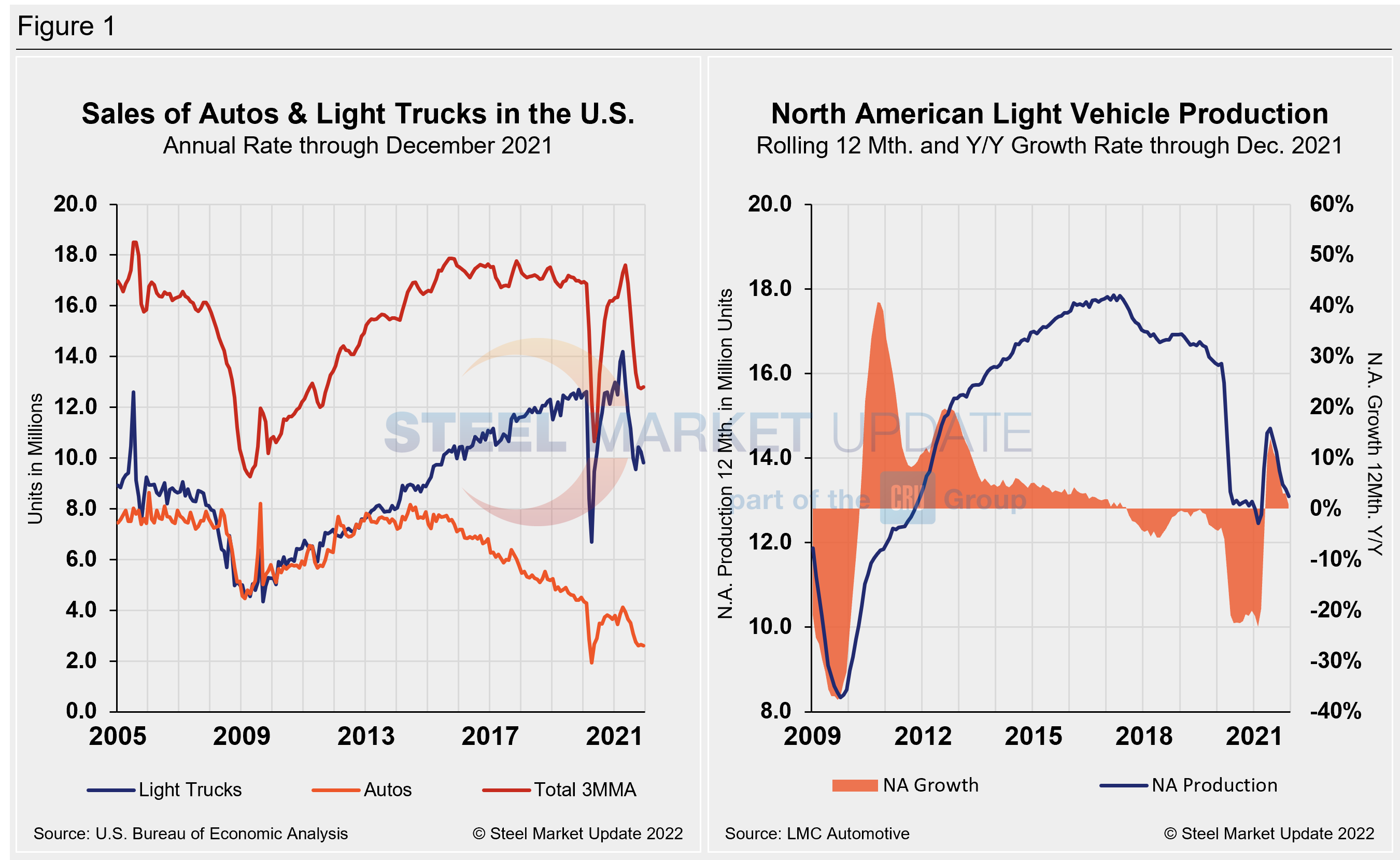

The supply crisis and its effect on prices continues to suppress light vehicle demand in North America, according to LMC Automotive (LMCA). Although sales were held back chiefly by supply-side issues, the fact that transaction prices have trended up to new record highs – reaching an average of $44,515 per vehicle in November – is scaring away potential buyers. Incentives were down to an average of $1,564 in November.

A short-term snapshot of assembly by nation and vehicle type is shown in the table below. It breaks down total North American personal and commercial vehicle production into the U.S, Canadian and Mexican components, along with the three- and 12-month growth rate for each. At the far right it shows the momentum for the total and for each of the three nations.

Although the initial rebound from the COVID-19 doldrums was impressive, the effect of the chip shortage has been even more damaging due to its prolonged nature. Through June, growth rates for personal and commercial light vehicles soared by 156.8% and 127.4%, respectively, but have since seen a nosedive as the chip shortage and supply-chain disruptions have taken hold.

In three months through December, the growth rate for total personal vehicle assemblies in the USMCA was a negative -20.0% year over year, but still a 7.0 percentage point improvement month on month. Commercial light vehicle assemblies saw a decline of -2.9% over the same period. The impact of the global semiconductor chip shortage on automotive production across North America has been disastrous.

Personal Vehicle Production

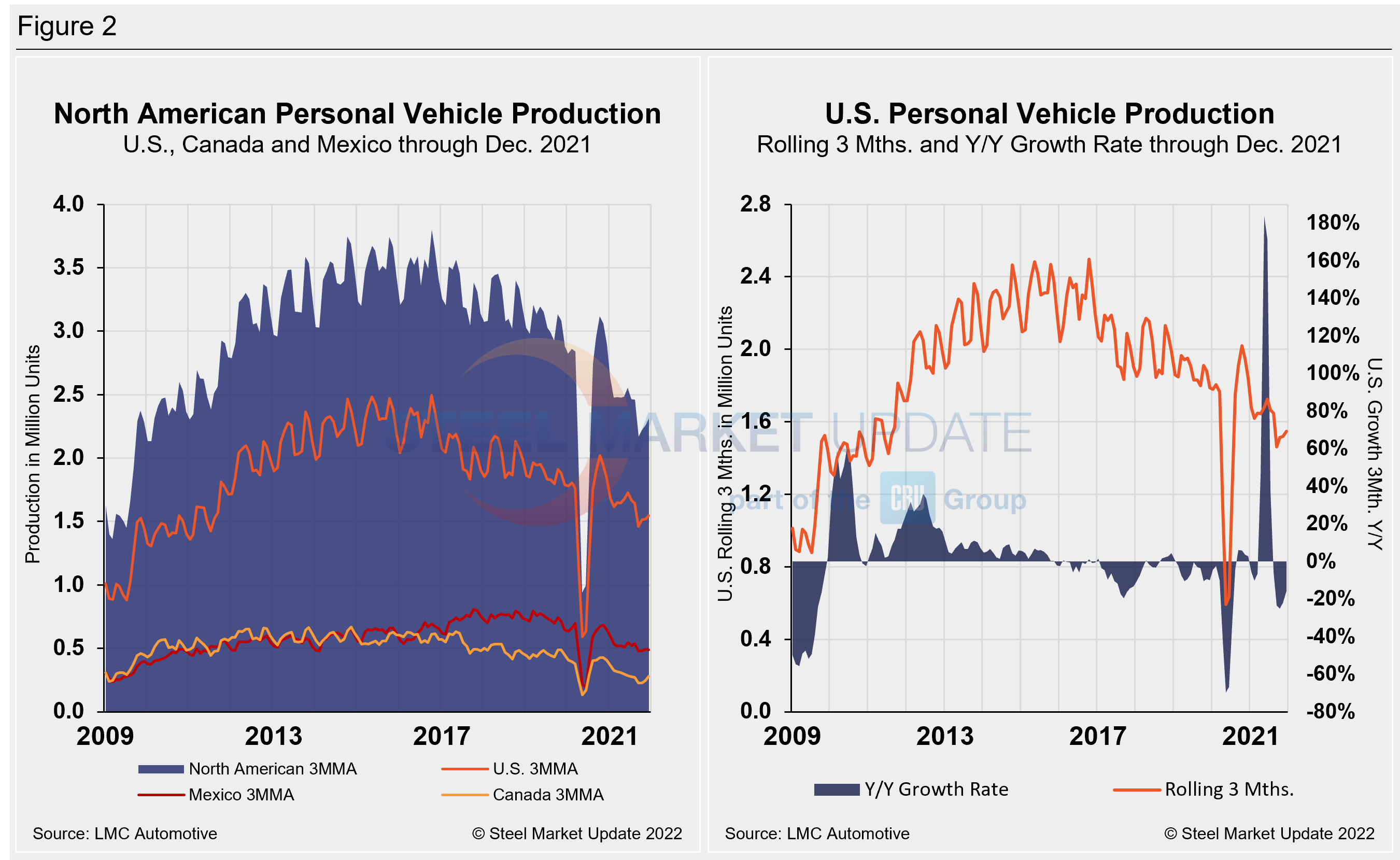

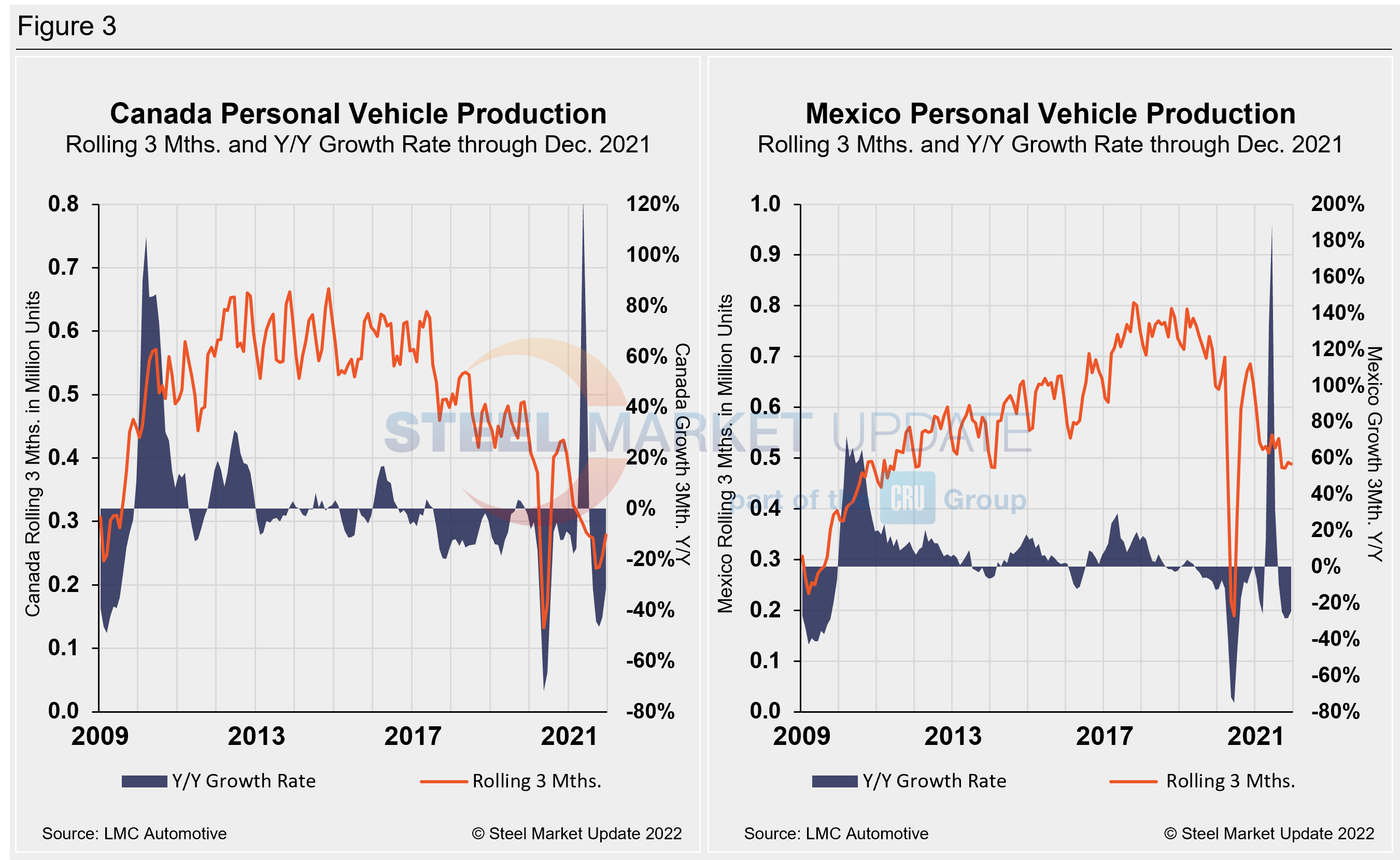

The longer-term picture on personal vehicle production across North America is shown below. The first chart in Figure 2 shows the total personal vehicle production for North America and the total for each nation. The production of personal vehicles in the U.S. and the year-over-year growth rate is displayed in the second chart. Figure 3 shows side-by-side the production of personal vehicles in Canada and Mexico and the year-over-year growth rate.

In terms of personal vehicle production, all three countries in the region saw declines in December, unable to maintain the growth seen in the prior two months. Holiday work stoppages certainly played a role in the contraction, however, supply-chain limitations contributed to the fall. Mexico saw the greatest percentage decline, down 21.9% or 38,992 more units when compared to the month prior. The U.S. saw the largest decline in total units, down 71,528 vehicles or 13.1% month on month. Canada auto assemblies were also down 13.1% and 13,560 fewer units in December versus the prior month. The annual growth rate across the region plummeted – Canada saw the most aggressive decrease at -31.6%, followed by Mexico at -24.5% and the U.S. at -15.8%.

Canada’s personal vehicle production share of the North American market rose to 12.0% in December, compared to 10.9% the month prior. Mexico’s share was at 21.1% last month versus 21.8% in November, while the U.S. edged down to a 66.9% share of the North American market in December versus 67.3% the month prior.

Commercial Vehicle Production

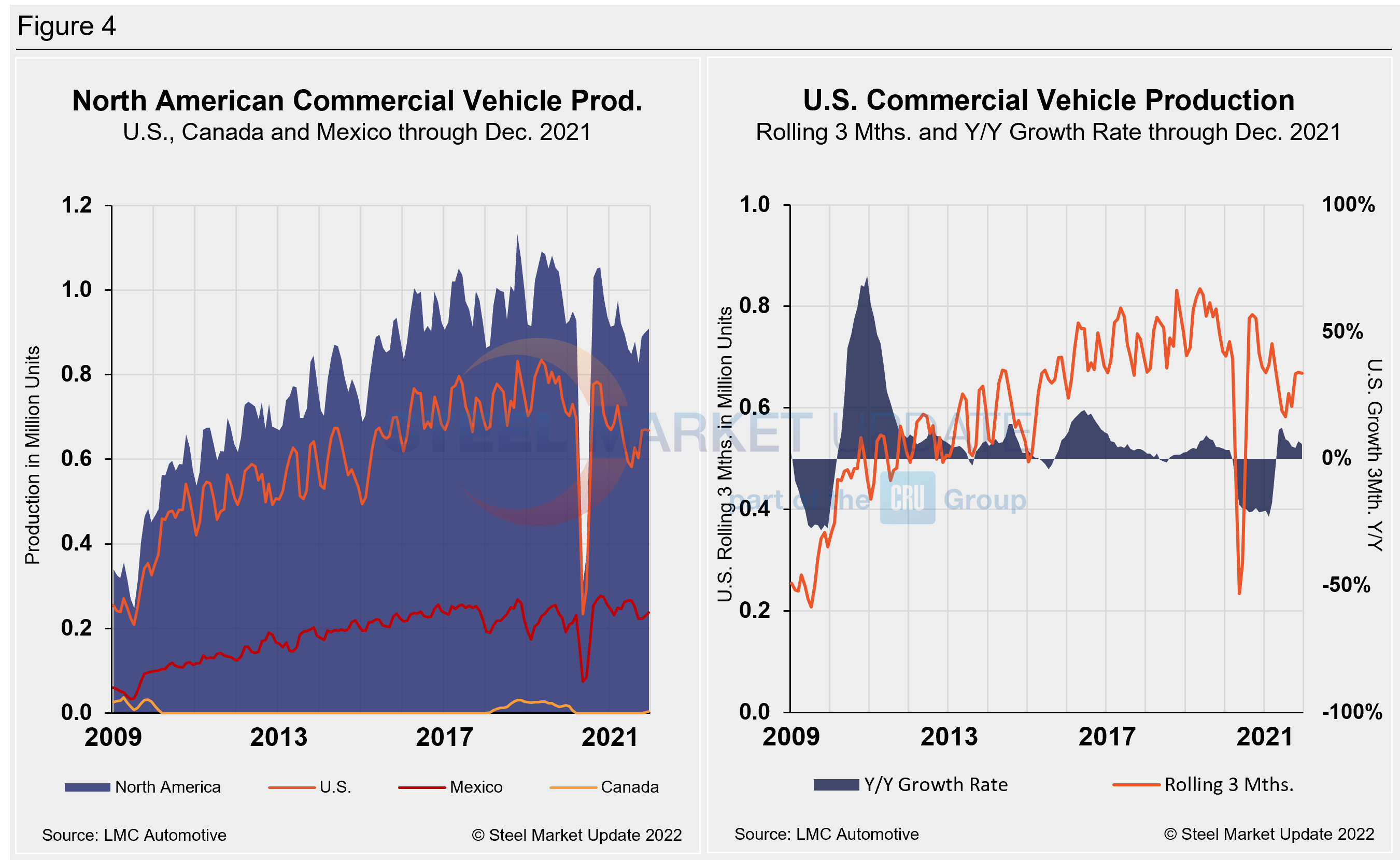

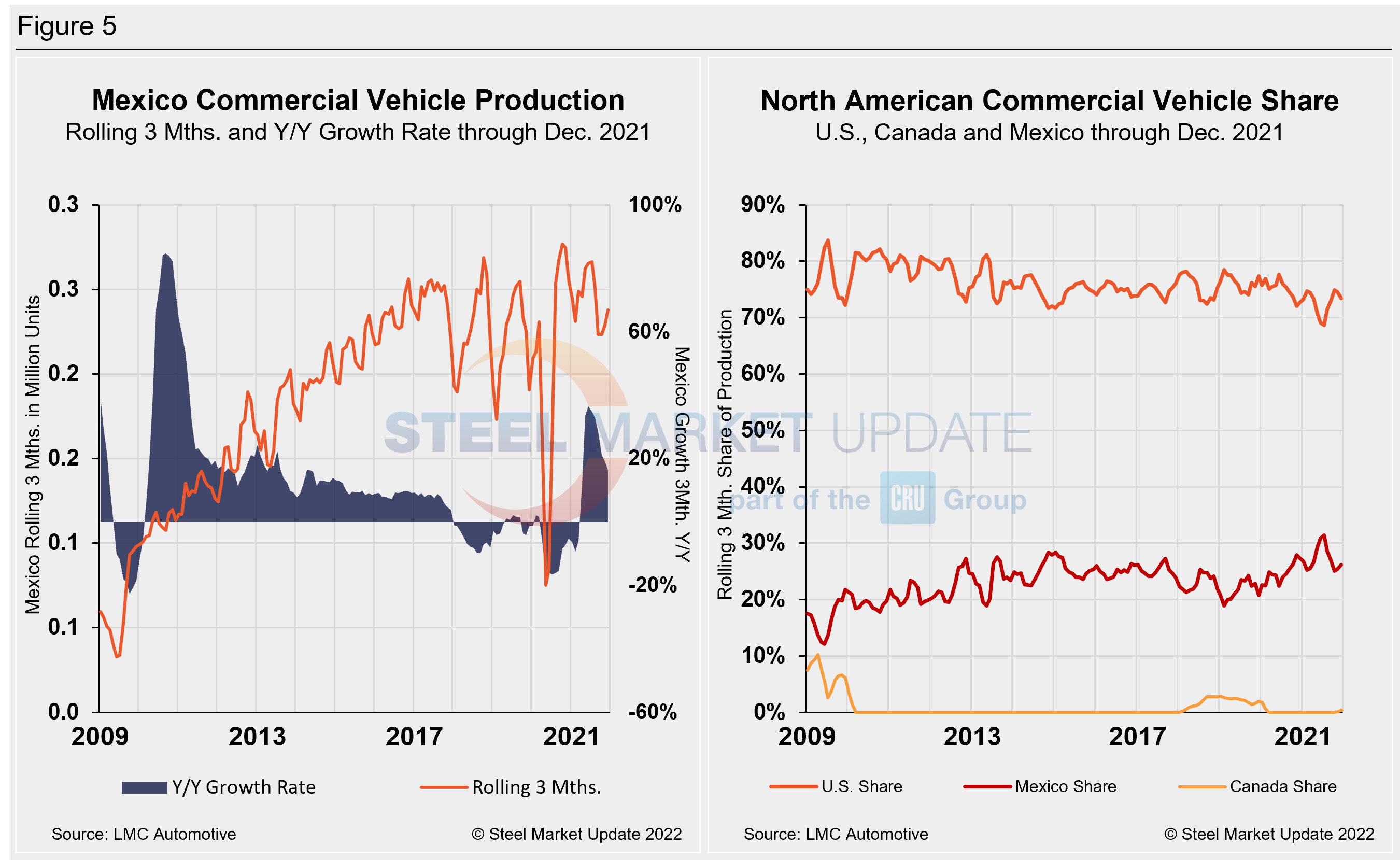

Total commercial vehicle production for North America and the total for each nation on a rolling three-month basis is shown below in the first chart in Figure 4, while the production of commercial vehicles in the U.S and the year-over-year growth rate is displayed in the second chart. Figure 5 shows the production of commercial vehicles and the year-over-year growth rate in Mexico displayed in the first chart, while the second chart shows the production share for each nation. Of note for the Canadian automotive sector, December marked Canada’s second month of commercial vehicle production in 24 months. The U.S.’s northern neighbor produced 2,739 light commercial vehicles in December, the second month of production since December 2019 when they produced 5,966 units, and up 1,944 units month on month.

North American commercial vehicle production declined 13.9% in December, down 44,031 units month on month. The downgrade comes after a surge of 22.5% just two months prior when the region produced 321,744 units. Despite the increase in Canadian light commercial vehicles, the month-on-month dip was driven by decreases of 16.1% or 37,574 units in the U.S., and a decrease of 10.3% or 8,401 unts in Mexico. Production limitations due to the semiconductor shortage and other supply-chain constraints are expected to continue into the first quarter of 2022, but the addition of Canadian-produced commercial light vehicles is noteworthy.

The annual growth rate is now negative at -7.0% in Mexico, year on year, while the U.S. growth rate over the same period is also down at -1.8%. Canada’s renewed production saw its growth rate improve to -40.8% in December. The U.S. share was 72.2% in December, down 1.2 percentage points versus the month prior. Mexico’s share expanded slightly to 26.8% month on month, up 0.2 of a percentage point, while Canada now has a 0.4% share of the market. Presently, Mexico exports just under 80% of its light vehicle production, while the U.S and Canada are the highest volume destinations for Mexican exports.

Editor’s Note: This report is based on data from LMC Automotive for automotive assemblies in the U.S., Canada and Mexico. The breakdown of assemblies is “Personal” (cars for personal use) and “Commercial” (light vehicles less than 6.0 metric tons gross vehicle weight rating; heavy trucks and buses are not included). In this report, we describe light vehicle sales in the U.S. and report in detail on assemblies in the three regions of North America.

By David Schollaert, David@SteelMarketUpdate.com