Market Data

January 12, 2022

Steel Product Shipments and Inventories Through November

Written by David Schollaert

U.S. steel product shipments rose for a seventh straight month in November, expanding by 0.7% versus the prior month. The pace of growth had been steadily rising over the past few months, however, the rate of rise eased in November, the first such shift since May.

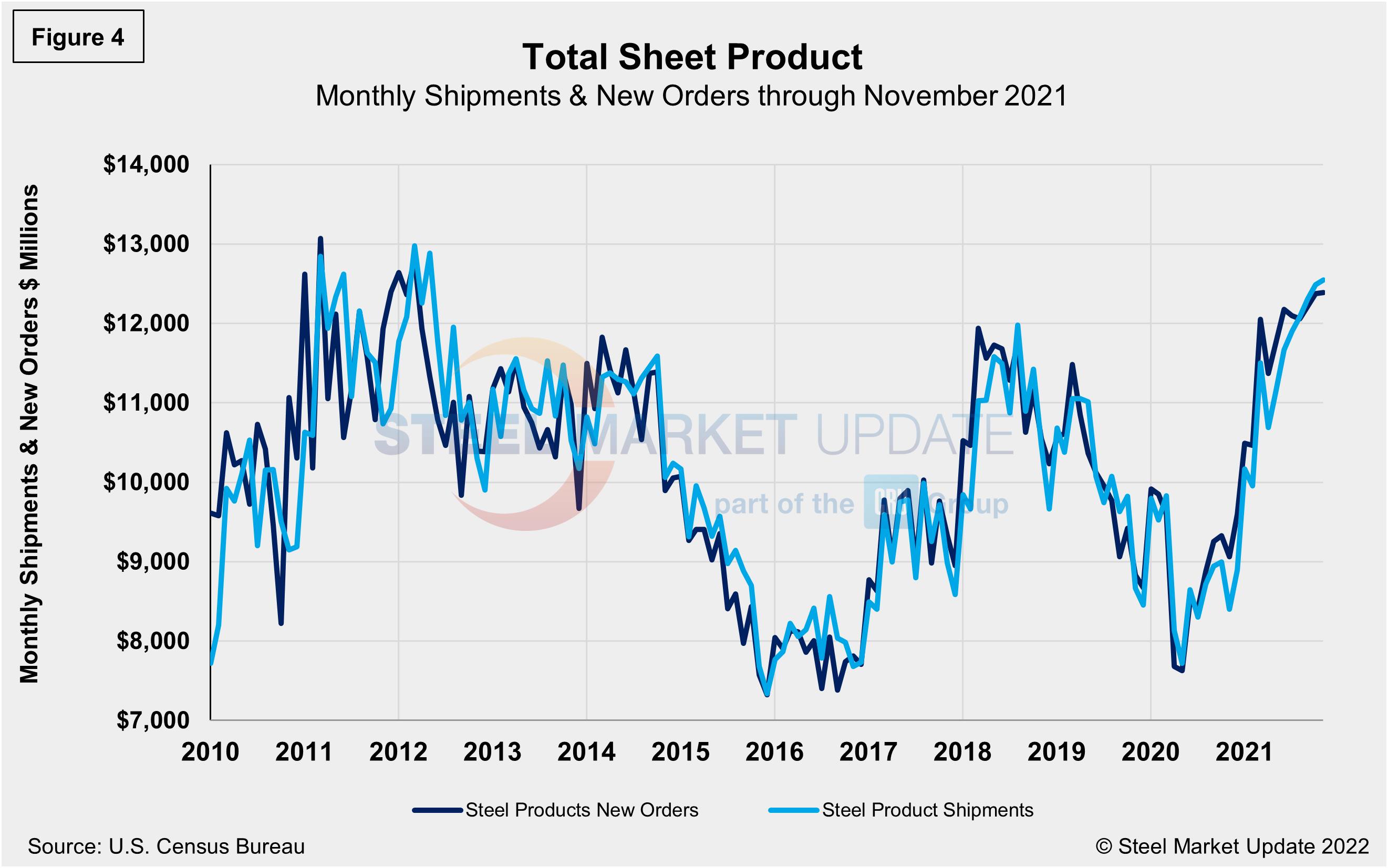

New orders for steel production, while fractionally higher in November, were outpaced by steel shipments for the first time all year. This shift suggests an easing in steel demand as prices have begun to erode.

Manufacturing inventories saw a much slower rate of rise in November, according to the latest available Census Bureau data on inventories, shipments and new orders for total U.S. manufacturing and steel products. Total manufacturing inventories were up fractionally in November, just 0.4% versus the month prior, but were up 7.3% and 4.5% when compared to the same 2020 and 2019 months, respectively. Steel product inventories have seen a far more pronounced growth rate over the same period. Although November’s total is up just 1.2% from the month prior, it’s up 27.6% versus the same 2020 period. The strong recovery in steel product inventories has rebounded above the 2019 pre-pandemic year by a noteworthy 16.8%.

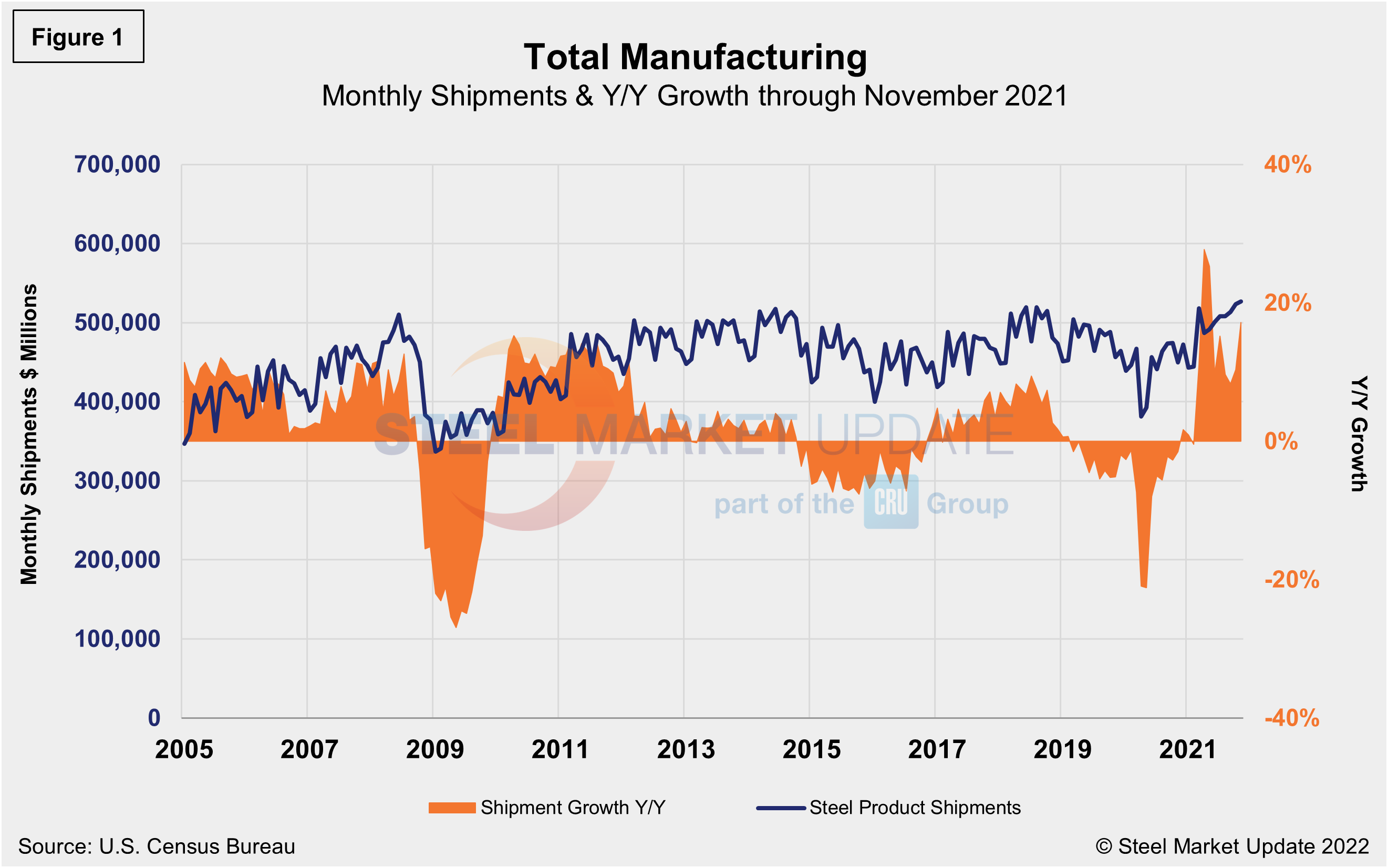

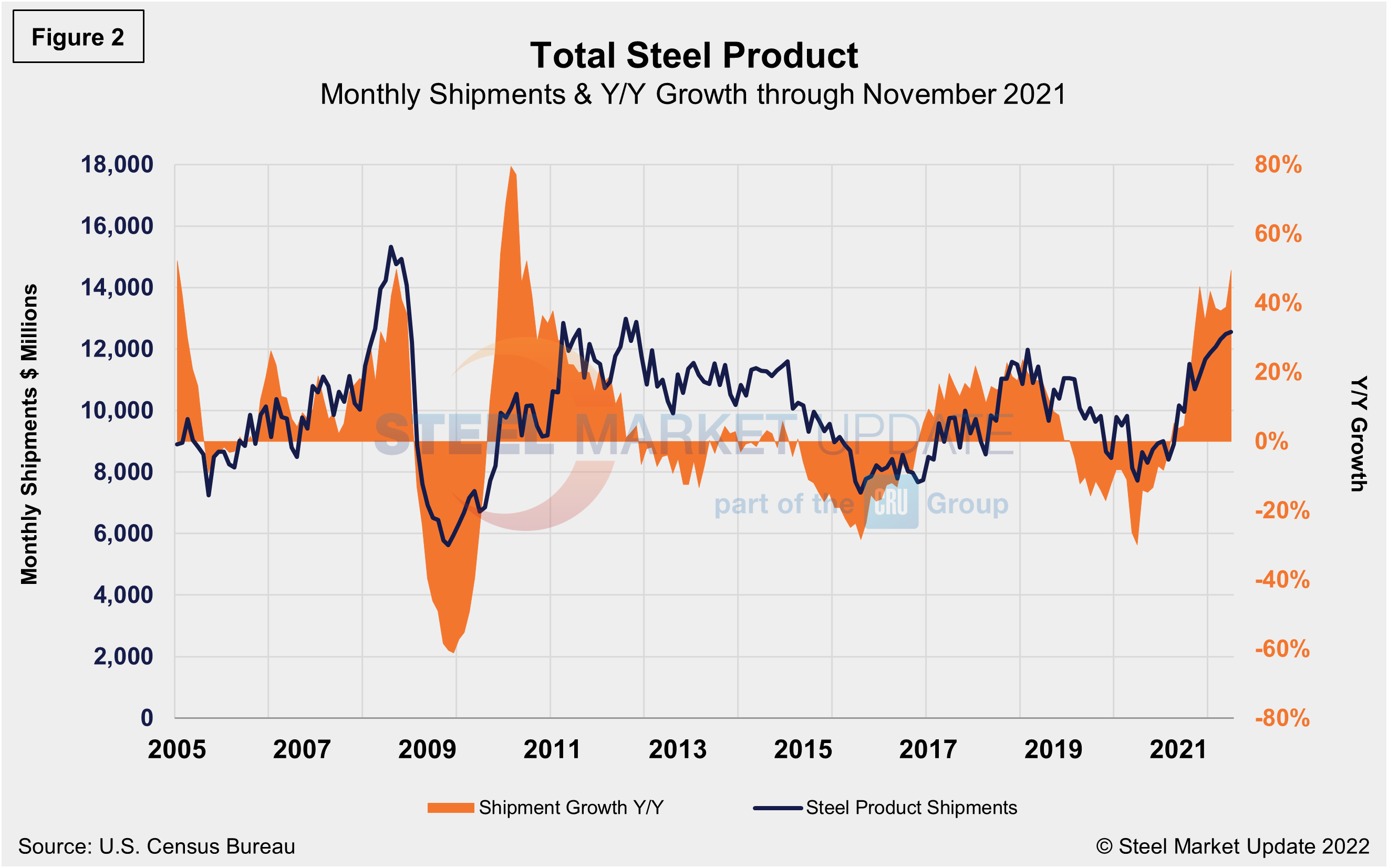

Total shipments and inventories are reported in millions of dollars, seasonally adjusted. Total steel shipments in November were 49.3% higher than in the same year-ago period and 44.8% higher when compared to the same pre-pandemic period in 2019. Year over year through November, total manufactured product shipments rose by 17.2%, and were up 15.4% when compared to the first 11 months of 2019. During the first wave of the global pandemic last April, total manufacturing shipments plunged by 19.4% and steel product shipments fell by 21.4% compared with the prior year. Both have recovered since. Figure 1 and Figure 2 show the history of both since 2005.

Monthly steel product shipments through November are detailed in Figure 2. Shipments of steel products totaled $12.545 billion in November, up 0.5% from the $12.483 billion in October, and up 49.3% from year-ago levels when shipments were $8.4 billion. Shipments of steel products had most recently peaked in August 2018 at $11.980 billion, then began a 20-month decline through May 2020. Although the growth rate declined from 23.6% in July 2018 to 3.8% through January 2021, the steady growth since has pushed shipments of steel products to their highest level to date.

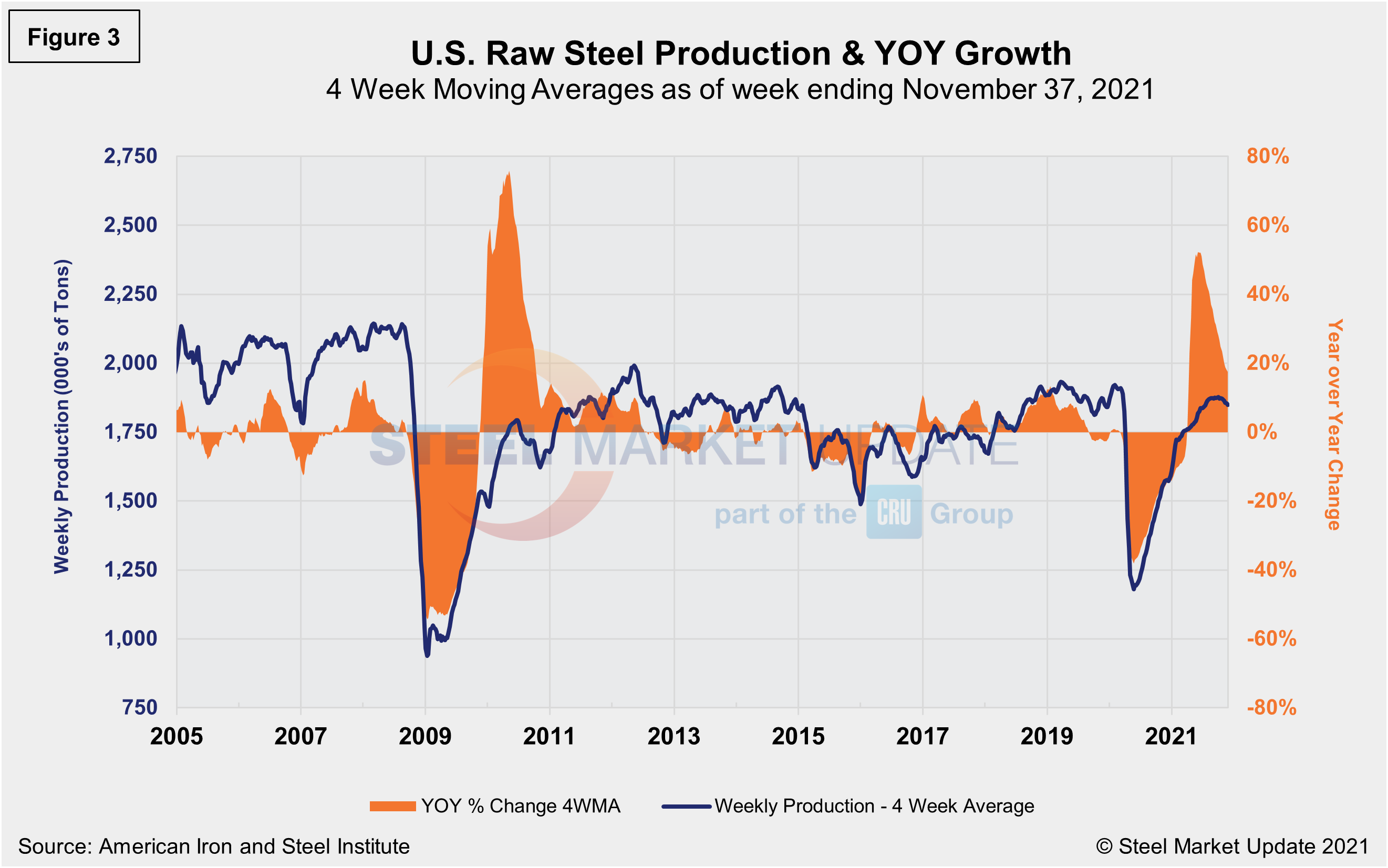

The Census data in Figure 2 compares well over the long term with the American Iron and Steel Institute (AISI) weekly crude steel production shown in Figure 3. Figure 2 is in dollars and Figure 3 is in tons, but they paint a similar picture. Steel production has rebounded since the freefall seen during the first wave of the pandemic, according to AISI data shown on a four-week moving average basis. Crude steel production was up 17.5% in the week ending Nov. 27 compared to the same period a year ago.

Steel product shipments and new orders on a monthly basis since 2010 are shown in Figure 4. New orders and shipments saw similar declines last April, but were back in balance by June. Since then, however, new orders had exceeded shipments and continued to steadily outpace them. Yet for the second straight month in November the dynamic has shifted. New orders totaled $160 million less than shipments as steel prices have stabilized and begun to turn down.

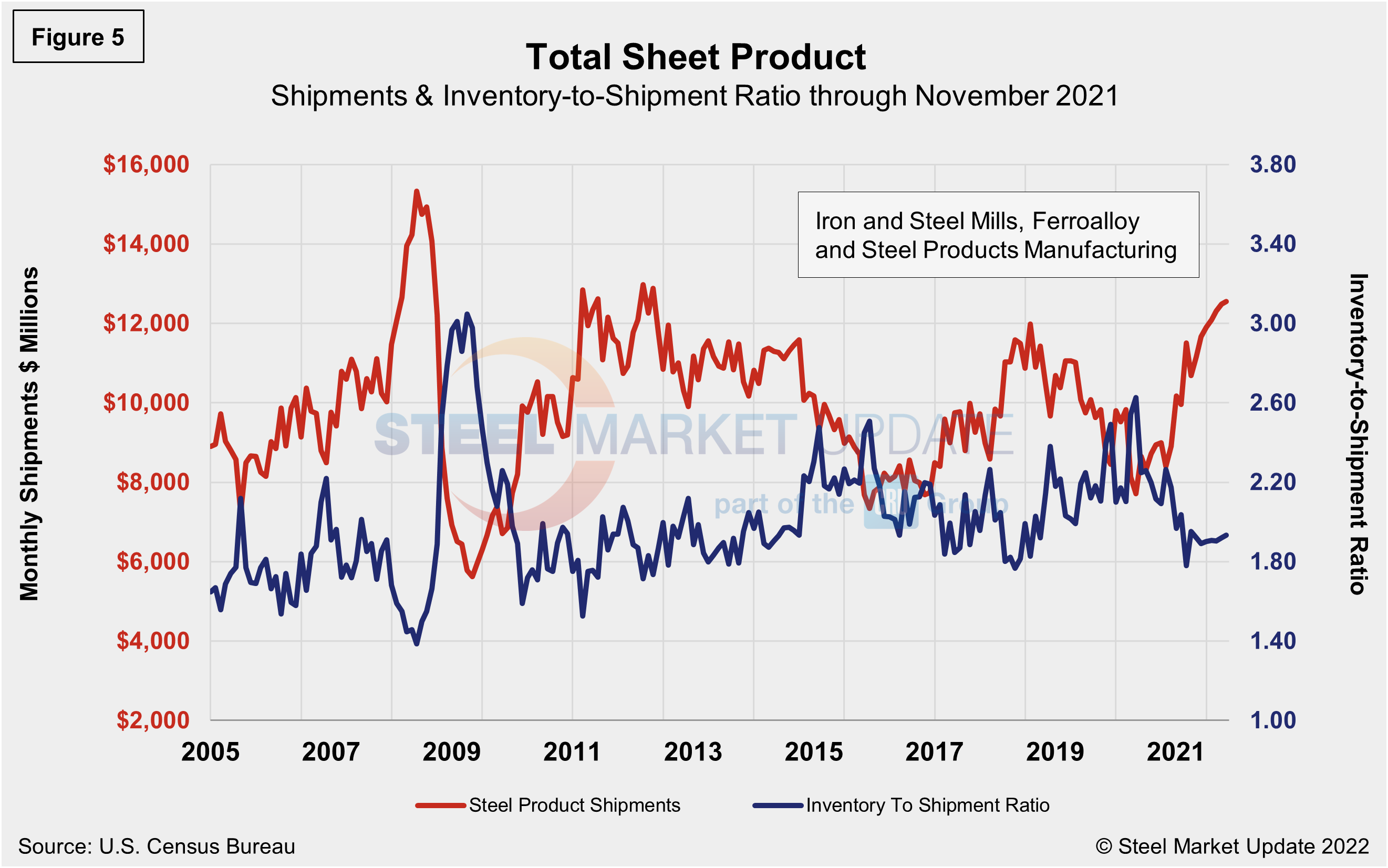

The same total shipment line as in Figure 2 is shown below in Figure 5, but now includes the inventory-to-shipment (IS) ratio. The IS ratio is a measure of how much inventory is necessary to support the level of shipments. Thus the lower the IS ratio, the better. The IS ratio for steel products shot up in May 2020 to 2.62% as shipments declined due to supply-chain disruptions from COVID-19-related closures. Now, nearly approaching the two-year mark since the onset of the pandemic, the IS ratio was at 1.93%, up a fraction of a percentage point month on month, as demand was no longer outpacing supply in November.

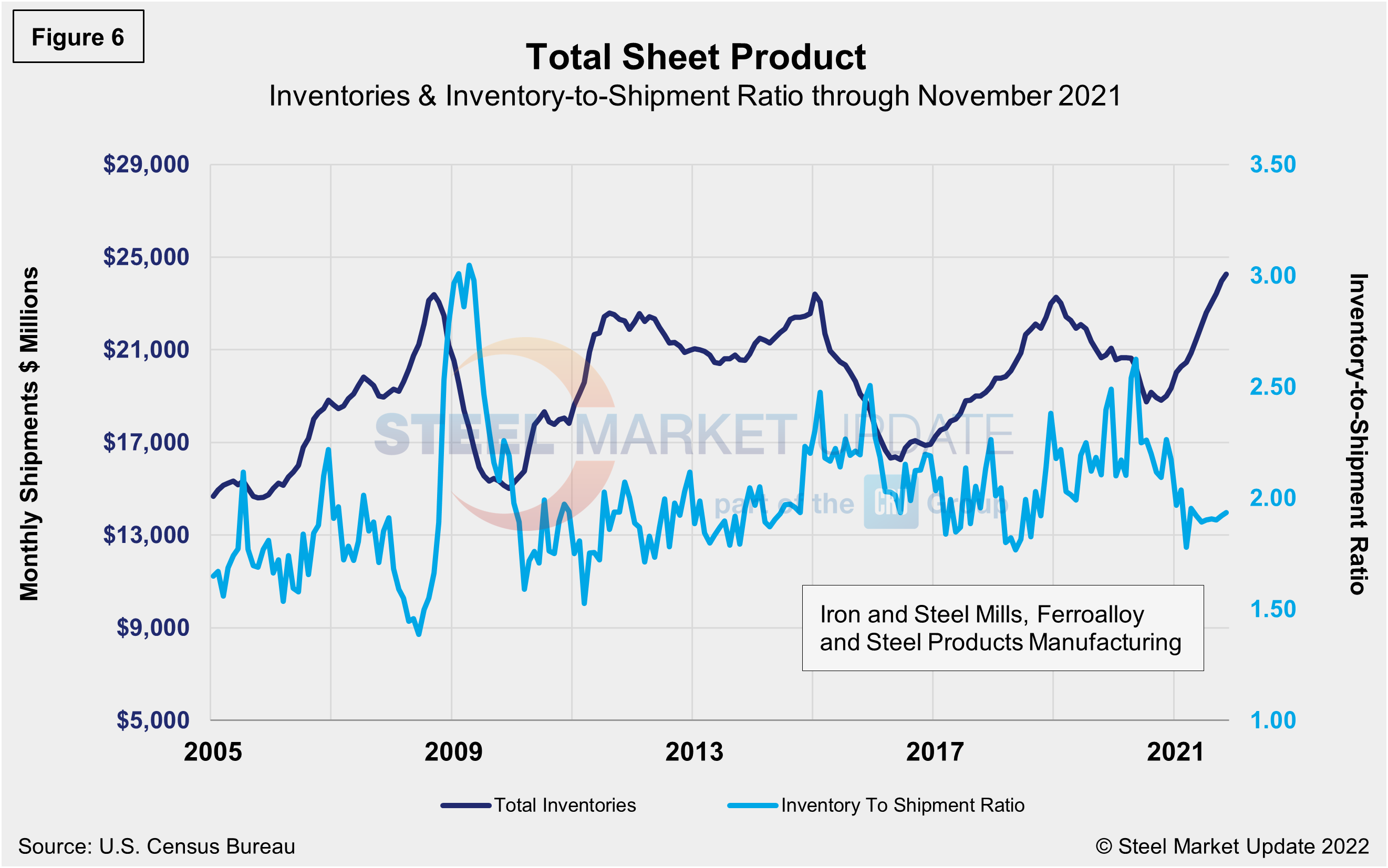

The IS ratio had been inconsistent through the first few months in 2021, reflecting weather-related delays, temporary disruptions, and maintenance outages. Total inventories are up just 7.3% in November, when compared to the same year-ago period, while shipments were up 17.2%, thus demand has grown at a greater rate than inventories. Overall, steel shipments have improved by 62.6% since April 2020, when the market reached bottom. Total inventory in millions of dollars is displayed in Figure 6 and echoes the inventory-to-shipment ratio shown in Figure 5.

By David Schollaert, David@SteelMarketUpdate.com