Prices

November 23, 2021

December Scrap Prices May See Small Increase

Written by Tim Triplett

December ferrous scrap prices are expected to trade sideways or up slightly after a surprise jump higher in November, Steel Market Update sources said.

“December scrap is likely to move sideways, particularly for sales done at the higher end of the November range. For sales at the lower end, a $10-20 per ton ‘catch-up’ increase is possible next month,” said one dealer in the Northeast

Domestic scrap demand should be solid again in December, although some mills may have overbought in November in anticipation of seasonally driven hurdles for scrap collection during winter. Moreover, there is little pressure from the export market, with deals done to Turkey down $10-20 from their peak in October, said CRU Senior Analyst Ryan McKinley.

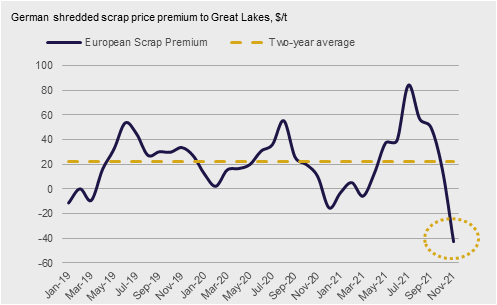

“I don’t think that demand from Turkish mills will return soon given the continual fall of the lira. I also do not think Turkish mills will be as keen on securing U.S. cargoes given the unusually large premium domestic U.S. prices hold to Europe,” he added (see chart).

U.S. shredded scrap is trading at a premium to the Turkish market, so there is no urgent need for U.S. mills to further increase domestic shred prices, agreed the dealer. Likewise for prime grades in the U.S., he foresees a generally sideways market, particularly in light of stable pig iron prices.

“U.S. scrap demand is very good, and we expect that to follow into January,” added the dealer. “Export pricing for 80/20 grade has stalled right around $495-500/MT CIF. While flows to the export docks are still relatively tight, Turkish buyers don’t have a lot of room to bid scrap prices higher, with the much weaker lira, rising conversion costs, and non-existent demand for their products in Asia. So, overseas demand is still good, but the Turkish mills appear rather boxed in with raw material pricing at the moment.”

Commented another scrap executive in the East with a slightly different view: “I expect prices for all grades to continue to go up, with obsoletes having the highest ceiling due to continued strong demand for shred and seasonal issues reducing inbound feedstock. At a minimum, sellers who received up $50-60/GT in November will be looking to make up the difference that the up $80-90/GT shredders in the western markets were able to secure. Scrap dealers are well suited to hold onto January if prices are not satisfactory.”

Some mills reportedly have had some trouble getting all the shred they need in November, said another source, so there may be additional demand at play. And supplies could tighten a bit in December, which is a holiday-shortened, wintry month. “Right now, the word on the street is that shredded and cut grades will be up $20-30/GT, and low-residual grades like #1 busheling and bundles will be up $10-20/GT,” he said.

Market watchers keep a close eye on mills’ ferrous scrap costs as a leading indicator of finished steel prices.

Pig Iron Market

One SMU source reported the following on pig iron trade:

“The pig iron market has been inactive lately after two Russian cargoes were booked earlier this month by U.S. mills. Those prices were reported to be $568/MT and $580/MT CFR. Since then, suppliers have been bullish for new sales. However, U.S. buyers have not relented and booked additional cargoes.

“One possible reason is that cargoes booked for China 1-2 months ago may be redirected to other countries, including the U.S. This happened earlier this year and it stopped the meteoric rise of pig iron prices at that time. However, this time it won’t be for the same reason. Earlier this year, several large cargoes were redirected from China to the U.S. because the principles took advantage of the rise in prices. They had bought cheaply months before and the market went up $150-200/MT before the shipment date. So they cashed in by selling these cargoes to pig iron-starved users in the U.S.

“This time, they could be redirecting cargoes to the U.S. due to the decline in the Chinese steel business and their declining prices. They may not need the material now. However, this time there will not be $100+ MT profit to be had. In fact, the American mills may be able to obtain a discount under current market levels.”

By Tim Triplett, Tim@SteelMarketUpdate.com