Market Data

December 6, 2021

Employment by Industry: November’s Results Backpedal

Written by David Schollaert

November was a major letdown for the U.S. labor market, which added just 210,000 jobs, though the unemployment rate ticked slightly lower. The latest data from the U.S. Bureau of Labor Statistics showed that the U.S. economy created far fewer jobs than expected in November, in a sign that hiring started to slow even ahead of the new COVID threat.

November’s results included nearly 82,000 more jobs than previously anticipated, as the October and September estimates were revised and moved up. It was a mixed bag of industries that accounted for growth last month. Substantial gains took place in professional and business services, adding 90,000 new jobs, transportation and warehousing payrolls increased 50,000, and construction added another 31,000 new jobs. But retail employment fell by 20,000 last month despite the traditional holiday hiring season.

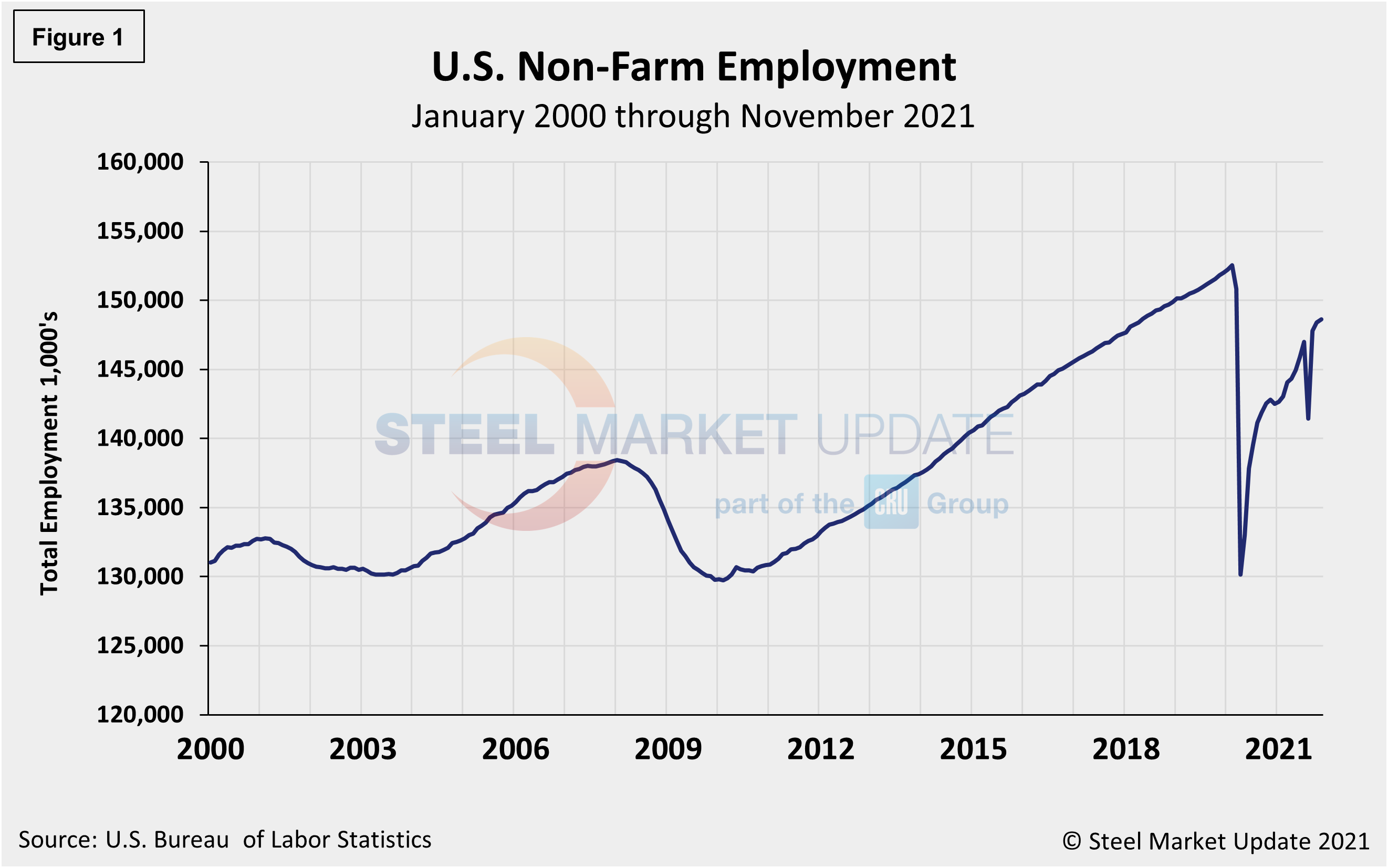

The number of unemployed persons fell by 594,000 to 6.3 million last month. To date, the U.S. has recovered nearly 16.2 million or 72% of the 22.5 million jobs lost last spring. There are just 84,000 more Americans out of work than at the start of the pandemic, a sign that the labor market recovery has made up significant ground. Figure 1 shows the total number of people employed in the nonfarm economy.

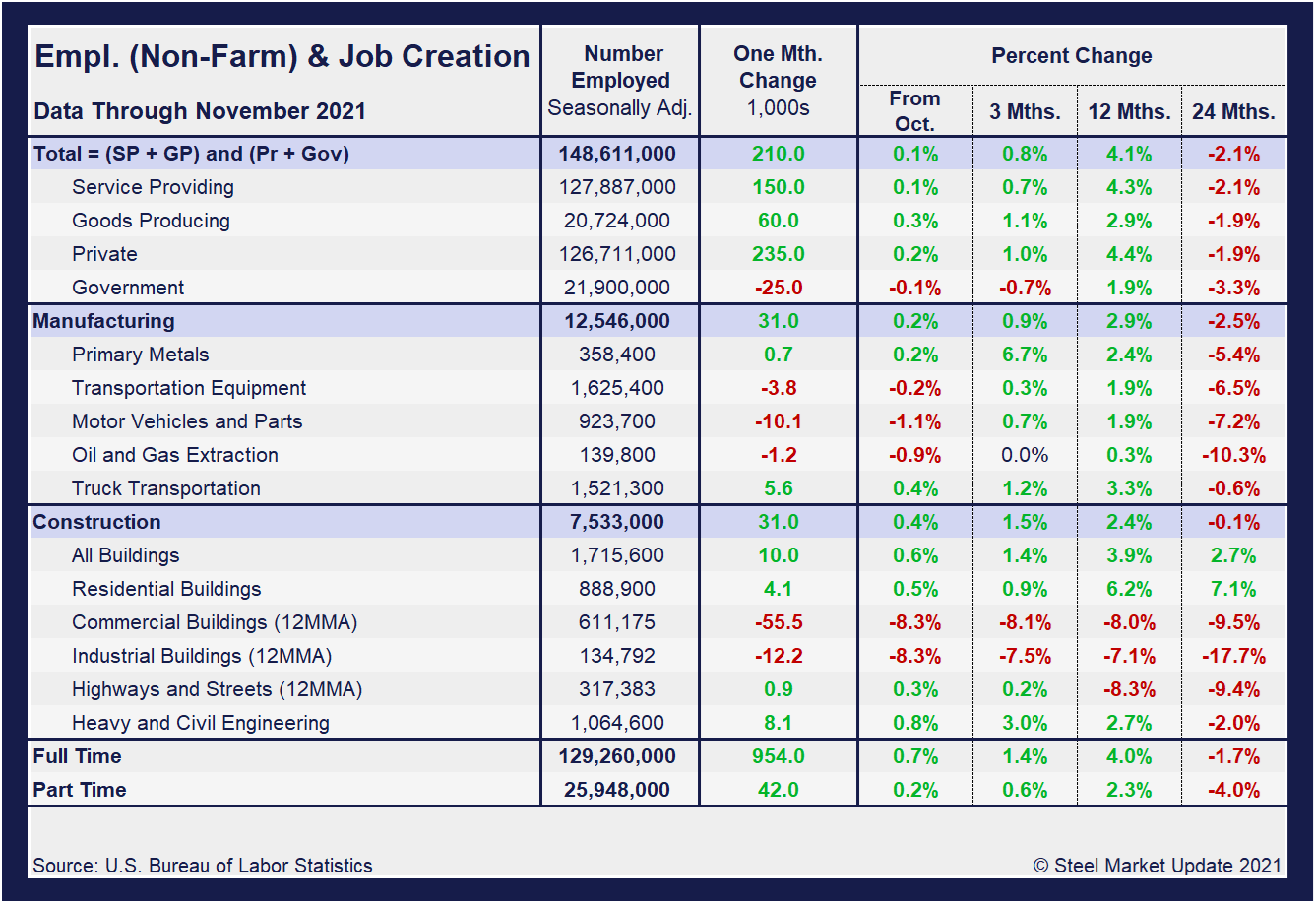

Designed on rolling time periods of 1 month, 3 months, 1 year and 2 years, the table below breaks total employment into service industries and goods-producing industries, and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction. Comparing service and goods-producing industries in November shows service jobs have increased by just 0.1%, while goods-producing jobs rose by 0.3% from October’s result. The steady month-on-month gains are now pushing both industries beyond pre-pandemic levels. Note, the subcomponents of both manufacturing and construction shown in this table don’t add up to the total because we have only included those with the most relevance to the steel industry.

Comparing November to October, manufacturing employment was up 0.2% versus a gain 0.5% the month prior. Construction was up 0.4% month on month compared to a 0.6% increase in October. The construction sector has been driven by the residential market, a 6.2% increase year on year. Gains have been held back, however, by struggling commercial and industrial building. Despite the overall improvement, the inconsistencies in some of the subcomponents reflects the significant obstacles still facing the U.S. economy and domestic job creation. The recovery has been remarkable, nevertheless, as the three-month and 12-month comparisons are mostly reporting growth, while the 24-month pre-pandemic comparisons are largely behind. And where there is growth, it is limited. In the year-over-year contrast, manufacturing is up just 2.9% and construction is up 2.4%. Further growth is still expected as the marketplace advances from the freefall seen in the second quarter of 2020.

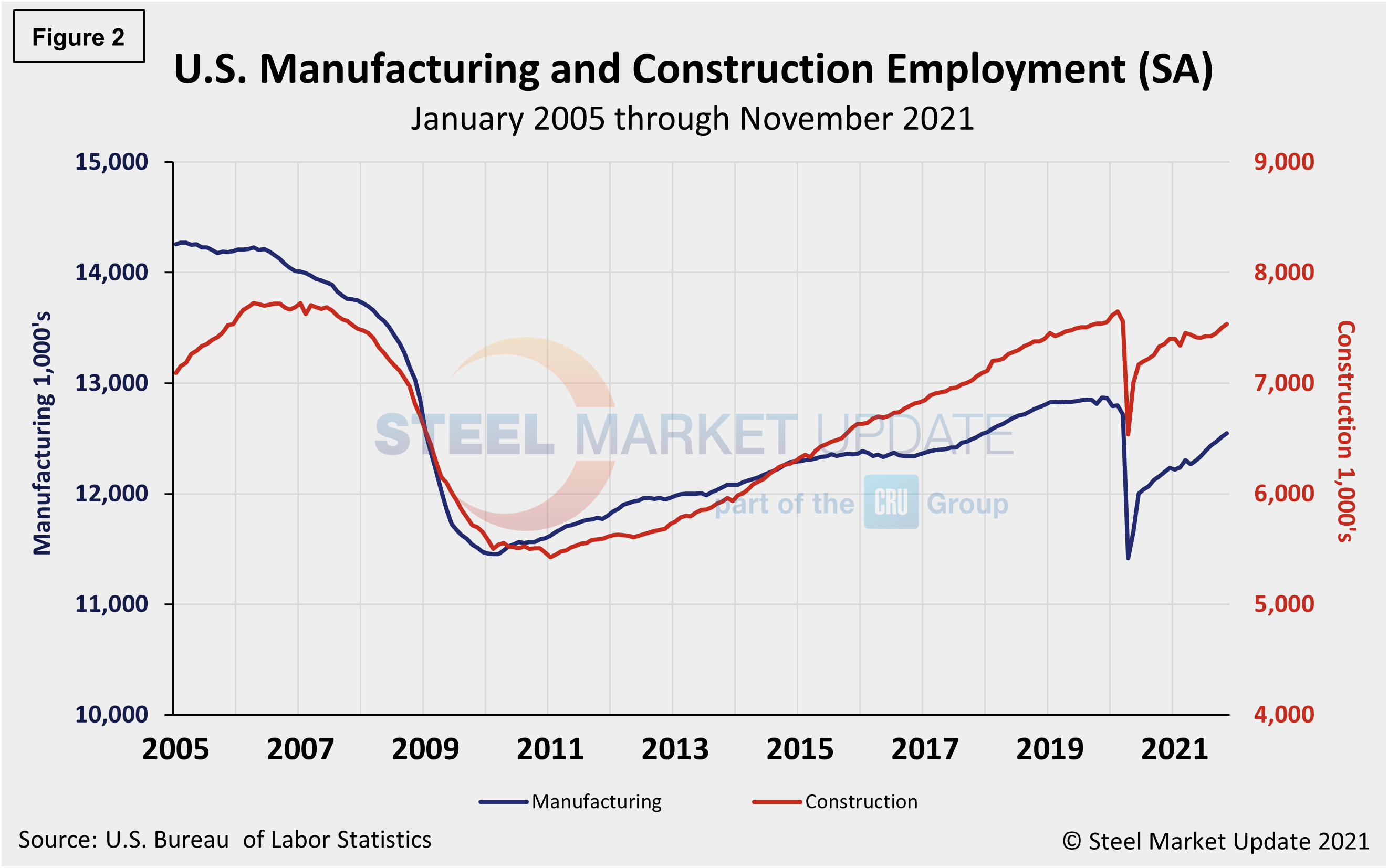

Manufacturing employment increased by just 31,000 jobs in November compared to an increase of 60,000 the month prior, led by gains of 10,000 in miscellaneous durable goods. Employment also rose in fabricated metal products by 8,000, while motor vehicles and parts lost 10,000 jobs. Manufacturing employment is still down by 253,000 compared with February 2020.

In November, construction employment rose by 31,000, following a 44,000 increase the month prior. Employment among specialty trade contractors was up 13,000, followed by construction of buildings adding 10,000 more jobs, and heavy and civil engineering construction adding 8,000. Construction employment is 115,000 below its February 2020 level. The history of employment in manufacturing and construction since January 2005 is show below in Figure 2, seasonally adjusted.

Companies in the technology sector announced the most job cuts in November with 1,980, for a total of 12,761 through November, down 84% from the 77,826 last year. The services sector announced the second-highest total in November at 1,835 for a total of 26,996 this year.

Aerospace/defense companies have announced the most cuts this year with 34,543, still 60% fewer than the 85,814 announced through the same period last year.

Energy companies announced 1,282 cuts in November for a total of 21,537 for the year – 56% lower than the 48,656 announced through November 2020.

Human resources consulting firm Challenger, Gray and Christmas Inc., said that company closings caused the most cuts in 2021 with 62,599, followed by restructuring, which was cited for 56,865 cuts year-to-date. Market conditions were cited for 50,394 cuts. COVID-19 has been cited as the reason for 8,904 cuts this year, compared to 1,105,599 cuts attributed to pandemic through November last year.

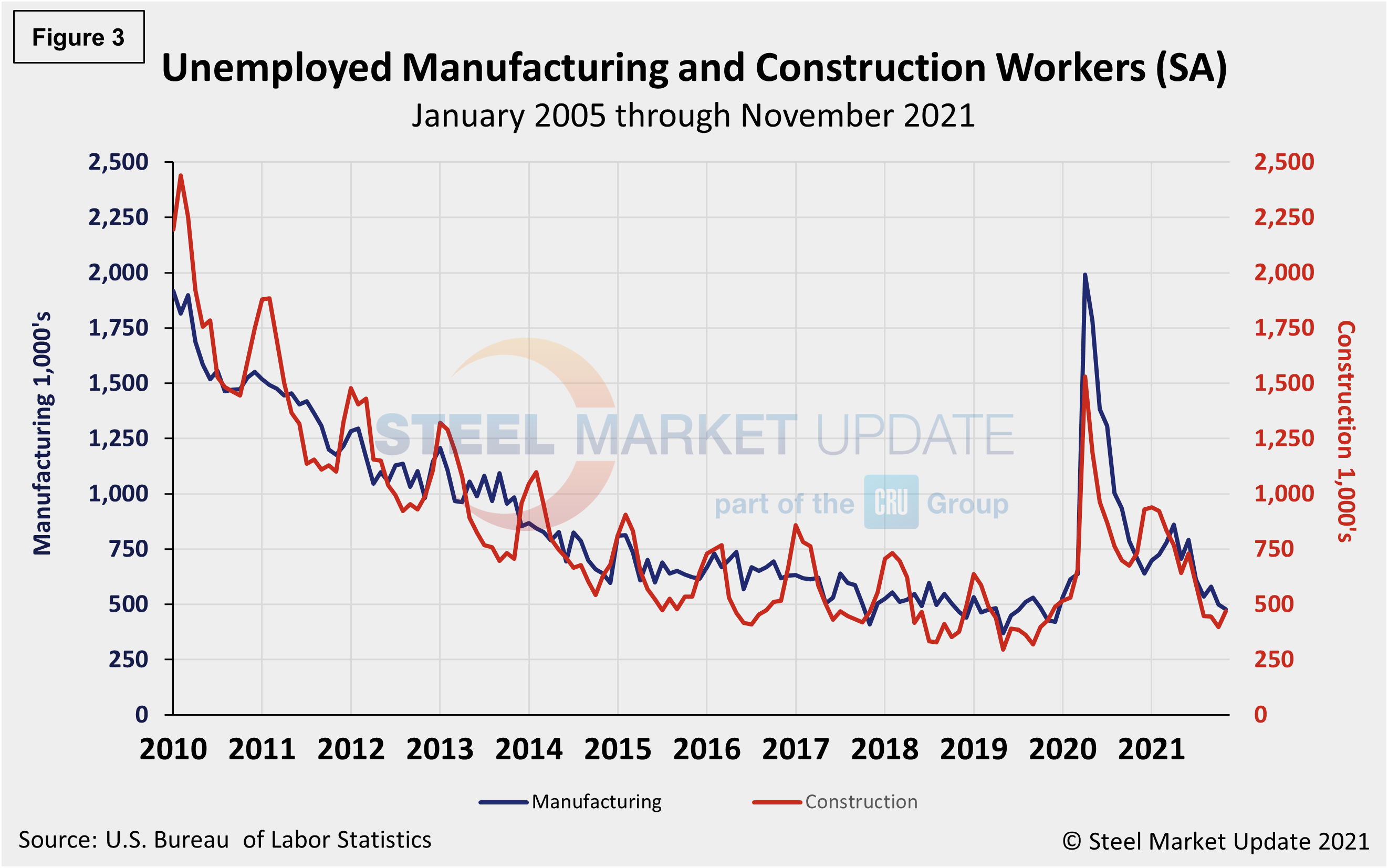

The reported number of unemployed manufacturing and construction workers is shown in Figure 3. Construction and manufacturing unemployment diverged in November compared to the month prior. Construction unemployment was up 17.8% month on month, from 398,000 in October to 469,000 in November. Manufacturing’s unemployed fell from 499,000 in October to 478,000 in November, a 4.2% decline month on month. Both sectors have been heavily impacted by supply-chain disruptions and labor force constraints.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is not necessarily the nominal numbers, but the direction in which they are headed.

By David Schollaert, David@SteelMarketUpdate.com