Market Data

January 6, 2022

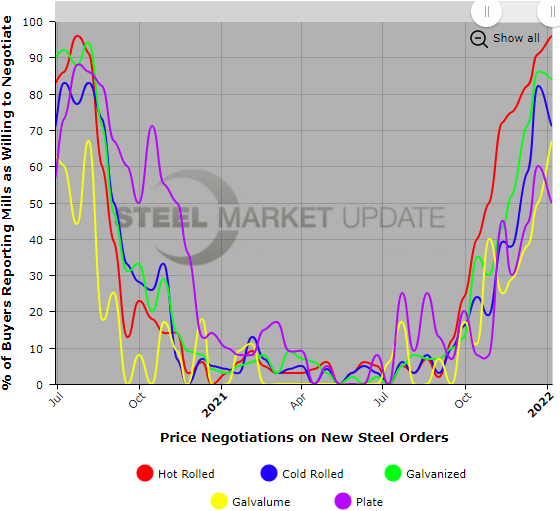

Steel Mill Negotiations: Buyers Gain the Upper Hand in the New Year

Written by Tim Triplett

After a year in which steel mills could basically name their price, 2022 is shaping up to be a buyer’s market – at least for the foreseeable future. Nearly all (96%) of the service center and manufacturing executives responding to Steel Market Update’s survey this week reported that the mills are willing to negotiate prices to secure orders of hot rolled steel.

Likewise, the vast majority of galvanized buyers (84%) and cold rolled buyers (71%) now say deals are highly negotiable in an environment in which steel prices are declining amid widespread inventory destocking and seasonal softness in demand.

“For large blocks of tons, there are some great deals out there,” said one buyer. “The mills are definitely willing to play ball right now. We’ll see if that continues as Q1 gets rolling,” said another.

There is some variation in negotiations depending on the product. Plate is a 50:50 proposition right now, according to SMU’s poll this week. “Plate seems to be holding its own right now, but I don’t know how long that will last,” commented one exec. “Cold rolled and coated are maybe a bit tighter, but mills still seem to be listening. I don’t think anyone is turning away orders right now,” added another.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com