Market Data

October 28, 2021

Steel Mill Lead Times: Downtrend Continues

Written by Tim Triplett

Lead times for orders of flat rolled and plate steel from the mills have shortened again compared to this time last month. About 60% of the buyers responding to Steel Market Update’s survey this week describe lead times as just “slightly longer than normal.” Only 15% still consider them “highly extended.”

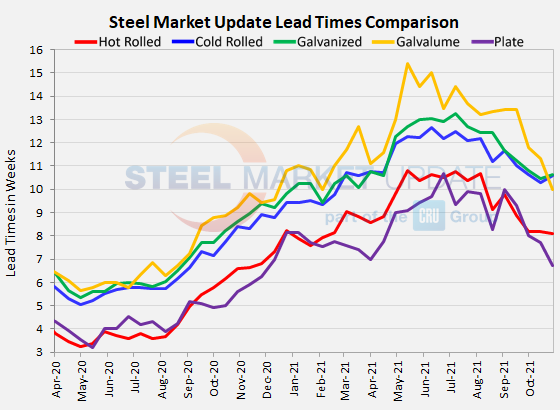

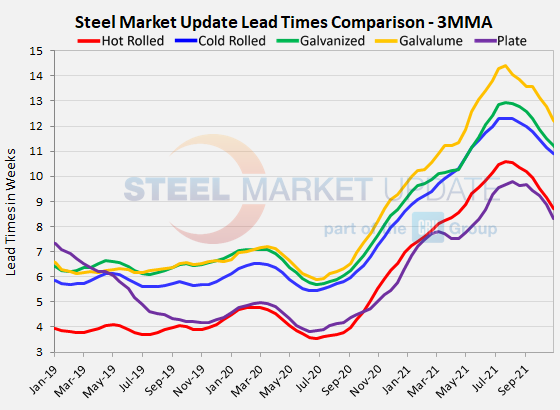

SMU’s check of the market shows that the typical hot rolled lead time is down to nearly eight weeks, while cold rolled and coated products are now below 11 weeks. Plate lead times have shrunk to less than seven weeks. While still twice as long as the historical averages, lead times appear to be shortening very gradually but consistently, which may foretell declining steel prices in the weeks and months ahead.

The buyers polled by SMU this week reported mill lead times ranging from 5-13 weeks for hot rolled, 7-14 weeks for cold rolled, 6-16 weeks for galvanized, 7-12 weeks for Galvalume, and 5-9 weeks for plate.

The average lead time for spot orders of hot rolled has declined slightly to 8.11 weeks, down from 8.21 weeks a month ago. Cold rolled lead times now average 10.58 weeks, a small dip from 10.64 weeks at the end of September. Galvanized lead times dipped to 10.61 weeks from 10.82 weeks in the same period. The average Galvalume lead time dropped by nearly two weeks to an average of 10.00 from 11.80 weeks.

Like sheet products, mill lead times for plate have also shortened. The average plate lead time moved down to 6.71 weeks from the 8.00 weeks seen in SMU’s market check a month ago.

For comparison, at the lengthiest ever measured by SMU, lead times for HR stretched as long as 10.81 weeks, CR 12.65 weeks, galvanized 13.26 weeks, Galvalume 15.40 weeks and plate 10.67 weeks in May/June of this year.

What Respondents Had to Say

“It’s all relative. Lead times (much like pricing) at the mill level are much better than they were two months ago. But when compared to historical averages, they are still outrageous.”

“Mills don’t want to talk about how soon they could actually ship steel.”

“All mills are running late regardless of what their published lead times are saying. They are all late across the board.”

“Realistically, most mills remain poor in terms of performance, so quoted lead times versus real lead times differ by 2-4 weeks. I expect they will perform through year-end to distribution and then backslide in Q1 as auto and OEM demand increases.”

By Tim Triplett, Tim@SteelMarketUpdate.com