Market Data

October 28, 2021

Steel Mill Negotiations: Now a 50-50 Proposition in HR

Written by Tim Triplett

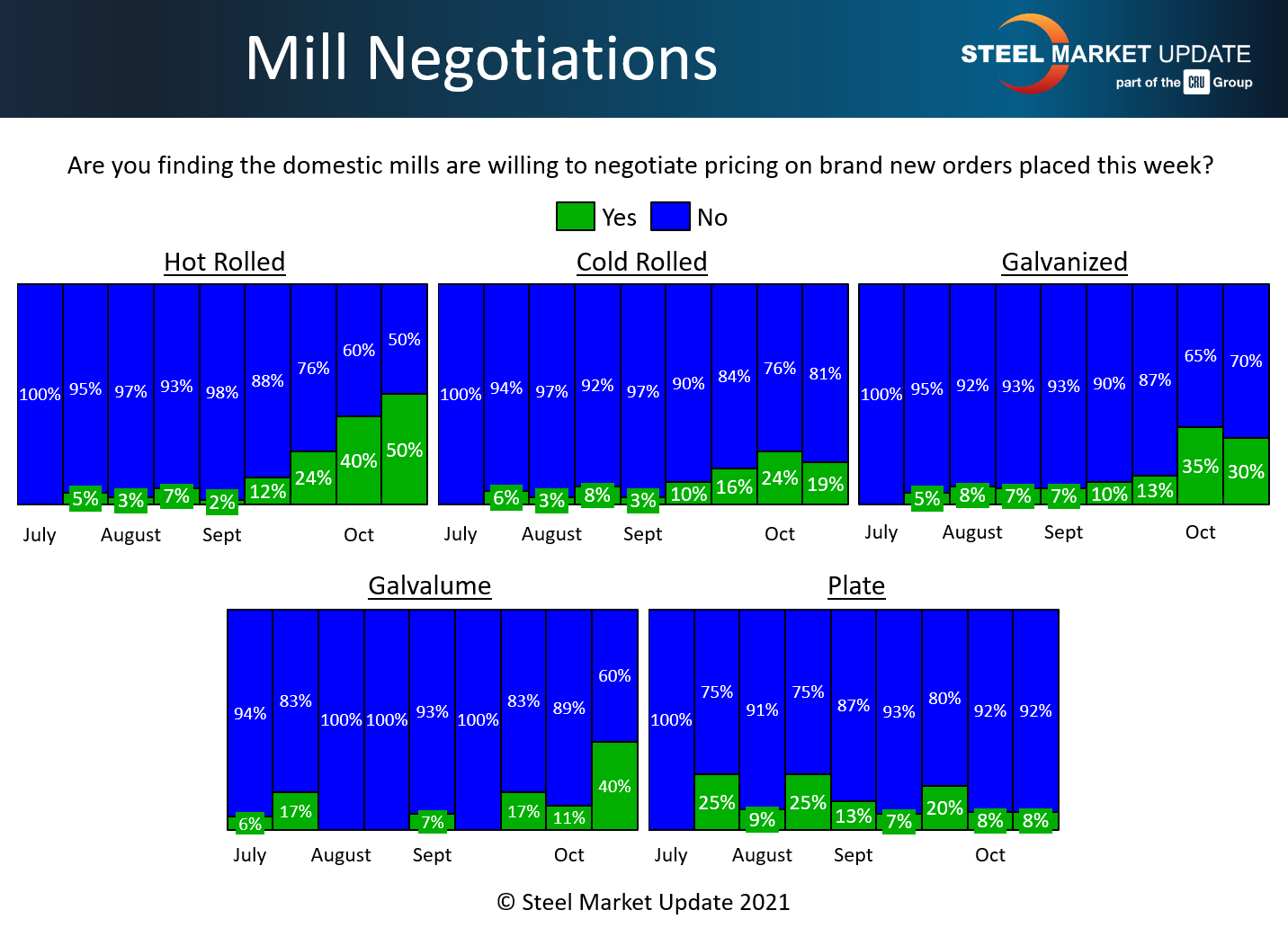

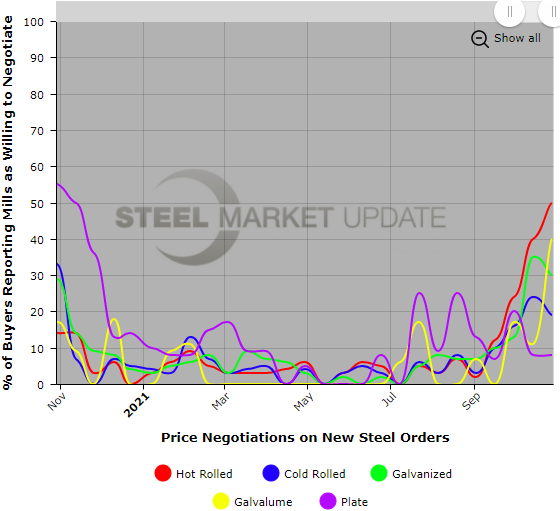

Steel Market Update data suggests buyers continue to gain some leverage in price negotiations. SMU asks buyers every two weeks if the mills are willing to talk price on spot orders. Around 50% of hot rolled buyers responding to this week’s poll said some mills are now willing to bargain to secure an order. That’s double the 24% just a month ago.

The mills maintain a tighter grip on negotiations in the other product categories. About 81% of cold rolled buyers, 70% of galvanized buyers, 60% of Galvalume buyers and 92% of plate buyers say the mills are still unwilling to negotiate as demand for their products remains strong.

Mills still have the dominant bargaining position for most products, but the fact that it’s a 50-50 proposition in hot rolled is a notable change and a balance not seen since August 2020.

What Respondents Had to Say

“No one is buying, so there’s no real negotiation yet.”

“Not much negotiating yet. The mills are toeing the same line across-the-board. Consolidation – and dare I say collusion – are adding a level of security for these lofty prices.”

“Mills seem to be satisfied protecting price and profit vs. chasing orders that don’t exist.”

“Pickling constraints are limiting any increased spot cold rolled, so there’s no need to lower prices.”

“Finally, plate has arrived at the party. The music is starting to slow of course, but the plate guys will try like hell to get back above coil.”

By Tim Triplett, Tim@SteelMarketUpdate.com