Analysis

November 16, 2021

Final Thoughts

Written by John Packard

Some of our key market indicators are pointing toward higher inventories at service centers and an “expectation” of lower prices out of the domestic steel mills.

There are many questions yet to be answered as to what the “new normal” will look like when it comes to flat rolled steel prices. We have not seen a wholesale collapse in pricing. Especially when it comes to coated products, which seem to be holding their own despite the chip shortage affecting automotive production.

Hot rolled price momentum is Lower. We have seen signs of some erosion in cold rolled and coated as well, but not enough yet to move momentum to Lower on those products. Many of our indicators are suggesting future slippage. However, we do not want to influence the market and will wait for more data points before moving off Neutral on CR, GI and AZ.

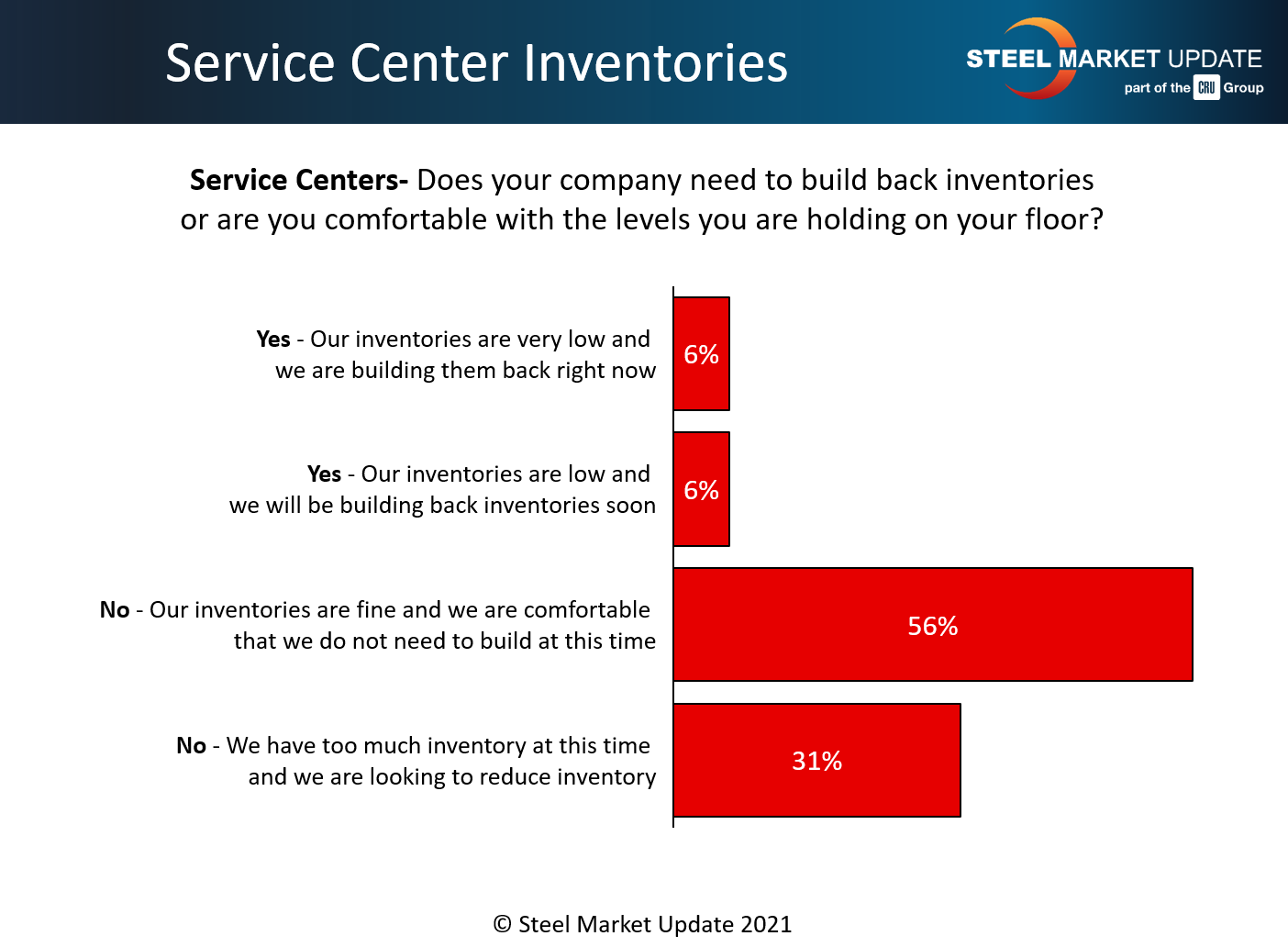

Steel Market Update has captured six straight months of service center inventory build on sheet products (flat rolled) based on our proprietary data. Inventories have reached 2.7 months of supply as of the end of October. This puts many distributors into a balanced or excess inventory situation depending on product. Our most recent survey data is finding a growing pool of service centers who are reporting they have too much inventory (31%), which will ultimately have an impact on spot prices.

SMU survey data is also showing a growing percentage of service centers who are having difficulties maintaining spot prices to their customers, and we are seeing a growing number who are now reducing spot prices to their end users. The percentage of service centers dropping prices has grown by significant numbers over the past month, according to the manufacturers (see below). About one-third of the service centers are reporting taking spot pricing down. We need to remember steel inventory on the floor is cheaper than new inventories that will be arriving over the next couple of months.

HARDI hosted one of their galvanized steel conference calls with members earlier today. HARDI members reported inventories as being balanced, allowing more flexibility in buying patterns. The slippage in spot prices out of the domestic mills has been relatively minor to date as galvanized lead times are down, but still extended. The number of competitors going after the same business is growing, which is another indicator of inventories growing at the distribution level.

One question HARDI members had was how much of an impact foreign steel would have on galvanized going forward? This is something SMU will be watching carefully over the coming weeks and months.

I spoke with a trading company last night who advised me the latest offers on foreign hot rolled delivered into U.S. ports is averaging $1,420 per ton, CIF Duty Paid, Loaded Truck. This is $435 per ton below last week’s SMU hot rolled index. Even so, the trader told me they were having difficulties getting orders at the $1,420 ($71.00/cwt) number.

Last week a domestic steel mill told me they had come across a $1,375 per ton foreign offer ($68.75/cwt) on hot rolled coil delivered to USA port.

Trade, steel prices, infrastructure and the changing steel universe will be on the front burner at the 2022 Tampa Steel Conference. Based on what we are seeing right now, the timing of this conference (and location) will be perfect for those wanting to learn more while at the same time having some quality time to network with others in the industry.

Registrations have begun to pick up for the 33rd Tampa Steel Conference, which will be held at the Marriott Water Street Hotel in Tampa, Fla., on Feb. 14-16, 2022. Note: the actual program begins on Tuesday afternoon, Feb. 15, for those who need to be in the office on Mondays or have Valentine’s Day plans with their significant other. Special networking events will be held on Monday, Feb. 14, and Tuesday morning, Feb. 15. You can find more details by clicking here.

We are closing in on 100 executives registered as we move toward our expected attendance of approximately 400 attendees for this conference. Here are just a few of the companies who have registered recently: AMS – Steelinvest, Metal Master*, Phillips Tube Group, SSA Atlantic*, Steel Construction Systems, ITW CIP, Second City Metals, Carver Companies* (companies with an * means more than one executive is registered from that company). You can learn more about the conference agenda, speakers, costs to attend, and how to register by clicking here or going to: www.tampasteelconference.com

I mentioned several proprietary indices produced by Steel Market Update in tonight’s Final Thoughts. You will see references to these and many more indices in our newsletter, on our website, in social media, and elsewhere. If you would like to participate as a data provider, please contact us at info@SteelMarketUpdate.com. If you would like to learn more about how you can access all our data, please contact Paige Mayhair at Paige@SteelMarketUpdate.com or by phone at 724-720-1012.

As always, your business is truly appreciated by all of us associated with Steel Market Update.

John Packard – John@SteelMarketUpdate.com