Community Events

December 19, 2021

ISM CEO: Supply-Chain Challenges to Persist in 2022

Written by Tim Triplett

Market forces are beginning to restore equilibrium to some parts of the economy, but not to others, said supply-chain expert Tom Derry, CEO of the Institute for Supply Management (ISM). Supply constraints will continue to be a drag on economic recovery in 2022, along with inflation and labor issues, he said during Steel Market Update’s Community Chat webinar on Wednesday.

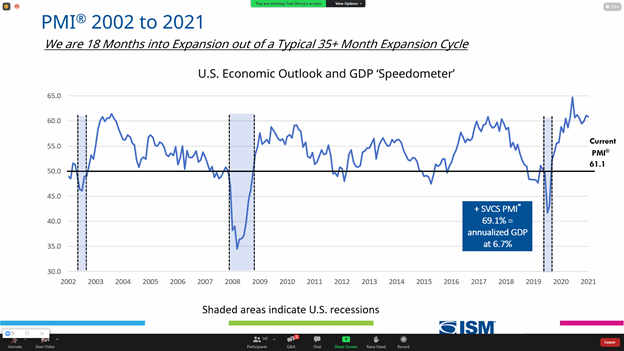

![]() ISM, based in Tempe, Ariz., is a not-for-profit supply management organization that offers education and research for supply managers and purchasing professionals. ISM’s PMI, an index based on its monthly survey of purchasing managers, is closely watched as a leading indicator of U.S. economic trends. As the chart below indicates, the current PMI of 61.1 shows the economy expanding at a healthy level.

ISM, based in Tempe, Ariz., is a not-for-profit supply management organization that offers education and research for supply managers and purchasing professionals. ISM’s PMI, an index based on its monthly survey of purchasing managers, is closely watched as a leading indicator of U.S. economic trends. As the chart below indicates, the current PMI of 61.1 shows the economy expanding at a healthy level.

But high inventory levels will be a drag on demand next year, Derry said. Inventory levels for many types of goods are highly extended throughout the supply chain. About 56% of firms surveyed by ISM report they are holding more inventory than normal – most intentionally due to over ordering of safety stock, but some unintentionally as work in process is stalled by shortages of components.

The demand curve has shifted in electronics, he noted, causing a serious shortage of microprocessors stemming from a lack of investment in microchip manufacturing since the recession of 2008-09. Sectors from appliances to automotive are now competing for chips. “Automotive wasn’t a big driver of chip demand 10 years ago, but it certainly is today,” he said. That shortfall in electronic components will be another obstacle to manufacturing and economic growth next year.

Likewise, COVID will be an unpredictable economic wild card next year as waves of outbreaks in the U.S. and abroad threaten to disrupt passenger flight operations and shut down manufacturing plants with potential ripple effects on the entire supply chain, he said.

Offering a few reasons for optimism, Derry pointed to the high levels of disposable income among consumers. “We’re already seeing signs of the services sector reverting to normal patterns. That will mitigate the issues around accelerated demand for manufactured goods, which will be helpful in restoring equilibrium across all the markets,” he said.

Paradoxically, the enormous backlogs of unfilled orders in the manufacturing sector may contain a silver lining. The manufacturing sector is facing a healthy scenario in which it may not to be able to fully satisfy customer demand for what could be 18 months. “Working off these backlogs could take us longer than usual. There is an argument to be made that the economic recovery may be sustained longer because we have demand we couldn’t fulfill [due to labor and material shortages],” Derry said.

When will the economy return to pre-pandemic conditions? Derry pointed to two main causes of concern – inflation and the labor market. “We are going to be dealing with broad-based inflation for a while yet. And the labor force participation rate is still very low. There is a lot of evidence that people left the labor market permanently as a result of the pandemic due to early retirements and health issues. That means we are very sensitive to supply disruptions because we don’t have enough people to build things. There is no indication the labor market will recover any time soon,” he said.

(Editor’s note: Did you miss this Community Chat? No problem. Click here to view a recording. While you are at it, register for the next Community Chat, which will feature Timna Tanners, managing director of equity research at Wolfe Research, beginning at 11 a.m. ET on Wednesday, Jan. 5. There is no charge to view SMU’s twice-monthly Community Chats.)

By Tim Triplett, Tim@SteelMarketUpdate.com