Market Data

October 19, 2021

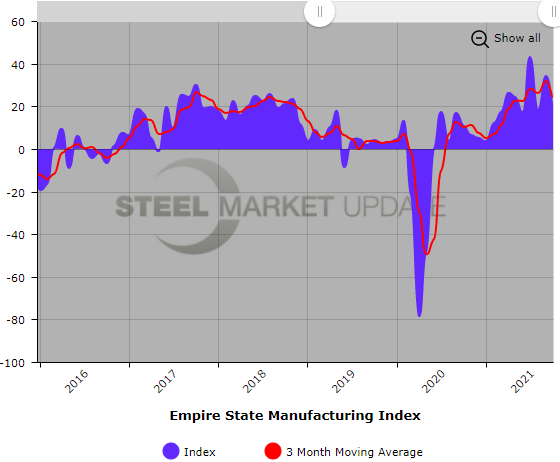

Empire State Manufacturing Index Growth Rate Slows in October

Written by David Schollaert

Manufacturing growth in the state of New York grew at a noticeably lower rate in October compared to September, according to the Empire State Manufacturing Survey. The headline general business conditions index fell nearly 15 points to 19.8 during the month.

![]() After climbing by 16 points in September, the headline index nearly lost all the ground it had gained. Despite the decrease month on month, manufacturing activity still grew at a solid clip in New York in October. Indices for new orders expanded by 23.3 points this month, down 9.4 from the prior month, while shipments grew by 8.9 points in October, 18.0 points lower than September.

After climbing by 16 points in September, the headline index nearly lost all the ground it had gained. Despite the decrease month on month, manufacturing activity still grew at a solid clip in New York in October. Indices for new orders expanded by 23.3 points this month, down 9.4 from the prior month, while shipments grew by 8.9 points in October, 18.0 points lower than September.

Unfilled orders were slightly lower in October at 18.5, down 2.4 points. Delivery times continued to lengthen, moving up 1.5 points to a new record high of 38, indicating significantly longer delivery times. The inventories index rose modestly by 0.7 points to a reading of 12 points.

Prices paid strengthened after contracting slightly the two months prior. Prices received dipped month on month in October. Prices paid rose by 3.0 points to 78.7, while prices received slipped by 4.3 to 43.5. The number of employees edged down 3.4 points to 17.1 in October, as did the average workweek index, falling 9.0 points to 15.3.

The six-month outlook remains optimistic, up 4.0 points to 52.0, the Federal Reserve Bank of New York said. The general business conditions index and new orders edged up 3.6 and 2.6, respectively, while shipments slipped 2.4 points to a measure of 52.3. Substantial increases in employment and prices are also expected in the coming months.

The capital expenditures index dipped 2.4 points after reached a multi-year high of 33.9 the month prior. The technology spending index was also down after reaching a record high in September, down 6.1 points in October.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use its interactive features. You can do so by clicking here. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com