Market Data

December 9, 2021

Steel Mill Negotiations: Pendulum Swinging the Other Way

Written by Tim Triplett

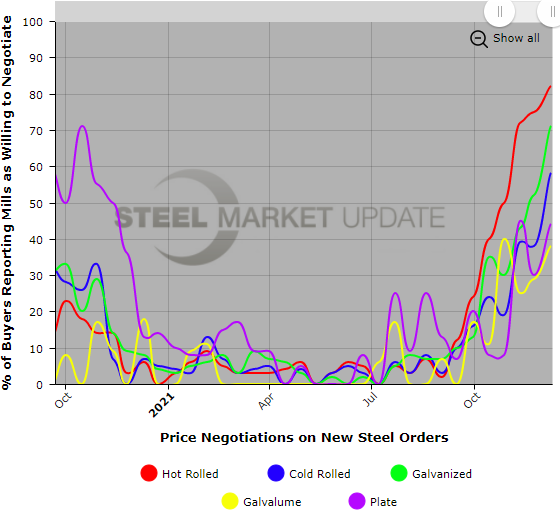

The pendulum has passed bottom and finally begun to swing the other way in price negotiations. Steel mills no longer hold a dominant bargaining position over spot buyers. That shift is consistent with the shortening lead times and declining prices reported by Steel Market Update.

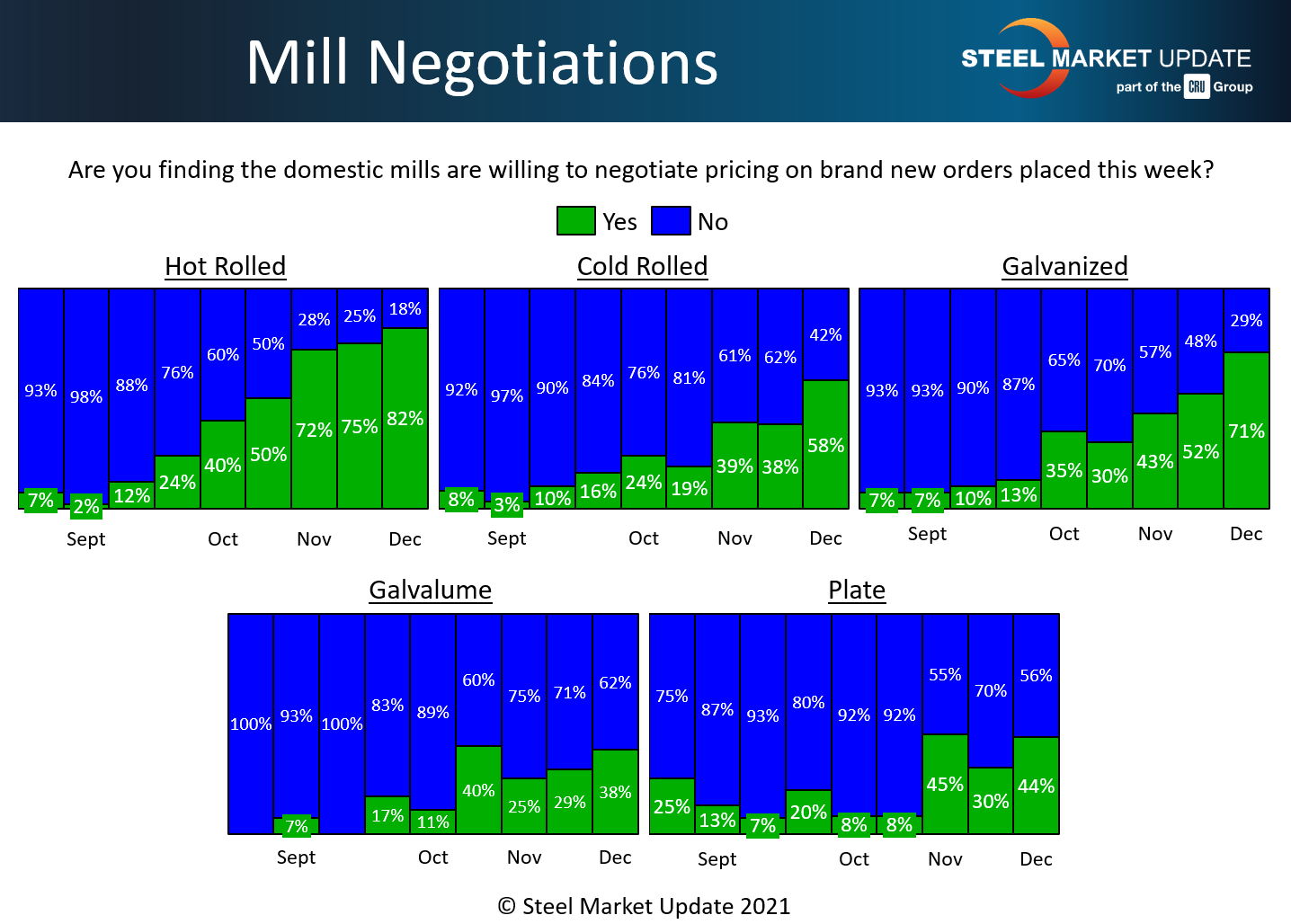

SMU asks buyers every two weeks whether mills are willing to talk price on spot orders. Majorities of the service center and manufacturing executives responding to SMU’s survey this week reported mills now willing to offer deals on most products, with the possible exception of Galvalume and plate. About 82% of hot rolled buyers, 71% of galvanized buyers and 58% of cold rolled buyers said mills are now open to negotiating to land an order.

As recently as September, there was little or no negotiation taking place on most products as demand continued to outpace supplies – meaning mills could basically dictate the price. One has to search SMU data as far back as the buyers’ market of August 2020, when the economy was still emerging from the initial pandemic shutdowns, to find percentages similar to the chart below.

The bargaining position of steel buyers is likely to strengthen further in the coming weeks if mill lead times and steel prices continue to decline as forecast.

What Respondents Had to Say

“Some negotiation, depending on the mill.”

“Mild negotiation, but the major mills understand this is a temporary situation.”

“They are negotiating, but more so on the extras than the base price.”

“Yes, but they are still way off the import price. There’s still too big a gap right now, like $140/ton.”

“There’s no real negotiation yet, but you can tell they want some tons, especially for Q1.”

By Tim Triplett, Tim@SteelMarketUpdate.com