Prices

November 4, 2021

Hot Rolled Futures: S232 Resolution - Opposing Forces

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

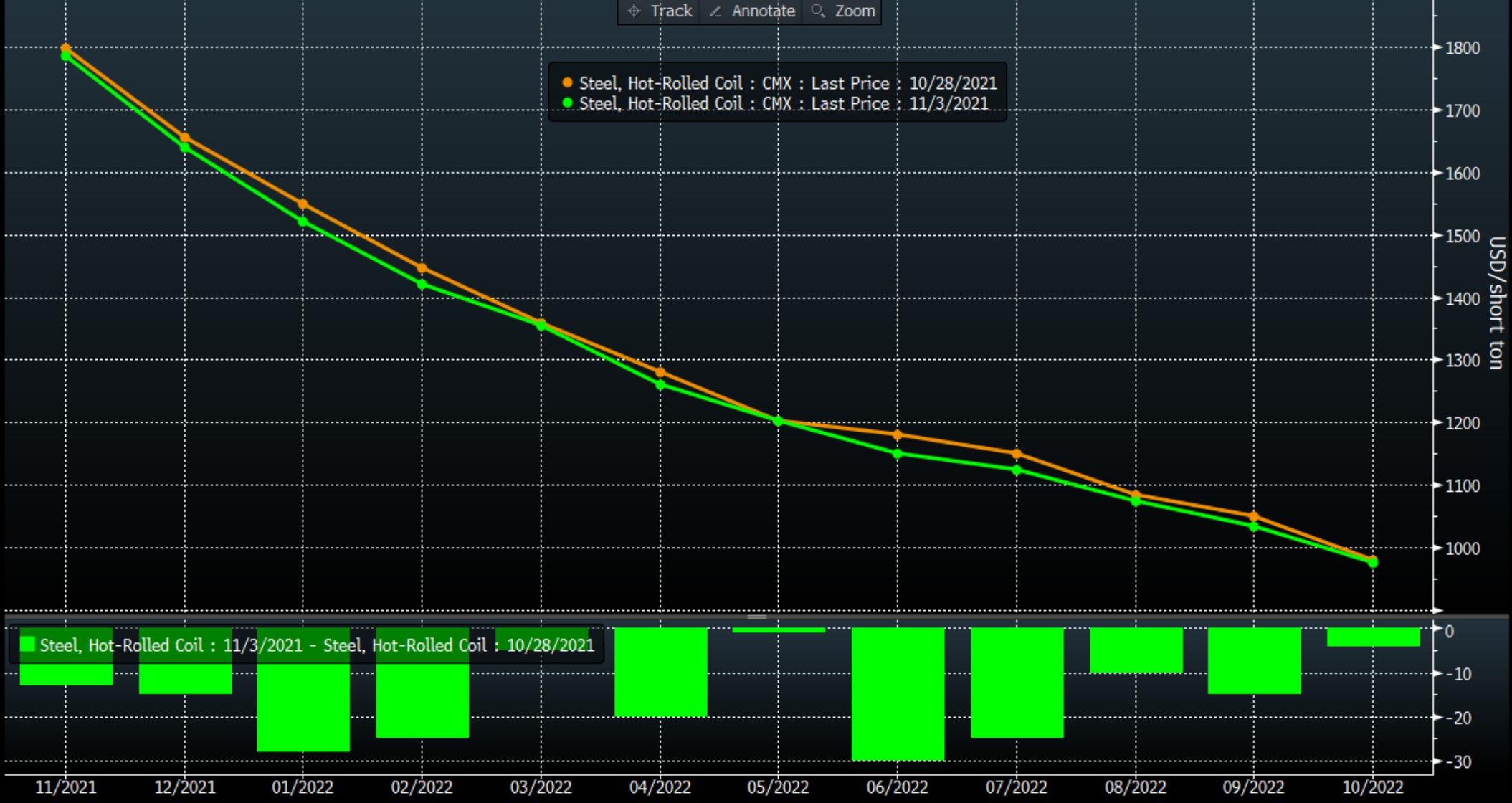

One might think that the Section 232 tariffs coming off European-origin steel would have a major impact on steel futures prices here in the U.S. It may indeed end up being the case, but the week-over-week change in the curve here has been a bit of a “yawner.”

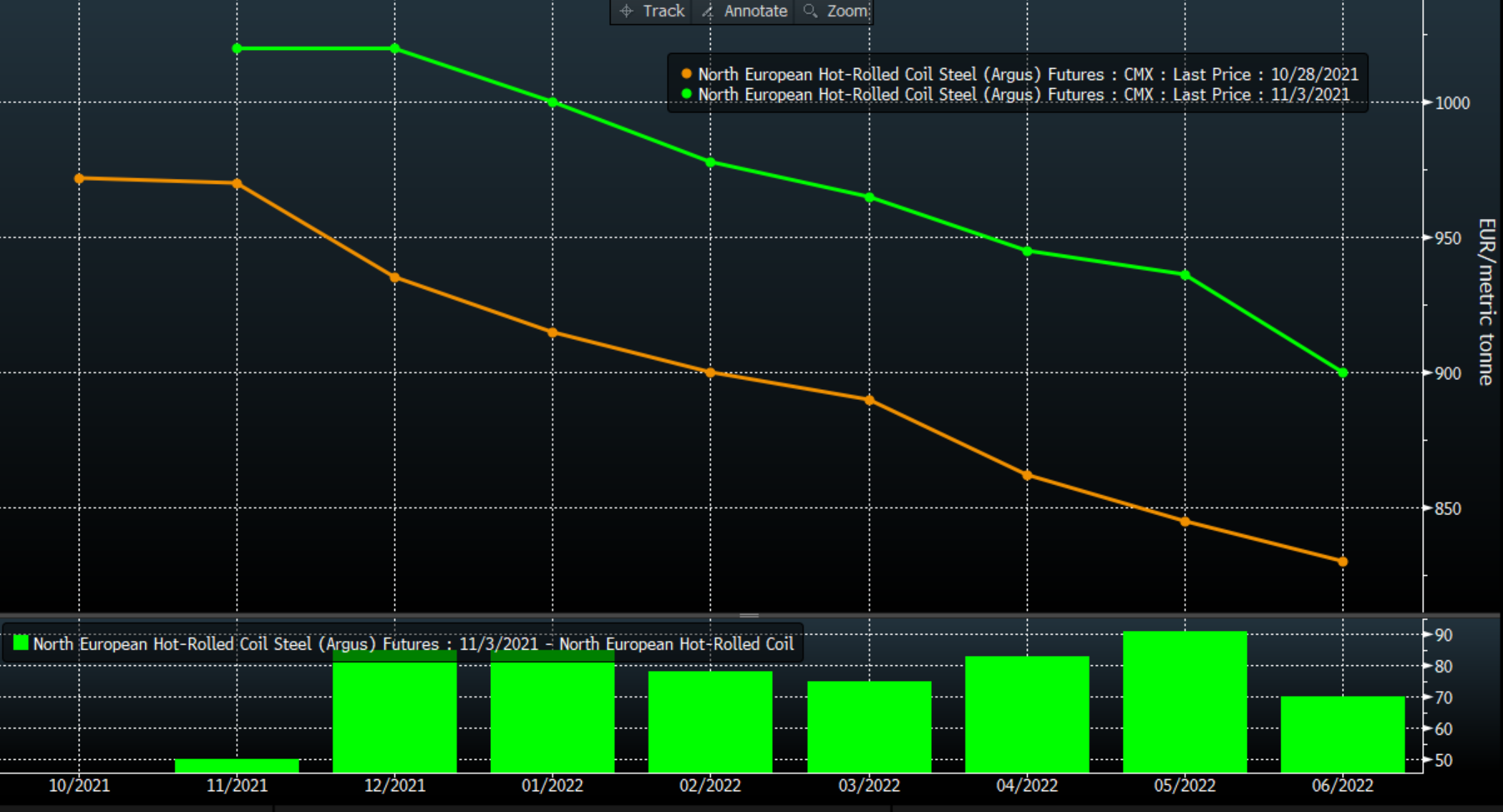

Why might this be? First off, a deal on the S232 tariffs has been rumored for months, so the market has had a chance to absorb this eventuality and discount the change ahead of time. Second, the deal seemed to coalesce more or less around what people had been thinking – a tariff rate quota system or TRQ. Third, prices in Europe firmed up a bit, which makes some sense given that if more steel can flow out of the region, the supply and demand balance gets incrementally tighter for that area. Below is a chart of the European HRC futures.

You can see this has been a pretty significant reaction week/week. So, on the futures curves, the spread between the U.S. and Europe did actually get a fair bit tighter. This chart is in USD, and has been adjusted for both contracts to be priced in short tons for the 3-month forward contracts:

So, once we look at both the U.S. and European HRC futures market reaction in combination, the change is more dramatic than what you would see if you had just looked at the U.S. HRC forward curve. It’s a good reminder to look beyond one’s normal horizon when it comes to making decisions!

On that note, we’d also like to revisit China, where lower steel production continues to dominate the news. After a brief recovery rally, ore prices sold off again in recent trading sessions:

While there have been some disruptions in ore supplies due to the global supply chain issues as well as COVID, the steep cuts in Chinese steel production are overwhelming these supply disruptions at the moment.

Chinese steel prices are also selling off, dropping roughly $100/metric ton over the past week or two. While many of us focus on the U.S. market, watching Asia is critical given the importance of that region to global steel production.

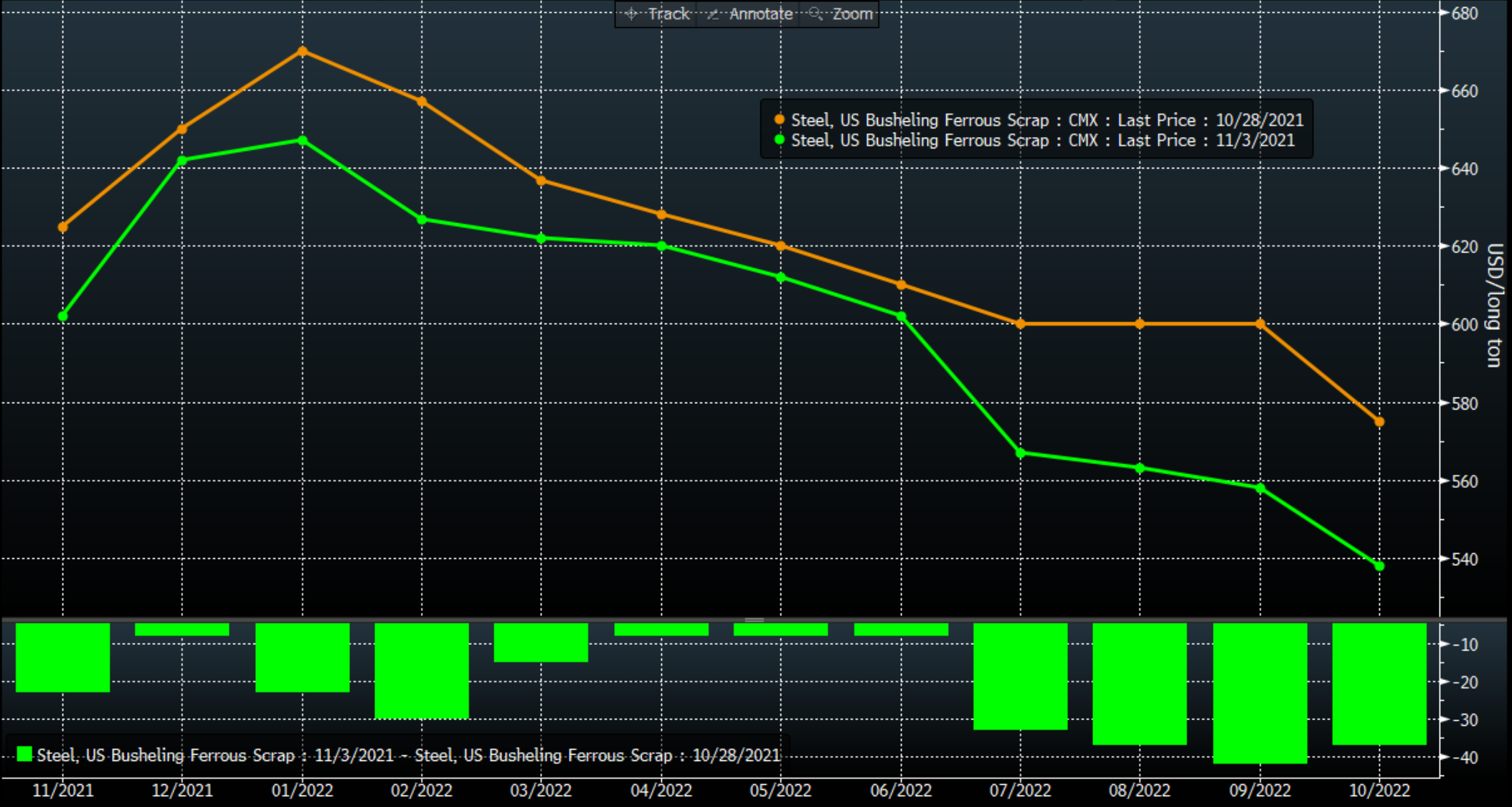

Back here in the U.S., the scrap curves moved lower week over week, but we are moving into a seasonal period where scrap pricing usually firms up, so we will see if this weakness lasts.

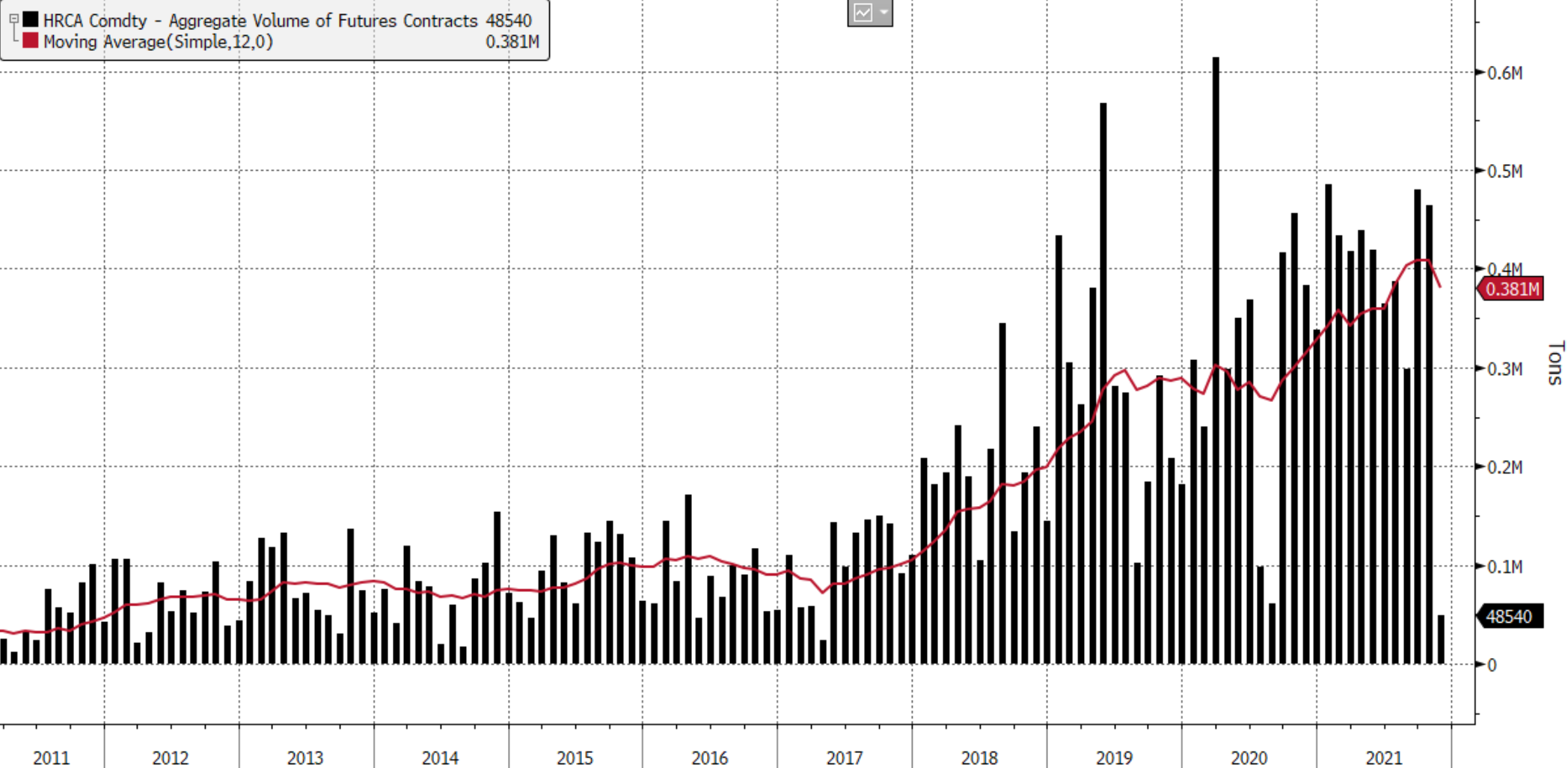

We will close with a word on volumes. The HRC contract in the U.S. continues to gain traction, and volumes in 2021 will likely be another record. The chart below shows the “cleared” volumes on the CME, but it is important to note that many tons also trade “OTC” or over the counter. These volumes are not counted in the below chart.

The adoption of futures continues to climb, as OEMs look to lock in their prices, service centers look to hedge their inventories, and import buyers look to hedge their buys further out in the future. Done correctly, hedging can smooth out earnings and allow companies to better anticipate margins out in the future. Thanks for reading!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information