Prices

January 13, 2022

HRC Futures – Flattening the Curve

Editor’s note: SMU contributor Bryan Tice is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and the firm design and execute risk management strategies for clients along with providing process and analytical support. Before joining Metal Edge Partners, Bryan held a variety of commercial leadership roles involving purchasing, sales, and risk management for Feralloy Corporation, Cargill Steel Service Centers and Plateplus Inc. You can learn more about Metal Edge at www.metaledgepartners.com. Bryan can be reached at Bryan@metaledgepartners.com.

Despite the dramatic rise in COVID cases as evidenced below, it seems the term “flattening the curve” has fallen out of favor. Early in the pandemic it became a consistent mantra as we attempted to avoid overwhelming the health care system and buy time until vaccines could be developed and deployed. Fortunately, the chart below shows that the recent spike in cases (red bars) has not resulted in a similar rise in deaths (white bars) as was seen in the Dec20-Jan21 growth in cases or in the Delta variant wave rise of Sept-Oct 2021. Much has been written about the lesser severity of the Omicron strain, and I hope that as more people are exposed and we increase immunity (naturally or through vaccines), that future strains will be less fatal regardless of how contagious they may be. On a side note, thanks to all the tireless efforts of healthcare professionals helping to fight this pandemic!

Back in the steel market, we seem to be embracing the idea of flattening the curve as it relates to HRC futures. The chart below is a month-over-month comparison of HRC settlements. This Wednesday’s modest decline in the CRU index helped erase some of the recent drift downward on the nearby months, pushing January/February settlements up $35/t and $17/t, respectively, day over day. As you can see from the chart, market participants have grown much less optimistic than they were a month ago that steel prices will decline gradually in Q1 ‘22. Rather those trading HRC futures seem to expect a more pronounced drop between now and the end of Q1 ‘22 and then grinding lower at a much slower pace over the course of the year.

HRC Curve MoM

The recent rise in COVID cases does bring into question what impact it could have on the demand environment and steel prices. Pent-up demand in many steel-consuming segments seems to be at near record levels due to low inventories and continued supply chain issues limiting manufacturers from building adequate stocks, however labor market challenges may become a limiting factor. Add any COVID-related shocks that further disrupt manufacturing into that equation, and it becomes understandable why some hold the belief that prices will move lower as new flat rolled supply increases and demand is constrained by a myriad of nontraditional influences.

It is also interesting that the shape of the current HRC curve is the exact opposite of what many astute market participants I speak with regularly had been expecting late last year, (ie) a gradual decline in pricing in the first half of 2022 and a precipitous drop in the second half as new capacity spoils the four-digit hot rolled era. Undoubtedly the forward curve for Q2 and beyond will look much different three months from now as compared to what it’s suggesting today, and the reality is that the current view on the market in that period as seen through the lens of those trading HRC futures will prove to be either too optimistic or too pessimistic. Perhaps within that lies a trading opportunity?

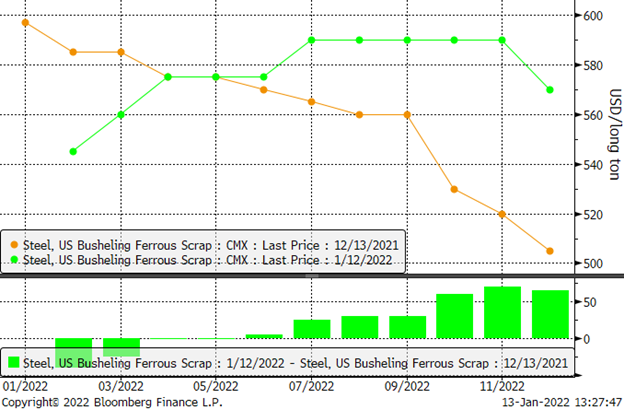

Scrap futures on the other hand are pointing to a much different view of 2022 as the curve has shifted from backwardation to contango over the course of the month, with Q4 2022 prices up near 10% from last month.

BUS Curve MoM

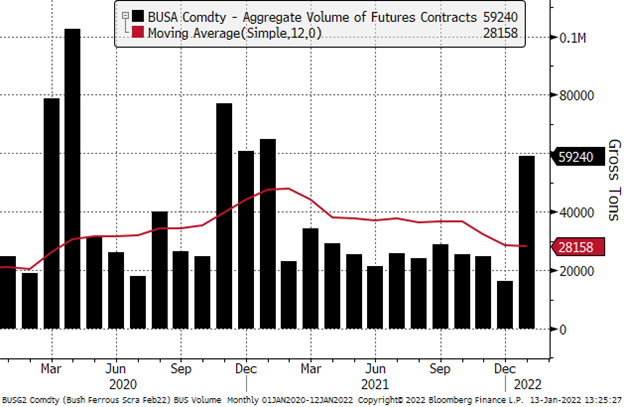

In addition to the improved outlook for scrap pricing, scrap futures have seen some increased activity with January volumes trading just below 60,000 tons month to date, more than two times the last two-year average.

Busheling Volume

Drawing parallels between COVID and steel pricing may seem somewhat obtuse, but the steel industry has always been highly cyclical, and in many ways has not yet built up its own immunity to the wild price swings we have witnessed over the past 18 months. Many within the industry today face the age-old issue of trying to liquidate physical inventories in the face of a falling market in an apparent demand pause to mitigate the financial impact of inventory devaluation, while adding momentum to the next up-cycle as the market typically overcorrects. The key question is whether your business can benefit from minimizing the risks inherent in these volatile price gyrations and smooth out earnings volatility by adopting risk management.

Whatever happens with the ferrous futures curves going forward, hopefully we can collectively put the COVID curve in permanent backwardation in 2022. Stay healthy and thanks for reading!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.