Prices

December 16, 2021

Hot Rolled Futures: Past, Present, Future

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

Does it make sense to say – “If you can make it through this year, then you can make it through anything”? It depends on your positioning. If you were a steel buyer this year, you’ve had to deal with unprecedented challenges – unless you had hedged yourself in late 2020 for the year or had a fixed price supplier deal that covered you. In addition, you probably had to worry about delivery issues and the myriad of supply-chain problems that the economy experienced over the past 12 months. Even if you had hedged yourself in late 2020, you are now faced with hedging your steel buy at much higher levels this year. The chart below shows the three-month forward HRC contract over the past two years.

OEMs may look at that chart and feel like they finally may be facing the end of cost inflation, though many will see steel costs increase well into 2022 due to the lagging impact of contracts. Service centers will face a whole new challenge in 2022, that being how to mitigate the impact of lower steel prices on their existing inventory values. Perhaps a more sensible thing to say if you are dealing with steel price volatility is, “If you can make it through 2021 AND 2022, you can make it through anything!”

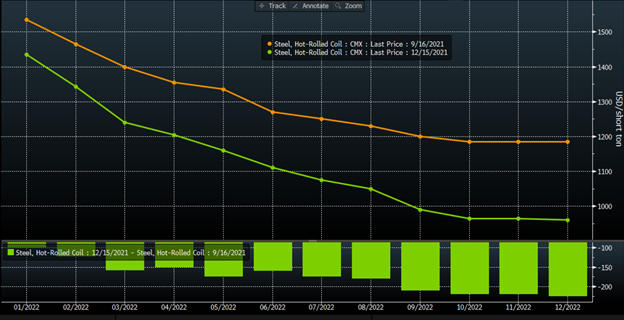

Looking through some of the forward curves, I thought it would be interesting to give a bit longer perspective. The chart below shows where the curve was three months ago and the curve as of Wednesday’s close:

You can see that the curve has come under some significant pressure, falling anywhere from $100 to $200. So hedging your inventory is more challenging in 2022, but locking in lower prices on a steel buy is getting more attractive.

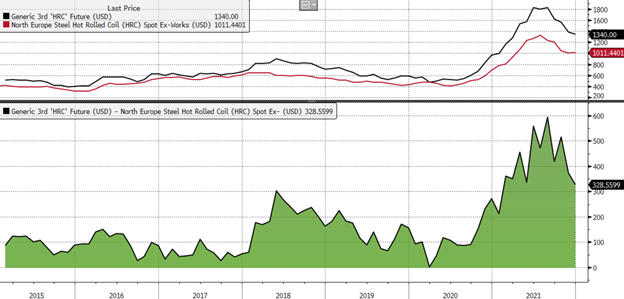

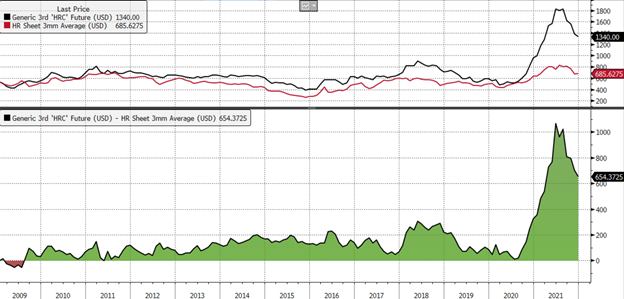

What might 2022 bring? We always try to think through the different factors that could influence steel prices in the future. We all know about all the steel capacity coming online in North America, but we don’t know how fast it will be ramped up. The recent steel mill consolidation could also change the way the mills act as we move into a pricing downcycle. International price levels remain well below the U.S., which in the past have been a source of gravitational pull on domestic price levels. See the below charts on the U.S. versus Europe and the U.S. versus China:

U.S. versus China:

The U.S./China spreads are huge, though the absolute number of tons flowing out of China haven’t been as large as they have been in the past, as their steel production has been extremely soft. In fact, we’ve seen production levels there in October and November around 20% below where they started the year. Despite the huge spread, the Chinese have been less aggressive exporters than they have in the past due to the lower production.

We also have the chip shortage and the impact on auto production, and other persistent supply-chain problems that continue to impact the economy. There may also be less federal stimulus spending, which could soften the consumer spending spree that has supported many industries in 2021.

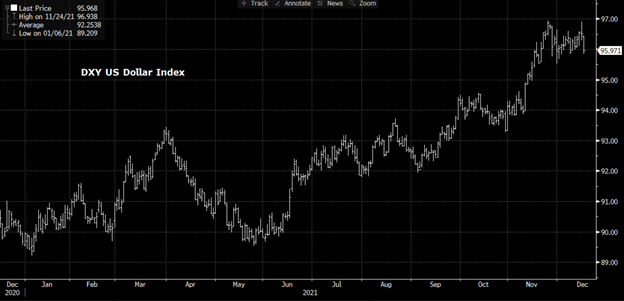

The Fed changing policy here in the U.S. is also worth considering, as they start to “taper” asset purchases and begin raising rates next year. Normally this would lead to a stronger U.S. dollar and lower commodity prices, all else equal. Indeed, the dollar has already been strengthening this year to some degree:

All of these factors will no doubt play a part in how things develop in the coming year. And there are many others that weren’t mentioned, some that we can’t even think of at the moment. The markets are full of surprises, and using hedging tools is one way to try to control the impact of these surprises on your business. One interesting quote we’ve heard recently is that our economy is no longer experiencing normal expansions and recessions, but “is in a perpetual boom that will be punctuated by an occasional crisis.” The term boom may be reassuring, but living through the crises is what will determine if your business really has staying power. The use of risk management tools is more important now than ever, as we face an uncertain future.

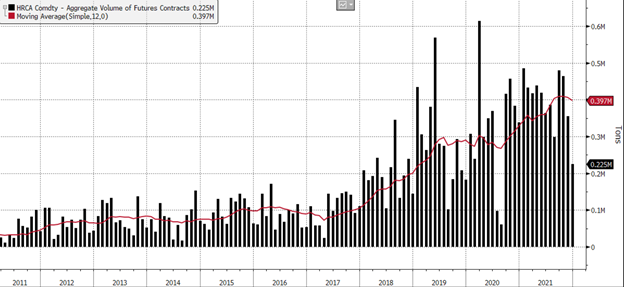

The futures market continues to grow, with more participation from industry participants as well as financial players.

The increased volumes make it easier for larger and larger entities to come into the market and use these tools, whether it’s for inventory hedges or locking in fixed prices. So while pricing in the physical market appears to be softening into year end, the cross currents of the above factors will almost guarantee continued volatility. Having the knowledge and expertise to use these tools will likely be “table stakes” in the future when it comes to living with the ups and downs of the steel market.

With this being the last article I will write this year, I’d like to wish everyone Happy Holidays, and a safe and prosperous 2022!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information