Market Data

October 15, 2021

Service Center Shipments and Inventories Report for September

Written by Estelle Tran

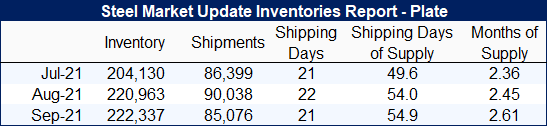

Flat Rolled = 54.5 Shipping Days of Supply

Plate = 54.9 Shipping Days of Supply

Flat Rolled

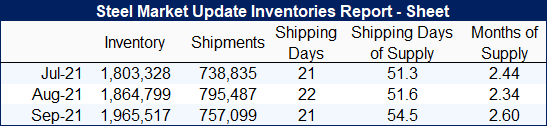

U.S. service center flat rolled inventories grew in September to the highest level seen since August 2020, according to Steel Market Update data. At the end of September, service centers carried 54.5 shipping days of supply on an adjusted basis, up from 51.6 in August’s final data. In terms of months, service centers carried 2.60 months of flat roll supply at the end of September, up from 2.35 in August.

September had 21 shipping days, one fewer than August’s 22. September shipments are expected to be down in line with the drop in shipping days, however, the total amount of sheet in inventory has risen about 5% m/m. Anecdotally, market participants have said that their inventories are balanced with demand – except for some hard-to-get items. Some of the inventory build can be directly attributed to the chip and component shortages impacting demand for autos and appliances.

The amount of material on order dropped significantly in September, as buyers focus on the material they have due and passing on new orders.

The lower amount of material on order reflects mill lead times shortening, import arrivals and diminished interest in placing new orders at current high prices. Multiple market contacts said they were keeping to contract minimums and not placing spot orders, as customers have been pushing back on higher prices. Some service centers have observed that the range of customer quotes has widened with more competitive offers and they are having to offer processed material at lower prices than what mills have been offering for coil.

Inventories appear to be leaning toward surplus, and with slower shipping months ahead, we expect that the inventory surplus will become more pronounced.

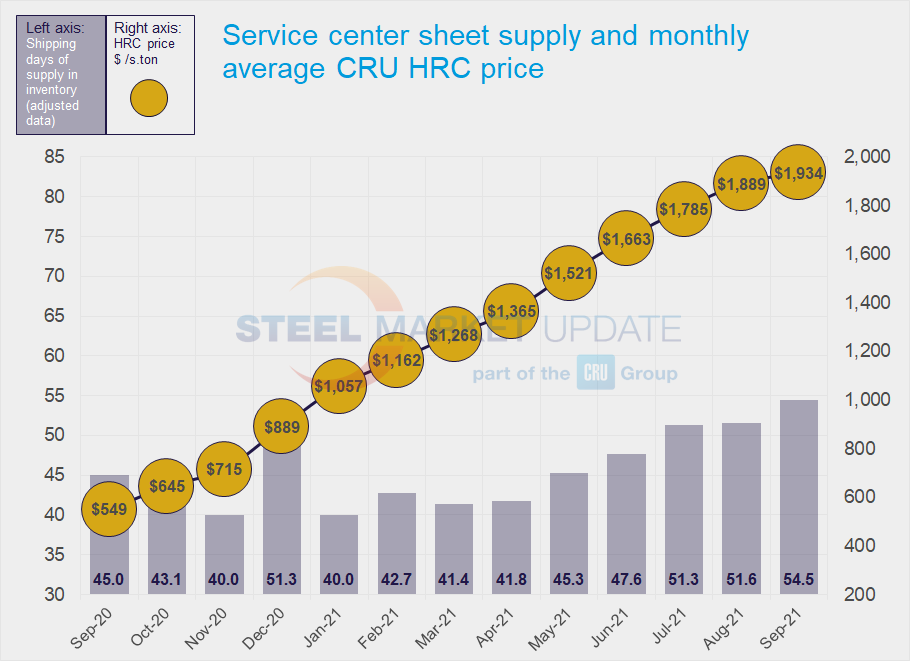

Plate

U.S. service center plate inventories edged up slightly in September, with service centers carrying 54.9 shipping days of supply. This is up from 54 shipping days of supply in August. In terms of months of supply, inventories rose to 2.61 months of supply on hand in September from 2.45 months in August.

Plate shipments were fairly steady in September when considering that September had one fewer shipping day. While certain sectors, such as energy, remain lackluster, mills successfully pushed through $80/st price increases in September. Service centers continue to be selective with placing orders at current high prices to avoid having too much high-priced inventory. Overall, plate inventories seem to be balanced with demand.

The amount of material on order decreased in September.

Plate mill lead times have shortened to eight weeks, according to the latest SMU survey on Sept. 30; this is two weeks shorter than a month ago.