Market Data

January 6, 2022

SMU Steel Buyers Sentiment: Year Begins with Optimism

Written by Tim Triplett

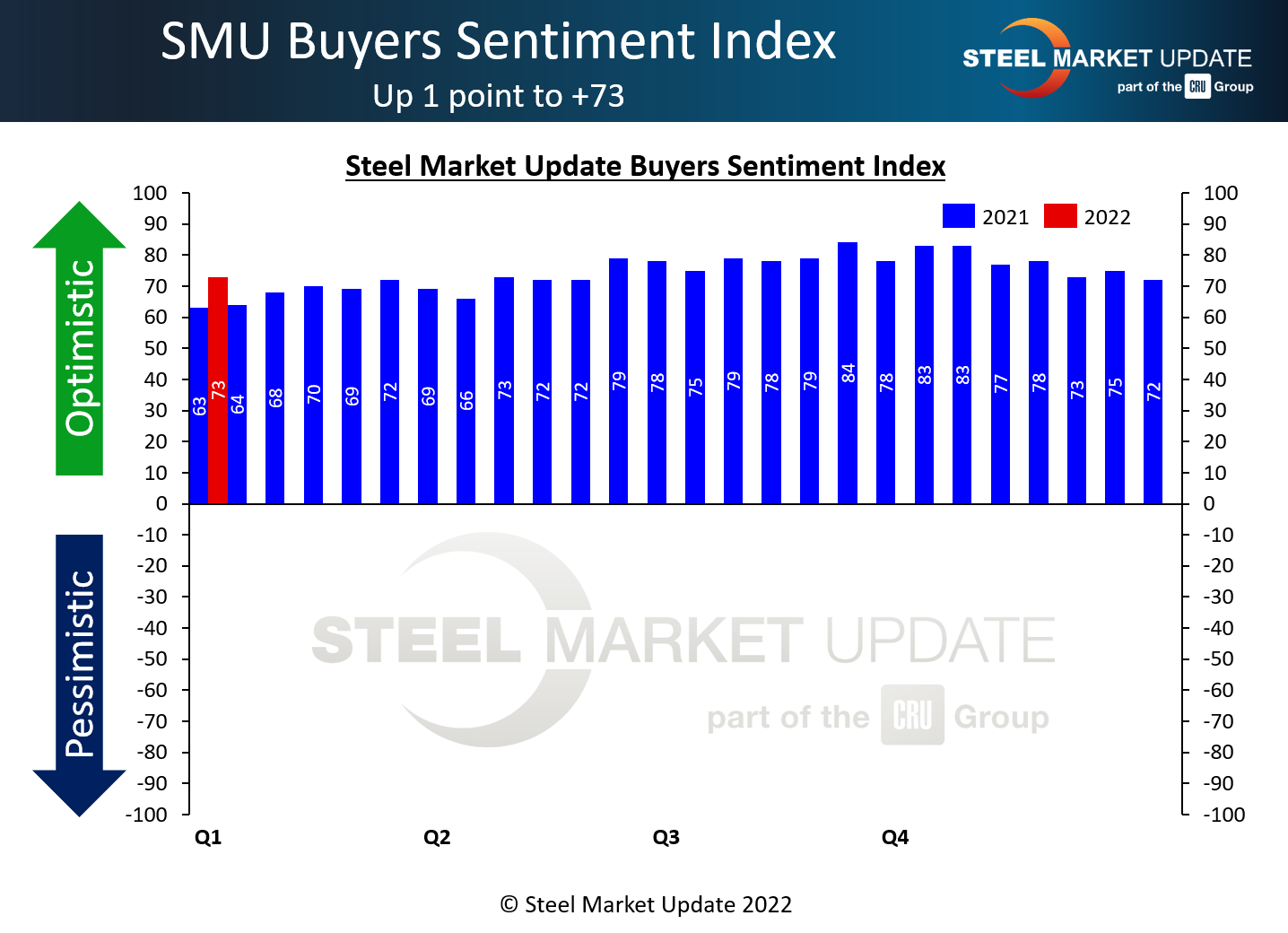

Steel Buyers Sentiment, as measured by Steel Market Update, saw its highest readings ever in September 2021. Not coincidentally, so did steel prices. In the four months since then, steel prices have softened by some 20%. Industry sentiment has also softened, but to a lesser extent – and it remains well above year-ago levels.

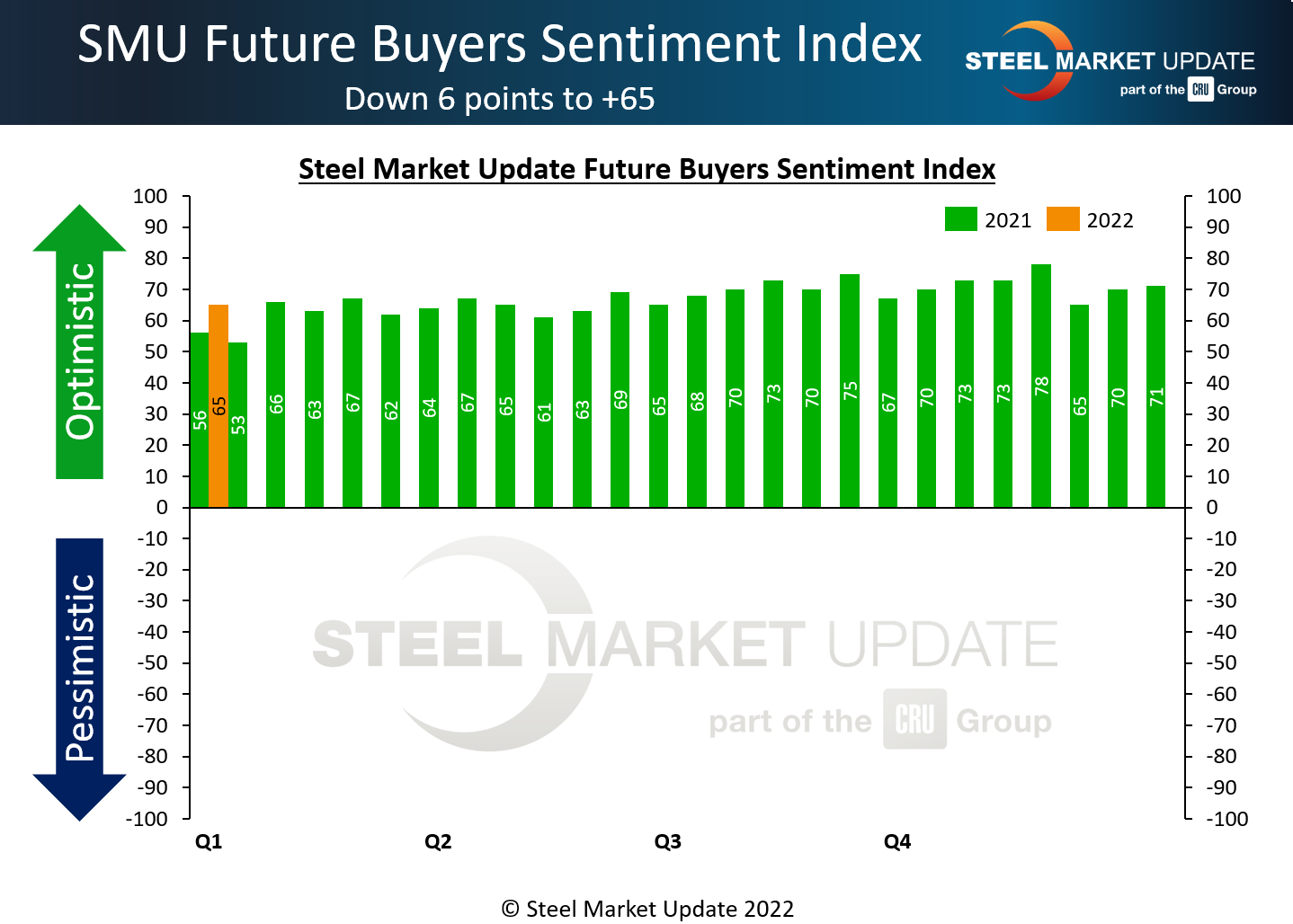

SMU surveys buyers every two weeks and asks how they view their chances of success in the near and longer term. SMU’s Current Sentiment Index has dropped by 11 points, from an all-time high of +84 to the current reading of +73. Future Sentiment, at the current reading of +65, is down 13 points from its high of +78.

Future Sentiment – which measures buyers’ feelings about their prospects three to six months in the future – saw a notable six-point drop over the past two weeks, which may reflect some nervousness in the marketplace as buyers look ahead to a new and uncertain year.

But the true takeaway from SMU’s data is that industry sentiment remains at a surprisingly optimistic level – varying within a narrow range from the mid-60s to the mid-80s on a 100-point scale – despite concerning headlines about labor shortages, supply-chain bottlenecks, inflation, and the omicron variant. One potential explanation for that disparity: the vast majority of respondents to SMU’s latest survey also report that demand is stable or improving.

2021 was a record year for many companies. Like sentiment, their prospects for 2022 are closely linked to what transpires with steel prices.

What Respondents Had to Say

“Uncertainty is always the unknown; risk of new trade action and COVID changes loom large.”

“We are still struggling with labor and non-steel-related component supply.”

“We think there is pent-up demand once people flush away higher levels of inventory, as we believe business was slower than expected in the fourth quarter.”

“Even with the falling pricing and holiday softness, we still wrapped up our best December in company history.”

“I expect 2022 to be a fantastic year – it’ll be one of our best ever. Just don’t compare it to 2021. Ha!”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page.

We send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com