Community Events

January 6, 2022

Tanners: 'Sheet Storm' on the Horizon to Bring Lower Prices

Written by Tim Triplett

Popular analyst Timna Tanners may have changed where she works but not her view that there’s a “sheet storm” on the horizon, one that will bring in sharply lower steel prices over the next few years.

Formerly with Bank of America, Tanners is now the managing director of metals and mining at Wolfe Research. Speaking during Steel Market Update’s Community Chat on Wednesday, she detailed the reasons she feels steel prices will almost certainly decline in 2022 and beyond.

“It’s clear prices have peaked and are going to fall. The question on everyone’s mind is to where? The trajectory for 2022 will depend on the pace of destocking, the new capacity ramping up and demand,” she said.

Inventories are too high throughout the supply chain, so widespread destocking will affect demand in the first quarter. Other factors, such as the ongoing chip shortage in automotive, may slow demand growth as well.

But the big story in 2022 will be on the supply side of the market, she said, as mills in North America add some 12 million tons of new capacity – a 12-15% increase that has “massive implications” for prices by the end of this year.

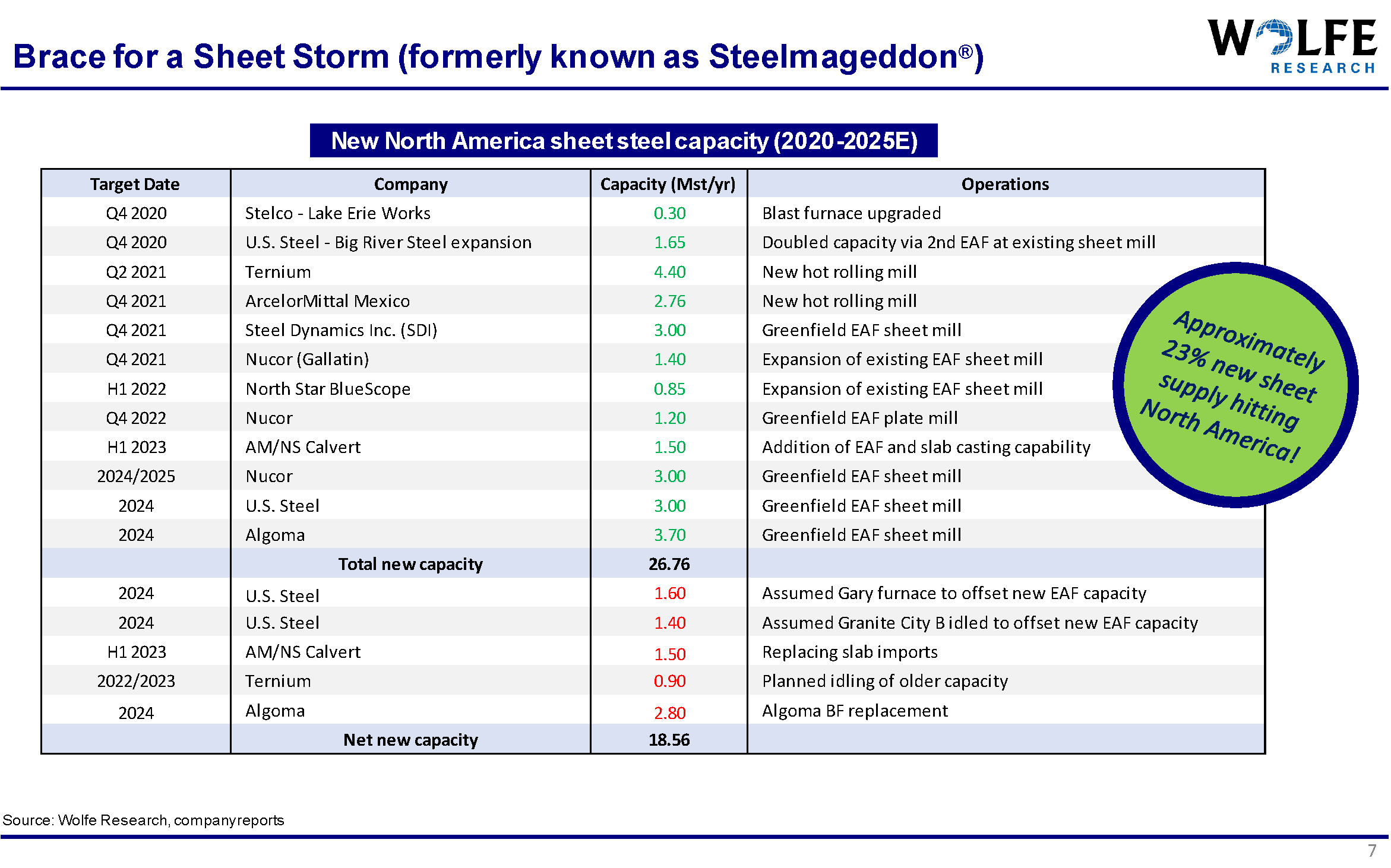

And the downtrend in steel pricing is likely to continue for years to come as steelmaking capacity outpaces demand. Wolfe Research is tracking a dozen capacity expansions at mills across North America that could add a net 18.5 million tons of steel sheet capacity by 2025 (see chart below, click to enlarge). “That adds up to about 23% more sheet supply hitting North America,” she noted.

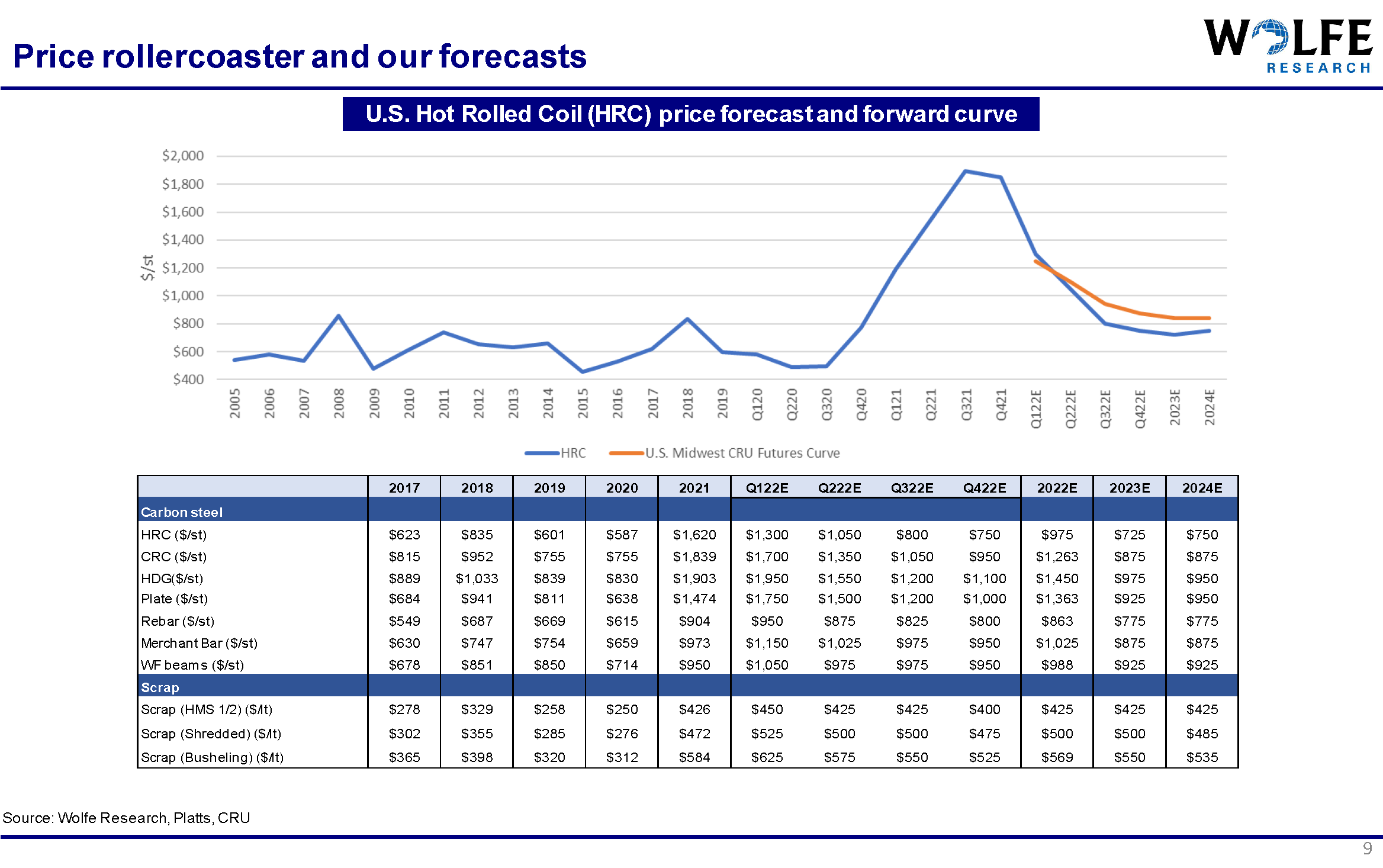

Looking more short-term, Tanners and Wolfe are forecasting an average price of $1,300 per ton for hot rolled in the first quarter this year. That compares to the current HR price published by Steel Market Update this week at $1,535 per ton. And HR prices have already dropped by more than $400 per ton since peaking in early September. Wolfe’s forecast calls for HR prices to end the year at around $750 per ton for an average in 2022 of $975 per ton (see chart below, click to enlarge). “Everyone is looking for some stability in the steel price. I don’t think they are going to get it in the next couple months,” Tanners said.

Wild cards that could affect her forecast include another COVID variant that hurts the economy, sanctions on Russia over its aggression toward Ukraine, a prolonged shortage of automotive microchips, and delays in some of the new steel capacity startups.

But no doubt there is big change ahead. “By the end of this year the U.S. could go from being the single biggest steel importer to being a steel exporter, and it could switch from being a scrap exporter to a scrap importer. This could be a really interesting flip flop for the U.S. market,” she said.

Editor’s note: Steel Market Update will host its next free Community Chat webinar at 11 a.m. on Wednesday, Jan. 26, speaker to be announced.

By Tim Triplett, Tim@SteelMarketUpdate.com